One of our favorite agriculture technology companies, Bee Vectoring (BEE.CN) released big news this week which saw the stock rip 50% at its highest peak this week. In recent weeks, I have highlighted the great support on the chart. If you are a regular reader, you had plenty of time to pick up some shares. Technically, we had so much evidence that buyers were defending support hard. They were holding the line. Technicals showcase emotions and psychology. Definitely add basic technical analysis to your investing tool kit. We expect many more moves like Bee Vectoring to occur based on good technicals in the future.

Before I talk about the Bee Vectoring news and the chart, let’s take a look at some of the big agriculture news this week. And there are some big ones.

Chances are, if you have gone out to malls or even restaurants, you have come across “Help Wanted” signs. An exodus of workers. Some call it a labour shortage. It hit me hard because my favorite sushi joint is now closed on Tuesdays and Wednesdays because they don’t have enough workers! Labour shortage is also affecting agriculture, and is resulting in the loss of billions in sales.

IPolitics put out a piece this week detailing the labor shortage, and what it means for profits and also food supply chains. Roughly 240,000 Canadians worked in agriculture in December 2021, a 21-year low for that month, according to Statistics Canada’s labour-force survey released Jan. 7. In contrast, nearly 350,000 Canadians held agricultural jobs in December 2000.

Keith Currie, the VP of the Canadian Federation of Agriculture, said labour shortages has caused $3 Billion in lost sales and that as many as 125,000 jobs in the farm-to-food value chain could be vacant by the end of the decade. Unfilled jobs have caused delays throughout the farm-to-fork supply chain. Farmers and producers are struggling to get their products to market.

You are seeing the empty shelves in grocery store pictures and videos once again. And I don’t think this will be the last time we see them.

An interesting point Mr. Currie makes, fits in with one of our going long Agriculture criteria. He believes that more awareness of the career opportunities in agriculture is needed.

“Not enough people think about agriculture as their first (job) choice,” he said. “If you’re a welder, plumber, or a mechanical carpenter, you can … work on a farm, because you need all that. We need those assets. It’s a great lifestyle, but I don’t think people understand the potential that’s out there.”

I just go back to Billionaire Jim Rogers saying that not many young people want to be farmers anymore. Not just studying horticulture and agriculture at university, but not many young people want to work in farms. The farming lifestyle is too tough. People just don’t want to work hard. What has been the solution thus far? Foreign workers coming in to fill this labour gap.

A couple of more news on supply chains. Let’s talk about Canada first. On January 15th, the Canadian government was going to prevent unvaccinated truckers from crossing the border. The mandate has now been reversed, and unvaccinated truckers will be allowed to enter Canada from the US. Canadian Prime Minister Justin Trudeau had faced pressure from the main opposition party and trucking lobby to drop the vaccine mandate for truckers, saying it could result in driver shortages, disrupt trade and drive up inflation. I am sure it was done to ensure no disruption in supply chains.

With Omicron causing lockdowns in China once again, the global economy is heading for “mother of all” supply chain shocks as China locks down ports. Uh oh. Downside economic risks could mean the Fed will continue cheap money policy. Would be great for the stock markets. The Fed could also continue blaming inflation on more supply chain issues rather than their money printing and monetary policy. The middle class is the loser, but the central banks come out as winners especially if you think they cannot raise rates due to all the debt there is. It allows them to save face and continue their cheap money policy. Significant for anyone trading and investing in markets in my opinion. Be sure to follow my Market Moment articles, and join our Discord group if you are interested in following markets and money flows.

Bee Vectoring (BEE.CN)

The thing I love about the agriculture and ag tech sector is all the unique and creative technology and ideas to make farming better. My favorite plays are those that harness the power of mother nature. Bee Vectoring is one of them.

Back in October 2021, I wrote a piece on Bee Vectoring covering the company, its technology and the cup and handle technical pattern I was seeing then. If you are interested in the company, you can read my full rundown here. I will also post a video explaining the company’s technology:

Bee Vectoring Technologies International Inc (BVT) is an agriculture technology company that develops and provides natural commercial farming solutions including crop protection. Its solutions include the Hive and Bees, an inoculum dispenser system; Vectorpak with Vectorite, a recipe of ingredients that allows bees to carry crop BVT-CR7 and other beneficial fungi or bacteria in their outbound flights to the crops; active ingredients, such as BVT-CR7, an organic strain of a natural occurring endophytic fungus; and pollen distribution systems. The company’s patented bee vectoring technology uses commercially-reared bees to deliver targeted crop controls through the natural process of pollination. It provides natural pest and disease management solutions for various crops, such as strawberries, sunflowers, apples, tomatoes, canola crops, blueberries, and other crops.

