Nice Mice

Considering the amount of junk food I have eaten in the past week, I figured now is as good a time as any to talk about obesity. Furthermore, seeing as cancer runs in my family, why not kill two birds with one stone? According to a group of researchers from the University of Erlangen-Nuremberg (FAU) and Trinity College Dublin, the PD-L1 protein in our bodies may act as a protector against obesity.

Why is this important? The PD-L1 protein acts as a sort of ‘brake’ to keep the body’s immune responses under control. When PD-L1 binds with PD-1, another protein, it keeps T cells from killing other cells containing PD-L1. Unfortunately, this includes cancer cells, however, this makes PD-L1 a popular target for cancer immunotherapies. By targeting PD-L1 proteins, anticancer drugs can prevent PD-L1 from binding to PD-1, leaving T cells free to kill cancer cells.

Aside from cancer, PD-L1 expression on a group of immune cells called dendritic cells is a key regulator in controlling inflammation in fat tissues. Let me explain. During the progression of obesity, the composition of immune cells in fat tissues shifts to an inflammatory state, however, the exact cause has been obscure. Until now.

In their study, the FAU-Trinity team removed PD-L1 in a mouse model of obesity-induced by a high-fat diet. Compared with normal mice, the engineered mice became more obese and had increased insulin resistance. The researchers then tested the effects of a PD-L1 inhibitor, which has been used to treat various cancer in people.

Results demonstrated that, in obese mice, animals that got an anti-PD-L1 treatment gained more weight. Furthermore, these mice exhibited a worse metabolic state similar to the effects observed in the aforementioned engineered mice. With this in mind, the study’s findings are relevant for research into treating obesity and for cancer patients who receive PD-1/L1 checkpoint inhibitors.

Axsome Therapeutics Inc.

- $1.203B Market Capitalization

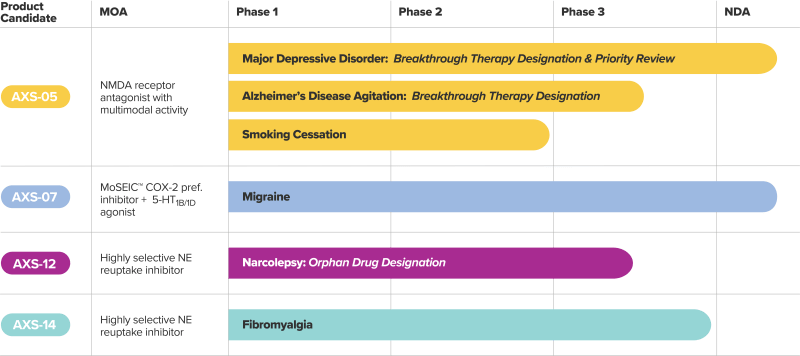

Axsome Therapeutics Inc. (AXSM.Q) is a biopharmaceutical company developing novel therapies for central nervous system (CNS) diseases that have limited treatment options. That being said, AXS-05 represents the Company’s novel, oral, patent-protected, investigational NMDA receptor antagonist with multimodal activity under development for the treatment of Major Depressive Disorder (MDD) and other CNS disorders.

For context, MDD is a debilitating, chronic, biologically-based disorder characterized by poor mood, inability to feel pleasure, feelings of guilt and worthlessness, low energy, among other emotional and physical symptoms. In severe cases, this can result in suicide. According to the World Health Organization, an estimated 7% of U.S. adults experience MDD each year.

Latest News

On March 1, 2022, Axsome reported its financials results for Q4 2021 and the year ended December 31, 2021. As of December 31, 2021, the Company had $86.5 million of cash compared to $183.9 million on December 31, 2020. In total, Axsome reported a net loss of $34 million, or $0.90 per share, for the three months ended December 31, 2021, up from a net loss of $29.2 million in Q4 2020.

Following the conclusion of several clinical trials, Axsome’s R&D expenses decreased to $13.8 million in Q4 2021 compared to $17.4 million in Q4 2020. For the year ended December 31, 2021, this number translates to $58.1 million, compared to $70.2 million for the year ended 2020. R&D expenses during FY2020 include a one-time charge for $10.2 million for the Pfizer license agreement.

“FDA review of our NDA for AXS-05 in depression is progressing, and the April 30 PDUFA date for our NDA for AXS-07 in the acute treatment of migraine is approaching,” said Herriot Tabuteau, MD, Chief Executive Officer of Axsome.

Additionally, Axsome provided a business update related to the Company’s clinical development. According to Axsome, the Company is prepared for a commercial launch of AXS-05 for the treatment of MDD, if approved by the FDA. With this in mind, Axsome has provided a response to the FDA addressing the two deficiencies outlined in the FDA’s response to Axsome’s NDA. More details regarding the NDA can be found here.

