At Equity Guru, we are bullish on the shift to the circular economy. Investment in this space is gaining steam. Lukas Kane gave a good summary on the consumer shift and regulatory catalyst that is bullish the sector.

The issue of single-use-plastic has penetrated the general psyche.

“Sometimes I think about how the plastic packaging from a salad I had on a random Tuesday ten years ago is still out there somewhere,” writes Rachel Kitchin. “And I feel horrible.”

Another major tail-wind is regulatory.

Jurisdictions across the North America have instituted bans and fees on various types of plastics including bags, carryout containers, polystyrene and straws.

As federal plastic bans spread across the globe, the market for bio-degradable plastic alternatives is expanding dramatically.

Where I live in BC, the city has banned all plastic bags. Don’t get any of them at grocery stores. Not even at Indian grocery stores which is a biggie because we keep all our plastic bags under our sink and use them as garbage bags. All about BYOB now (bring your own bags). So we are already seeing major developments in the circular economy. Bags might just be a small thing, but the shift has the real potential to snowball.

In this chart attack, I will look at two plays which I have discussed before. Northstar Clean Technologies (ROOF.V) and Kontrol Technologies (KNR.NE).

Northstar Clean Technologies

Northstar Clean Technologies Inc is a clean technology company, focused on the recovery and repurposing of single-use asphalt shingles in North America. The company has developed a proprietary design process for taking discarded asphalt shingles or destined for already over-crowded landfills, and extracting the liquid asphalt, aggregate sands, and fiber for usage in new hot mix asphalt, construction products, and other industrial applications.

Their clean technology solution is expected to have a significant impact on the environment by reducing landfill usage, reducing the CO2 impact of asphalt, fiber and aggregate production, and contributing to the “circular economy”. Also addresses a US $1.35 Billion in Canada with limited proven processing alternatives.

