What a year it has been for agriculture and agricultural commodities! And folks, I believe we are still in the early stages! It has been quite the year for me and this space. Not only from a trading and investment perspective. I began the agriculture sector round up this year because I am extremely bullish on the space. In summer of 2021, I wrote my maiden piece on this space. It came out at a great time, when BC was experiencing a record heat wave. Now we are experiencing record December temperatures. Looking forward to shoveling the 10cm of snow that fell last night.

Climate change means that crop cycles are being altered. Extreme weather cases this year saw agriculture taking a hit in Iowa, and a huge mess in coffee bean supply with freezing in Brazil and flooding in parts of South-East Asia. As a trader, we can play these supply-demand imbalances through agricultural commodities. As an investor, we can take advantage of the same supply-demand imbalances, and front running FUTURE imbalances due to climate. Things will get a bit hectic, but I have spoken about why indoor farming and vertical integrated farming will be how we combat unpredictable weather cycles.

For those that are new to my work, or need a refresher on why I am going all in on Agriculture, here is my maiden piece. Read that piece for a detailed explanation, but to summarize the 4 reasons:

- Big Money, specifically Jim Rogers. Agriculture isn’t sexy, and still remains under the radar.

- The Weather

- Supply Chain Issues

- Green/Clean Energy

A year ago, I put out my 2021 Agriculture outlook. All our weekly chart targets were hit within the first quarter of 2021. In just a second, I will run through what I am currently seeing on the weekly charts of Corn, Wheat, Soybeans and Coffee.

The one theme I mentioned a year ago was to expect higher food prices. I am sorry to say that this has not changed. Food prices will continue to climb higher. Inflation is the big theme, and we will continue to see this at grocery stores and in restaurants. A popular way to hide inflation is through shrinkflation. Basically charging the same price for a food item, but the portion and content is reduced. I have already seen this in restaurants, and we might begin to see this on grocery store shelves as well in 2022.

In fact, Canada’s Food Price Report is predicting food prices will climb between 5-7% in 2022, adding nearly $1000 a year to the grocery bill of the average family of four. Restaurant meals, dairy, vegetable and bakery prices will see the largest price increases. The overall increase is the highest yet predicted by the report, which has been forecasting food inflation for the past 12 years. Already hearing the term food insecurity be thrown around. It will be a tough few years for the middle class. Inflation will be hitting all aspects of our lives. All from Central Bank money printing and the fact that productivity has not increased. We are in a situation where there are people with more money competing for the same number of goods and services. It does not help that many young people are quitting their jobs to trade crypto’s and markets in general.

But as inflation continues rising, money will continue into markets and other assets to make yield. We will continue to make money and keep killing it.

Before I look at some agricultural commodities, just a quick aside on water. This year has seen a lot of water crisis documentaries on Netflix and other streaming platforms. A lot more people are talking about how fresh water sources could be impacted with climate change. I think this theme will continue into 2022.

Water Ways Technologies (WWT.V) has been one of the big winners this year, and a very popular company among my agriculture sector readers. The company has announced many deals and revenue sources this year. 2022 will be a big year for this company. Keep them on your radar.

Or you can be like me, and continue to add to my Ishares Global Water Index ETF traded on the Canadian market. Pays a dividend, and just recently hit all time record highs a few days ago before pulling back to retest the breakout zone. A long term play on water. I expect any companies that deal with water and waste management, sewage, and water and agriculture to continue to be popular long term picks.