Keep in mind AXS-05 has already been granted FDA Breakthrough Therapy designations for MDD and Alzheimer’s Disease Agitation (AD). Furthermore, analysts expect AXS-05’s peak annual sales to reach $2.6 billion. Similarly, projected estimates for the Company’s AXS-07 in the US alone are more than $500 million per year. Axsome’s AXS-14, if approved, could also generate between $500 million and $1 billion, according to analysts.

Axsome’s share price opened at $30.82 on March 10, 2022, down from a previous close of $31.13. The Company’s shares were up 0.39% and were trading at $31.25 as of 1:18 PM EST.

PharmaCyte Biotech Inc.

- $44.539M Market Capitalization

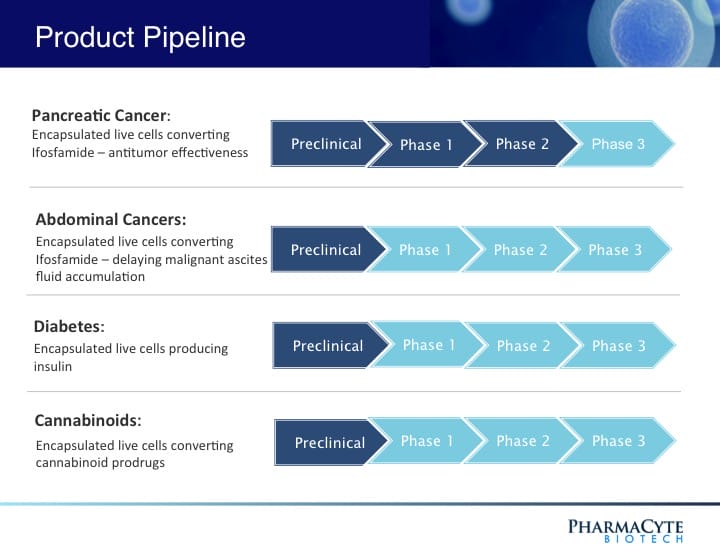

PharmaCyte Biotech Inc. (PMCB.Q) is a biotechnology company developing cellular therapies for cancer and diabetes utilizing PharmaCyte’s cellulose-based live-cell encapsulation technology known as “Cell-in-a-Box®.” This technology is being used as a platform to develop therapies for several types of cancer and diabetes.

Cell-in-a-Box® works by encapsulating different types of genetically modified living cells depending on the disease being treated. In the case of pancreatic cancer, these capsules are implanted into a patient’s blood vessels leading to the pancreatic tumor. PharmaCyte’s therapy for cancer involves encapsulating genetically engineered human cells that are capable of converting an inactive chemotherapy drug into its “cancer-killing” form.

Latest News

On February 14, 2022, PharmaCyte provided an update on the Company’s completed and ongoing activities to lift the FDA’s clinical hold on its treatment for locally advanced, inoperable pancreatic cancer (LAPC). For context, PharmaCyte received an FDA clinical hold letter on November 4, 2020, following the FDA’s notification that the Company’s IND had been placed on clinical hold on October 2, 2020.

In order to lift the clinical hold, the FDA informed the Company that it needs to conduct several additional preclinical studies. The FDA also requested additional information regarding several topics, including data, manufacturing information, and product release specifications.

“We completely understand the FDA’s need for more information. We are confident that with the data we’re producing in our additional studies and assays that the FDA will grant us an open IND just as the FDA granted us the Orphan Drug Designation for our treatment for LAPC,” commented PharmaCyte’s Chief Executive Officer, Kenneth L. Waggoner.

With this in mind, PharmaCyte’s press release dated February 14, 2022, indicates that a number of additional studies and assays have since been completed, with several others underway or slated to begin soon. As each study and assay is completed, the Company is compiling results to complete its IND submission package to the FDA.

PharmaCyte’s share price opened at $2.10 on March 10, 2022, down from a previous close of $2.13. The Company’s shares were up 0.94% and were trading at $2.15 as of 1:11 PM EST.

Akebia Therapeutics Inc.

- $502.01M Market Capitalization

Akebia Therapeutics Inc. (AKBA.Q) is a fully integrated biopharmaceutical company focused on achieving better outcomes for people with kidney disease. With this in mind, vadadustat refers to the Company’s oral hypoxia-inducible factor prolyl hydroxylase (HIF-PH) inhibitor for the treatment of anemia due to chronic kidney disease (CKD). In addition to CKD, vadadustat’s indication is being expanded to include acute respiratory distress syndrome (ARDS).

With Phase III results published in the New England Journal of Medicine (NEJM), Akebia is positioned to disrupt the $2 billion dialysis-dependent injectable erythropoiesis-stimulating agents (ESAs) market. ESAs are a group of medicines that help take the place of a hormone called erythropoietin (EPO), a hormone released by the kidneys to stimulate the production of red blood cells. Bearing this in mind, people with CKD may not have enough EPO coming from their kidneys to generate more red blood cells, resulting in anemia.

