Massachusetts senator, Elizabeth Warren, put her two cents in earlier this week telling us all everything we already know. DeFi is technically the most dangerous space in crypto because it’s unregulated and therefore home to the thieves, crooks, swindlers and potential terrorists.

What she didn’t mention, and couldn’t possibly have known because it’s clear she’s never actually talked to anyone involved in a DAO or any other part of DeFi, is that the probability of meeting these folks is infinitesimally small right now. It’ll develop. Sure. But most folks involved in DeFi at this stage of its evolution aren’t (usually) the type to get swindled out of their stake.

If you want to look at a dangerous sector for crypto—look at bitcoin ATMs. They’re organized crime magnets.

DeFi Technologies offers gateway to the Metaverse

But if you ask me, the most dangerous part of the crypto-sphere in the next few years is likely is going to be the metaverse. Think about the dopamine hits the metaverse is going to offer-up when full immersion happens. I’ve watched friends lose entire weeks of their lives in MMO’s like City of Heroes (when it was a thing), World of Warcraft, or in single player craziness like The Sims. I’ve tried VR roleplaying at a friend’s place on their Oculus Rift and I got lost for hours. I came out of that weird virtual world reluctantly and didn’t want to go home.

The mushrooms may have had something to do with it, but I digress. I cannot recommend playing VR while on mushrooms in good conscience, but it worked for me.

DeFi Technologies (DEFI.E) are offering investors a chance to get some direct exposure to the metaverse and related projects through a single investment. It’s the Metaverse and Gaming Index ETP, and after they get the nod from Swedish regulator, Finansinspektionen, they’ll launch.

The ETP is an index of the top five digital assets related to the metaverse, and already has regulatory approval for distribution throughout the EU. These projects include Decentraland (MANA) and play to earn games like Axie Infinity (AXS).

“The crypto metaverse consists of immersive virtual worlds with immense social and financial potential,” said Russell Starr, CEO of DeFi Technologies. “This is just one more example of our commitment to making innovative solutions available to enable all investors the opportunity to access the digital economy.”

It’s going to be peculiar to see how DeFi connects to the metaverse, and not through some variety of NFT supply. But that’s definitely something for the future.

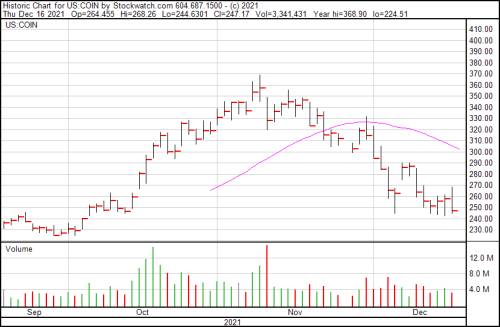

Kevin Durant and Coinbase throw-down NFT drops

NBA superstar Kevin Durant and sports manager Rich Kleiman announced a deal with Coinbase (COIN.Q) to create non-fungible tokens (NFT) drops and storytelling content. The announcement will also be included as a philanthropic integration with the Kevin Durant Charity Foundation.

Because when you get rich enough that you have more money than you know what to do with—you start a charity, and maybe there’s tax breaks in there. I don’t know.

Anyway, if you don’t know who Kevin Durant is:

Coinbase is presently the third biggest centralized crypto-exchange in the world by trading volume, and there’s a 2.6 million user long waitlist for Coinbase NFTs, so have fun with that. They’re presently designing a self-custody wallet for NFT integration, and by the end of the year, their NFT sales will zoom past $17 billion.

Here’s what Rich Kleiman had to say about the partnership:

“Historically, premium has meant brands that have been around forever, like Mercedes, Rolex, and American Express. But in five years, Coinbase has become representative of that era and is in line with our premium brand philosophy. And we’re getting into this formalized agreement with a company that is just scratching the surface on where it’s going.”

