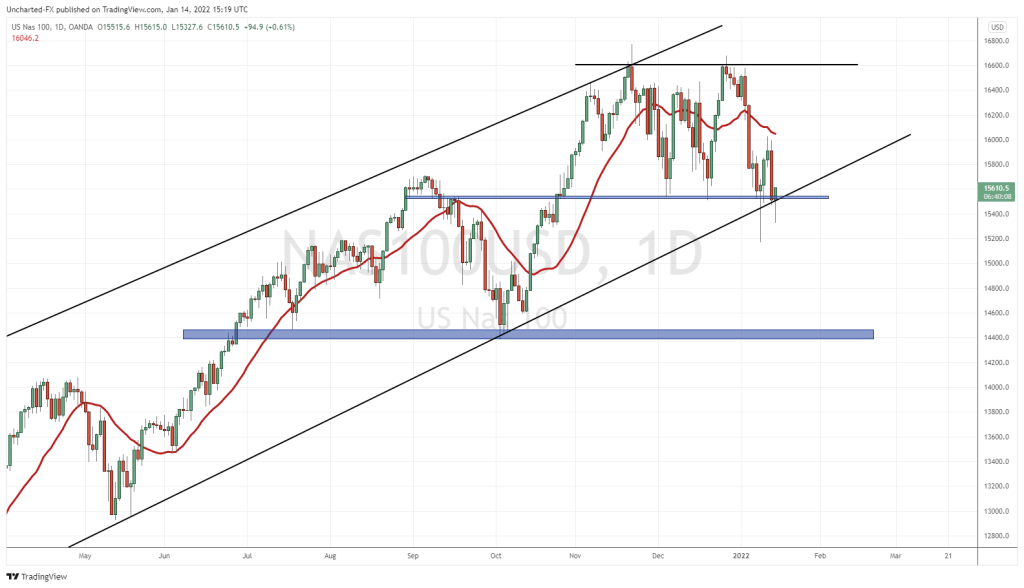

The Nasdaq is once again on the verge of a breakdown which would lead to a new downtrend/ bear market. Very big day for US stock markets today.

US markets dropped on Monday, but recovered the entire drop on Tuesday and Wednesday. It seemed to be a dead cat bounce, and markets saw a large sell off Thursday. The reason? All about the Federal Reserve. We went from “to taper or not to taper”, to “to hike or not to hike”. Fed chair Jerome Powell at his testimony adopted a less hawkish tone. Some go as far to say he shifted back to dovish. He did not give any concrete date for rate hikes, and it seems markets were now not pricing in 3-4 rate hikes this year. Great for markets that are propped by easy money.

This all changed Wednesday when Fed President Harker came out super hawkish, calling for ‘action on inflation‘ and sees 3-4 rate hikes this year. I sort of find it amusing how inflation is now based on money printing and the Fed’s monetary policy. Remember, the Fed has been saying inflation is rising due to supply chains and not their monetary policy. Some free thinkers out there are wondering how hiking rates will solve the supply chain issues.

Here are some comments from Fed Harker:

“We do need to take action on inflation. It is more persistent than we thought a while ago. I’ve been off the ‘transitory’ team for a while now,” he said, citing the term Fed officials used to characterize inflation through most of 2021 before pivoting toward the end of the year.

“I think it’s appropriate to take action this year,” Harker said. “Three [hikes] is what I’ve penciled in, but four is not out of the question in my mind.”