A huge week for Bee Vectoring stock. The stock is up 25% in the last five days, and this week was up nearly 50% from the lows of the week at $0.30, to the highs printed at $0.45. The news out this week announced Bee Vectoring and BioSafe Systems signing a memorandum of understanding where the companies have agreed to enter into detailed discussions on multiple business projects that call upon each other’s expertise. Both companies are leaders in their agricultural biologicals industry with a similar customer base and offer products and services that are complementary to one another.

“We are excited to announce this inaugural arrangement with an industry partner that is a leader in biological products,” said Ashish Malik, CEO of BVT. “Our strategy is to build partnerships with established partners to accelerate our growth and broaden our customer reach. Therefore, being able to attract the attention of an industry leader such as BioSafe validates that our technology is gaining momentum among growers and in the market. BioSafe’s multi-market and multi-channel focus will help BVT accelerate growth and maximize shareholder value.”

The stock has been featured heavily in my Agriculture sector roundups in the past few months. The technicals were intriguing. We have been testing a huge support zone at the $0.235 zone. Since September, the stock has been received by a heavy wall of buyers here five times. Take a look at those large wick candles. Showing that buyers were coming in strength, and would not close below. One could also draw a trendline and visually see the trend shift. I just use my moving average, the line depicted in red, to indicate a reversal. January 4th 2022 was when we got the close above, setting us up for a runner the week after.

The news was released on January 11th 2022 post market. Take a look at how the market received it the morning after. POP. A nice 31% green day with EPIC volume. 1,959,752 shares traded. The most shares traded ever. Things are looking bright for Bee Vectoring. Message boards are alive and speculation is rampant. Investors are expecting a lot of good news with this partnership. Bigger players might get interested in the stock, and there are already talks of a buyout contender.

I like the stock long term and I continue to hold. The technicals still look prime, and I expect more higher lows to develop. For those looking for an entry, or those wanting to add more shares, what would be the plan of action? Well it sure looks like profits are being taken. I would watch how price reacts at $0.335. This is an upcoming major support zone that is about to be retested. We actually broke right through it on the epic January 12th day. If we see a nice large wick, or green daily candle close on that retest, it is positive signs that buyers are entering. We then ride the next higher low swing in this uptrend which would take us over $0.46 and into new record high territory.

CubicFarms (CUB.TO)

CubicFarm Systems put out their first press releases of 2022. G. David Cole, MBA, join the Company’s Board of Directors. Mr. Cole is an internationally recognized as an accomplished senior financial executive with nearly 40 years of corporate experience. Mr. Cole has extensive expertise in strategic business growth, capital markets, financial products, and client-centric sales and marketing as he was previously the Vice Chairman of the Enterprise Strategic Client Group at RBC.

“From the moment I first saw the CubicFarms technologies, I knew I wanted to help this Canadian Ag-Tech company to achieve global market dominance,” said Cole. “They are leading a crucially important emerging industry that addresses both food supply chain and climate change issues. I wholeheartedly believe in their purpose to help farmers and communities to grow more with less, locally and sustainably. I connected immediately with the energy, focus, and drive of the CubicFarms leadership team and the vast opportunity in front of us.”

Another award for CubicFarms. This time Real Leaders® recognized CubicFarms as one of its 2022 Top Impact Companies from around the world.

Real Leaders is a membership community for impact leaders with a global media platform dedicated to driving positive change. It’s on a mission to unite farsighted leaders to transform our shortsighted world. Founded in 2010, Real Leaders recognized early on that businesses bore a responsibility to be as cognizant of their impact on employees, society, and the planet as they are on their bottom line.

“We’re pleased to be recognized as a purpose-driven company by Real Leaders among many other values-aligned companies,” said Dave Dinesen, Chief Executive Officer, CubicFarms. “Our long-term focus on delivering automated indoor agriculture technologies to help farmers keep growing more sustainably has been a huge part of achieving this award. By using our local chain ag-tech to grow indoors in any climate, year-round, farmers can continue growing profitably while minimizing and making better use of our natural resources like water and land.”

