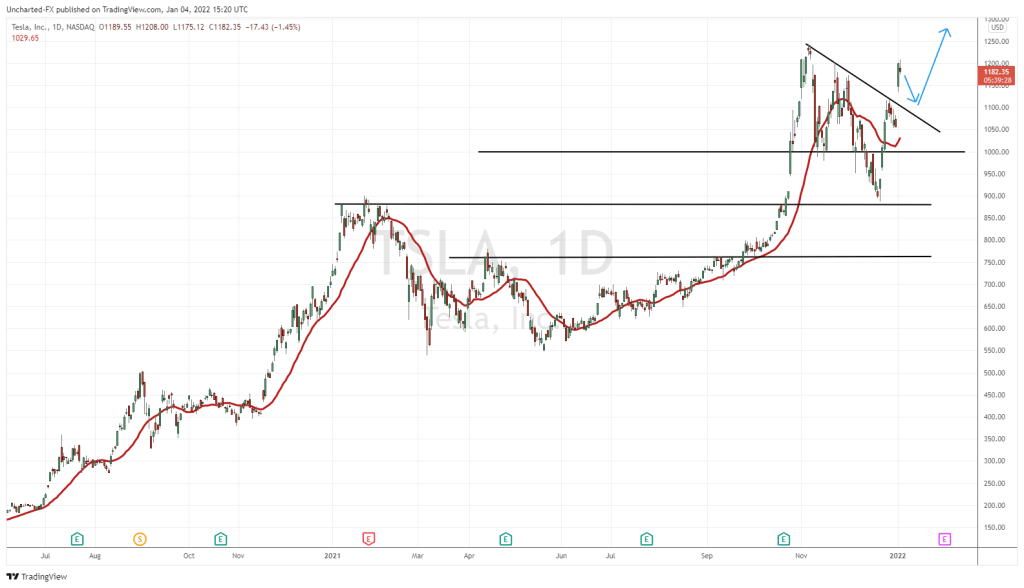

Days before Christmas, I laid out a present for my readers. A technical strategy for Tesla stock (TSLA). In that post, I highlighted an upcoming bullish flag pattern. As a reminder here is the chart:

When I was writing that Market Moment post, Tesla stock was battling at the $1000 resistance zone. My support at $880 held, and buyers piled in. I explained that the breakout above $1000 was likely given the price action on the stock market indices. Both the S&P 500 and the Nasdaq had just bounced from major support levels, and a breakout into new record highs by the end of 2021 was expected.

Obviously, if you follow Tesla stock, then you know that this flag pattern has triggered. Before I post the current chart and give a bit of a technical review, let’s talk about the big fundamental news.

Tesla stock surged after surprising Wall Street. Vehicle delivery record to end 2021 took Wall Street analysts, pundits and traders by surprise.

Worldwide deliveries totaled 308,600 vehicles in the fourth quarter, well ahead of the average analyst estimate of roughly 263,000 vehicles, and topping the company’s previous record of 241,300 from the prior quarter. Annual handovers surged to more than 936,000 in 2021, up 87 per cent from the previous year’s level.

“This is a trophy-case quarter for Tesla as the company blew away even bull-case expectations,” Daniel Ives, an analyst at Wedbush Securities, said in an email. He called it a “jaw-dropper performance” for the end of the year that gives “massive tailwinds” heading into 2022.

The record quarter underscores the “green tidal wave taking hold” for Tesla and Chief Executive Officer Elon Musk, Ives said in a note to clients. The results also point to robust demand in China and Tesla’s skill at navigating the global semiconductor shortage, he said.

Quarterly deliveries are one of the most closely watched indicators for Tesla. They underpin its financial results and are widely seen as a barometer of consumer demand for electric vehicles as a whole because the company has led the charge for battery-powered cars.

Tesla has said repeatedly it expects 50 per cent annual increases in deliveries over a multi-year period. The seventh consecutive quarterly gain comes amid a global semiconductor slump that has crimped production at most other automakers and kept sales in check despite rising demand.

What gets people even more bullish is the activity at their factory in China, and also the upcoming factory being built in Germany. It may take some time, but growth investors believe the stock moves higher based on that future expectation.

Interestingly enough, as I googled Tesla this morning, the first news story to pop up was a recall story. Tesla is recalling 475,000 US vehicles for safety issues. The breakdown is for 356,309 Model 3 sedans (years 2017-2020) to be recalled because of a rearview camera cable harness which may damage the opening and closing of the trunk lid and prevent the rearview camera image from displaying. To round it up, 119,009 Model S vehicles from model years 2014-2021 will be recalled due to misaligned frunk latch assemblies which could prevent a secondary frunk latch from engaging.

Recalls aren’t new news for Tesla. We have seen numerous recalls in the past few years, generally related to assembly errors which have affected both software and physical components. The stock doesn’t seem to care as Tesla does a good job in recalling and fixing the problem.

Tesla stock kicked off 2022 with a bang. A 13% plus move to kick off the first trading day of the New Year, which actually is the best start to the year Tesla has had since its been publicly traded.

As you can see from the current chart above, Tesla stock not only confirmed another touch on our flag pattern trendline, but penetrated through it like a hot knife through butter. Deliveries were the catalyst to trigger the breakout pattern. The stock is bullish with the breakout. I expect previous record highs not only to be tested, but to be taken out. However, as with bullish flags, price may pullback first to retest the trendline breakout. The trajectory for this has been drawn out on my chart. A pullback retest, allowing new buyers to pile in, and then the push to new record highs.

What price do we target next? The analysts on Wall Street are targeting $1400. Technically, I came up with the same level. $1408 to be exact, but I will show you guys the sorcery that is Fibonacci:

The fibonacci tool is great when you are looking for price targets into uncharted record high (or low) territory. I fibbed the latest weekly move. Notice how price bounced at a fib level which coincided with our major support zone. Saw big buyers come in at the fib, and fibonacci traders would consider this a buying opportunity. What I want to point out is the first price target. My fibonacci extension comes in at $1408.91. Pretty darn close to all the analyst calls of $1400. They probably use fibonacci rather than coming up with this number through fancy mathematical equations.

As I finish writing this Market Moment, the S&P 500 and the Nasdaq are under pressure. The former printed new record highs and is retreating a bit. The Nasdaq is yet to join the all time record high party. Keep eyes on both of these indices since Tesla composes a large part of them. If the Nasdaq gets its breakout, Tesla stock will see its previous high be taken out. I’m not too worried right now. I expect the Nasdaq to battle around this resistance, but will eventually join in with the Dow Jones and the S&P 500 into new record high territory.