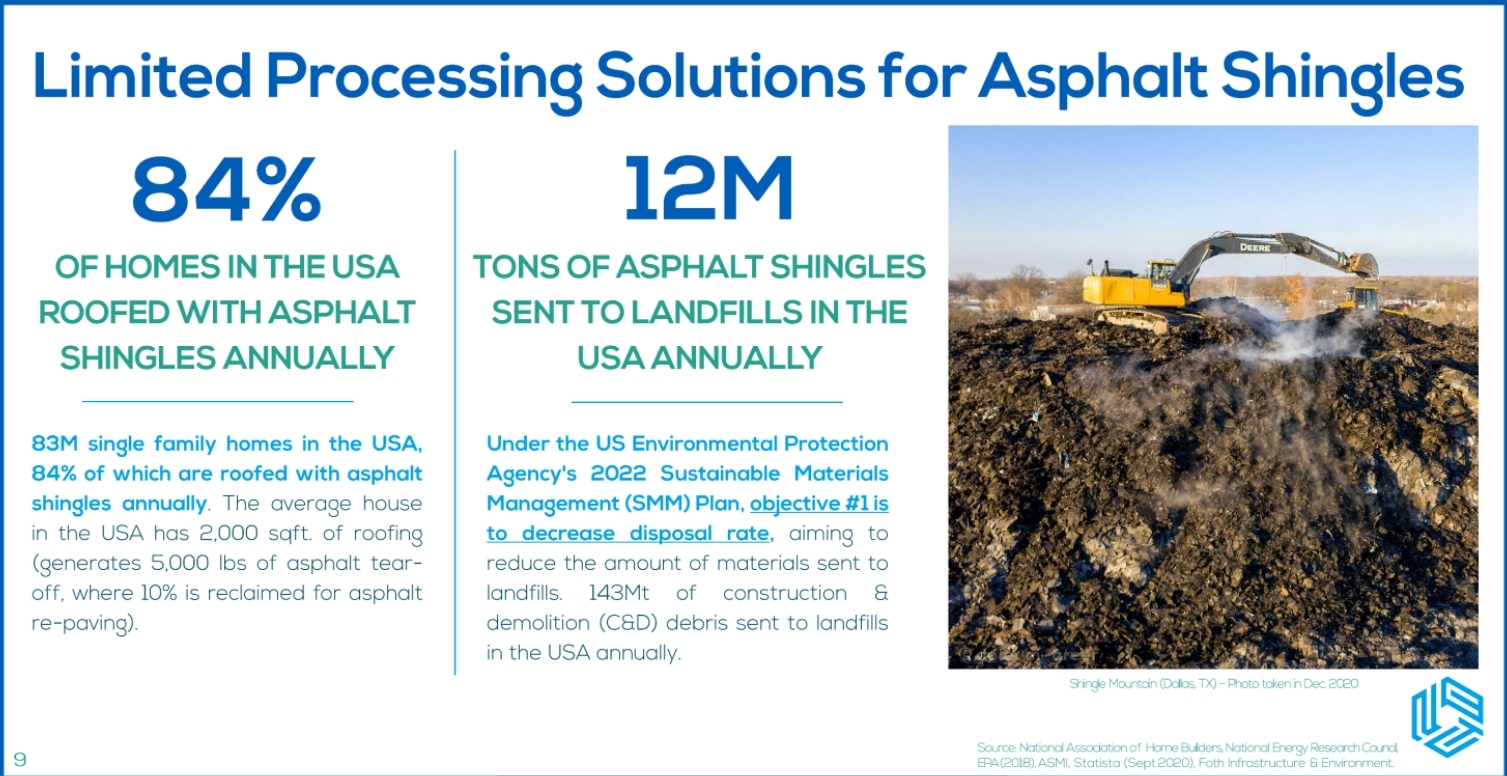

Asphalt shingles are used in 84% of American homes. 12 million tons of shingles are sent to landfills in the US annually. Disposing of them in an environmentally-friendly way is a major problem as asphalt shingles do not biodegrade or decompose in a landfill. They just sit there. Northstar’s Clean Technologies presents an opportunity to divert materials from landfills and extract the bitumen oil, fiber, and aggregate for re-purposed usage in new asphalt shingles, asphalt for road construction, construction products and other industrial applications.

The circular economy trend is just beginning. My generation, and millennial money will be looking at ESG plays and anything good for the environment. The circular economy is all about designing products and solutions that can be made to be made again, rather than the current system of using a product which then becomes waste. This creates an economic system which helps combat problems like climate change, biodiversity loss, waste and pollution.

According to Northstar’s investor presentation, the circular economy is based on three principles:

- Design out waster and pollution

- Keep products and materials in use

- Regenerate natural systems

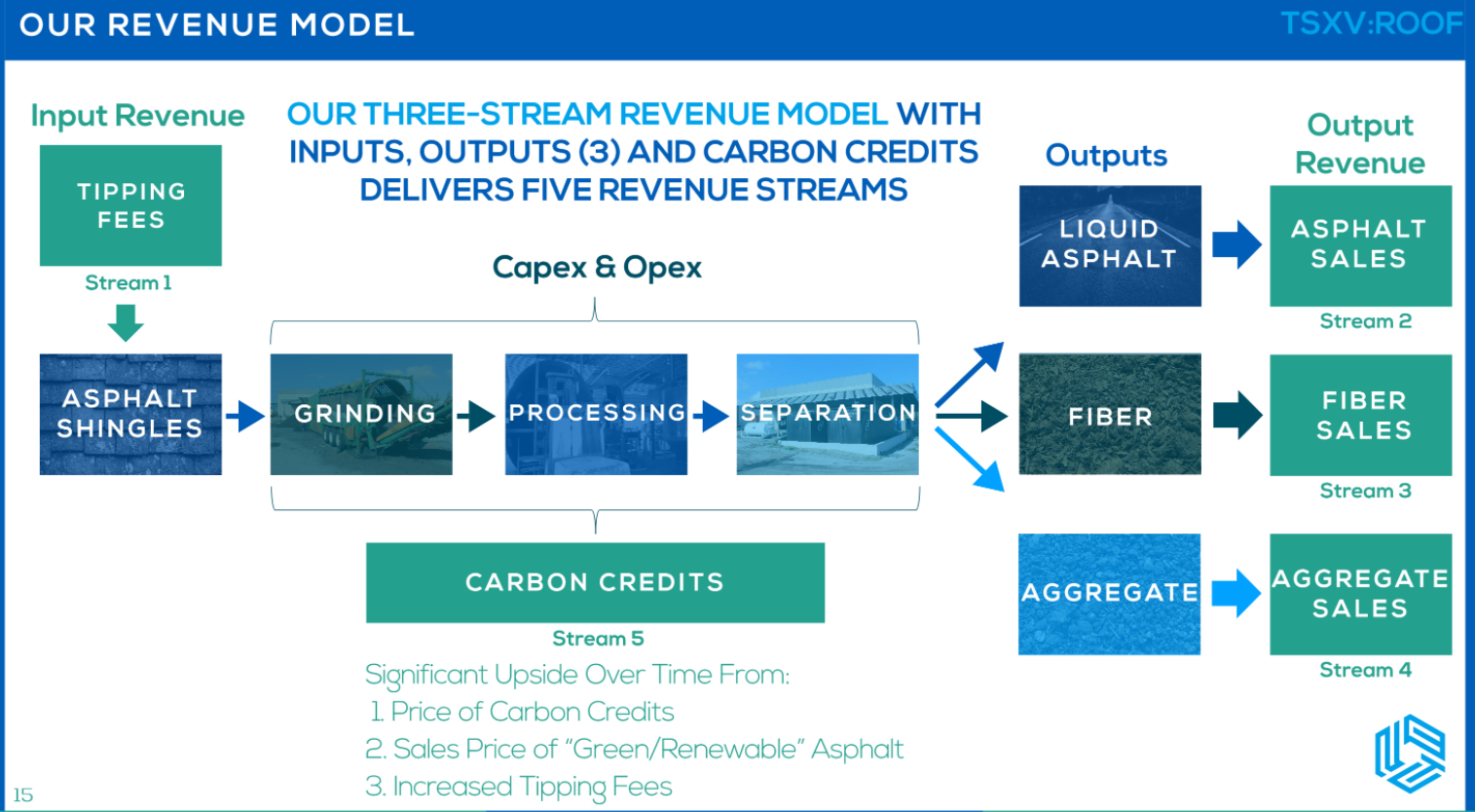

In terms of Northstar’s technology, it involves taking asphalt, grinding it, processing it in a facility, with the application of Northstar’s trade secret, and then turning that into fiber, liquid asphalt or aggregate to be used again in the circular economy.

A key is Northstar has five different potential revenue streams (four as part of the company’s own proprietary process). This includes tipping fees, processing and sales of liquid asphalt, processing and sales of fiber, processing and sales of aggregate, and carbon credits. For those not up to date on Carbon Credits, check out Marin Katusa’s new book “The Rise of America“. All about why Carbon Credits will be the next big investment on Wall Street as the world pledges to reduce emissions and combat the climate crisis. For me personally, I am keeping a close eye on any company venturing into carbon credits.

