Initially, I was going to say “hey folks, let’s watch the Euro and Europe for one reason: Turkey”, but now, things are more complicated than that. Europe, specifically the European Union nations that use the Euro, have been a hot topic in financial debates for the past few years. The debates increased after Greece. I have heard people say Europe is finished, a Euro member will leave, and/or Europe will become the next Africa in a few years. Spain has had an employment problem for over a decade. The unemployment rate for young people is around 25% (probably higher now). Spain is one of the PIIGS nations. I am talking about Portugal, Italy, Ireland, Greece and Spain. These nations are seen as the weakest as they are unable to refinance their government debt or bail out over indebted banks. One would think if a larger nation gets into trouble, Germany and other European nations would be forced to bail them out…which would tick off Greece, who had to agree to austerity measures. But this would be a case of ‘too big to fail’. Sorry Greece.

With the pandemic, the European Central Bank (ECB) initiated its pandemic emergency purchase programme (PEPP). The central bank’s Pandemic Emergency Purchase Programme was implemented in March 2020 to support the euro zone economy through the Covid-19 crisis, and is due to end in March 2022 at a potential total value of 1.85 trillion euros ($2.19 trillion). The question is will the ECB taper? A good question for many central banks actually. It is pretty much accepted that the EU is just like Japan. There can be no interest rate hike going forward. Tapering? Sure, but I won’t believe it until I see it. The Fed said they want to taper but we are seeing their balance sheet increase.

But enough of me venting. Let’s get down to some charts and reasons why you should be watching Europe. Let’s start off with something that may see the ECB (and the Fed) continue their cheap money policy: Covid.

Big news was that Austria went under full lockdown. Three days after forcing the unvaccinated to stay at home, Austria saw the most daily cases ever. 14,000 plus daily infections compared to the previous high of 10,000.

Deutsche Bank economist Robin Winkler has been pointing out that the vaccination rate in Austria (64%) is somewhat lower than the likes of Spain (79%), Italy (74%), France (69%), the UK (69%) and Germany (68%) but it is still higher than the US (58%). The question in everybody’s mind is who is next? I am focusing on Europe, but we cannot count out Canada and the US and other nations. Perhaps this is why markets are a bit shaky. Fear of another major Global lockdown in Winter.

Here are some other things happening in Europe: Ireland, which has a vaccinated population of 93%, re-imposed partial lockdowns including curfews at pubs. Local businesses are not happy. Gibraltar, which has a 100% vaccinated population, the most vaccinated population on earth, is re-imposing restrictions on rising Covid cases and has effectively cancelled Christmas. A few European nations such as Germany, Italy and Spain have hinted that they will follow Austria in imposing nation wide lockdowns and mandatory vaccinations. The German health minister Jens Spahn, had this to say on Covid as Covid cases rise and Winter approaches: by the end of winter – everyone in the country will be “vaccinated, recovered or dead.”

People are beginning to lose confidence in the government as partial lockdowns are announced. We are hearing about large protests in the Netherlands, Croatia, Belgium, Italy, Spain, Germany and the list goes on and on. They are turning violent too.

My bet for the next lockdown candidate is Italy or Spain. Here’s why:

The Italian stock market broke a support structure, and the retest saw sellers.

The Spanish IBEX has been falling heavily the past few days. Some green yesterday and today. Both of these markets have fallen more heavily than France, Germany and the UK. Maybe some worried investors. I do want to point out one thing. It might be controversial but I have been hinting about it all year. If you believe Central Banks cannot taper or hike rates, then a resurgence of Covid comes as a blessing in disguise for them. They can continue the cheap money policy going forward and say that they were going to do all the things they said they would do, but unfortunately Covid came back. They get a way out to save face and maintain confidence.

Also one more key point: stock markets may not sell off heavily as before. Yes, another Global lockdown is not priced into markets, so they would sell off if it happened. But last time, there was no cheap central bank policy. This time, the markets know central banks will not change monetary policy, and keep assets supported. Buy that dip.

