Forget-Me-Not

Whether you believe in the metaphysical or not, there’s no denying the achievements of science. In particular, biotechnology has uncovered significant advancements in the field of medicine. For context, biotechnology refers to a branch of applied science that uses living organisms and their derivatives to create products and processes.

Some examples of significant biotechnological innovations include bioenergy, bioplastics, and gene editing, to name just a few. Even today, strides are being made in the field of biotechnology. Recently, in two studies scientists from Stanford University, Mayo Clinic, University College London, and the National Institutes of Health made an impressive discovery.

According to research from these studies, scientists discovered why a common genetic variant, worsens disease outcomes in amyotrophic lateral sclerosis (ALS) and frontotemporal dementia (FTD). Keep in mind, almost all cases of ALS and half of FTD cases are linked to the dysfunction of the protein TDP-43 in the body.

That being said, study results indicated that a lack of TDP-43 could sabotage the proper expression of the neuronal protein UNC13A. To make matters worse, when UNC13A genetic variants were present, the risk of more severe ALS and FTD was increased.

With this in mind, these studies have revealed a possible biomarker and new therapeutic target. In conclusion, researchers now view restoring UNC13A production as a possible new strategy for therapies against ALS and FTD, representing a significant step towards the efficacious treatment of both. Now, let’s talk about biotechnology companies that may or may not be doing their part.

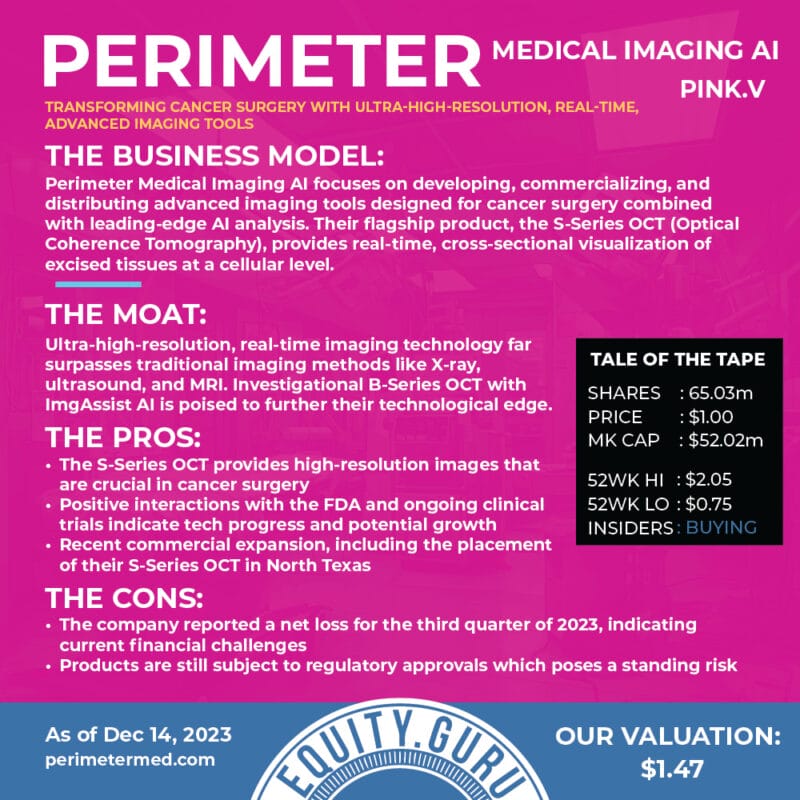

Perimeter Medical Imaging AI Inc.

- $179.704M Market Capitalization

Perimeter Medical Imaging AI Inc. (PINK.V) is a medical technology company transforming cancer surgery with ultra-high resolution, real-time, advanced imaging tools to address unmet medical needs. With this in mind, Perimeter’s S-Series Optical Coherence Tomography (OCT) platform is capable of delivering 2mm subsurface imaging of excised tissue margins, allowing surgeons to make informed decisions in real-time during an operation.

Ultimately, Perimeter’s technology is intended to reduce the prevalence of positive margins during breast-conserving surgery (BCS). Positive margin refers to when a pathologist finds cancer cells at the edge of the tissue, suggesting that the cancerous legion has not been removed during BCS. That being said, breast cancer recurrence risk doubles when positive margins are not excised, with 48% complication rates for re-operations. For a closer look at Perimeter, check out this article.