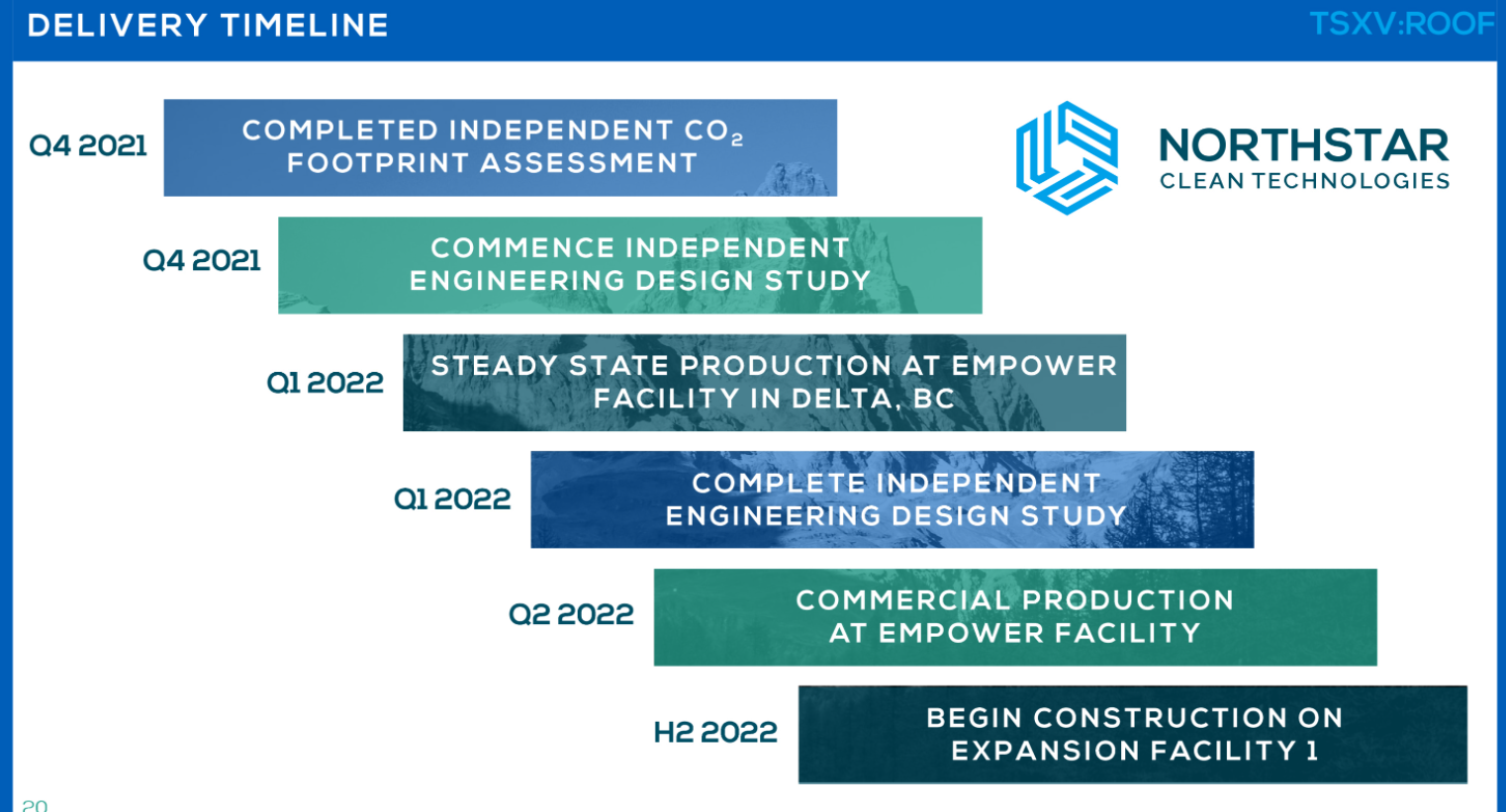

So what next? Northstar is in the process of constructing a facility in Delta, BC Canada. The facility should be good to go with commercial production beginning in Q2 2021.

2022 is setting up to be a big year for Northstar. Expansion and government engagement talks are ongoing with Wellington Dupont Public Affairs, a North American public affairs firm that is well-positioned to offer high-level counsel, including former Canadian politicians who can execute strategies to successfully create policy changes.

Recent news also highlights Northstar initiating steady state production at the Empower Pilot facility, and will be hosting visits for shareholders in March 2022 for industry stakeholders, investors, media and government agencies to showcase its operating process and technology. Here are highlights:

• Operation validates the use of Northstar’s proprietary Bitumen Extraction & Separation Technology (“BEST”) in the foundational design of the Company’s future “scale up” facilities

• The Company has initiated a production plan that includes: (i) Daily production of up to 6 hours per day, (ii) Processing up to 4-5 days per week, (iii) Feedstock production of 10-20 tonnes per day (“tpd”)

• Liquid asphalt and aggregate precisely meets the Company’s end product specification objectives

• Ramping up to steady state production provides a clear roadmap to deliver commercial production of 50-75 tpd

• Providing production samples to industry partners and potential customers for detailed technical analysis

