Ethereum hit new record all time highs last week (be prepared to hear ‘new record all time highs’ a few more times pertaining to Ethereum) as the crypto took another step closer to the highly anticipated Ethereum 2.0. I don’t think too many people know that this major fundamental event took place on the Ethereum network last week because all the crypto attention was focused on this:

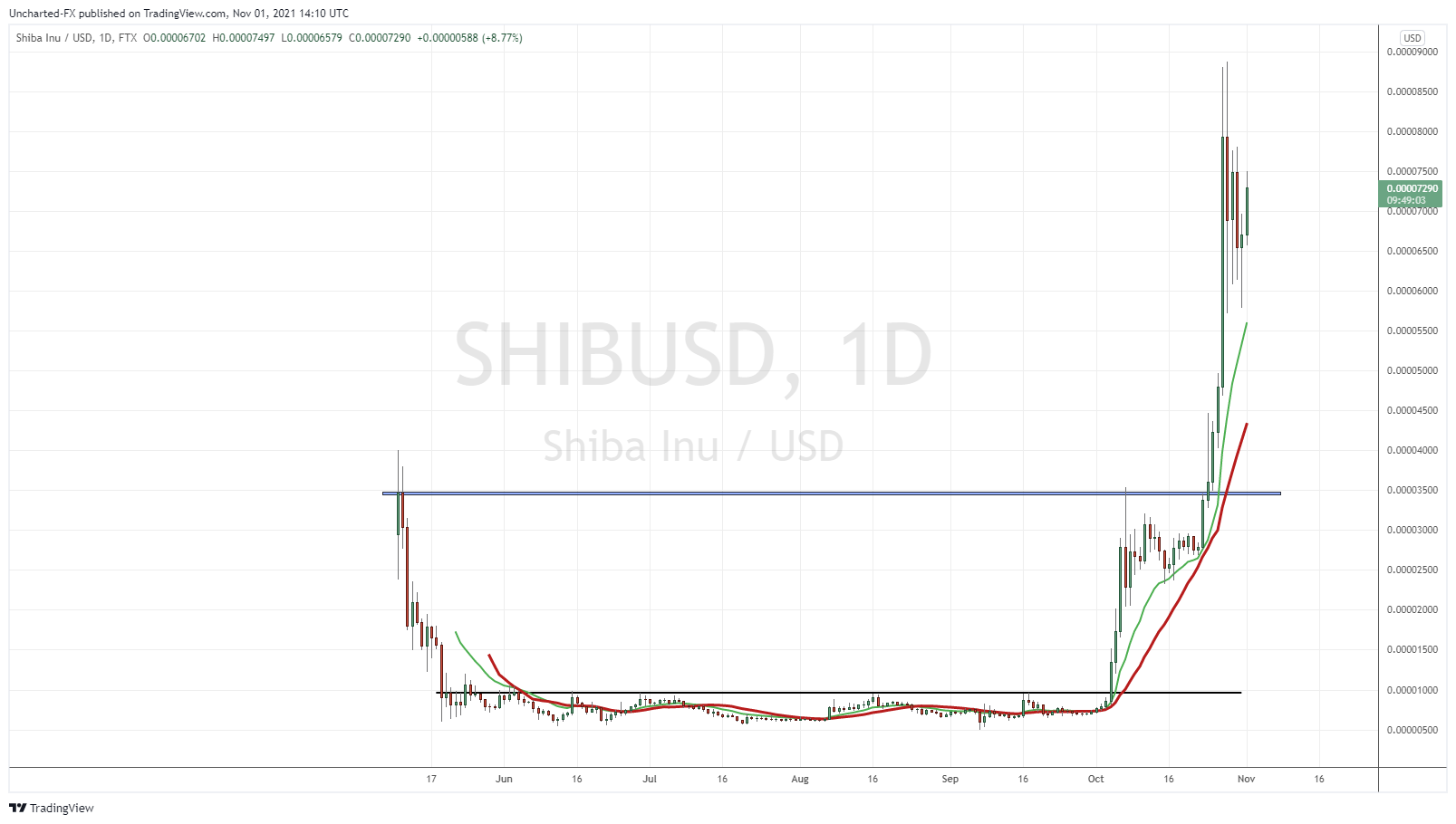

Yup that’s right, Shiba Inu was making all the crypto headlines. We were even seeing money leave Doge to chase Shiba Inu. Floki Inu is being touted as the ‘you miss Shiba Inu? Then buy Floki” token. Oh and a Squid Game token saw a gain of 45,000%. Crazy stuff, and the retail crowd and the meme coins remain strong. As I said, I have no problem with trading this stuff. Shiba Inu had one of the best market structure charts before the breakout. Anytime I see a long range break after a downtrend, I would buy the asset. For the new traders, just don’t be the bag holder. I don’t think these meme coins have any sort of value, although Shiba does have that burn rate which is a cool deflationary tool. Hence it being referred to as the decentralized deflationary evolution to Doge. But nonetheless, when you are up over a few 1000%, at least take some of your profits. Taking profits is never a bad idea. Take some, and then ride the rest of the position pretty much risk free.