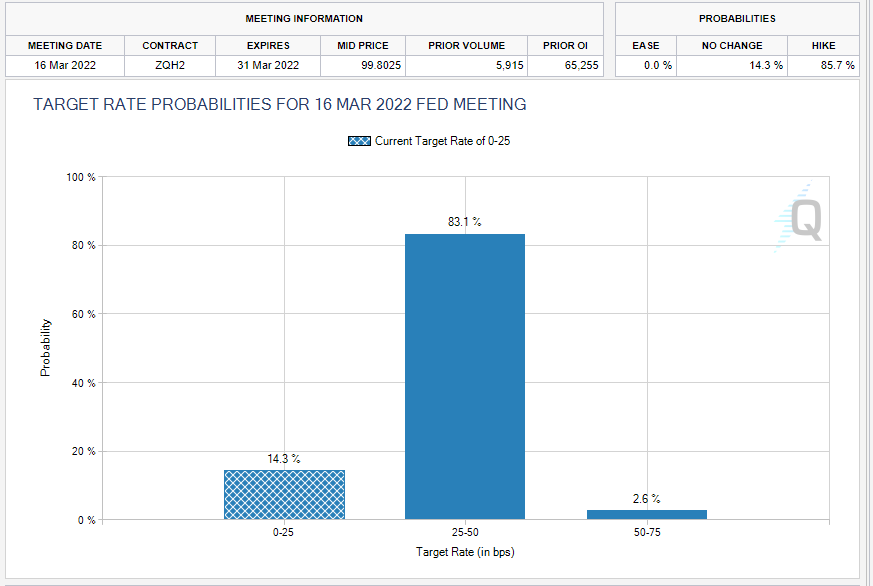

Good to know Harker was not on team transitory (inflation coming from supply chains). Currently the markets are still pricing in a rate hike in March 2022.

The probability of a 25 basis hike actually increased to 85.7%. The Fed will have to deliver come March. They don’t want markets to go volatile when they don’t do something the markets have already priced in. It would also lead to a confidence crisis. Is there an escape? On the pandemic side, we are seeing US hospitalizations break records. Hospitals are overflowing again, and I remember when President Trump was in office, the media and the financial media was all about shutting the country down to deal with this overflow. Let’s see if they take the same approach here with President Biden. More restrictions and lockdowns would mean the Fed delays the rate hike.

But maybe, the Fed doesn’t need that excuse. Last week, we saw US employment numbers come in for the month of December 2021 with a huge miss. We had US retail sales for December 2021 come out today, and we got another huge miss. Surprising because Christmas time is when people spend money. Not in 2021 though.

Retail sales declined 1.9% in December, much worse than the forecast for a 0.1% drop. People are not even spending online! Online spending took the biggest hit as a share of overall spending, with non store retailers reporting a plunge of 8.7% for the month. Furniture and home furnishing sales declined 5.5% and sporting goods, music and book stores saw a 4.3% drop.

The question being posed by financial media right now is if the Fed can even hike rates in a weak economy? Hikes are usually attributed to slowing down a booming economy. We all know the Fed will have to raise rates to curb inflation, which stems from their monetary policy. The big question is, with all the debt out there (government and consumer), how much can the Fed hike without breaking debtors. Some say the Fed cannot go over 1%, so about three 25 basis point hikes. Others say maybe not even 1 hike of 25 basis points.

All I can say is keep watching the Fed Fund futures probabilities. Right now, the market is pricing in a hike and the Fed cannot disappoint unless they want to see stock markets go crazy. There are a lot of days left from now until March so anything can change from now until then to alter the probabilities.

On Monday, I wrote a Market Moment article highlighting how important the Nasdaq technicals were. We were on the verge of a reversal. We actually broke below support and the channel. Things looked grim. I said that if we got a daily close confirmation, the uptrend is over. What we saw instead was probably the largest daily dip buy in a single day. They managed to prop the Nasdaq green and got the index to close above support AND the channel trendline. Amazing.

Today’s (Friday) price action is playing with our dangerous zone again. Support and the channel trendline are being tested. We need to get a daily close above by the end of the day to stay in an uptrend. So far so good. Another large wick indicating huge amounts of buying. But we still have plenty of time left in the day. A close below would set us up for a Black Tuesday as US markets are closed on Monday for Martin Luther King day.

The VIX popped, but is now selling off. The danger zone is a daily close above my horizontal line. Watch the close today. If this breaks out, it will coincide with a Nasdaq breakdown.

This is the most important chart on my watchlist. The 10 year yield. We have had a breakout, which the market is interpreting as 3-4 Fed rate hikes this year. Rates are rising, and bonds are being sold off. For us market bulls, we wanted to see a close back below 1.70% to nullify the breakout. Unfortunately, we are seeing the opposite. As the probability for rate hikes increases, the 10 year yield will continue to rise. Rising rates do not bode well for stock markets that have been propped by cheap money. Already hearing people say we need to start looking at the deflation trade. Oh, and I should say that Gold is still holding up really well even with rising rates. A rising rate environment usually hurts Gold. But Gold remains propped either as an inflation hedge, or because people are losing confidence in governments and central banks.