While Durant issued this tweet:

Ready for the next phase

@coinbase

@35ventures

@boardroom

https://t.co/j7jMczim9b

pic.twitter.com/Jn9LslDqER—

Kevin Durant (@KDTrey5) December

15, 2021

Adidas offers buzzword soup – oh and they’re in the metaverse too

Remember Adidas (ADDF.Q)? Yeah. Shoe company. The shoe of choice for ballers in the 90’s who couldn’t afford Jordans? Them. They’re forming NFT partnerships and jumping onto the metaverse. You can tell the promotional FOMO’s heating up when the shoe companies start getting involved. You can almost hear them in their little board rooms, those soupy-eyed human combovers in their $10,000 suits trying to figure out how to bamboozle 12 year olds into badgering their lower-middle class parents into buying their next overprice product.

Too negative? Sorry. I couldn’t afford Jordans as a kid and now I don’t give a shit for basketball. (But the shoes are still fairly swank.)

“This autumn, Adidas, known for celebrating ideas at the bleeding edge of originality, it settling in at the frontier of creativity: The Metaverse. Our goal there? To see every one of its inhabitants thrive. The Metaverse is where anyone can express their most original ideas and be their most authentic selves, in whatever form they might take. And thanks to the blockchain [and NFTs], those pioneers can own a piece of what they create.”

Really sorta out themselves with that statement, didn’t they? How many buzzwords (authentic selves, original ideas) can they fit into one or two sentences without saying much at all?

No. I’m not bitter. Why do you ask?

Does anyone at Voyager Digital even play soccer?

Now in more sports related news, Voyager Digital (VOYG.T) has become the official broker of the National Women’s Soccer League. Admittedly, soccer isn’t the first thing that comes to mind when talking about cryptocurrency, but hey, exposure is exposure.

Voyager will also include a NWSL Voyager Player Ambassador roster with one player form each team. They’ll also include making public promo appearances, content creation, and working with their teammates to manage their Voyager accounts. You know? Like reminding the goalie about the difference between private and public keys. Or something. I don’t know.

Regardless, the NWSL will grow to 12 teams in 2022 as two more soccer clubs join the fold, and two days later they’ll have a draft on the CBS, which will be streamed to NSWL’s Twitch channel.

I’m a Canadian. Sometimes I forget that soccer is the world’s most popular sport. Primarily, because I think it’d be much better if it was on skates, involved body contact and periodically someone punched someone else. Your mileage may vary.

New environmentally conscious Bitcoiner TeraWulf comes online

TeraWulf (WULF.Q) is not a mid-oughts powermetal band from Germany. My bad. (That’s Powerwolf as it turns out) They are, in fact, a newly formed Bitcoin miner, fresh off their merger with the IKONICS Corporation[. Their claim to fame is getting onboard with putting together their operation in an environmentally sustainably way.

“Completing the business combination takes us one step closer to achieving our mission of generating environmentally sustainable bitcoin at industrial scale in the United States while using over 90% zero-carbon energy,” said Paul Prager, Chief Executive Officer and chair of the board of TeraWulf. “As TeraWulf begins its journey as a publicly traded company, we believe that our energy infrastructure expertise and our core focus on ESG set us apart from our competitors and tie directly to our business success. TeraWulf intends to utilize cost-efficient, reliable and sustainable energy from nuclear, hydro and solar sources to form a fully-integrated, environmentally clean platform with attractive economics. We look forward to creating substantial value for our shareholders through a new paradigm in the world of cryptocurrency mining.”

They raised $200 million in debt and equity financing from a mix of institutional and individual investors, and the cash is expected to bump their yield up to 6 exahash per second, or 200 megawatts, of mining capacity by the second half of 2022. Also, 800 megawatts of mining capacity by 2025, enabling 23 exahash per second of expected hashrate.

This kind of thing is going to become the norm. New companies getting in as old companies bottom out as Bitcoin mining gets a little too crowded, or expensive. And they’ll be onboard with the new environmental oeuvre put forth or they’ll fall behind. Eventually, the environmental kick will spread to all sections and sectors, like Mogo (MOGO.T) offering carbon offsets and eventually into DeFi.

Galaxy Digital and Bloomberg are on board with a Solana-based Index

Solana touts itself as the world’s fastest programmable blockchain, capable of handling up to 50,000 transactions a second and hosting over 400 DeFi, NFT and other Web 3.0 projects. It’s easily the second most recognized DeFi specific coin, right behind ETH. It’s presently the fifth largest cryptocurrency by market, ahead of USDC and tucked behind the bloated mess that is USDT. It has a total value locked of $11 billion, up from $150 million in March of this year. That’s a sizeable jump.

