Music to my ears. After months of us ‘alternative’ or contrarian armchair economists and macro strategists have been warning inflation is not transitory, the Fed finally admitted it too. Okay, maybe it wasn’t just us contrarians. Hedge fund managers and people such as Ray Dalio, Stanley Druckenmiller and the recently departed ex Twitter CEO Jack Dorsey have been sounding the alarm bells on inflation. Many other market participants and economists you see on mainstream financial media admit it too by saying the Fed should be tapering and hiking rates sooner. What they are trying to say is the Fed needs to do this to get ahead of, or control inflation.

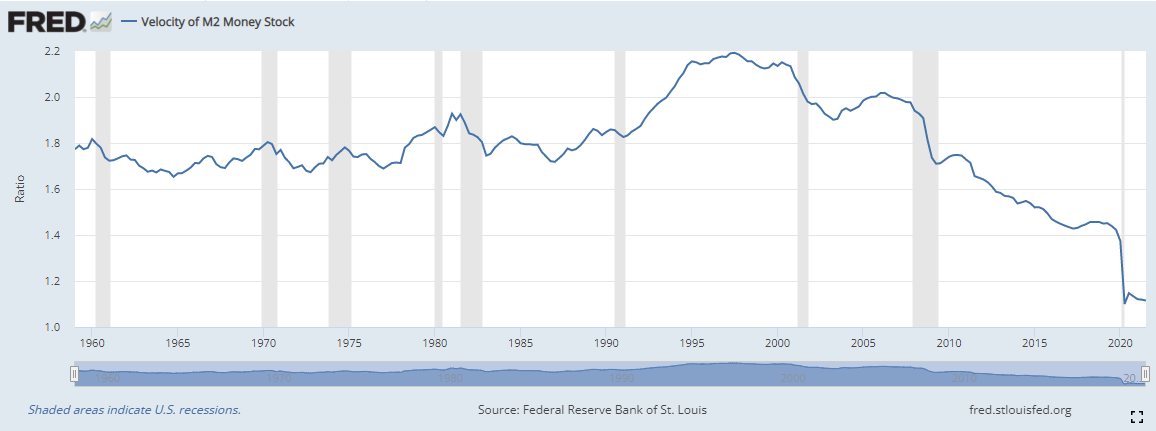

Since day 1, we contrarians have almost had meltdowns warning people that inflation was not going to be transitory. We have a situation where there are more money and productivity has not increased. In essence, we have a situation where there is people with more money competing for the same number of goods and services. Sure, money velocity is key too. This is a big factor for hyperinflation because people are spending money right when they receive it. They have no trust in governments and central banks.

Money velocity has been declining since 2000. New lows during 2020 because of lockdowns. The argument is that money velocity is low so we will not see huge levels of inflation. Rather, it is supply chain issues causing rising prices. The monetarist argument is that inflation takes its time. Economies opened up earlier this year, so money velocity and subsequent inflation is just picking up. The funny thing is if this Omicron variant turns out to be worse than expected, more lockdowns could subdue money velocity and in a way, help central banks control inflationary pressures. But it would make the situation worse because they would have to pump more money into the system. Doing so while not increasing productivity. Let’s hope this doesn’t happen, but we still need to deal with the previous money printing.

Readers of my work have heard my definition of inflation many times: Inflation is the decrease in purchasing power. A weakening of a currency, where it takes more of that weaker currency to buy something, hence higher and rising prices. We are seeing this play out in the country of Turkey. The Lira keeps weakening, and inflation is close to 20%. It takes more of that weaker Lira to buy something. Residents don’t want to hold Lira’s. They would rather spend it because the currency may weaken the day after. This means money velocity increases adding more pressure to inflationary pressures.

When you look at currencies, you need to point your fingers at central banks. An astute economist over on Twitter said “Inflation is not by accident, it is a policy”. For those of us who trade the Forex markets, be prepared for a volatile year ahead. We will be seeing some epic moves. Already seeing an epic move on the EURCHF, and nobody is talking about it. Currency war gets thrown out a lot. Many export nations will want to maintain a weaker currency to boost exports and quite frankly, to keep assets propped via inflation. The US Dollar is the key chart. It has either been rising due to risk off money flows, or because money is thinking the Fed tapers and raises rates. In my opinion, a stronger US Dollar will do more damage to the world. Commodity prices, which are priced in Dollars will be affected, and emerging markets with Dollar denominated debt will also feel the pinch. Keep your eyes on the South African Rand, USDZAR has already confirmed a breakout, and I feel it will go the way of the Turkish Lira.

Back to Mr. Powell. Powell and Treasury Secretary Janet Yellen testified to congress yesterday, and are doing so today. Stock markets moved on Powell’s taper comments. Oh no! Is this the real taper tantrum? How about no! Markets have regained all losses. It could be because prices were near support. Or the markets aren’t buying Powell’s taper comments. OR the market is reacting to inflationary comments. More on that in a second.

Powell said that the Fed will discuss speeding up their taper program this month:

“At this point, the economy is very strong and inflationary pressures are higher, and it is therefore appropriate in my view to consider wrapping up the taper of our asset purchases, which we actually announced at the November meeting, perhaps a few months sooner,” he said. “I expect that we will discuss that at our upcoming meeting.”

The Federal Open Market Committee, which sets monetary policy including interest rates and the Fed’s efforts to boost activity through bond purchases, said following its November meeting that the pace would be cut by $15 billion a month — $10 billion in Treasurys and $5 billion in mortgage-backed securities.

“The word transitory has different meanings for different people. To many it carries a sense of short-lived. We tend to use it to mean that it won’t leave a permanent mark in the form of higher inflation,” Powell said. “I think it’s probably a good time to retire that word and try to explain more clearly what we mean.”

Many saw this comment, and subsequent taper comments as ‘uh oh! the Fed is admitting they could be losing control over inflation and need to taper and hike quickly”. But the markets haven’t lost confidence in the Fed just yet. Or have they? The Omicron variant could change things. Market participants believe that stock markets would drop again just like they did in 202o with the global lockdown. I argue that we didn’t have current monetary policy back then. If another global lockdown occurs, the Fed will un-taper their taper, and probably increase asset purchases. They will support and prop these markets. Markets won’t fall too hard, and if they do, the dips will be quickly bought up knowing the Fed has our back. The Powell put as some call it.

Another factor could be inflation. Believe it or not, but stock markets do well in inflationary periods because they tend to be the best way to make a yield which can beat the rate of inflation. Need a case study? Turkey once again.

This is Turkey’s BIST stock market index. New record highs, and makes record high after record high. Even though they have a high inflation and the Turkish Lira keeps losing value, the stock markets are ripping. You think this has to do with fundamentals in the economy? This is money chasing yield.

I expect the same thing to happen in US markets and other global markets as the currency crisis unfolds. It is all about central banks folks. Do not bet against them.