On the charts, CubicFarms still battles around support, and hovers above the psychological important $1.00 zone. Disclosure: I am a shareholder, and I am looking to add some more in this area. I have two options: 1) just pick shares here close to $1.00 or 2) Await for the uptrend to continue. The latter requires a breakout above $1.25. I can see an inverse head and shoulders reversal pattern printing.

Above $1.25, there is a huge gap. That will be acting as resistance, but a close into the gap sets us up nicely for a recovery. Remember the gap occurred because of a $20 million bought deal public offering. Shares diluted yes, but CubicFarms now has cash to focus on its goals and initiate a catalyst for the stock price. Because I am looking at this as a long term hold, I prefer option 1. Those looking to deploy money and get a return as a swing trade should wait for option 2 to trigger.

Organto Foods (OGO.V)

Organto Foods, a company that engages in the sourcing, processing, packaging, distribution, and marketing of organic and specialty food products, announced the upgrade of their US listing to the OTCQB effective January 13th 2022. The Company’s current OTC ticker symbol, “OGOFF” remains unchanged.

“Our OTCQB listing combined with our previously announced DTC eligibility is expected to provide a platform to both increase investor awareness of our business while at the same time facilitating a more seamless trading experience for our investors.” commented Steve Bromley, Chair and Co-CEO. “We are pleased by the progress we continue to make in our strategy to build an ethics driven “one-stop shop” in fresh organic and specialty fruits and vegetable products, and excited to have this investment opportunity listed and accessible on the OTCQB. Consumer interest in healthy foods produced in a sustainable and transparent manner continues to grow, and we believe we are well-positioned to capitalize on this long-term global trend.”

If you want a company that is a fast growing provider of organic fruits and vegetables, and a play related to healthy eating trends and sustainable organic foods, Organto is one to add to your watchlist.

The stock is still in a downtrend. We were not able to hold support at $0.30. There is a chance we reverse here. I am looking for signs of a double bottom pattern. Basically a stock pattern that looks like a “W”. The next few days of price action will be crucial in determining whether or not we print a double bottom. We are seeing signs of buyers defending this $0.20 zone. I want to see larger volume and a nice green candle. The trigger though for the reversal would be a break back above $0.25. Watch the next few days, and hopefully we do not get a close below $0.20 because then we will be looking for support at $0.15.

Verde Agritech (NPK.TO)

Verde Agritech has also been one of our largest winners. The stock just keeps on going and is up 243% going back one year. It is funny because I just watched a controversial interview of some food analyst saying fertilizer shortages are coming this year. I actually wrote an Ag sector roundup about this, where I focused just on fertilizers. This has the potential to be a big play.

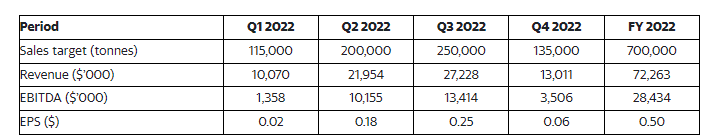

This week, Verde announced the 2022 guidance and two year outlook. Guidance comes in at 700,000 tonnes production, with sales of $72.3 million, EBITDA of $28.4 million, net earnings per share (“EPS”) of $0.50; and a 2023 guidance of 1.4 million tonnes. I placed the quarterly basis details below, but check out the full press release for the complete guidance including assumptions based on the exchange rate etc.

As I said, this has been one of our biggest winners. Been bullish ever since that breakout back at $1.50. We then took out $1.90 and have maintained higher lows and higher highs. The recent higher low comes in at $2.80. We are technically in an uptrend as long as this holds. I am expecting some resistance at $4.00 though. That could provide us with a brief pullback for a re-entry opportunity. If we break through $4.00 with ease, then forget about that. We’ll continue shooting higher.

Water Ways Technologies (WWT.V)

Another readers favorite, Water Ways Technologies, announced the acquisition of the majority of shares of a Chilean Irrigation Company named Hidrotop. Hidrotop is an Irrigation and hydraulic engineering company operating in the agricultural and mining industries in Chile and Argentina. Since 1997, Hidrotop has been innovative in the area of irrigation, and has installed over 30,000 hectares of irrigation projects. Hidrotop has professional teams with extensive experience in automation and remote systems administration.