Latest News

On February 24, 2022, Perimeter announced that it has been named one of the 2022 Venture 50 Companies by the TSX Venture Exchange (TSXV). In the Clean Technology & Life Science sector, the Company was ranked sixth, with a market capitalization increase of approximately 79% and a share price increase of 55% in 2021.

The TSX Venture 50 is a yearly ranking conducted by TMX Group of 50 upcoming companies on the TSXV. Every year, the list is decided by assigning equal weighting to share price appreciation, trading volume, market capitalization growth, and analyst coverage.

“We are honored to be named as one of the Venture 50 Companies and see this recognition as further validation of the significant progress made in both the commercial and clinical development areas of our business in 2021.

Our TSX Venture listing has provided Perimeter with increased awareness from both the capital and commercial markets, access to capital, and additional support to drive our business forward,” commented Jeremy Sobotta, Perimeter’s Chief Executive Officer.

Why is this important? The TSX Venture 50 Program provides companies with the opportunity to showcase their successes and contributions, driving growth in the Canadian economy, creating jobs, and, arguably the most important, building shareholder value.

Additionally, on February 24, 2022, Perimeter provided a corporate update on its progress towards achieving key corporate objectives, as well as commercial, clinical, and product development milestones.

“I believe 2021 was a transformative year for Perimeter, and today’s update summarizes the key milestones achieved across all areas of our business,” said Jeremy Sobotta.

Some of Perimeter’s commercial highlights include receiving 510(k) clearance for the Company’s S-Series OCT imaging platform from the U.S. Food and Drug Administration (FDA). For context, 510(k) refers to a premarket submission made to the FDA demonstrating that a device intended for marketing is safe and effective as well as substantially equivalent to a legally marketed device.

With this in mind, having secured FDA 510(k) clearance, Perimeter is now able to pursue its commercial launch in the United States (US). Moving forward, the Company will continue to build upon its sales and marketing infrastructure, including key hires of market development managers to cover regions across the US.

Speaking of commercial sales, on June 8, 2021, Perimeter partnered with Minnetronix Medical, a leading medical technology and operations partner, to secure commercial-scale manufacturing of Perimeter’s S-Series OCT. More specifically, the Company announced that it had completed the technology transfer of its manufacturing process with Minnetronix.

In addition to Perimeter’s S-Series OCT, Perimeter received U.S. FDA Breakthrough Device Designation for the Company’s Perimeter B-Series OCT combined with its proprietary ImgAssist Artificial Intelligence (AI) software. Whew, that’s a mouthful.

The purpose of the FDA’s Breakthrough Devices Program is to provide patients and health care providers with timely access to medical devices that provide for more effective treatment or diagnosis of life-threatening or irreversibly debilitating diseases or conditions. The program does this by accelerating the development, assessment, and review of potential devices, in this case, Perimeter’s B-Series OCT.

With this in mind, the FDA has provided Perimeter with a potential expedited pathway for the development and adoption of its B-Series OCT with ImgAssist. This technology is further supported by the Company’s recently initiated multi-center, randomized, two-arm pivotal clinical trial evaluating Perimeter’s B-Series OCT with ImgAssist for use during Breast Conservation Surgery (BCS). Study completion is anticipated by the end of 2022.

Perimeter’s share price opened at $2.99 on February 24, 2022, down from a previous close of $3.01. The Company’s shares were down -2.99% and were trading at $2.92 at closing.

Full Disclosure: Perimeter Medical Imaging AI Inc. (PINK.V) is a marketing client of Equity Guru.

Sernova Corp.

