Hey, Can I Borrow Your Charger?

Electric vehicles are cool. I remember my first time riding in the back of a Tesla when I was still in high school. If my memory serves me right, it was the Tesla Model S which was released back in 2012. I would have only been around 15-16 years old right when Tesla began making a name for itself as a publicly-traded company. Since then, the Electric Vehicle (EV) market as a whole has flourished beyond belief. In fact, in 2020, global sales of EVs rose by 43% to more than 3 million vehicles. That’s pretty impressive when we consider the fact that overall car sales were reduced by a fifth during the pandemic.

To be expected, Tesla sold the most EVs, delivering almost 500,000, followed by Volkswagen. Furthermore, sales of electric cars more than doubled in Europe, surpassing China as the world’s largest market for EVs. Overall, in 2021, almost all regions and most countries experienced strong increases in EV sales, with growth rates 3-8 times higher than for the total light vehicle markets. More specifically, sales of battery electric vehicles (BEVs) and plug-in hybrid electric vehicles (PHEVs) made up 4.2% of the global car market. This marks a 2.5% increase compared to 2019, driven in part by government policies to reduce carbon emissions.

In case you’re an EV novice like myself, let me try and clarify some terms here. A BEV refers to a battery-electric vehicle. BEVs are entirely powered by electricity, meaning a BEV has no ICE, fuel tank, or exhaust pipe. For context, ICE refers to an Internal Combustion Engine, which is used to power most vehicles today include cars, aircraft, and boats. Unlike BEVs, plug-in hybrid electric vehicles (PHEVs) have both an electric motor and a fuel-based ICE. While they differ in this sense, both BEVs and PHEVs need to be recharged via an external outlet.

With this in mind, the EV market has seen some explosive growth in the last few years, with sales surging in all three top auto markets including China, the United States, and Europe. To be specific, sales increased by 160% in the first half of 2021 compared to a year earlier. That being said, there’s no shortage of companies looking to capitalize on the lucrative EV market, which was valued at USD$162.34 billion in 2019. Keep in mind, this market is expected to reach $802.81 billion by 2027, expanding at an impressive compound annual growth rate (CAGR) of 22.6%. However, it’s not just about the cars, it’s about the parts that make them.

Exro Technologies Inc.

Exro Technologies Inc. (EXRO.T) is a clean technology company pioneering intelligent control solutions in power electronics. The Company has developed a new class of control technology intended to expand the capabilities of electric motors, generators, and batteries. Coils are a fundamental component of many power conversion applications, including electric motors. With this in mind, Exro’s innovation brings two different formats of power electronics together into one device capable of achieving greater control of coils. This device is called the Coil Driver™. Currently, Exro offers three variations of the Coil Driver™:

- Coil Driver™ Low Voltage: 100 Volt Electric Motor Controller

- Coil Driver™ High Voltage: 800 Volt Electric Motor Controller

- Coil Drive System™ High Voltage: 800 Volt Motor & Inverter System

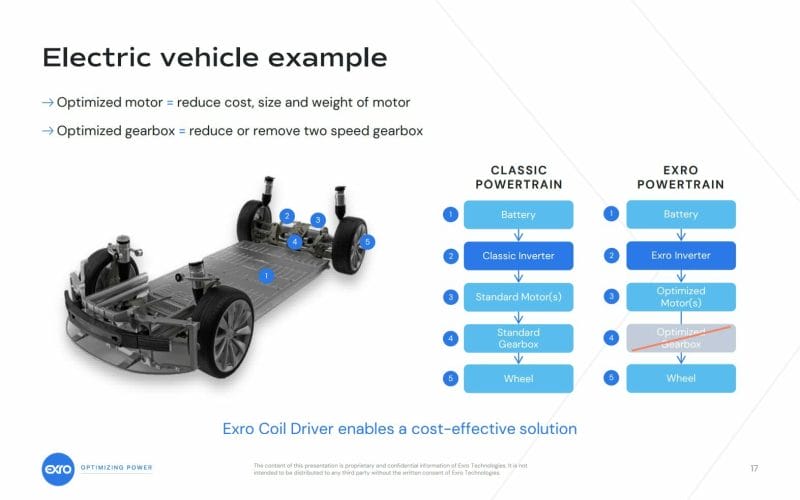

Ultimately, the Company Coil Driver™ inverter is intended for mobility applications, including the ability to control two torque profiles within a single motor and coil switching. It is worth noting that electric motors are commonly tuned to either maximize speed, torque, or a combination of both. On the contrary, Exro’s Coil Driver™ technology is able to automatically determine the most appropriate motor configuration in real-time, also known as coil switching. In doing so, the need for a gearbox or dual electric motor setup becomes unnecessary.

With this in mind, every vehicle has at least one inverter. That being said, the Global Traction Inverter Market is projected to grow at a CAGR of 17.57%, reaching a valuation of $7.7 billion by 2025 from an estimated USD$2.5 billion in 2018. Similarly, the Global Inverter Market, which was valued at USD$12.8 billion in 2020, is expected to grow at a CAGR of 15.6% from 2020 to 2025. In total, this market is expected to reach USD$26.5 billion by 2025. EV market aside, the growing stringency of mandates related to emissions in several countries has inflated the demand for vehicle inverters. That’s great news for a company like Exro, which has established itself as a leading clean technology company.

Latest News

Exro announced today (November 17, 2021) the successful new vehicle integration of its 100 Volt Coil Driver™ technology. This marks the second vehicle integration of the Company’s Coil Driver™ technology within the past month. Furthermore, Exro’s latest news follows shortly after an independent assessment. This assessment proves that Coil Driver™ successfully combines two traditionally separate formats of power electronics for the first time. In doing so, Exro’s technology has the potential to reduce the weight and cost of electric powertrains. The Company’s latest vehicle integration demonstrates how Exro technology can be applied to optimize new light-duty EV applications.

“Last month in our company update webcast, I spoke to Exro’s robust pipeline, which includes several strong NDA partners and at least ten active projects,” said Sue Ozedmir, CEO of Exro.

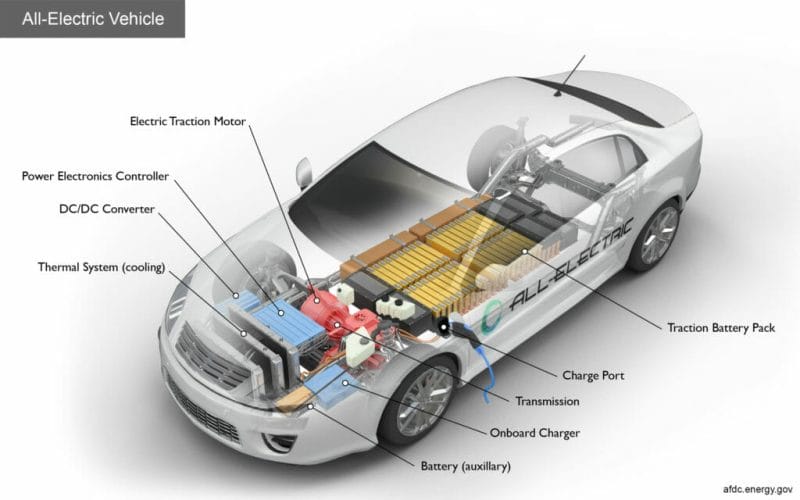

When I think of a powertrain, I think of railways and cable cars. Like I said, I am an EV novice. Turns out powertrains aren’t actually vehicles themselves. Instead, a powertrain refers to the set of components responsible for generating the power required to move a vehicle. That being said, the powertrain of an EV is comprised of fewer components than that of a vehicle powered by an ICE. See the figure provided earlier for a visualization of this. Now that you know what a powertrain is, let’s get back to the news at hand.

The emerging growth partner entered into a non-disclosure agreement (NDA) with Exro. According to this agreement, Exro will assist its partner in increasing acceleration at low speed for its electric compact car designed for the European market. Additionally, Exro will also aid in improving the vehicle’s power output at high speeds. Furthermore, Exro and its NDA partner have worked together to successfully integrate the 100 Volt Coil Driver™ into the light-duty EV, which optimizes the powertrain by expanding the torque and power output of the motor.

