It’s going to be a big few weeks for central banks and monetary policy. We had the Reserve Bank of Australia yesterday (no change in monetary policy), and all eyes and ears will be glued to Fed chair Powell when we have the FOMC meeting and press conference on December 15th. Remember, Powell has been a bit hawkish lately saying the committee would consider increasing, or doubling, their taper. As US Stock Markets seem to have recovered from the Omicron fears, we now wait to see if a taper tantrum is in play. Right when the S&P 500 is hovering near previous record highs.

Speaking about central banks, the Bank of Canada just released their monetary policy report this morning. Governor Tiff Macklem and the Bank of Canada have decided to keep interest rates unchanged at 0.25%. In terms of forward guidance, the language has changed due to recent events, but the Bank of Canada is still on the path to normalize rates beginning in the second half of 2022. Slightly hawkish but non-committal is the best way to describe this rate decision.

The Bank of Canada highlighted the recovery in the global economy, citing the economic growth in the US led by consumption. The central banks take on inflation is that prices are rising due to strong demand for goods amid supply chain disruptions. One key language change that everyone saw coming is the Bank of Canada says the Omicron variant “has injected renewed uncertainty“. If there ever was a way to downplay imminent rate hike expectations, this is it. Although, persistent inflation will keep imminent rate hike expectations high.

Here is what the Bank of Canada had to say regarding the Canadian economy:

Canada’s economy grew by about 5½ percent in the third quarter, as expected. Together with a downward revision to the second quarter, this brings the level of GDP to about 1½ percent below its level in the last quarter of 2019, before the pandemic began. Third-quarter growth was led by a rebound in consumption, particularly services, as restrictions were further eased and higher vaccination rates improved confidence. Persistent supply bottlenecks continued to inhibit growth in other components of GDP, including non-commodity exports and business investment.

Recent economic indicators suggest the economy had considerable momentum into the fourth quarter. This includes broad-based job gains in recent months that have brought the employment rate essentially back to its pre-pandemic level. Job vacancies remain elevated and wage growth has also picked up. Housing activity had been moderating, but appears to be regaining strength, notably in resales. The devastating floods in British Columbia and uncertainties arising from the Omicron variant could weigh on growth by compounding supply chain disruptions and reducing demand for some services.

As noted previously, the central bank expects inflation to persist due to global supply constraints, with effects of these constraints taking some time to work through. Oil prices, which is a major factor in determining CPI inflation, have declined and core measures of inflation are little changed since September. That might change given the new technical uptrend breakout on Oil which I have called on Equity Guru’s Free Discord channel. In a way, the Bank of Canada knows this too as they expect “CPI inflation to remain elevated in the first half of 2022 and ease back towards 2 percent in the second half of the year.”

In terms of current monetary policy? Holdings of Government of Canada bonds will remain constant, and “The Governing Council judges that in view of ongoing excess capacity, the economy continues to require considerable monetary policy support.” Rates will remain unchanged until the 2% inflation target is consistently achieved, which the bank believes will occur sometime in mid 2022.

The Canadian TSX is red today, but is likely more impacted by the recent US market sell off.

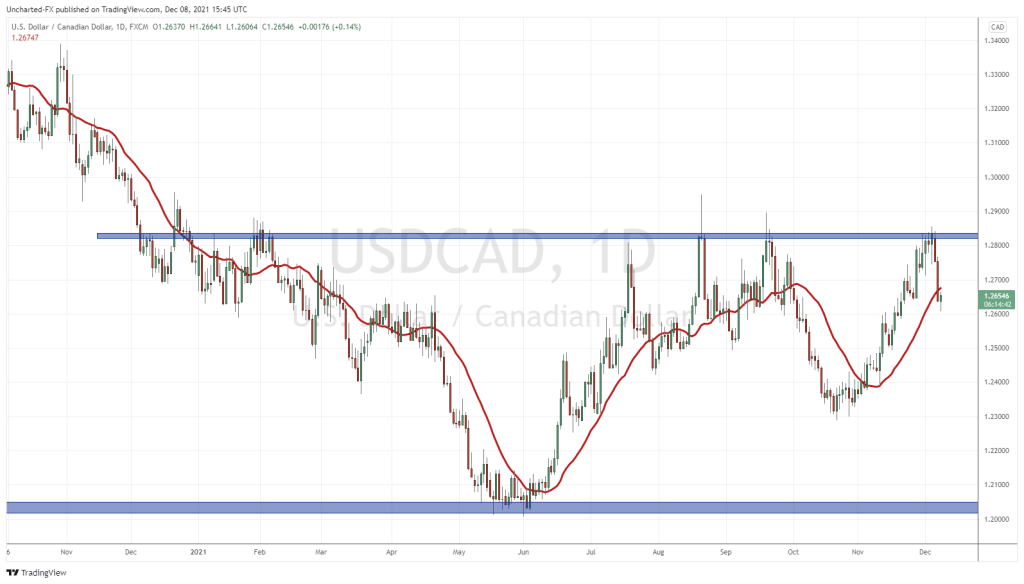

The USDCAD has seen some action in recent days. A strong Loonie (CAD) appreciation in the past two days. USDCAD hit an important resistance (price ceiling) level at 1.28, ranged there for a few days, before dropping to 1.26. Perhaps traders were anticipating a hawkish Bank of Canada, but I believe this move occurred due to Oil strength and the technicals (a resistance zone) being lined up. On the rate decision, the Loonie gave up its earlier gains with the US Dollar now appreciating against it. On a technical note, I think the Loonie continues to strengthen to 1.25, but keep in mind, we have the Federal Reserve next week which will increase volatility on all Dollar pairs.

Again, the question remains how many times can central banks raise rates without breaking the consumer and the government, both of which are holding record amounts of debt. This is the $1 million dollar question going forward, and contrarians are betting that there will be no rate changes. Essentially, we have all become Japan or the EU without negative rates, but unable to raise rates significantly if any at all.