Water Ways will pay an aggregate acquisition price of US$3,500,000, upon closing of the Acquisition consisting of: (i) a one-time cash payment equal to US$2,000,000; and (ii) issue 5,686,364 common shares in the capital of Water Ways at a deemed price per Subject Share of CDN$0.33, subject to a standard four month and one day hold period from Closing. The completion of the Acquisition is anticipated to be on or before February 28, 2022 or such later date as may be mutually agreed upon between the parties.

A solid way to strengthen the foundations in the South American market. Water Ways CEO, Ohad Haber, had this to say:

“Our long term goal is to establish Water Ways as a leading irrigation and agriculture technology provider worldwide. We aim to increase and strengthen our presence in the South American market. By completing the acquisition of Hidrotop, we aim to increase our sales and distribution center for South America serving both the Chilean market and the South American farming community.”

As a technical analyst, it has been a pleasure to talk about this chart. Very clean and crisp. The structure and the levels are clear. The trend is also obvious. In a recent Agriculture Sector roundup, I discussed the $0.25 zone. Exactly where we saw buyers jump in.

Now, we are waiting for the breakout in new all time record high territory. With all the great things this company has done, I think new records are coming. A break and close above $0.35 confirms the breakout. The only sign of concern I have is that we have tried to break above this zone for the past 7 trading days. We can’t seem to penetrate it. If stock markets continue to weaken, we shareholders may need to wait a bit longer.

But I am not deterred. Any pullbacks will allow us to add to our positions.

EarthRenew (ERTH.CN)

I am glad EarthRenew put out a press release because their chart looks prime. The company is driven to support a farm system that puts healthy soils and grower profitability back on the table. Using circular economic principles of upcycling waste materials into high-value agronomic inputs, we are building an innovative platform of soil health products that offer growers an alternative to conventional fertilizers which leave the soil devoid of nutrients and bacteria essential to plant life. EarthRenew benefits from multiple revenue streams including, primarily, the sale of regenerative fertilizers, but also enjoys secondary revenue from generating power and selling surplus electricity.

The company is a favorite here at Equity Guru. We like the things they are doing and the value they provide. If you are into fertilizers, this is another stock to consider on the shortage play.

This week EarthRenew announced positive results for 2021 product field trials. The field trial was a collaboration between the Company’s subsidiary, Replenish Nutrients, Lethbridge College, and Biome Makers. Here are the highlights:

- Production of healthier potatoes with Rebuilder – free from common defects

- Rebuilder achieved equivalent marketable yield compared to a standard synthetic fertilizer program at a lower nutrient cost while rebuilding soil health

- Improved microbial diversity and variety in the soil over standard synthetic fertilizer

- Increasing trend in phytohormone production (in particular gibberellin, auxin and cytokinin)

Analysis of the data from the field trial proved that EarthRenew’s regenerative fertilizer produced equivalent yield and equivalent marketable yield when compared to a standard synthetic fertilizer program and with the added benefit of organic carbon back to the soil. Trial results showed a significant increase in microbial diversity and variety of soil organisms with the use of Rebuilder over the control and synthetic treatment. This supports the Company’s belief that use of their fertilizer improves the soil’s microbiome, creating healthier soil, a more balanced ecosystem, and ultimately, better quality food.

This is perhaps the best looking reversal candidate chart in the agriculture space. The best I have seen thus far. Just simple market structure here. We have our downtrend, our range, and we just need the uptrend to complete the cycle. The trigger though is a break and close above $0.20. Preferably with nice volume and a large green candle close. The stock remains ranged and coiled, and I am just waiting for that breakout to initiate a new uptrend. A positive catalyst will get things rolling.

AgriFORCE (AGRI)

AgriFORCE growing systems provided an update on their planned acquisition of a leading European Agriculture/Horticulture ag tech consultancy firm. The company entered into a binding letter to acquire said AgTech consultancy back in October 2021. AgriFORCE reports that it has now completed its due diligence. The impending acquisition will be focused on driving agricultural optimization, innovation, solutions, and operational expertise in the agriculture, horticulture, and Controlled-Environment Agriculture (CEA) sectors.

Not much more has to be said about the stock chart other than BASED. Prices still remain in a range after the epic rally back in November 2021. $2.50 is the resistance of the range we are working with. A break and close is required to trigger the breakout. Currently, we are more likely to approach the bottom limit of the range at around $1.75. Look out for some support buyers. The signal will be a nice wick or large green candle.