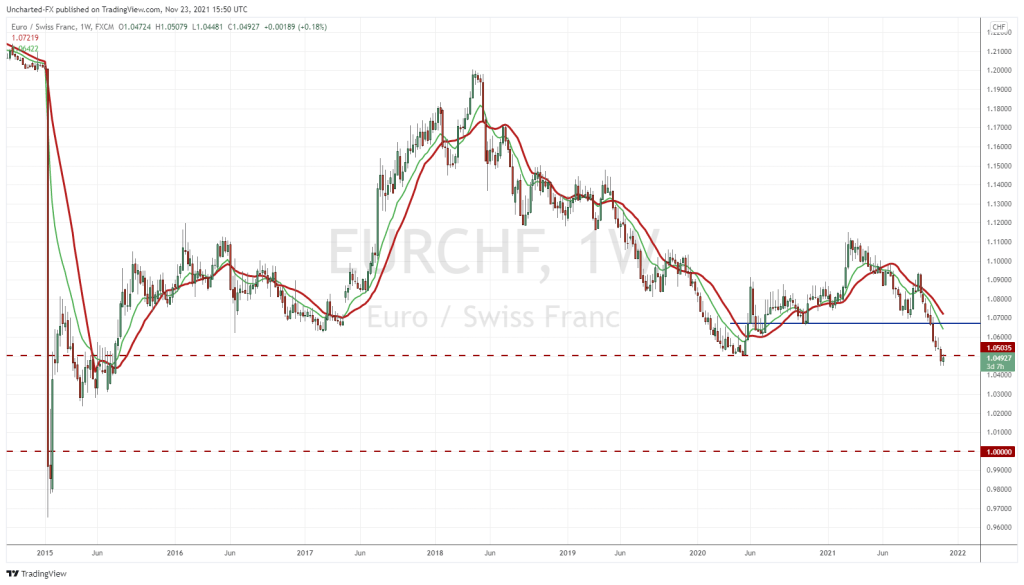

EURCHF

If you follow my work on social media or are a member of Equity Guru’s free Discord Channel, I have been warning about the EURCHF currency pair. In fact, the Euro is weakening against most currencies. Gaining against others such as the Russian Ruble, the Mexican Peso, and both the Norwegian and Swedish Krona.

Many of us alternative thinkers are seeing wealthy Europeans run to Swiss Bank Accounts. Have been for a while, way before Austria went full lockdown mode.

The EURCHF on the weekly close below 1.05. When we hit parity, that’s when financial media will tell you money in Europe has been fleeing to Switzerland. I’m just giving you the heads up now.

The Swiss National Bank, the Central Bank of Switzerland, played a large part in moving markets. I remember. I was there that day. January 15th 2015, when the Swiss National Bank scrapped the peg of 1.20 CHF per Euro. You see the effects of that on my chart to the very left. We dipped below parity back then. Epic price action.

As EURCHF drops, it means the Swiss Franc is getting stronger. Not the best for Switzerland who export to Europe. Some say the Swiss National Bank may be forced to act, but in reality what can they do when they are also at negative rates and are actively buying stocks? More negative rates than the ECB to get money to flow out of the Franc and into the Euro?

Watch the action on the EURCHF folks. This is very important.

Turkey

A few years ago, I wrote a post on Equity Guru titled ‘The Tale of Two Dollars‘. I spoke about dollar denominated debt, and how a stronger US Dollar could wreak havoc. A similar approach to Brent Johnson and his Dollar Milkshake Theory. That article may be old, but is still relevant today. In fact, it seems current events were predicted in that piece.

You have probably heard that the Turkish Lira is imploding. The weakest it has ever been. A currency crisis is under way.

A big weak day for the Turkish Lira today. Wow. Things are getting crazy, especially when you have a guy like Erdogan who probably wants to remain in power for life. If he is blamed for this weakness, he is finished, but from what I am hearing, his support is strong. Turkey is blaming outside influences for this currency weakness.

Erdogan has fired multiple Central Bankers, including his son-in-law. They have restricted purchases of the US Dollar and Crypto’s to try to keep money flowing out of the Lira. And recently, Turkey has been CUTTING interest rates. Generally, a Central Bank would hike interest rates to try to get money to flow into the Lira. This means there are other fundamental financial problems behind the scenes. Let’s just say it: debt problems.

Now here is where things get crazy. It will be Europe that feels the blunt of this damage. Turkey has a large Dollar denominated debt. But Turkey has not borrowed US Dollars from the US. There is something called the Euro Dollar system, and I am not talking about the Forex pair EURUSD. Essentially, because of the demand for Dollars from wealthy Europeans and corporations, European central banks began printing US Dollars. These US Dollars are not controlled by the Federal Reserve. There are even books saying the USSR got their Dollars this way. Since they weren’t on good terms with the capitalist US, the only way for the USSR to access Dollars was through European banks. Fast forward to today, and this is why the US is keen on European nations not buying energy from Iran.

So where has Turkey gotten these US Dollars from? French, German, Spanish, Italian etc banks. Uh oh. If Turkey defaults or has a major financial problem, it will be European banks and Europe that will take the hit.

This is another reason why money is running out of the Euro. I mentioned EURCHF, but I should also show you guys EURGBP:

Big weekly close below support on the EURGBP last week, but the Pound has slowly but steadily appreciated against the Euro in the last few weeks and months. Brexit perhaps? In a way, the UK may have dodged a bullet. Let’s say the Turkish situation gets out of hand, and the European banks who lent to Turkey need a bailout. In this case, Germany will have to approve a bailout. Heck, their banks might even be feeling the pinch. The German taxpayer will be bailing out Europe. Pre Brexit, the British taxpayer would also be involved. Not anymore.

In summary, Europe is becoming a basket case. I forgot to mention that the US is warning Europe that the Russians might be preparing an invasion of Ukraine. Europe has internal problems with Covid and people protesting, and may have a financial issue with Turkey. Perhaps the Russians are counting on no European response. Just adds more drama to the European story.

Watch EURCHF and other Euro pairs like a hawk. As we head closer to parity on EURCHF, mainstream media will start asking questions. But my readers already have the answers.

Next several months we will see rising US dollar and that is bad for stock market, commodity, precious metals and even cryptos. Just my opinion.

Thanks for the comment! Yes a very real possibility to see everything drop as money runs into the safety of the US Dollar! The Dollar breakout is very strong, and has more room to the upside. Let’s be cautious!