Exro’s latest news comes on the heels of Exro and Potencia Industrial teams’ successful installation of the 100 Volt Coil Driver™ into Potencia’s EV last month. Unlike the Potencia vehicle integration, which demonstrated how the Company’s technology can be retrofitted into a vehicle application, Exro’s latest integration was applied to a new car. We’re talking new frame and entirely new components. This represents another significant milestone for Exro, highlighting the versatility and market potential for Coil Driver™.

“I’m pleased to provide our shareholders with an update on one of these NDA projects and highlight another successful vehicle integration of our Coil Driver™ technology. This milestone is another tangible example of how the Coil Driver™ can be customized and scaled to meet our customers’ powertrain requirements to ultimately optimize performance,” continued Sue Ozedmir.

Referring back to Exro’s latest news, the EV compact car is currently in operation for closed circuit testing. Looking forward, Exro’s team will now work with its NDA partner on functional reliability and safety testing to validate the operating performance of the light-duty EV. Furthermore, the Company’s partner plans to develop the vehicle and continue testing the 100 Volt Coil Driver™ in various operations. As a development partner, this application will serve as a demonstrator to grow the European market, which represents a profitable market for the Company.

Financials

According to Exro’s Q3 2021 Financial Results, the Company had cash and cash equivalents of CAD$28,112,764 on September 30, 2021, compared to CAD$48,298,894. In the same period, Exro’s total assets and total liabilities were CAD$49,274,942 and CAD$7,733,608, respectively. In total, the Company reported total expenses of CAD$8,223,178 and a net loss of CAD$7,622,230 for the three months ended September 30, 2021. This indicates an increased loss per share of $0.06 from $0.03 on September 30, 2020.

As of September 30, 2021, Exro had 120,624,274 common shares issued and outstanding. During the nine months ended September 30, 2021, the Company issued 2,133,201 shares on exercise of options for total proceeds of $1,436,674 and 1,045,265 shares on exercise of warrants for total proceeds of $1,402,649. Overall, Exro experienced losses that can be attributed to increased expenditures. Some of these expenditures include increased selling, general, and administration expenses, which increased by $928,834 to $1,635,236. Similarly, Exro’s R&D expenses increased substantially by $1,778,280 to $2,019,303, or 603%.

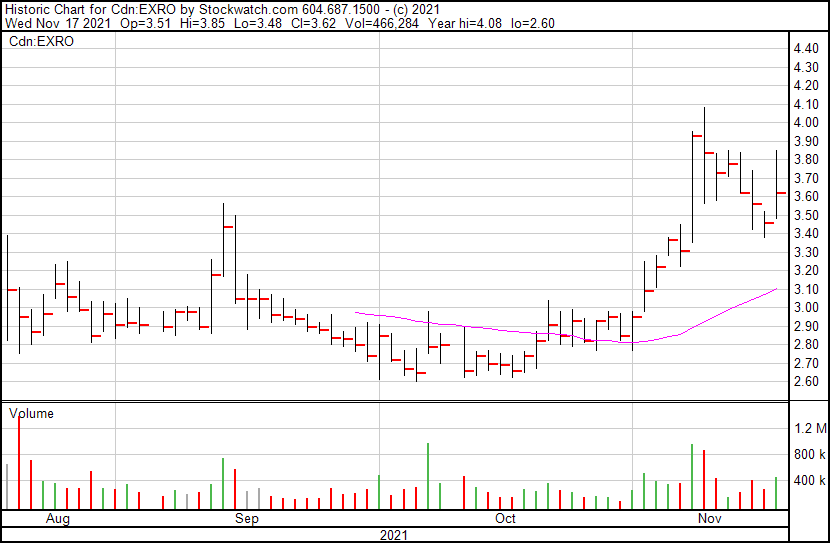

Exro’s share price opened at $3.51, up from a previous close of $3.46. The Company’s shares are up 3.75% and were trading at $3.59 as of 1:36 PM ET.