What a weekend for cryptocurrencies. Major sell offs during the weekend. Zerohedge discussed leverage traders getting smashed and flushed out:

Then at midnight into the early hours of Saturday morning, during the traditionally illiquid Asian session when things normally go splat in the night for cryptos as one or more super levered Asian momentum chasers blow up, Bitcoin suffered a massive liquidation and crashed down to the $42k level, tumbling into a bear market. Price has recovered some, now trading around $47k.

And sure enough, according to Coinglass, over 410K crypto accounts were liquidated in the past 24 hours totaling $2.6 billion with the largest liquidation being $27 million.

Even though I am long crypto’s, and a hodler for the same reasons I am long precious metals (ie: holding non-fiat assets), I acknowledge that cryptocurrencies are NOT acting as safe havens right now. Regular readers know this, but let me explain this concept for new readers. There are two types of environments: risk on and risk off. A risk on environment is when money runs into stocks. No fear, and things are looking rosy that investors pile in on risky assets. A risk off asset is the opposite. Money leaves risky assets and runs into bonds or the US Dollar. Anything perceived as safety. In my opinion, cryptocurrencies have been acting like a risk on assets. They have a positive correlation with stock markets. I am talking about high 90 plus percentage correlation. So when stock markets fall, crypto’s fall, but when stock markets move up, crypto’s follow.

Over the weekend, I got a bit worried because these crypto drops could have meant more stock market sell off come Monday morning. However, Bitcoin and Ethereum largely recovered on Sunday, leading to a stronger open for stocks. If stocks continue higher here, then things look good for cryptocurrency.

The big fundamental reason is that Fauci is now saying the Omicron severity isn’t as bad as first thought. Travel stocks are all ripping, and markets are definitely shedding that fear. It could flip on a dime if another negative Omicron headline comes out and freaks the market. But you all know me, I am putting more weight on the Federal Reserve and their meeting this month, where they are saying they will increase their tapering.

Back to crypto and what I see coming next. First off this is where the buying is coming according to a recent Zerohedge article:

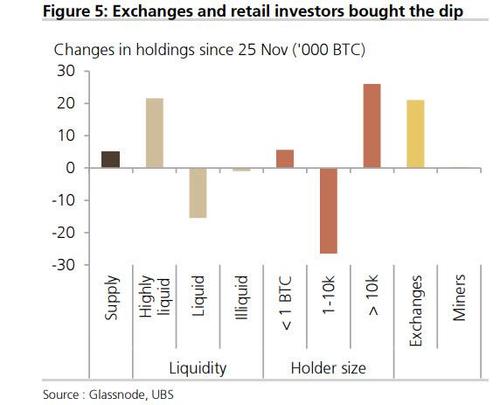

According to UBS analysis of Glassnode on-chain data, the dip was bought by the smallest and the largest holder cohorts as well as crypto exchanges. In other words, both retail and whale were waving it in, as medium-sized clients were actively shorting. This sets the scene for the next short squeeze.

First the daily Bitcoin chart. If you are a part of our free Discord group, I posted how the breakdown below $60k was bearish. The arrow marked where I shifted to a bear. Not a long term bear, but just a move lower according to market structure principles. Basically, we had multiple higher lows and higher highs in the uptrend. A pullback was expected…just like stocks. The speed of the drop is what surprised traders, but the way I look at it, we hit a major support zone (or short target) very quickly rather than making lower highs and lower lows. $50,000 is the big psychological number ahead, and if we can get a daily close above it, things look good for Bitcoin and crypto.

For me to go full bear, this is what I would need to see:

I take us out to the weekly chart. According to market structure, an asset is in an uptrend if the higher low is holding. On the weekly Bitcoin chart, that higher low comes in around $40,700 , which is pointed out with my arrow. If we were to get a WEEKLY close below this zone, then things wouldn’t look so good for Bitcoin. Notice how buyers stepped in near this support. Some of you might be saying I sound like a perma bull, so let me highlight one bearish thing I see. The breakout above $60,000 was not held. Some may say this was a fake out, but the support target for shorts was met.

Ethereum is an interesting one. The coin has held relatively well compared to Bitcoin. Crypto traders even argue that money is running ETH for safety. All I can say is technically, $4000 is huge. Notice the large sell off candle December 4th, or on Saturday. As a technical trader, it was huge that the candle did not end up closing below $4000. I see this kind of stuff all the time. A breakout or breakdown looks likely, and then by the time the candle is about to close, ‘they’ reverse it the other way and trap the FOMO traders. Hence why I always say, be patient and wait for candles to close. If Ethereum did have a body close below $4000, then oh boy, it wouldn’t have looked too good. We are not out of the woods just yet. Technically, this does look bearish with a double top and a move below my moving average…all happening after Ethereum made multiple higher low swings. But the trigger remains the candle breakdown below $4000. If this happens, then maybe we can start talking about crypto winters, because Bitcoin would probably be below $40,700 as well.

But let’s end off on a positive note. Again, quickly glancing at the daily chart, we see wicks on the daily candles indicating buying at $4k support. Now shifting to the 4 hour chart, we can see evidence of basing at $4k. My trigger? Simple. If we can get a candle close above $4210, that would be a breakout and a trigger bulls who are watching this support will be looking for.

In summary, Ethereum is looking promising, and Bitcoin gets interesting with a close above $50,000. Crypto’s are acting like risk on assets, meaning they will move just like Stock Markets. Watch to see if markets can bottom and gain a bid. Still influx, but I would watch for a daily close above last week’s candle highs.