Solana is a public blockchain in the same vein as Ethereum. It doesn’t have as much history going for it as do some of the other coins, only having been around since April 2019, which given the sordid histories of some of its predecessors may actually work on its favour. At present, it is the fifth largest cryptocurrency by market cap, tucked neatly behind USDT at $69,581,855,086.

The Solana blockchain went offline on Sept 14, 2021, after a blast of transactions hit the network so hard it forced it to fork, and different validators had different views on the state of the network. The network was back online the next day. SOL claims to be able to handle 700,000 transactions per second (actually differing sources also include the number 50,000 transactions per second) both of which are considerably faster than Ethereum—which caps out at 15.

Solana is one of the so-called Ethereum killers, but it has a different technical underpinning as developers write applications using the Rust programming language rather than Solidity or Vyper. The non exhaustive list of where it’s since spread out to include applications in decentralized finance (DeFi), non-fungible tokens (NFT), marketplaces and games.

Apparently, Solana Labs co-founder Raj Gokal disagrees with the Ethereum killer designation:

“’Knives out’ implies we are trying to kill Ethereum. Ethereum cannot be killed, it’s impossible. And it’s already a beautiful force of good in the world, empowering millions and creating billions in wealth. Bitcoin is quite obviously the same.”

For awhile there you couldn’t go anywhere on the internet without someone raving about how much money they’ve made on Solana. Given the general incline of their price-chart over the past year, it’s small wonder. But there’s nothing here particularly which strikes me as interesting, and by interesting I mean, that doesn’t track with the general upward trend of this latest Bitcoin bullrun. This coin traces along quite nicely with the others, suggesting that it’s price fluctuations are interchangeable with Ethereum, Bitcoin, and the others its purported to kill.

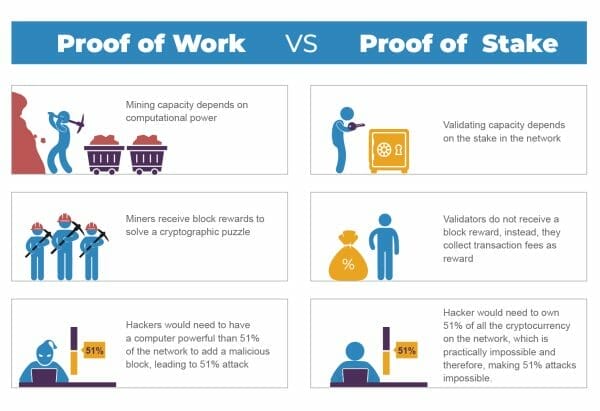

What is particularly interesting is their consensus mechanism. They have two. The first is standard proof-of-stake, which could flippantly be described as the person with the most coins wins, but it has a second mechanism called Proof-of-History (PoH).

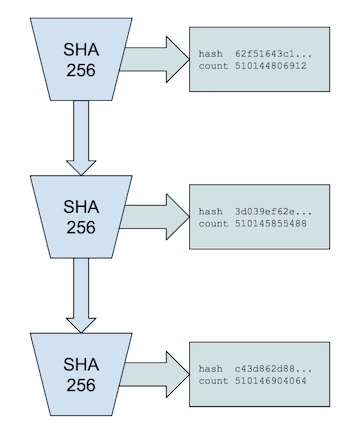

The PoH mechanism resolves one of the most difficult problems in distribution systems in that they can’t necessarily agree on time. There’s a going argument that Bitcoin’s Proof-of-Work algorithm is functioning as a decentralized clock for the system. It closes every ten minutes like clockwork and can therefore be relied upon. Proof-of-Stake algorithms cannot be relied upon in such a way.

Decentralized networks have solved the problem before using centralized timing solutions. There’s Google’s Spanner, which uses synchronized atomic clocks between its data centres. Google’s engineers sync these clocks and constantly maintain them. This problem isn’t quite so easily resolved with adversarial systems like blockchain.

Nodes in the network cannot trust an external source of time or any timestamp. It’s what Hashgraph calls ‘fair’ ordering. Each message goes to the supermajority of the nodes, then after the message collects enough signatures, the entire set needs to be pushed to the whole network. This is not exactly a speedy process, as you can imagine. More like herding cats.

PoH gets around this by creating a historical record proving that an event took place at a specific moment in time. This way each entry into the blockchain can be verified by dint of it having been there before via its timestamp, thus speeding up the process and giving it more ability to scale. Solana’s native currency SOL is used to pay for transaction fees and staking in order to support the network. SOL coin can be bought on exchanges such as FTX, Coinbase, Kraken, and more.

—Joseph Morton

I am watching this one too.