As we witness an everything sell off in Stock Markets and other assets, investors are beginning to look for good deals during this dip. One of the sectors to provide this will be precious metals. Here’s why:

On the weekly, Gold is still above the $1750 zone. I remain bullish long as we remain above this price zone on the weekly chart. We have had quite the retreat from $1860, and if the stock markets get a bid, Gold will as well.

On the Silver side of things, we are back at our major weekly support zone. The $22 zone, an area which I have discussed a few times here on Equity Guru. We played the bounce in September 2021, and spoke about the retest of this breakout way back in 2020.I will be watching this zone like a hawk in the upcoming weeks, and I am liking the signs of bottoming that I am already seeing. No trigger just yet.

As precious metals look to form a potential bottom in the next few days or weeks, investors will look at beat up stocks. When Gold and Silver move up, the junior gold miners follow along. Great gains from these types of setups are some of my favorites.

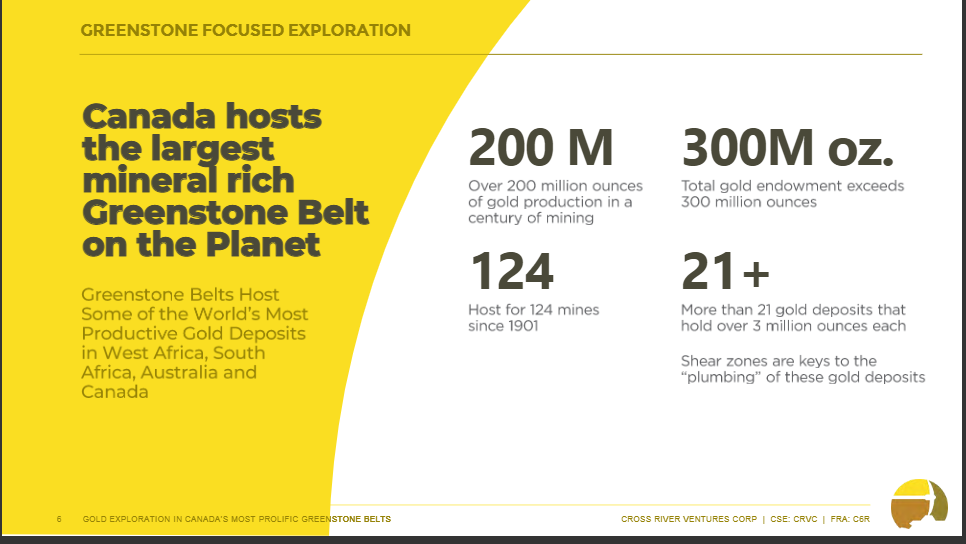

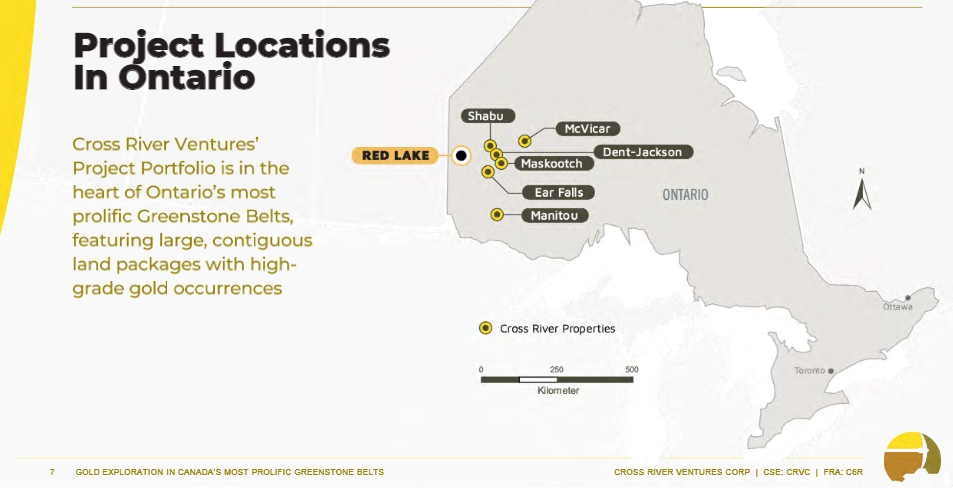

Today’s idea is Cross River Ventures Corp (CRVC.CN). An early stage Gold explorer in a prolific Greenstone belt in Ontario.

Here are the properties that Cross River Ventures holds:

Cross River’s flagship project is the McVicar Gold project. Situated near Gold occurrences and near gold projects of other companies. Why is this important? Well it means the project has a high potential for discovery due to the highly prospective structural and geologic contacts. There has been no coordinated exploration on McVicar since 1994.

![]()

Cross River has done some sampling, and here are the results so far:

- 6.46 g/t Au over 10.09m (including 29.86 g/t over 1.86m),

- 5.5 g/t Au over 3.6m,

- 11.72 g/t Au over 1.52m,

- 33 g/t Au over 1.86m,

- 5.0 g/t Au over 2.74m, and

- 9.3 g/t Au over 2.02m

Just last month, Cross River defined a new surface trend at McVicar, with samples up to 19.75 g/t Au. You can read more about these samples here.

The most recent news from the company actually comes from their Maskootch project. Assay grab samples are encouraging showing up to 32 g/t Au.

A play with exciting discovery potential, and I will be looking forward to their full drilling campaign and their subsequent results.

My readers know that not only is jurisdiction important for mining projects, but so is the management. Cross River has a management team with decades of experience, and a world class technical team with a history of exploration and discovery success. The CEO is Alex Klenman, who Chris Parry says is the hardest working man in the mining sector, and currently holds positions with Nexus Gold Corp, Leocor Gold, Azincourt Energy, Arbor Metals, Manning Ventures to name a few. He has previously worked with companies such as Roxgold Inc, Forum Uranium, Integra Gold and Midnight Sun Mining.

The company has made new record lows (will attract the eyes of bottom pickers), and the question now becomes, is it the best time to buy the dip? Keep in mind this gold explorer is still very early stage. The current market cap according to Marketwatch is $3.77 Million. The company has cash which is close to half of their market cap. To me, this is an attractive longer term play given the current market cap, the current market condition, and the technicals.

It might be one where a catalyst might take some time to come down the pipeline, but here is how I would play it. Technically, in order for this downtrend to be neutralized, we need a candle close above $0.15. If you take a look at my chart, we attempted to do this a few weeks ago. Unsuccessful, and I must add that if we did get that close, we would have printed a mini cup and handle reversal pattern. Just shows you why it is worth waiting that extra day to confirm a candle close. One could initiate an initial position here, and add more down the line when we close above $0.15. Remember, an overall rise in Gold could also get the stock moving. In summary, the potential for the gains is quite significant given the team behind the project, their assets, and a broader move in Gold and Silver.