But enough about those meme coins, this Market Moment is about Ethereum. In the past, I have lamented about the Ethereum gas fees when I was buying NFTs and staking DeFi tokens. Very expensive at times. For Ethereum to be the currency of the internet, this issue must be addressed. Right now, its ecosystem is what creates the value. You need Ethereum to buy NFTs and some DeFi. Other crypto enthusiasts point to Cardano as being the faster and cheaper version of Ethereum, but the ecosystem and what you can do with Cardano is pretty slack right now. There are some projects and tokens out there referred to as ‘swap’ networks. Offering better fees and speed. Keep your eyes on them.

Enter Ethereum 2.0, which is promised to fix speed and gas fees. After last week’s news, we are getting closer to the long awaited and highly anticipated Ethereum 2.0.

Cointelegraph reported on Thursday that the Ethereum 2.0 Altair Beacon Chain update had a successful start, with 98.7% of the nodes upgraded at the time. A successful Altair upgrade to the Beacon Chain was seen as an important factor clearing the way to the merge with the Ethereum mainnet and the transition to a proof-of-stake consensus mechanism in Ethereum 2.0.

The immediate impact of Altair might only be noticeable to validators, or those who verify transactions on Ethereum. But Altair is one of the pivotal upgrades for Ethereum 2.0, or Eth2, and investors should be aware. Eth2 will change the Ethereum infrastructure, ultimately making mining obsolete.

Currently, Ethereum operates on a proof of work (PoW) model, where miners must compete to solve complex puzzles in order to validate transactions. This model gets a lot of criticism due to its environmental impact, as it requires an extreme amount of computer power.

In 2022, Ethereum plans to shift to a proof of stake (PoS) model, where users can only validate transactions according to how many coins they hold.

So yes, this Altair update is leading to big change. News of this upgrade propelled Ethereum to hit record all time highs at $4456.50.