- $360.536M Market Capitalization

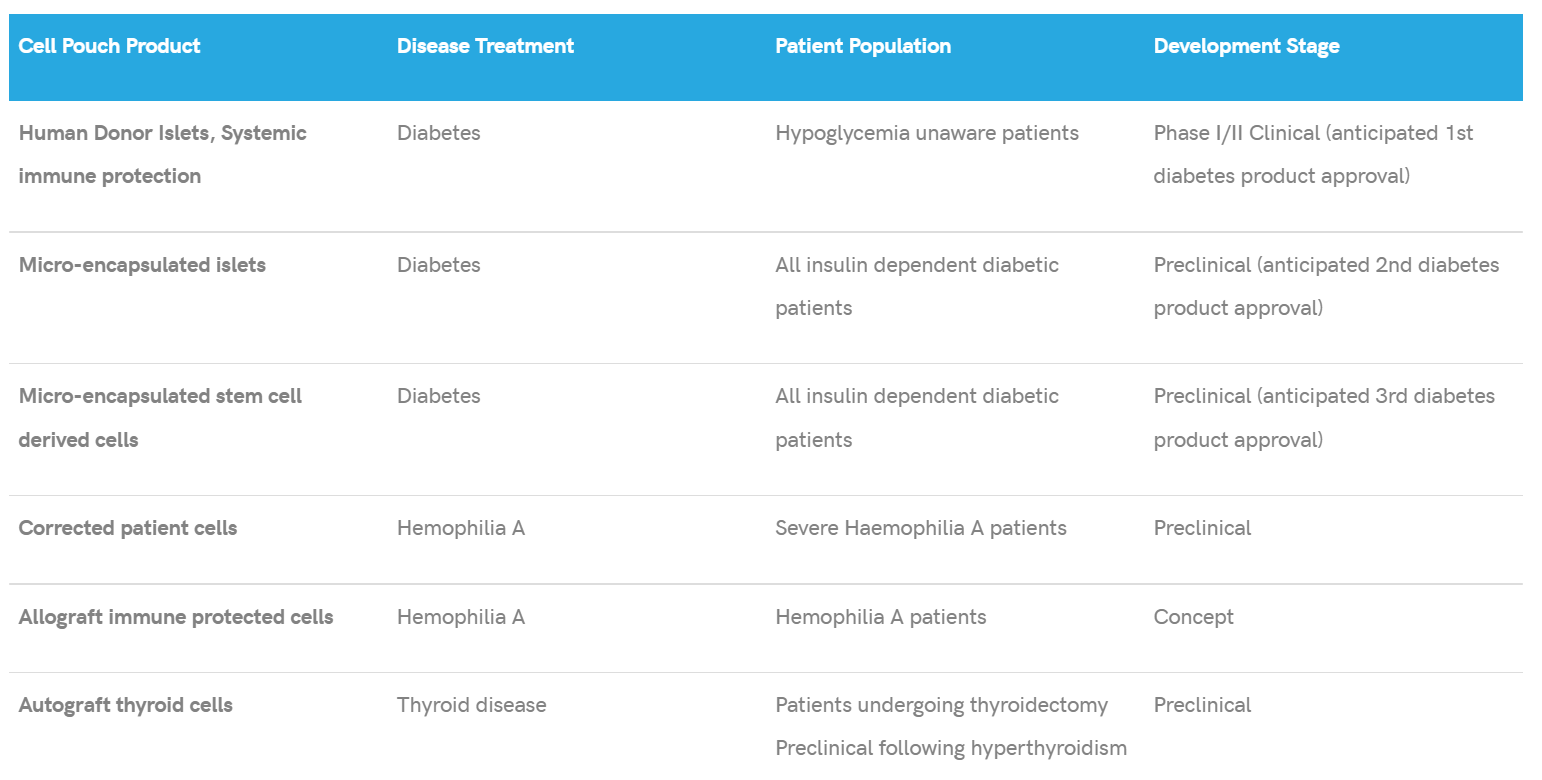

Sernova Corp. (SVA.V) is a clinical-stage regenerative medicine technology company committed to the development and clinical advancement of its products for metabolic, hematological, and other chronic diseases. With this in mind, Sernova believes in advancing its clinical programs as well as building collaborations and partnerships intended to accelerate the Company’s portfolio of products into the market.

To date, Sernova has partnered with BIOTECanada, Alliance for Regenerative Medicine, and the Biotech Innovation Organization, to name just a few. Of its products, Sernova’s Cell Pouch System™ has received various certifications, including ISO 13485, MDR2017/745, US FDA Quality System Regulations 21 CFR 820, and Canadian Medical Device Regulation.

Latest News

On February 24, 2022, Sernova announced that it has been named as one of the top 50 performers on the TSXV. While Perimeter ranked sixth on this list, Sernova secured first place in the Clean Technology & Life Sciences category. This represents the second year in a row that the Company has secured a position as a Top 50 company.

