Hi. It’s me. You didn’t think I was just going to stop bombarding your inbox with unsolicited financial advice and uninvited political opinion, did you?

Here we are again, another January past. In less than 5 years I will be 30. I don’t know what my point is there, but it is something I keep saying to myself. In September I found wrinkles on my forehead that seem to remain creased even after I stop frowning and a facialist called my freckles “age spots”. For a few weeks I wondered if I had already missed my window for “Preventative Botox” and have become someone who now just needs “Botox Botox”. Then I watched the film Don’t Look Up and was reminded that none of it matters anyway.

But I didn’t come here to talk about my receding youth, and I didn’t come here to make friends. I came here to contemplate how I’ve been writing a financial literacy column for over a year and somehow find my personal finances in shambles. Also, for the fleeting satisfaction of filling a white space with words and later telling someone “I am a writer who actually gets paid to write!” (which is to say, “See? I have some value”) – but that is an egomaniacal compulsion for another day.

By some incomprehensible break in the time-space continuum, it is 2022.

And putting the physics of how we jumped from 2019 to 2022 in 4 nanoseconds aside, it is time to sort out our shit.

We are taught that the only way to truly understand where we are is to look back at where we came from. It is the reason for high-school History classes and subsequent purpose for pretentious History professors.

Thing is, I don’t want to look back. Much to my therapist’s dissatisfaction, I have been working very hard at dissociation and neglect of things past. This is the year of letting your demons marinate in your subconscious only to have them take you by surprise at the most inconvenient time! Health and balance simply do not belong in a pandemic-ridden world.

Nevertheless, financial instability gives me chin pimples and apparently forehead wrinkles and the very thought of organizing my financial life at least gives some illusion (however delusional) that I have a handle on something. So, here goes. These are the 3 minor things I am doing in this week’s episode of “Playing Adult”:

1. Scheduling a call with my financial advisor

Jay hasn’t heard from me in over a year. This is the equivalent of bailing on your bi-annual dental cleaning. You somehow feel like you’re getting away with something sinister, but the reality is, your hygienist doesn’t care. It is not their mouth that is rotting.

This call will be a friendly reminder of all the things I want to forget – savings, budgeting, future goals, RRSPs, taxes, etc. (The more you find yourself wanting to forget – the more I’d recommend scheduling this call).

If you do not have a financial advisor and aren’t keen to invest on your own…it’s time to go shopping. Shopping for a financial advisor is just like dating – you won’t know that you’ve found a match unless you have surveyed the field. And in the same vein, you won’t know if you’re dealing with a good person unless you ask a lot of questions.

If I buy this [financial product], do you get paid?

What do you get paid?

Is this pushed by your company?

Do you support ESG companies?

Remember: You would ask tough questions if you were going to buy a Honda Civic.

This is a commercial transaction and you’re the customer.

2. Trying to fill out my cousin’s neurotic budgeting plan

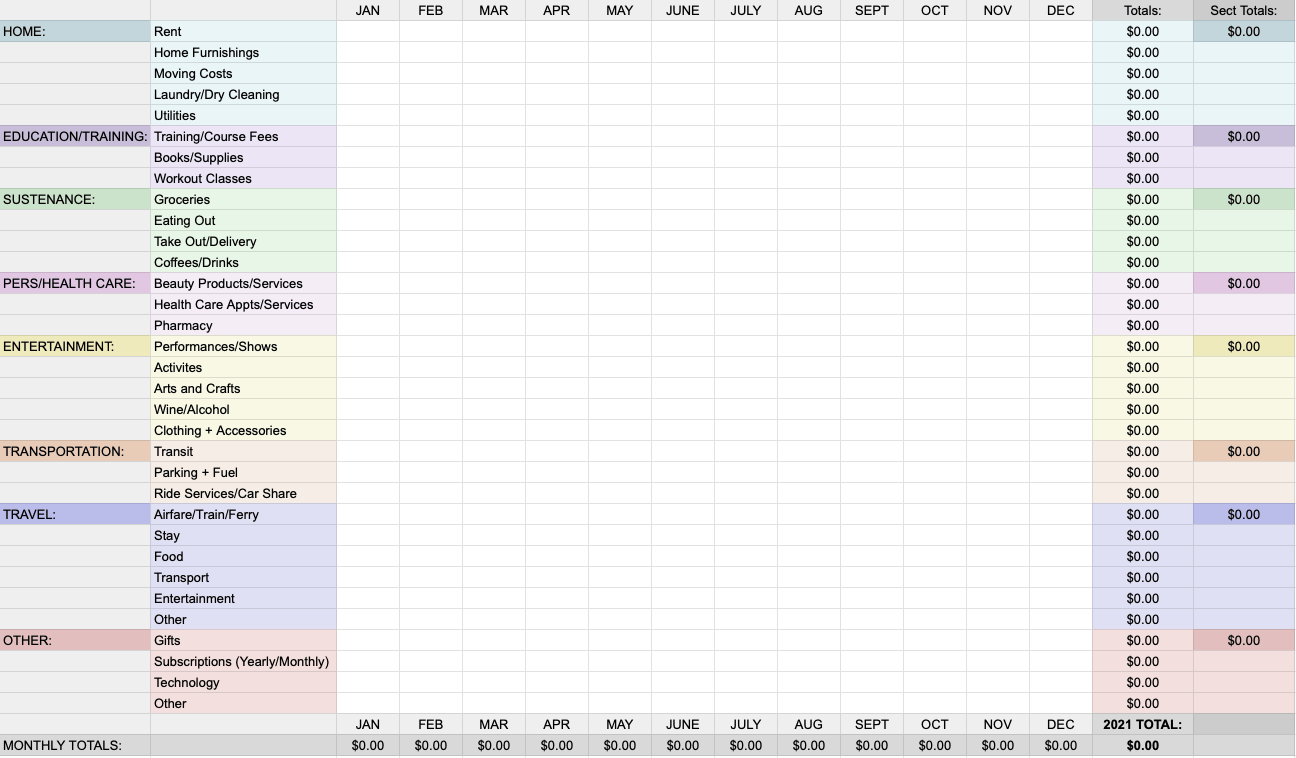

Every evening, my cousin pours a cup of tea and fills out her spending for the day in a perfectly color coordinated Excel spreadsheet. This is unreal in several capacities, but if you can manage to even be 0.5% as fiscally aware as she is, I promise you that your life will be easier.

Is a daily $9 chai/matcha latte to be considered unnecessary and excessive spending?

Once looking at it in spreadsheet form does it seem like overkill?

No. But at least now we’ve thought about it.

3. Going through my credit card statement

Do you ever wonder why you’ve never addressed that mystery Amazon channel you’re being charged $11.95 for each month?

Same.

I have spent $215.10 in the past year and a half, and it is probably because I wanted to re-watch episode 1 of Friday Night Lights that one Sunday afternoon. (Even Tim Riggins is not worth $215.10). You don’t need me to tell you that sneaky expenses add up. Go through last month’s credit card statement and jot down any random subscriptions you are being charged for that you don’t use. Then cancel them.

Getting your financial life in order is a big thing. And my lack of financial togetherness despite writing about it every week certainly can’t be inspiring to any of you. But I will tell you what I tell myself:

Breaking big things down into small things is how we get stuff done — by composing a set of tasks and spreading them out over time. Creating a set of doable things is what gets us moving. And if you think it’s too late to get your financial life in order because you fall under the bracket of “Botox Botox” people, I leave you with this Hallmark card:

The best time to plant a tree is 30 years ago. The second-best time is today.

Go plant your tree. Until next time.