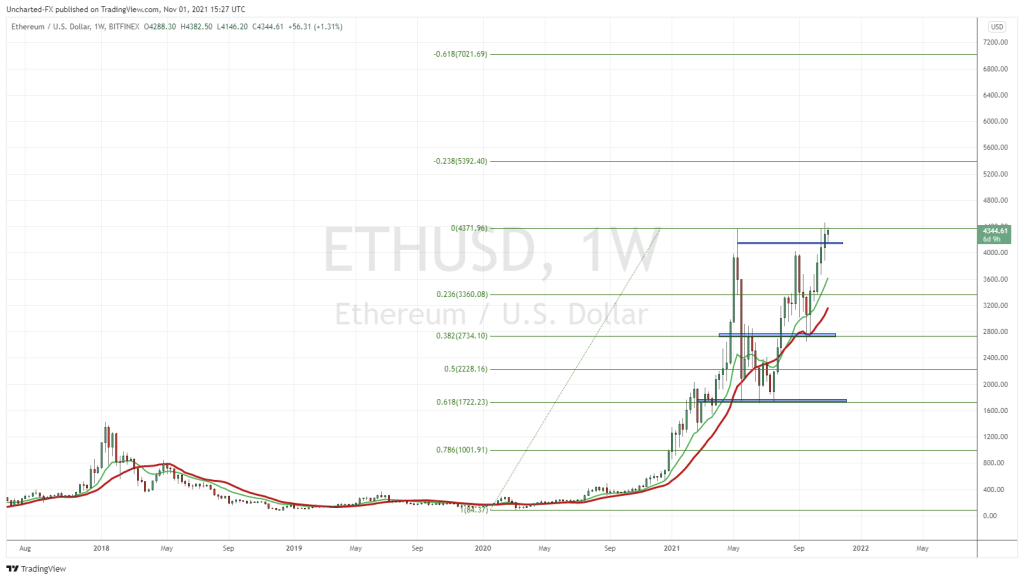

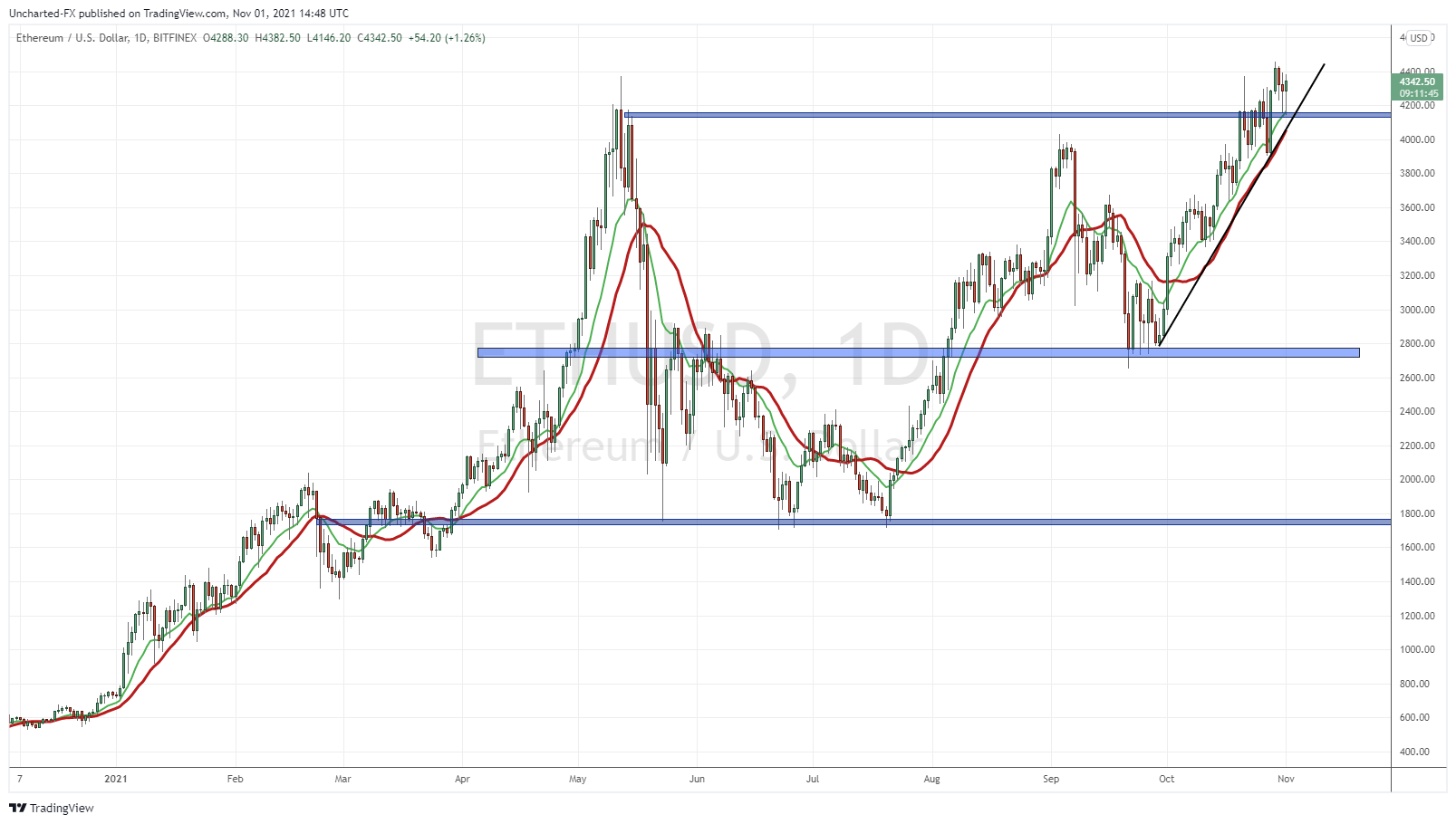

But I know what you are asking. What are the next price targets? Don’t worry I got you all covered. Let’s start off with the daily chart:

My favorite thing about crypto charts is just how clean they look. They are a treat for technical traders, and it isn’t just me, but many of us find technicals work the best on cryptos. Some go to lengths to say this market is only driven technically, but now more and more fundamental approaches are coming to light. My fundamentals on cryptos is very simple: an asset class that allows me to diversify away from fiat currency. When central bank digital currencies come, cryptos will be a way for me to hide my money unless governments make it illegal to own them.

You can see from the chart above, that I have drawn out major support and resistance levels. The one of importance to us is the one around $4150, as that used to be previous resistance before Ethereum broke out into new record highs. Just applying typical market breakout structure: what was once resistance becomes new support, and price tends to pullback to retest the breakout zone as support, allowing new buyers to hop in and carry price higher. Yesterday and today’s daily candle are indicating buyers hopping in on the retest. Look at those major wicks bouncing from support indicating buyers.

