Here at Equity Guru we are doing something different. Our writers will talk about one company that they really love on a regular basis. It could be because we think the management is doing a great job, or what the company does provides value. But let’s face it. At the end of the day, it is all about the return on your money. These are companies that we believe you need to look at in the intermediate term and the long term. For my part, these are companies that I have personally put my money where my mouth is.

My readers and followers know where I have been putting my money for the last year and a half. I was talking about the inflation trade ever since governments began distributing money. At that time, the economy was still closed. The re-opening is what kicked things in motion. Inflation is a monetary phenomenon and I believe we haven’t even seen the worst of it yet. Hence why I encourage investing in hard assets and commodities. Gold and Silver being my favorite. Not a surprise to most of you.

However, some of you have been with me since day 1, where on a fateful Summer day in 2021, I wrote my maiden piece on investing in agriculture. A company I really like was the main company featured. Not the company of choice for this article, but I will discuss them sometime down the road. For those new to my work, I suggest you read about “why I am going big on Agriculture” written on June 20th 2021. Our main reasons are relevant today. Not just relevant, but are playing out just as forecasted.

Since then, I have been posting a weekly Agriculture sector roundup where I go over the big news in the ag space and company news and charts. One of the companies popular with readers is Bee Vectoring Technologies (BEE.CN).

I love this sector because of the great innovation going on. You come across some cool technologies, and Bee Vectoring definitely has one of the coolest.

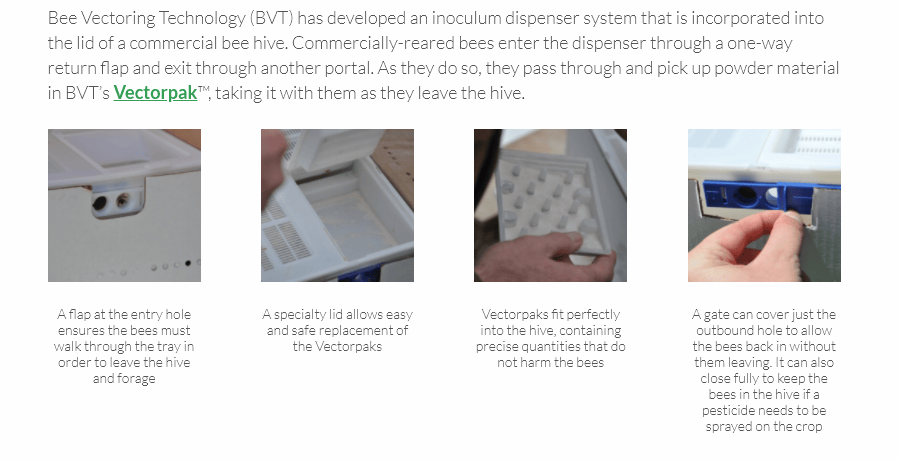

Bee Vectoring Technologies International Inc (BVT) is an agriculture technology company, develops and provides natural commercial farming solutions including crop protection. Its solutions include the Hive and Bees, an inoculum dispenser system; Vectorpak with Vectorite, a recipe of ingredients that allows bees to carry crop BVT-CR7 and other beneficial fungi or bacteria in their outbound flights to the crops; active ingredients, such as BVT-CR7, an organic strain of a natural occurring endophytic fungus; and pollen distribution systems.

The company’s patented bee vectoring technology uses commercially-reared bees to deliver targeted crop controls through the natural process of pollination. It provides natural pest and disease management solutions for various crops, such as strawberries, sunflowers, apples, tomatoes, canola crops, blueberries, and other crops.

A market disruptor within the $240 billion crop protection and fertilizer market, with a product/technology that replaces chemical pesticides and wasteful plant protection product spray applications by delivering biological pesticide alternatives to crops using commercially grown bees.

The video above does a good job explaining the technology, but here is my synopsis:

BVT’s commercially reared bee’s (either bumble or honey) pick up the company’s Vectorite powder which is within Vectorpacks just before they leave the beehive. This powder poses no risks to the bees, to people, nor the environment and the process follows the principles of natural pollination. The bees deliver single or multiple materials at the same time to the flower.

No water is used, meaning no spray applications, which also reduces the amount of active ingredients put out into the environment. A highly targeted delivery system that leaves fewer active ingredients drifting into water sources and unintended plants. It should also be noted that the BVT system can also be used for both pollination and disease and pest management.

Bee Vectoring’s BVT-CR7 is an organic strain of a naturally occurring endophytic fungus. It is commonly found around the world, and grows harmlessly inside the plant tissue. It is not harmful to bees and humans alike, and after delivery, it dies out naturally within 24-48 hours if it is unable to find a suitable plant host. You can read about the active ingredients here.

The Vectorhive system has been proven to control diseases and increase resistance in plants, enhances plant growth, and improves crop yield. All good things for farmers, and my readers know my take on crop yield and why it will be super important going forward. It is one of the reasons we are bullish on agriculture.

A major milestone news was released on October 13th 2021. Bee Vectoring signed their first commercial industry partnership with BIOGARD, one of the leading bioprotectant companies in Europe. Through the agreement, Bee Vectoring will have exclusive access to BIOGARD’s biological insecticide Beauveria bassiana ATCC 74040 for bee vectoring uses throughout the European Union and Switzerland, accelerating the company’s growth and market entry into Europe!

