Big day for Tesla. Bulls are happy! The stock gapped up on the open and is set to approach a major resistance, or price ceiling zone. A lot of headlines when you look up Tesla news releases. We do have news that authorities have submitted documents for the German plant approval. The approval process is still going, and a decision will be made perhaps in early 2022.

But let’s be real folks. We know that’s not the reason the stock gapped up. It was from another Elon Musk comment. Two words. “Enough stock”.

Musk has said that he has sold “enough stock” in last night’s Babylon Bee interview. Tesla stock gapped up, and is trading up over 5% at time of writing. For those that don’t know, Musk said he was going to sell a 10% stake in Tesla to pay taxes on stock options Musk is due to exercise. He also allowed people to vote on Twitter to whether or not he should sell shares. Others *cough Dr. Michael Burry cough* claim Musk was selling shares to pay off debts, using his twitter scraps with Bernie Sanders and others as cover. It was quite the entertaining time period on Twitter, and still is if you follow Musk. Recently, Musk has called Elizabeth Warren a Karen.

Just yesterday, insider announced Musk sold 583,611 shares of TSLA on 12/21/2021 at an average price of $904.74 a share. The total sale was $528 million. That sale appears to have wrapped up the unwinding of Musk’s 10% stake.

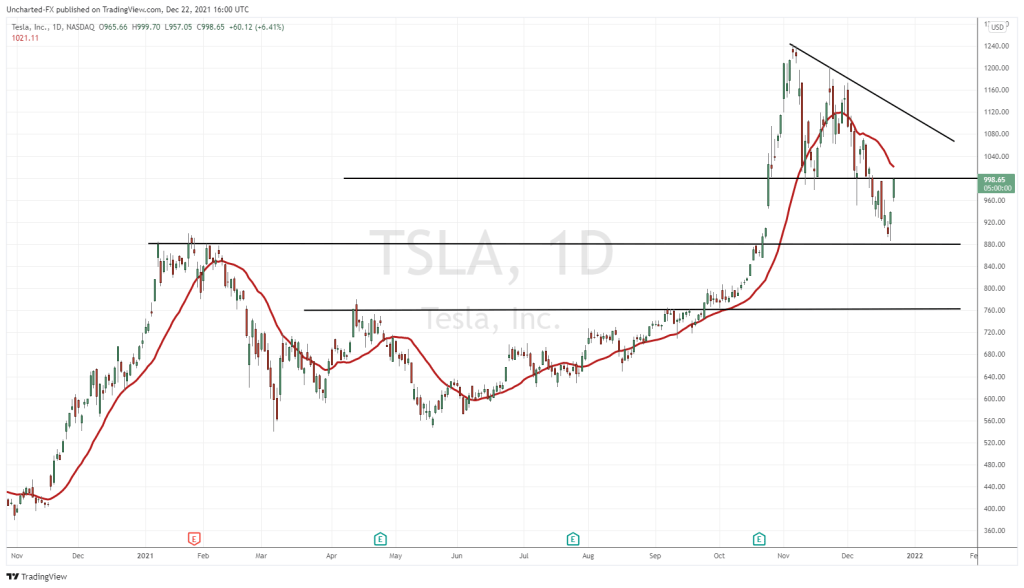

On December 7th 2021, I warned market participants that Tesla was testing a major support zone at the psychologically important $1000 zone. In that post, I went through the scenario if Tesla did break below support. I also provided the support targets for a bounce and took profit for a quick short trade.

Above is how the chart of Tesla looked before. And here is the after:

First off, take a look at the breakdown below $1000. We had a confirmed daily candle close, which is important for the trigger. Then, the stock retested the breakdown zone on December 16th. Typical break down and retest pattern. This repeats all the time in markets. My readers should know this by now.

The sell off on the retest provided an opportunity for sellers to enter if they missed the initial breakdown. We then dropped to hit our major support zone around $880 to the dot. In fact, we hit that level yesterday, and got a nice wick and green candle indicating buying…or shorts closing, which turn into buy orders. We then got the Babylon Bee interview, and here we are today. Tesla stock is once again knocking at the door of resistance at $1000. If the stock can obtain a daily candle close above $1000 at the end of the trading day, we will be heading HIGHER to at least $1080, which is near a downtrend trend line that I am watching. Appears to be a triangle pattern, but we will get to that in the future…especially if price breaks above it.

At time of writing, Tesla is at $1010, with crazy intraday candles. But we still have five hours left in the trading day before we can confirm a close above $1000.

It is a holiday week, but stock markets have managed to hold above the major support zones I have been highlighting on Market Moment and over on our Equity Guru Discord Channel.

The S&P 500 levels are self explanatory. Our uptrend line is holding, and so is support. We are waiting for a breakout candle above previous highs. The market could just range this week during the less liquidity holiday, but I still maintain that we will make record highs by the end of 2021. The Santa Claus rally is finally here.

Same structure on the Nasdaq. What I am trying to say here is that both of these markets still have room to the upside even if the markets just range. Keep this in mind when considering if Tesla can get the juice and momentum to maintain a close above $1000. It is looking positive so far.