“Being awarded this title two years in a row is a strong validation of our persistent dedication to increasing shareholder value as we continue to deliver on our strategic plan to build a leadership position in the regenerative medicine cell therapy therapeutics field.

In 2022, we look forward to driving continued success through, evolving our clinical programs, further developing our pharmaceutical partnerships, and advancing our capital market initiatives,” said Dr. Philip Toleikis, Chief Executive Officer of Sernova.

In 2021 Sernova’s share price change was an impressive 172%, demonstrating the Company’s continual success. As much as I am sure you’d love to hear more about the TSX Venture 50, let’s talk about Sernova’s Cell Pouch System, the Company’s poster child.

On January 27, 2022, Sernova announced the publication of a peer-reviewed preclinical study demonstrating positive results of the Company’s Cell Pouch System cell therapy approach to treat hypothyroidism and potentially avoid lifelong dependence on thyroid medications following surgical removal of the thyroid gland.

To provide some background, the thyroid gland is responsible for producing hormones that regulate metabolism within a narrow functional range. Some vital bodily functions the thyroid gland regulates include breathing, heart rate, body weight, and body temperature, among others.

With this in mind, thyroid deficiencies can lead to two diseases related to hormone levels, namely hyperthyroidism and hypothyroidism. Personally, I know a few people with hypothyroidism, including my girlfriend who is sensitive to cold temperatures, one of many symptoms of an underactive thyroid.

In cases where thyroid activity is insufficient or absent, thyroid hormone replacements drugs are frequently used. However, optimization of thyroid replacement medications can be challenging with dose adjustments requiring frequent lab tests to reach appropriate levels.

Furthermore, thyroid replacement therapy is associated with numerous side effects including impaired cognition, lethargy, weight gain, all of which lead to a diminished quality of life and increased ongoing costs to the patient and healthcare system.

The solution? Sernova’s Cell Pouch System. Moving forward, Sernova is preparing regulatory documents to proceed with a Phase I/II human clinical trial in subjects undergoing thyroid surgery. In the study, subjects will be implanted with the Cell Pouch.

The study will then assess the safety and efficacy of the Cell Pouch translated tissue, with efficacy measured as the recovery of thyroid hormone in the bloodstream. Sernova expects to submit a clinical trial application in 2022.