Latest News

On March 1, 2022, Akebia reported its financial results for Q4 2021 and the full year ended December 31, 2021. The Company also provided various business updates related to pre-commercialization activities ahead of a potential first-in-class US launch for vadadustat for the treatment of CKD-related anemia. It is worth noting that vadadustat is currently under review by the FDA with a scheduled Prescription Drug User Fee Act (PDUFA) date of March 29, 2022.

Put simply, a PDUFA action date is the date by which the FDA must respond to an NDA or Biologics License Application (BLA). For more details about PDUFA, check out this informative article. Moving on, as of December 31, 2021, Akebia had cash and cash equivalents of $149.8 million. The Company believes that its cash resources will be enough to fund its current operating plan for the next twelve months at least.

“If approved, we will immediately initiate the process to secure reimbursement for vadadustat under the Transitional Drug Add-on Payment Adjustment (TDAPA) period for dialysis organizations, which we expect will take approximately six months. We believe TDAPA designation for vadadustat will be an important driver for adoption within U.S. dialysis organizations,” said Dell Faulkingham, Chief Commercial Officer of Akebia.

Akebia’s total revenue for Q4 2021 was $59.6 million compared to $56.7 million in Q4 2020. For FY2021 and FY2020, these numbers translate to $213.6 million and $295.3 million, respectively. In total, Akebia reported a net loss of $70.7 million in Q4 2021, compared to $87 million in Q4 2020. For FY2021 and FY2020, these numbers translate to $282.8 million and $383.5 million, respectively.

Shortly after, on March 2, 2022, Akebia granted 12 newly-hired employees options to purchase an aggregate of 97,000 shares of the Company’s common stock on February 28, 2022. The options have an exercise price of $2.16 per share, which is equal to the closing price of Akebia’s common stock on the grant date.

Akebia’s share price opened at $2.85 on March 10, 2022, down from a previous close of $2.93. The Company’s shares are down -5.46% and were trading at $2.765 as of 1:25 PM EST.

Tiziana Life Sciences PLC

- $43.301M Market Capitalization

Tiziana Life Sciences PLC (TLSA.Q) is a clinical-stage biopharmaceutical company developing breakthrough therapies using transformational drug delivery technologies to enable alternative routes of immunotherapy. To be more specific, Tiziana has developed nasal, oral, and inhalation approaches with the potential to provide improved efficacy, safety, and tolerability compared to intravenous (IV) delivery.

Currently, Tiziana has two lead candidates, intranasal foralumab and milciclib. Foralumab represents the only fully human anti-CD3 monoclonal antibody (mAb). What the hell does that mean? To date, investigations have shown that anti-CD3 mAbs have been effective in treating autoimmune diseases in animal models.

With this in mind, along with milciclib, a pan-CDK inhibitor, both of the Company’s lead candidates have demonstrated favorable safety profiles and clinical responses in patients through various studies. Furthermore, Tiziana’s technology for alternative routes of immunotherapy has been patented, with several applications pending.

Latest News

On March 10, 2022, Tiziana announced positive clinical data in a patient with Secondary Progressive Multiple Sclerosis (SPMS), following the completion of six months of treatment with intranasally administered foralumab. In addition to being well-tolerated, both biological and clinical improvements were seen in the patient using the Company’s immunotherapy technology, bypassing the challenge of delivering this antibody across the blood-brain barrier (BBB).

“Importantly, data from this patient serve as the first validation of our breakthrough and potentially transformational approach with a convenient, intranasal ‘take home’ immunotherapy for SPMS and other neurological diseases,” said Dr. Kunwar Shailubhai, Chief Executive Officer & Chief Scientific Officer of Tiziana.

Having generated positive results, Tiziana has received FDA authorization to continue treating this patient for an additional 6 months to determine if 12 months of consistent treatment maintains clinical stabilization and provides sustained clinical benefit. Study data will be presented in a virtual Key Opinion Leader (KOL) event hosted by Tiziana on March 14, 2022.

I touched on it briefly earlier, but let’s talk a little more about foralumab. In a humanized mouse model, orally administered foralumab was shown to modulate immune responses of the T cells and enhance regulatory T cells. As a result, foralumab was able to provide therapeutic benefit in treating inflammatory and autoimmune diseases without the occurrence of potential adverse events commonly associated with mAb therapy.

With this in mind, once a day treatment for just 10 consecutive days with the Company’s intranasal foralumab was well tolerated and produced strong clinical responses in COVID-19 patients. Based on these studies, foralumab has the potential to become a well-tolerated immunotherapy for autoimmune and inflammatory diseases.

Tiziana’s share price opened at $0.95 on March 10, 2022, up from a previous close of $0.7328. The Company’s shares are up 22.12% and were trading at $0.8949 as of 1:41 PM EST.