The preamble is necessary to know because Galaxy Digital (GLXY.T) is getting in bed with Bloomberg to build the Galaxy Solana Funds, passively managed funds that track the performance of the newly-launched Bloomberg Galaxy Solana Index.

“We’re consistently looking for opportunities in the ever-evolving crypto markets and it’s clear that Solana is growing quickly in the space,” said Alan Campbell, global head of product for Bloomberg’s Multi-Asset Index business. “This new index is another opportunity to meet the actively engaged institutional market, and we’re excited to continue working closely with an industry leader like Galaxy as we expand our crypto capabilities and offerings.”

The Galaxy Solana Funds give institutional investors access to returns based Solana’s performance in much the same way a spot ETF would without the necessity of the SEC getting involved. But your secret’s good with me.

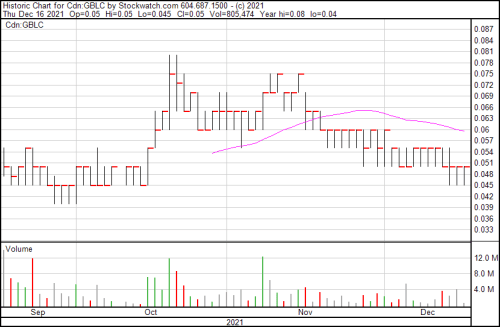

Graph’s New World to launch Theodorou NFT Dec. 18

Tomorrow, Graph Blockchain’s (GBLC.C) subsidiary New World is going to drop a signature NFT featuring UFC battler Elias ‘The Spartan’ Theodorou. The world of mixed martial arts and NFTs have an odd synergy—apparently the notion of kicking people in the head translates well to a digital format.

The Spartan is going to square off against Bryan Baker in the main event of Colorado Combat Club 10 that day. He’s committed to fighting the stigma of medical cannabis in athletics, and intends to be the first pro-athlete to compete on American soil with a therapeutic use exemption for medical cannabis.

What I want to know is whether or not he’s going to fight high. His martial art styles are Muay Thai (for standup) and brazillian jiujitsu for the mats. BJJ I know can be quite efficient when you’re high because the technical requirements require a certain measure of precision that being high on the right supply can bring. Muay Thai is a bit of a mystery.

For me, it’s all that scary bamboo-kicking monster from that Jean Claude Van Damme movie, and maybe a little bit of Cris Cyborg from the UFC and Bellator. Regardless, he’s enough of a draw that it should be curious.

A cryptocurrency roundup within the roundup: The obligatory miner bit

The Chinese diaspora had a peculiar ripple effect on the cryptocurrency economy stretching out from punctured crypto-prices to the rise in demand for green crypto. Now companies setting up shop in the United States have spurred a wave of clean energy through the digital mining sector. There’s sustaining mining operations, including Marathon Digital Holdings (MARA.Q), DMG Blockchain Solutions (DMGI.V) with their respective terapool and marapools. Also, Bitfarms (BITF.Q) and newcomer EV Battery Technologies (ACDC.C), which pivoted to crypto not long ago.

“We began the pivot into the crypto space which has allowed our shareholders to participate in this market, whilst we continue to build out our products and services, and build further shareholder value,”said EV Battery Tech CEO, Bryson Goodwin. “The acquisition of Optimal will provide us with an ideal opportunity to become a significant cryptocurrency miner!”

Specifically, Bitfarms boosted their Bitcoin mining production by 38% during Q2, from 759 BTC while reducing its overhead by 23%.

Not bad.

“Bitfarms is building a truly global enterprise by focusing on strategic opportunities to cost effectively leverage our expertise and gain market share. As of today, we have increased our hashrate to over 2 Exahash per second (EH/s) and expanded our production capacity to 106 Megawatts (MW) in Canada and the U.S., with an additional 298 MW in development underway in Canada, Paraguay and Argentina. We are confident we will create additional shareholder value as we continue our efforts to achieve our computational goals of 3 EH/s by March 31, 2022, and 8 EH/s by December 31, 2022,” said Emiliano Grodzki, Bitfarms founder and chief executive officer.

—Joseph Morton