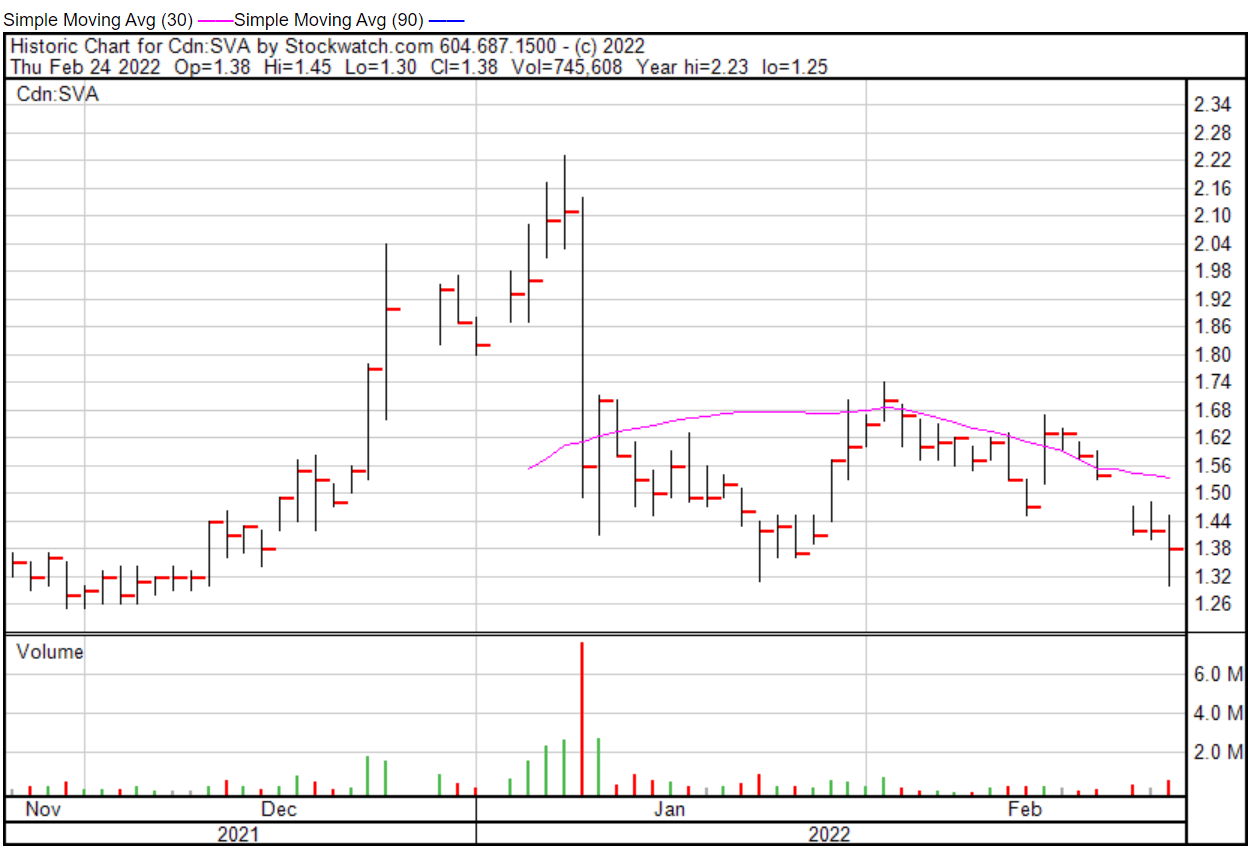

Sernova’s share price opened at $1.38 on February 24, 2022, down from a previous close of $1.42. The Company’s shares were down -2.82% and were trading at $1.38 at closing.

Edesa Biotech Inc.

- $48.627M Market Capitalization

Edesa Biotech Inc. (EDSA.Q) is a clinical-stage biopharmaceutical company focused on developing innovative treatments for inflammatory and immune-related diseases with unmet medical needs. The Company’s product pipeline covers a variety of indications including Acute Respiratory Distress Syndrome (ARDS), Allergic Contact Dermatitis, Hemorrhoids, and Immunotherapy.

Edesa’s EB05 is a monoclonal antibody therapy being developed by the Company to treat ARDS, a life-threatening form of respiratory failure and the leading cause of death among COVID-19 patients. Normally, I wouldn’t care much for yet another company cashing in on COVID-19 vaccines, however, Edesa is marketing critically ill patients.

With this in mind, according to the U.S. Centers for Disease Control (CDC), 20% to 42% of hospitalized COVID-19 patients develop ARDS, which increases up to 85% for patients admitted to the ICU. Overall, mortality among patients admitted to the ICU ranges from 39% to 72%.

Latest News

On February 17, 2022, Edesa provided an update on the Health Canada approved Phase III part of a Phase II/III clinical study evaluating the Company’s EB05 as a single-dose therapy for hospitalized COVID-19 patients. More specifically, the Phase III double-blind study is designed to assess the safety and efficacy of EB05 among critically ill COVID-19 patients receiving life support.

“Based on the significant effect demonstrated in reducing mortality in the Phase 2 study, we believe that Edesa’s monoclonal antibody EB05 could significantly reduce mortalities and alleviate the stress on the healthcare system, especially in the ICU where beds are limited, care is very expensive and patient outcomes have been tragically poor,” said Dr. Par Nijhawan, MD, Chief Executive Officer of Edesa.

Previously, Edesa’s Phase II results demonstrated encouraging preliminary evidence of EB05 in reducing mortality in the sickest patients. Of these results, critically ill hospitalized COVID-19 patients given EB05 plus standard care treatment had a 68.5% reduction in the risk of dying when compared to placebo at 28 days.

