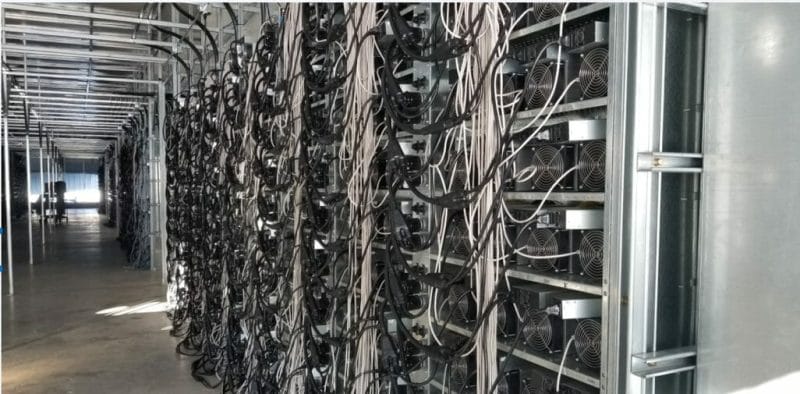

DMG Blockchain Solutions (DMGI.C) is a vertically integrated blockchain and cryptocurrency company that manages, operates, and develops end-to-end digital solutions to monetize the blockchain ecosystem. DMGI runs its data center in Christina Lake, BC. The Data Centre is fully owned by DMGI and includes its own privately constructed 85-megawatt substation.

A substation may include transformers to change voltage levels between high transmission voltages and lower distribution voltages, or at the interconnectedness of two different transmission voltages. Generally, substations are unattended, relying on Supervisory control and data acquisition (“SCADA”) for remote supervision and control.

Owning this asset gives the company many advantages in power infrastructure, which is the primary need of any crypto mining. By owning the infrastructure, DMGI is not only free from leases and landlords but also is liberated from drawing community needs for power where they operate.

For more details on the Blockseer’s Platforms and the company’s renewables strategy check out Joseph Morton’s take on all the technical stuff about the company’s operations.

I thought we would focus instead on the company’s latest financial reports for any clues about what’s going on under the hood. The best place to start is the company top line figures in the income statement. What the income statement ultimately provides is a look at the overall picture. A business that is showing a profit or sales is usually doing something right. If not, then they may be doing something wrong or in the early stages of development.

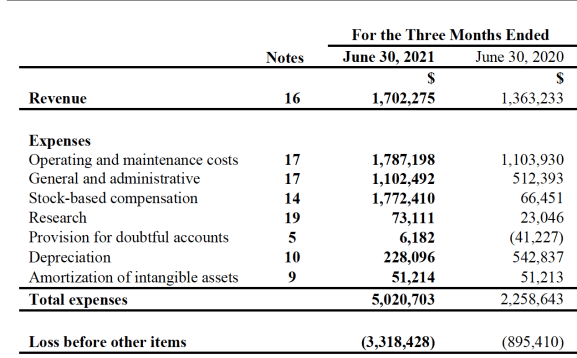

The company reported its June 30, 2021, results with an increase in revenue of just shy of $500,000 year to date. they recorded $1.7 million of sales in the three months ended June 30, 2021, compared to $1.3 million the previous year. Of the 1.7 million in sales 1.2 million came from the Mining equipment hosting and set up service fees compared to 730,000 from these service fees in 2020. The company experienced a drop in Digital currency mining and Forensics income. They also did not record any sales fees for software and consulting fees. During the period ended June 30, 2021, the Company received $625,300 in shares of a public company as a payment for the software revenue for the same period with a current unrealized loss of around $150,000.

Total operating expenses have also increased by close to $3 million mainly due to an increase in operating and maintenance costs, general administrative expenses, and a stock-based compensation payment of close to $1.7 million in the three months ended June 30, 2021.

On March 15, March 31, and April 15 0f 2021 the company issued 200 thousand, 200 thousand, and 1.9 million in incentive stock options to officers and employees of the company, respectively. These options had a fair value of between $1.33 to 2.02 per option using the Black -Scholes model.

The company’s general and administrative expense is comprised mainly of consulting fees, office expenses, and investor relations expenses. The company’s largest operating and maintenance costs were the utility bill of $1.3 million followed by just shy of 400,000 on employee wages. The company also spent modestly on research expenses mainly comprised of salaries of software developers involved in the research of existing and new cryptocurrency-related tools and services. The majority of these new services might not provide any future economic benefit.

Taking all the sales for the quarter (1.7million) and subtracting the operating expenses (5 million) we get a 3.3 million loss from operations. This means the company is losing more money than it is generating from its operations currently because of the stage that it’s in in the development cycle.

If we ignore the company’s other income and expenses for a second and jump straight into the balance sheet, we can get a look at the financial condition and how conservative the operators are being with their capital structure.

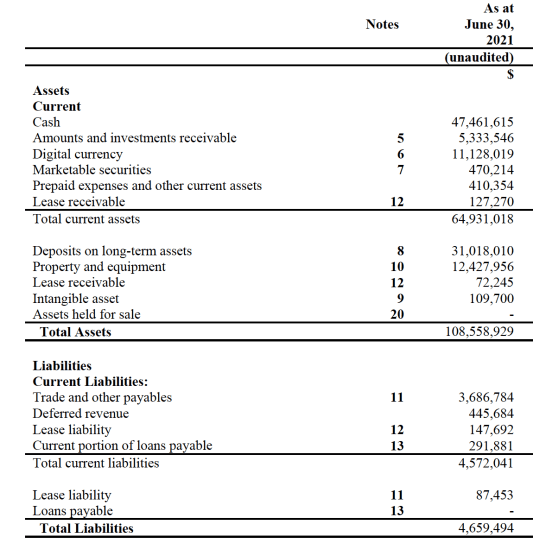

The company currently has $47 million in cash in its balance sheet, $11 million in digital currencies, $470,000 in marketable securities, and $5 million in amounts and investments receivables. For reference, the stock is currently trading at $198 million meaning their net working capital (Current assets minus current liabilities) is about 30% of the market value. The situation gets better when you realize that they only have 87,000 in long-term liabilities meaning the firm has an equity-heavy capital structure with very little credit default risk.

The net book value of the tangible assets is $103 million or 52% of the market value. The remaining 48% can be explained by the market’s expectations about the future of their cash flows from operations, their managements team’s know-how, or the eventual success of the digital currencies space.

From this, it is obvious that the stock is being dictated by the assets that the business owns mainly the property plant and equipment, cash and cash equivalents, Digital currencies that they hold, and any deposits online long-term assets. the underlying business is still trying to get on its feet and developments in the operations of the business will be of interest to those investors who are in the stock for the long haul.