Good bullish signs all around. I want to point out my uptrend line too. Nice structure, and adds more confluence that we will make another wave higher. But I put more emphasis on the support rather than the trendline. So if we keep moving higher, and Ethereum 2.0 comes along, what are the next new record high price targets? That’s where my fibonacci tool comes in.

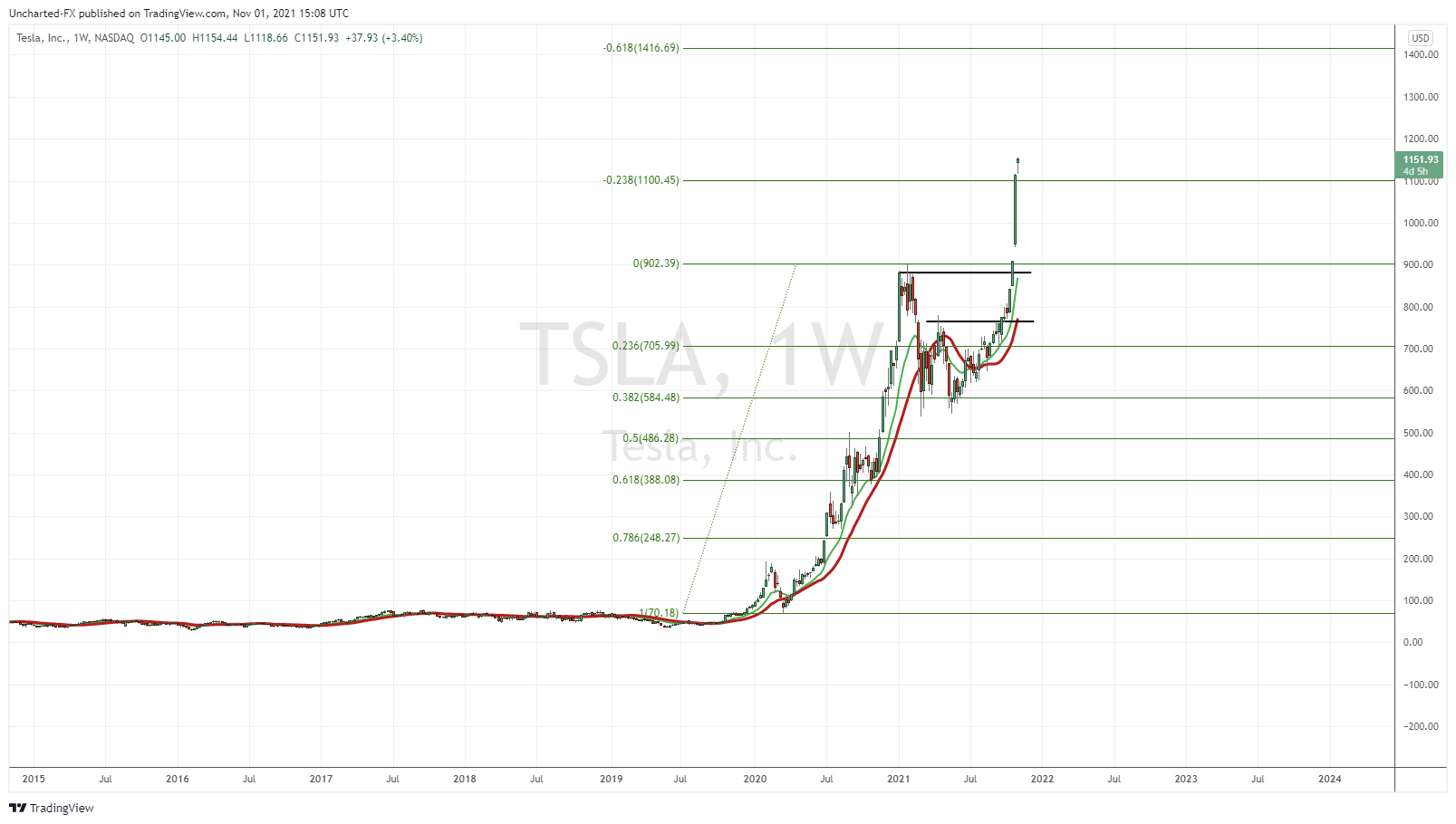

Before I begin, I applied fibs to Tesla stock last week.