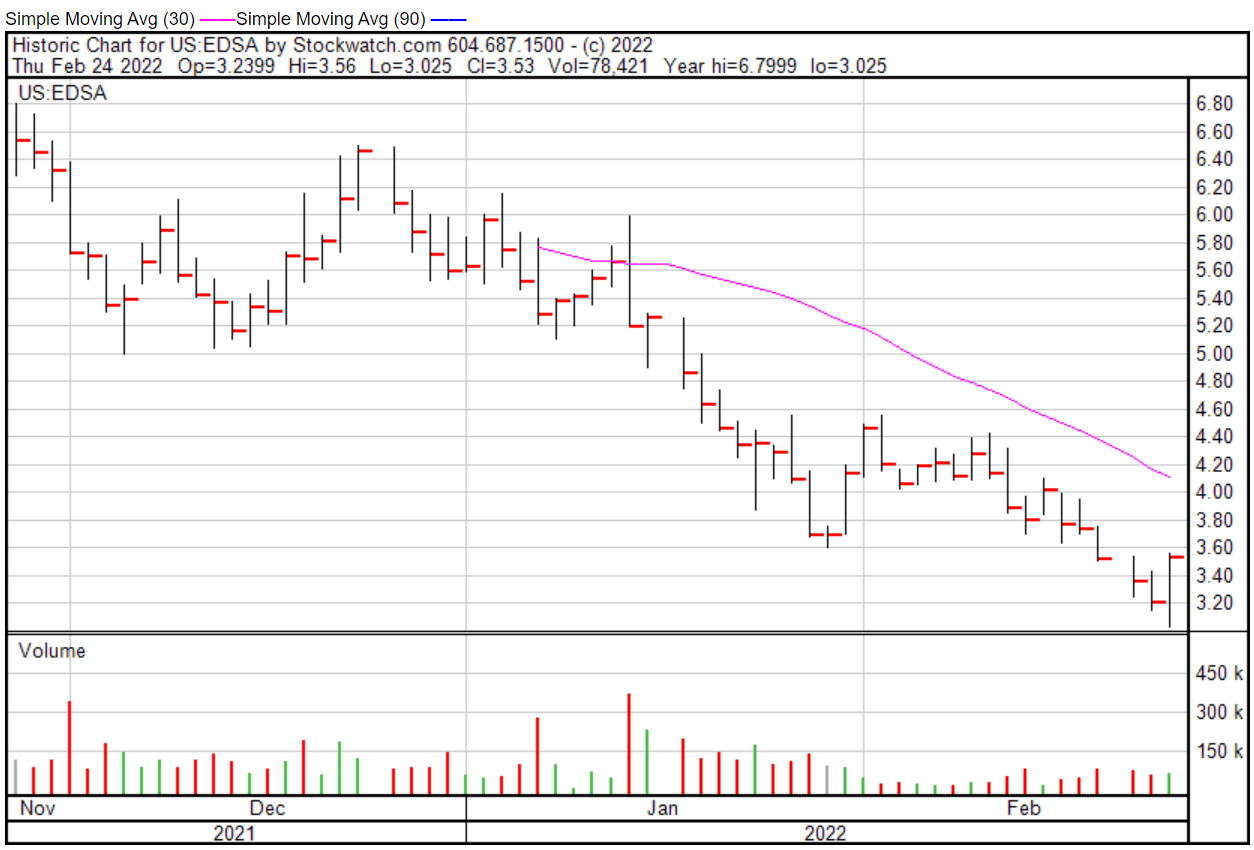

Edesa’s share price opened at $2.96 on February 24, 2022, down from a previous close of $3.21. The Company’s shares were up 9.97% and were trading at $3.53 at closing.

