It is a quiet week on the stock market front. It makes sense. Last full trading week of the year, and many companies have things wrapped up and are preparing for the New Year. With so many holidays crammed together in two weeks, market participants (mainly banks and funds) take things easy. Those who are watching the markets can attest to that. Not much action. Liquidity is low.

In terms of economic events, there isn’t anything high risk on my calendar except Chinese Manufacturing PMI on Friday. That’s it.

In the month of December, the financial media always talks about the Santa Claus rally. I feel like putting that “real” meme up:

Just substitute the words “Elon Musk” with “Santa Claus Rally”, and show the technicals of the market on the left with the ‘Perfection” image being this week’s price action.

What the financial media doesn’t tell you, but pretty much known by all market participants, is that the Santa Clause rally occurs in the last week of December. Why? Liquidity is low. Oh, and it is also about the money. Corporate Management’s Bonuses are based on the year end stock price. CEO’s and other higher ups have options which expire at the end of the year as an incentive to do the best for the company so the share price is higher. The CEO’s hard work is then rewarded with millions of dollars.

What tends to happen is we see stock buybacks and large cap stocks moving higher at the end of the year to pump up that year end stock price. All for those bonuses. Speaking of bonuses, it won’t just be the corporate world, Wall Street is set to receive record bonuses. But I do think this end of the year stock price information is very important, because nobody really stops to think how management and higher ups get their bonuses. Take advantage of the low liquidity.

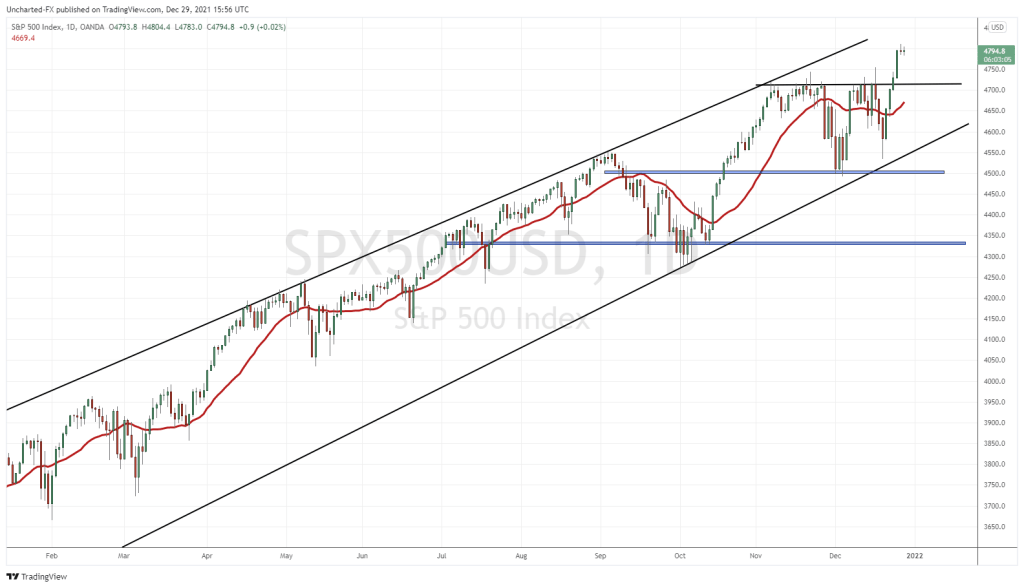

On the market front, the S&P 500 has printed new record all time highs.

Very strong candle close and body on Monday. Tuesday saw record highs hit before closing into a doji candle. Price action currently for Wednesday remains mixed. I might still sound like a broken record but markets will continue moving higher as long as the Fed’s cheap money policy continues. They are not moving due to forward guidance or other ratios in my opinion. It is all about chasing yield and cheap money. Throw in inflation, and the stock markets have a real possibility of going parabolic in the first half of 2022.

The uptrend remains intact. Price will continue to bounce in this beautiful channel I have drawn. Current support sits at the 4700 zone which could see a retest before moving higher. Continue to buy those dips.

A drop in bonds also indicates the return of a risk on environment. Money is leaving the safety of bonds, and heading into riskier assets such as stocks. This bodes well for the stock markets.

The Nasdaq bounced at our major support zone and the structure remains intact. No record close nor a record high just yet. The price is hovering at a resistance zone, just awaiting the breakout. I wouldn’t be surprised if new record highs are confirmed by the end of this week. If not, I am sure we will get it during the first week of 2022.

The Dow Jones is set to form a new record close. Perhaps even new record highs today as we still have five hours of trading to go. This is the market I am currently going to play through CFDs and futures. If we can achieve a green body close above this resistance level highlighted in blue, I expect some really nice follow through momentum tomorrow. Similar to how the S&P 500 moved on Monday after confirming a daily breakout close last week on Friday.

In summary, it is a low liquidity week. Not much is happening on the event risk calendar. Things are quiet, and companies aren’t in a hurry to release major press releases this week. Unless it is bad stuff because now would be the best time without so many prying eyes fixed on monitors. Be careful if you are trading. My approach right now is very simple: just play things which are pulling back to support, or breakouts (Dow Jones). A lot of charts are just going to be ranging, and the momentum push might only be a day or two. We’ll wait until regular liquidity returns to take up full positions. As a trader myself, I do enjoy just going back through my trading journal and reviewing the year during the last week of trading. A time to recover, relax, review and prepare the mind, body and spirit for 2022.