• Currently reprocessing large on-site asphalt shingle inventory

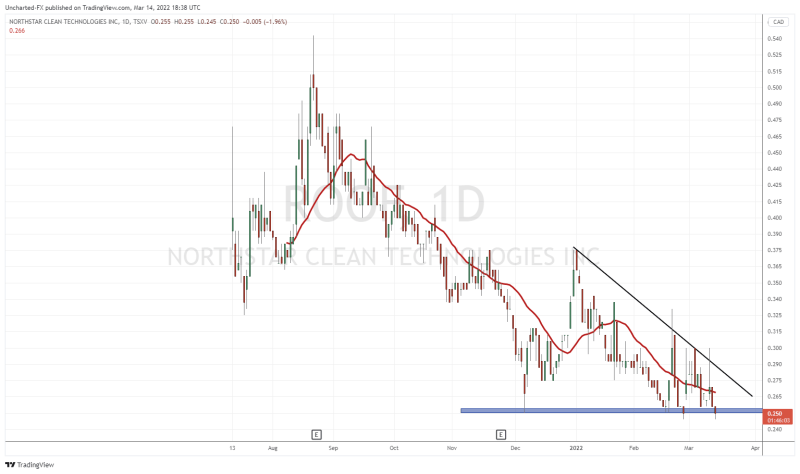

So what about the chart?

Technically, we have bounced at a major support zone, and the highly important psychological level of $0.25. Really liking what I am seeing here. I like my reversal patterns to trigger at major support zones, and what better area than previous record lows?

I have drawn a trendline connecting the recent daily highs. Note the trend is still down. Note that we rejected a close above this trendline three times! When I see three touches, that to me is a sign that this trendline is valid. If we get a breakout, we are good to go!

As a technical chartist, I want to see a daily candle close above this trendline. We do not have that just yet. We attempted to break above on February 28th 2022, but no success. Prices can still bounce in this zone marked by our support and this trendline. A move at support could be a zone for entry IF we see the right type of candle. We would want to see a candle with a large green body, a large wick, accompanied by large volume. Something like the candle we see on Feb 17th, which was accompanied by large volume.

Recent geopolitical issues may cause stock markets to drop if things get out of hand. You would see money leave stocks and run into cash and bonds. If so, I am sure small cap companies will also take a hit. But looking to the future, we are heading into a green/clean tech world. If you look at the long term, a company like Northstar Clean Technology will have a role to play!

Kontrol Technologies

Kontrol Technologies (KNR.NE) provides energy efficiency solutions and technologies to commercial energy consumers. It offers SmartSite, a building energy software technology to assist in the operation and management of complex heating, ventilation, and cooling systems for factories, large multi-residential, commercial, and mission critical buildings; SmartSuite that connects into existing building automation systems and also communicate with utilities; and BioCloud, a real-time analyzer designed to detect airborne pathogens for various applications, such as classrooms, retirement homes, hospitals, mass transportation, offices, break rooms, and others defined spaces.

BioCloud technology is designed to detect airborne viruses and pathogens. Maybe you can think of a reason why this is important today, and will be important as years go by. BioCloud has been designed to operate as a safe space technology by sampling the air quality continuously. With a proprietary detection chamber that can be replaced as needed, viruses are detected, and a silent notification system is created.

If you are into smart cities and smart buildings, then Kontrol Technologies is the company for you. Putting the BioCloud stuff aside, the green movement is real. Carbon credits are already becoming a huge market, and reducing emissions will be a government policy in the near future. Autonomous buildings that are smart, clean and sustainable is Kontrol’s forte. Kontrol’s overall aim as a company is to integrate smart energy devices, energy software and energy retrofits to help organizations benefit from energy cost savings while minimizing greenhouse gas emissions.

The customer base? Anyone who wants to reduce energy consumption, lower GHG emissions, and create a safe and healthy space for employees, customers and stakeholders.

For you footie fans like me, Kontrol Technologies was selected by Bundesliga team VFL Wolfsburg to provide real-time air quality and viral monitoring. Remember, this team is owned by Volkswagen.