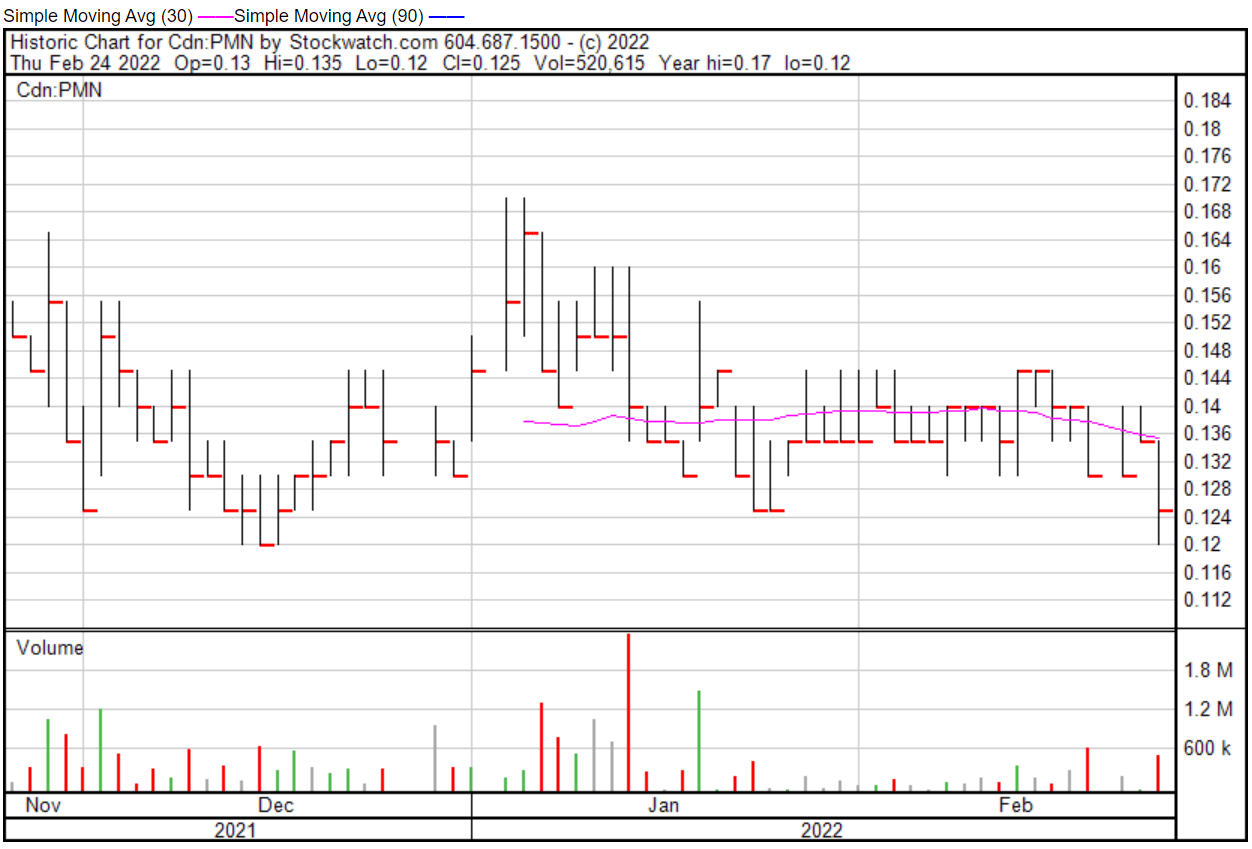

ProMIS Neurosciences Inc.