On that Market Moment post, you can see how price reacted exactly at our first fib. Almost like magic and wizardry. These fib levels are real folks. So let’s apply fibs to Ethereum.

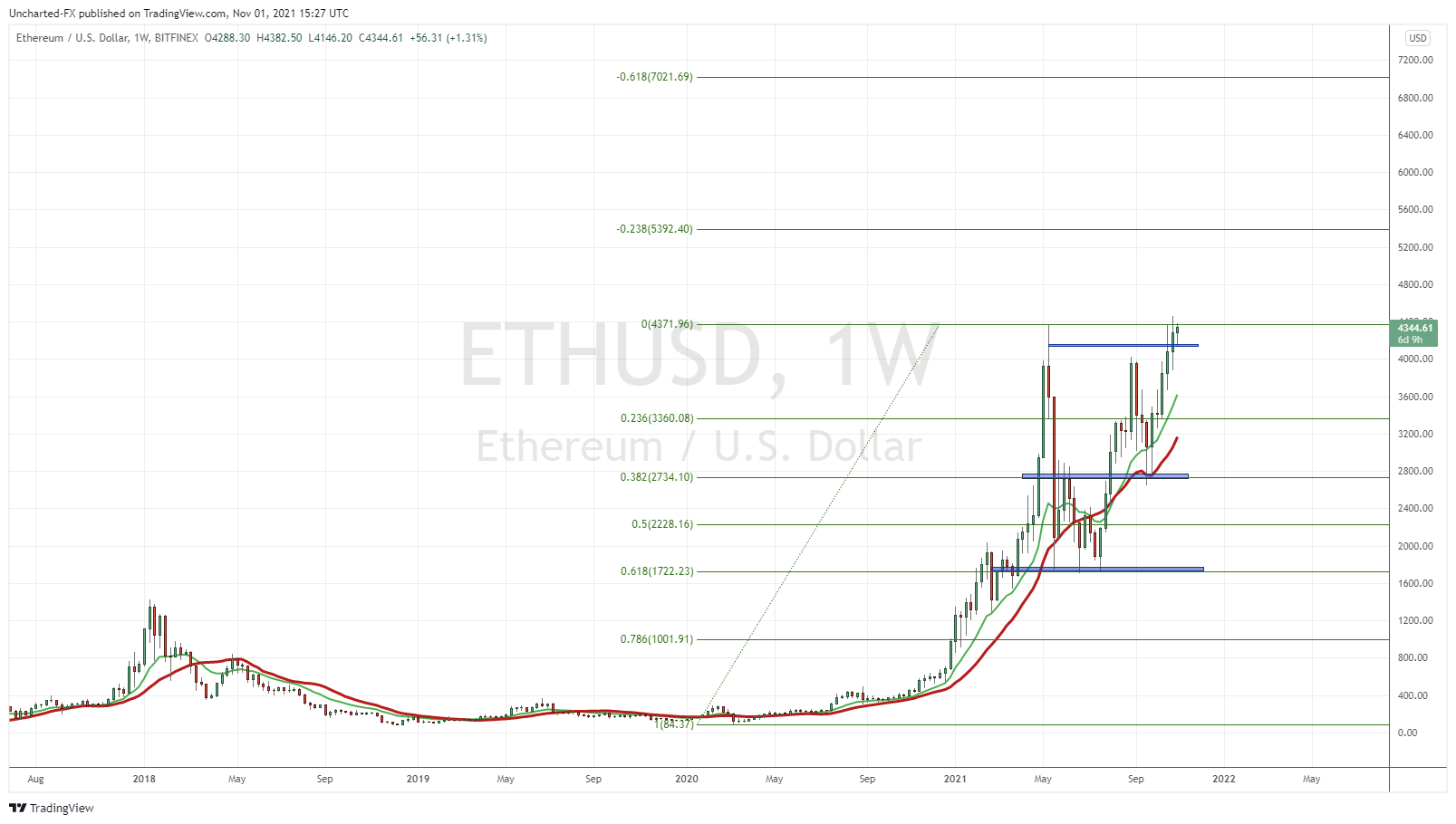

On the weekly chart, I fibbed the most recent move from top to bottom. Note how the 61.8 fib was tested in the past. This is how I know this fib is valid. Quick fib lesson: prices tend to pullback and bounce at the 61.8 fib, before hitting the first extension. My extensions are shown above. Next targets for Ethereum are $5392 and then $7021. If we get another weekly close record above $4371, the likelihood of our first fib target being hit increases dramatically. As long as our structure holds, Ethereum and Bitcoin, will be making new record highs.