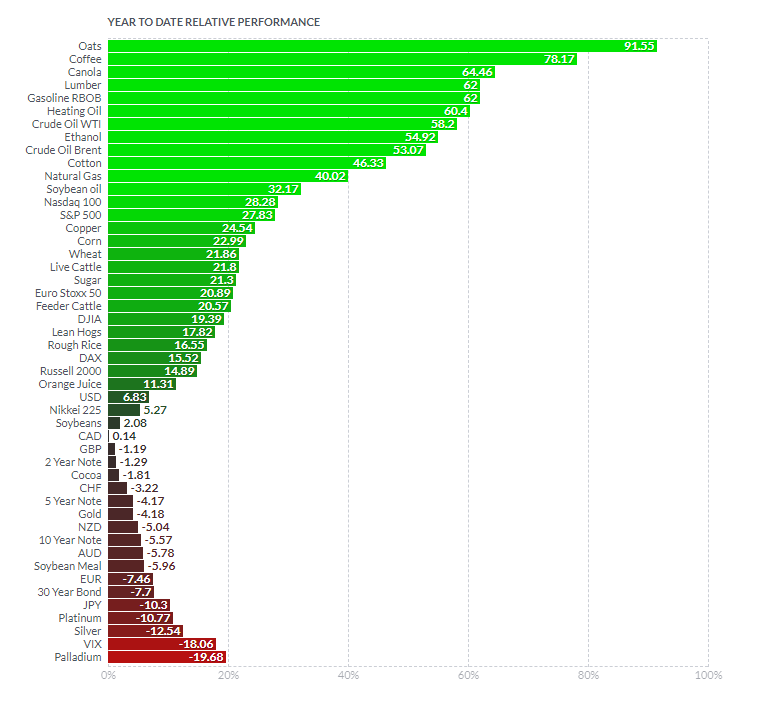

When we take a look at year to date performances for 2021, the top of the list is stacked with agricultural commodities. Oats the top performing asset! Who saw that coming? Outperformed the S&P 500, the Nasdaq and the Dow Jones combined!

Coffee is something I am not too surprised about because of the disruptions and the high level demand of coffee. Just go to any local Starbucks. I do expect prices to continue to rise. You can read my caffeinated agriculture sector round up on all things Coffee here.

Just Soybean Meal and Cocoa saw some red this year, but not by much.

Let’s take a look at the weekly charts to end off. Just a reminder: Wheat, Soybeans and Corn will be CFD charts. The prices might be different from futures, but the chart structure looks the same. Meaning the trajectory will be the same.

Corn kicked off the year with a bang, hitting highs in May 2021. Just recently, we got a weekly break in November 2021. That was a bullish break which hints at gains in 2022. A nice technical break taking us back over my moving average. Some interim resistance at around 640, but I like the highs around 720 and higher. Inflation could be the driving force for Corn and all the other ags. Technically, all these charts can still pull off a higher low swing from the breakout I highlighted in last year’s outlook!

Corn continues its uptrend that it has maintained all year around. We made new highs breaking above 760, and saw a retest of the breakout last week. As long as we hold this, we can build from here and continue to move higher into 2022. Let’s watch to see if this weekly chart turns out to be a double topping pattern, or the uptrend continues. A close below 760 would mean the former.

Something similar to the Corn chart is Soybeans. Same structure. Last week was huge for Soybeans, taking us over the moving average, and closing above a resistance zone. Sets us up nicely for 2022. The one thing which could add a bit of volatility to Soybeans is any US-China headlines. Soybeans felt the impact of trade war headlines. I don’t think the US and China headlines are done. For more info, I suggest reading Ray Dalio’s new book highlighting the decline of a former power, the US, and the rise of China, referred to as the Thucydides trap.

For coffee, I wanted to zoom out. And I mean zoom out to the monthly chart. A very nice basing pattern that we saw in 2019 with the breakout in 2021. We haven’t seen a basing pattern like this since 2001! To me, it means a new uptrend is in with higher lows and higher highs to come in the months ahead. $140 was the breakout, and we haven’t looked back since. No retest, and pullbacks are bought. A very bullish year for coffee.

Looking ahead, I see some interim resistance at the $300 zone. You can see that once we climb above $300, we have never seen a strong monthly candle close. A lot of wicks, indicating a sell off at that zone. With inflation taking off, and coffee demand higher than before, will we have enough to form a new record all time close. I think the stars are aligning quite nicely.