- $53.967M Market Capitalization

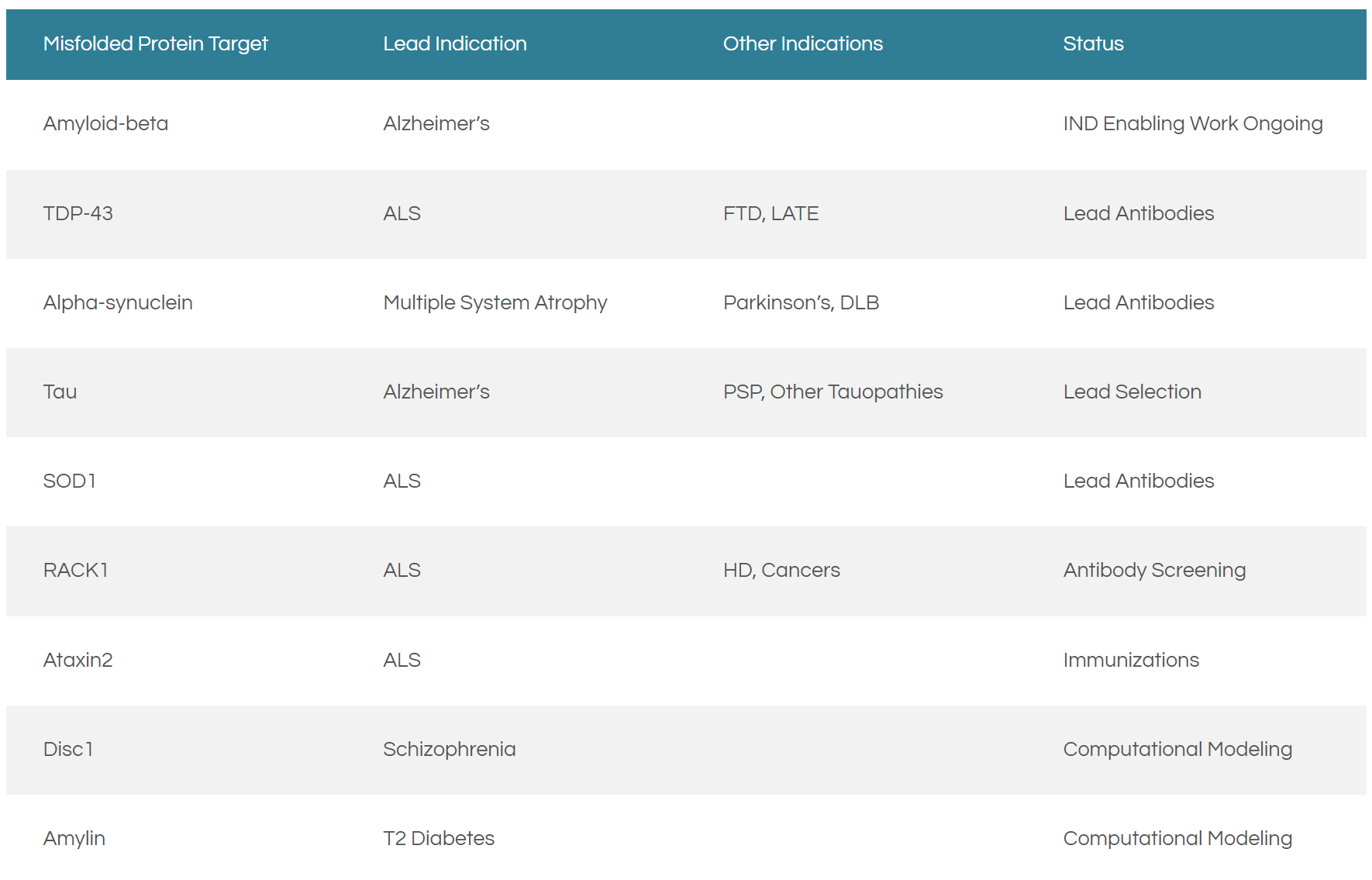

ProMIS Neurosciences Inc. (PMN.T) is a development-stage biotechnology company committed to the discovery and development of therapeutic antibodies for the treatment of neurodegenerative diseases. Using its proprietary target discovery engine the Company is able to predict novel targets known as Disease Specific Epitopes (DSEs) that cause neurodegenerative diseases, including Alzheimer’s Disease, Multiple System Atrophy (MSA), amyotrophic lateral sclerosis (ALS), and Parkinson’s Disease.

That being said, the ProMIS discovery engine is comprised of two complementary algorithms, namely ProMIS™ and Collective Coordinates. Together, these algorithms are able to predict and identify DSEs, providing new opportunities for early detection via diagnostics as well as the development of selective antibody therapies, a process that ProMIS is undertaking. Currently, the Company has a portfolio of highly selective antibodies in multiple disease indications.

Latest News

Most noteworthy, on January 18, 2022, ProMIS announced that it has initiated a program to develop monoclonal antibodies to treat schizophrenia and other chronic mental illnesses. However, before we get into the details, it is worth noting that DSEs cause both neurodegenerative and protein misfolding-related diseases.

What is protein misfolding? I am probably not the person to answer this, but here goes nothing. A protein is considered to be misfolded if it cannot achieve its normal native state. This can be due to a variety of reasons such as mutations in the amino acid sequence or a disruption of the normal folding process by external factors.

With this in mind, biomedical literature has implicated protein misfolding as one of the causes of schizophrenia. In particular, the DISC1 gene, and its genetically-linked protein interactions in the brain, represent a new target platform for ProMIS.

“We now have tools – including ProMIS’ proprietary computational algorithms – to approach schizophrenia and related diseases for druggable misfolded protein targets,” said Dr. Neil Cashman, ProMIS’ Chief Scientific Officer.

With the program now underway, ProMIS has recruited Dr. Carsten Korth, a biological psychiatrist and pioneer regarding the role of DISC1 in chronic mental illness. Dr. Korth has been appointed to the Company’s Scientific Advisory Board to share her expertise on and scientific knowledge on the subject.

ProMIS’ share price opened at $0.13 on February 24, 2022, down from a previous close of $0.135. The Company’s shares were down -7.41% and were trading at $0.125 at closing.