Now it is all about trials. In 2022, Bee Vectoring announced positive results in the progress of its proprietary biological control agent Clonostachys rosea strain CR-7. Not to be confused with Cristiano Ronaldo CR-7. Trials with CR-7 treated soybeans demonstrated 36% larger root system and 16% greater stems and leaves tissue mass.

“This marks the first data we have for CR-7 on a major row crop such as soybeans,” said Ashish Malik, CEO of BVT. “This is the type of crop that gets the attention of the major global multinationals, and we have generated interest from as many as eight companies to whom we presented our results from the 2021 work. One of them is conducting their own independent trials as well.”

“These are great results after the first year which allow us to talk to potential partners who are looking to differentiate their portfolio offerings in soybeans, one of the major worldwide crops” added Mr. Malik. “We have shown two different ways to bring value to such a portfolio – as a way to enhance yields in combination with current soybean inoculants, and to control SDS disease. Through a future licensing agreement, BVT could potentially reap significant annual royalties from this application. This is an exciting development for the Company.”

The company’s most recent news announced it is conducting 10 almond trials in the 2022 growing season, which started during the almond bloom period (mid-February to mid-March) and will continue through harvest in the Fall. The locations are throughout California’s Central Valley, including in Bakersville, in the Fresno area, and in Northern California. This is the second year for BVT almond trials as farmers require multi-year data under local conditions for proof of efficacy.

California almond pollination is believed to be the largest single pollination event worldwide. Valued at over US$6 billion, almonds are California’s largest non-dairy crop in the state, with over 1.2 million acres in production. Almond growing is big business and the sector has key sustainability objectives: the Almond Board of California has committed to increasing adoption of environmentally-friendly pest management tools by 25% by 2025. A potential lucrative market for Bee Vectoring.

This chart isn’t new for my readers. As mentioned before, Bee Vectoring is popular with my agriculture sector roundup readers. We are all fans of the chart because it has provided us with returns on the bounce at support. $0.225 is a MAJOR support zone for the stock. We have bounced here multiple times in the past. Buyers always step in here. And we are hoping to see a repeat here again.

For those wanting to play it safe…or just align probabilities to their side, then there are a few things I would wait for. We have been developing a nice mini range here. I have drawn out a downtrend line which could add more confluence when broken, but $0.25 is the big zone. If we can get a nice and strong daily candle close above $0.25, then we can safely say that the buyers have defended $0.225. Look for a nice green candle close, and also, pretty decent volume on the breakout.

We get this, and the stock can retest levels between $0.30-$0.325. After that, I would look up to $0.38.

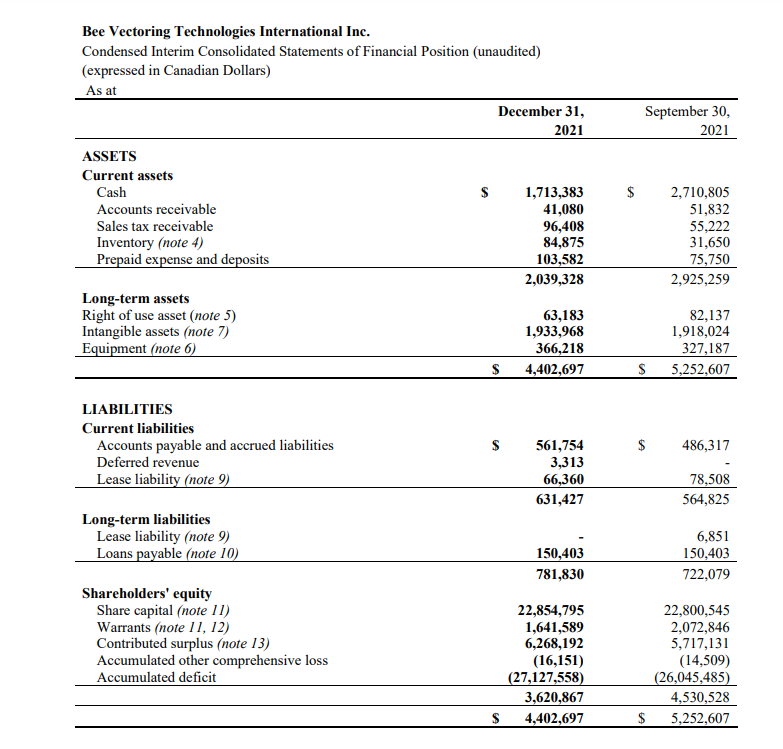

When looking at the current balance sheet (Q1 2022), Bee Vectoring meets my simple working capital criteria. Subtracting current assets-current liabilities should be positive. Simple, but a powerful analysis you can use for other companies.

The one thing I am a bit worried about is the cash position. $1.7 million in cash. Bee Vectoring will likely be looking at ways to raise some cash in the near future, and it might come in the form of financing which could dilute shares. This could cause a breakdown below our major technical support level of $0.225.

What I will do for my readers is to get in touch with management, and ask them about this year’s big goal and other questions.

I find the technicals are at a major inflection point, the innovative technology has real world applications and value, and the agriculture sector is about to get more eyes on it which means more investor money flows.

Disclaimer: I own shares of Bee Vectoring.