The Asphalt Roofing Manufacturing Association estimates each new home roof in America requires approximately 3,000 to 4,000 square feet of asphalt shingles resulting in approximately 300 to 400 square feet of shingle scrap. Extrapolated, that figure grows to an estimated 7 to 10 million tons of shingle tear-off waste and installation scrap from roof installations each year in the U.S. alone.

The good news is, this mountain of roofing material contains a mix of ingredients that can be extracted and repurposed, rather than taking up valuable landfill space. The recycled components can be used for:

- hot-mix asphalt additive

- cold patch for pothole repair

- temporary roads, driveways, and parking lots

- new shingles additive

- aggregate road base

- dust and erosion control at construction sites and rural roads

- aircraft and defense manufacturing

- boats and watercraft

- fuel

However, there remains a challenge; single use asphalt shingles are bound together by bitumen, the same thick black liquid extracted from Alberta’s oilsands. Heavy oil remains stable at ambient temperatures but when it is heated in traditional recycling methods, it emits a complex and variable mix of inorganic particulates and organic compounds that include aliphatics, polycyclic aromatic hydrocarbons and heterocyclic aromatic compounds containing sulphur and nitrogen.

Northstar Clean Technologies (ROOF.V), a Canadian-based company providing solutions for the circular economy, has rethought the asphalt shingle recycling process, and come up with a proprietary patentable environmentally friendly method for extracting 99% of asphalt shingle components.

Northstar Clean Technologies (ROOF.V), a Canadian-based company providing solutions for the circular economy, has rethought the asphalt shingle recycling process, and come up with a proprietary patentable environmentally friendly method for extracting 99% of asphalt shingle components.

On top of its industry-leading efficiency, the company’s novel technology will reduce greenhouse gas emissions by over 120 kg, water consumption by more than 650 litres and land disturbance by more than 0.4 square metres per tonne feed.

Northstar is committed to maintaining ESG standards as it enters the North American recycled asphalt shingles (“RAS”) market expected to grow to $1.23 billion USD by 2028 at 5.8% CAGR. Capitalizing on the current limited processing options for clients, Northstar will be able to significantly tap into several potential revenue streams including tipping fees, liquid asphalt, fiber, aggregate and carbon credits.

The RAS sector is characterized with a high barrier to entry due to capital intensive operations, specialist knowledge, economies of scale and challenges to product distribution. RAS product vendors must differentiate themselves in a highly competitive environment where buyers typically make the rules. However, the threat of substitution products is low, so once a company has established themselves using a unique service and necessary product attached to superior distribution, it will be hard to displace them. So, how is Northstar set up?

The company has spent most of the cap ex needed to get going and presently has an off-take agreement in place for 100% of its liquid asphalt production at its Empower Facility located in Delta, British Columbia. The site houses a 20,000 square foot warehouse office space and yard works on 4.3 acres of land. Empower, situated near two major highways for easy access, has a significant stockpile of asphalt shingle material and is expected to reach steady state production in Q1 2022.

Northstar had $8.25 million CAD in cash as of September 30, 2021, and $2.90 million in property, plant, and equipment. It has a small amount of debt in the form of a credit facility with Vancity Savings Credit Union which is due on demand and serviced monthly by the company – it totaled $505,054 by the end of Q3 2021.

Looking ahead, the company expects to complete its independent engineering study in Q1 2022, achieve commercial production in Q2 and begin construction on the phase 1 expansion of its Empower Facility in the second half of the 2022 fiscal year.

The asphalt shingle recycler has 106.11 million issued and outstanding shares with a market cap of $32.36 million as of trading on Wednesday. Hopefully there won’t need to be many more, if any, large equity raises to reach their near-term goals as it could painfully dilute the share base. That fiduciary duty will rest on the shoulders of management. So, who is at the helm?

Northstar CEO, Aidan Mills, has a degree in Engineering from Edinburgh University and an MBA with distinction from Edinburgh Business School. Before his appointment at Northstar, Mills had over thirty years of experience in energy, resources, capital markets and commodities.

Northstar CEO, Aidan Mills, has a degree in Engineering from Edinburgh University and an MBA with distinction from Edinburgh Business School. Before his appointment at Northstar, Mills had over thirty years of experience in energy, resources, capital markets and commodities.

The remaining management team is a powerhouse executive suite with over 200 years combined experience in asphalt manufacturing, business management, equity financing, corporate governance, product development, banking, resources, minerals, transportation, government, regulatory compliance, and energy.

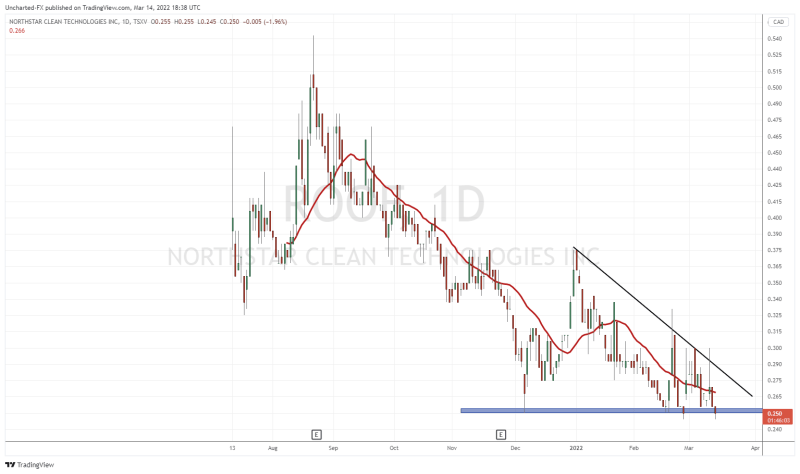

The company currently trades $0.10 below its $0.40 entry in the middle of July but seems to be maintaining a range. With real assets, large cash balance, low debt, off-take agreement, and production just around the corner, Northstar may have seen its bottom this year and could be heading north by the end of January. Of course, tax loss season continues, so it may be prudent to keep your powder dry until commercial production begins at the Empower Facility.

You can get more opinions on Northstar and its potential in our video Investor Roundtable.

If want an in-depth technical analysis, read EG’s own Vishal Toora’s chart breakdown of Northstar.

Do your research, pick your winners, and make a better world. Good luck to all!

–Gaalen Engen