A wild overnight futures trading session. Markets were selling off hard, which was laying down the foundation for Monday’s opening move. Red day. The Dow Jones has fallen 600 points to begin the week. The S&P 500 dipped 1.4% and the technology-focused Nasdaq Composite declined 1.3%. The small-cap benchmark Russell 2000 lost 2.2%. We’ll take a look at the charts because some equity markets are at MAJOR support.

Omicron is spooking investors. Fears of restrictions and lockdowns in the future. The Netherlands have gone back into full lockdown. The UK is considering the same. Some Canadian Provinces have reinstated restrictions heading into the Holiday period. But the big news event will be on Tuesday December 21st 2021. President Joe Biden will be addressing the nation, and rumors are that he will be announcing restrictions…even a possibility of shutting down the border.

Stock Markets could sell off initially on the news. Personally, I don’t think we will see another everything sell off like February of 2020 because back then, we did not have this current monetary policy. Even though we had a hawkish Fed last week, if the US imposes restrictions or goes under another lockdown, the Fed would have to keep the cheap money going. Possibly un-taper their taper and be more accommodating. It would be a buy the dip opportunity for any stock market drop.

Keep in mind this is a shortened week so liquidity will be less than normal. Let’s take a look at some charts.

Let’s start with Oil. Nearly down 6% today. It seems like Oil markets are pricing in another slow down…or another lockdown. I don’t think we see Oil futures go into the negative, unless we see a global lockdown. Keep your eyes on this. It looks like another leg is coming down. One way to play this is by playing the oil currencies. My preference is going long USDCAD.

In terms of fear, the VIX had a spectacular pop. Investors are sending some fear here. One can also watch bonds to gauge risk off money flows. The VIX has retreated from highs of the day, so let’s keep an eye on this for hints that fear is subsiding. This makes sense when you see where the equity markets are currently. Big support zones.

This is the current daily chart of the Nasdaq. Last week, I discussed the Nasdaq and the Russell 2000. Our Discord members were notified in real time. Huge support zones. The current daily candle is looking quite bearish, and would confirm a breakdown IF we close like this. However, there are still four plus hours left in the US trading session. Plenty of time for buyers to build a support here and bid prices higher. If we do get a breakdown, the final nail in the coffin would be a close below my channel trendline. It would mean the bull market is over.

The Russell 2000 is also in ‘squeaky bum’ territory. This market has just been ranging since the beginning of the year. We had the breakout recently in November, but failed to hold the retest. Not a strong sign. Now, we are back at the major support zone which has held all year. Will it breakdown now? We will find out by the end of the trading day. Not looking great on this candle, but we have plenty of time for buyers to step in and give us a close above support.

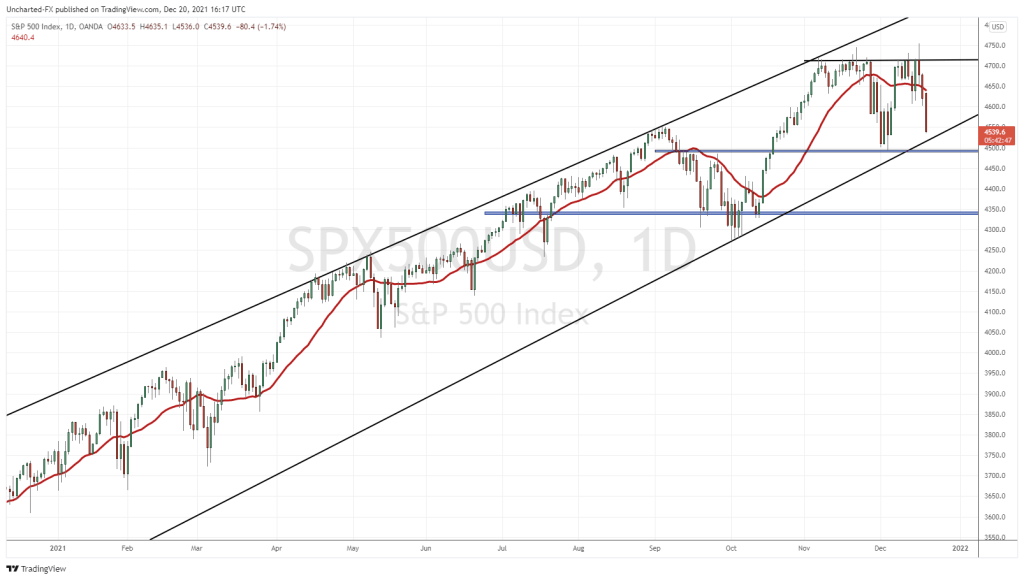

The S&P 500 is nearly at major support. Not in dangerous territory like the Russell and the Nasdaq, but close to a zone where a bounce could be expected. A breakdown below support and the trendline would be very bearish. Watch the Nasdaq and the Russell. If those markets breakdown, the S&P 500 joins them.

The Dow is still ways away from its major support. I find the Dow interesting because of its value stocks. If markets are dropping, people run into safety. Bonds are generally the risk off asset. But here’s the thing: they don’t yield much. Just speculation on my part, but I think funds might look to hold value stocks for safety. Sure, they might get hit on an overall market drop, but the dividend yields for certain companies like Coca Cola, Abbvie etc will be higher than those on government debt. If so, the Dow might fare better.

Big week for the Stock Markets as they test major support levels. In summary, there could be an initial drop on the Biden announcement, or announcement of restrictions and lockdowns. But in the end, all it means is the Fed and other Central Banks will have to keep cheap money and accommodating (more brrrr) policy going.