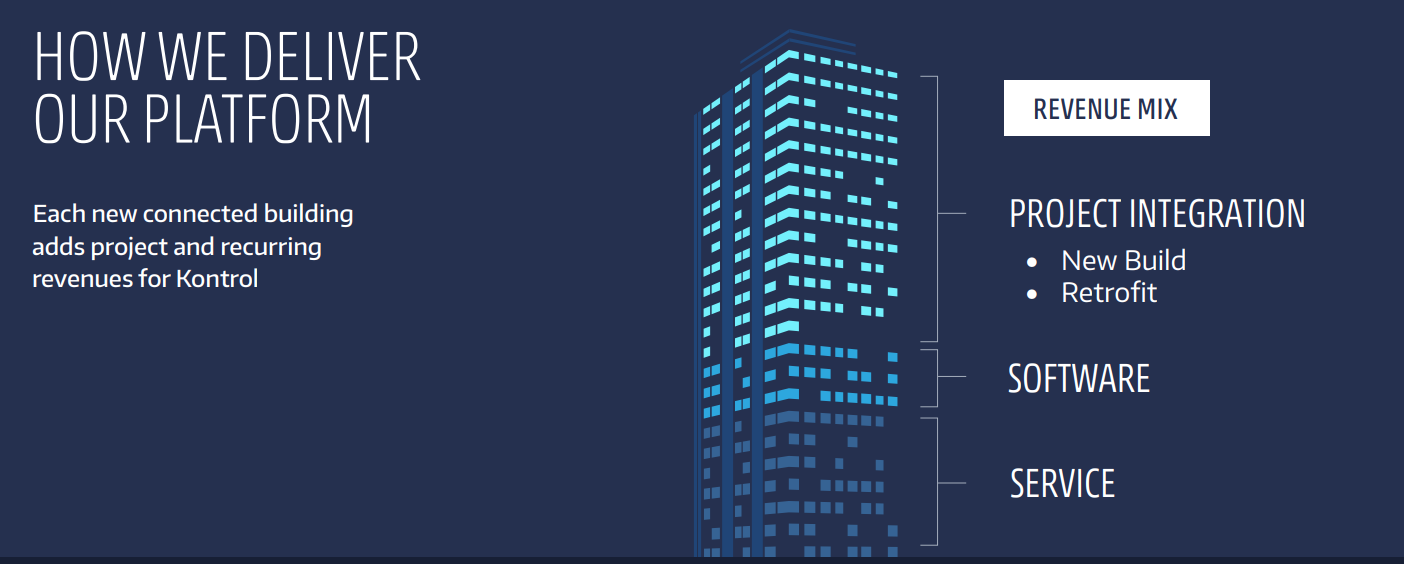

The company recently has been awarded a $9.7 Million HVAC and Automation project, through its wholly owned subsidiary Global HVAC and Automation for a new high rise building in the Greater Toronto Area. The contract is expected to take place in Q2, 2022. The project is anticipated to commence in Q3, 2022, with estimated completion in Q4, 2023.

“We are pleased that we are able to win these larger opportunities with our Global team,” says Paul Ghezzi, CEO of Kontrol Technologies. “Global provides us with a larger project footprint and capability that we seek to expand while we also focus on adding recurring revenues through an integrated building technology and service platform.”

For investors, there is a major catalyst coming up with a Health Canada testing update. The final phase of BioCloud testing is anticipated to be completed in February 2022, and testing is being conducted at the request of various government agencies. A government angle here and deal has the potential to be huge. Honestly, the future looks bright for Kontrol Technologies and their services.

So what do I see on the technicals? As of now, the stock needs to do some things for me to go bullish. Kontrol Technologies was holding a range from August 2021 until January 2022. We ranged between $2.00 and $3.00. In early January 2022, we tested support and investor’s hoped we would bounce like the multiple times we have done in the recent past. This is why I still wait for technical confirmations and do not buy or sell exactly at support or resistance. A trader can for sure, but I look for confirmation to increase the probability of my trade.

We broke below support which coincided with the overall sell off in stock markets. Very volatile markets, but things seem to be on the verge of shifting. We did recently get a nice close above $2.00 with pretty good volume. The market really likes the recent news of a $9.7 million contract.

From here, there isn’t much to do but wait for a nice close above $2.00 from a technical perspective. There is even a possibility that if the stock falls a bit further, then turns around, we create an inverse head and shoulders pattern too.

From a risk vs reward perspective, both stocks present a great opportunity for the long term at these price levels and technical points.