Canntab Therapeutics (PILL.CN) is a Canadian biopharmaceutical company focused on the manufacturing and distribution of a suite of hard pill cannabinoid formulations in multiple doses and timed-release combinations. Canntab’s proprietary hard pill cannabinoid formulations provide doctors, patients and consumers with medical grade solutions which incorporate all the features one would expect from any prescription or over the counter medication sold in pharmacies around the world. Think of it as a blend between cannabis and pharmaceuticals. Or as Canntab puts it, the new way to experience medical cannabis.

Their products are labelled “Elevation and Enhancement”, “Calming Comfort”, and “Relief PLUS”. You can read about them more here, but their names give you a good idea regarding the benefits.

There are plenty of benefits of the pills over oils and smoking. Smoking Cannabis results in a large initial dose of the drug but is followed by a quick drop in effect. Not to mention the lingering smell. While edibles are more convenient, the effects are unpredictable, usually slow to take effect and eventually subside.

Here is a summary of Canntab’s advantage over oils and edibles, and smoking cannabis:

It should be noted that Canntab’s value comes in the fact that they OWN the patented Instant Release and Extended Release formulations with THC, CBD, and a variety of Terpenes and other Cannabinoids derived from Canadian grown cannabis. If you watched our Investor’s Roundtable, you heard Chris Parry talk about how big of a deal this is.

The company hasn’t had much press releases. In fact, there has been nothing out since the unfortunate passing of Co-Founder Jeffrey Ward Renwick, back in May of 2021. We did have news regarding an announced receipt of CAD$1,259,250 in gross proceeds from the early exercise of 1,679,000 warrants into common shares. That all changed yesterday with news on an agreement with 36Eight Technologies which will see 36Eight list, market, and support all of Canntab’s market-exclusive and patent-protected solid and exact dose products. Our very own Kieran Robertson covered the news and what it means here.

“This is an exciting opportunity for Canntab, as we believe 36Eight’s unique and valuable complementary platform will support our ability to provide effective solutions for patients while reinforcing the confidence of patients in their relationship with their clinical pharmacist,” said Larry Latowsky, CEO of Canntab.

This is welcome news after months of silence. This could be the catalyst to get the stock moving at an important support level. But before we talk about the charts, Canntab’s plans for 2022 include plans to initiate additional clinical trials utilizing its patent-pending delivery mechanisms and formulation capabilities for sleep, pain, arthritis, irritable bowel syndrome (IBS), and Temporomandibular Joint Disorder. Additionally, the Company intends to continue partnering with Canadian businesses looking to use Canntab’s proprietary oral dose delivery system for their own formulations.

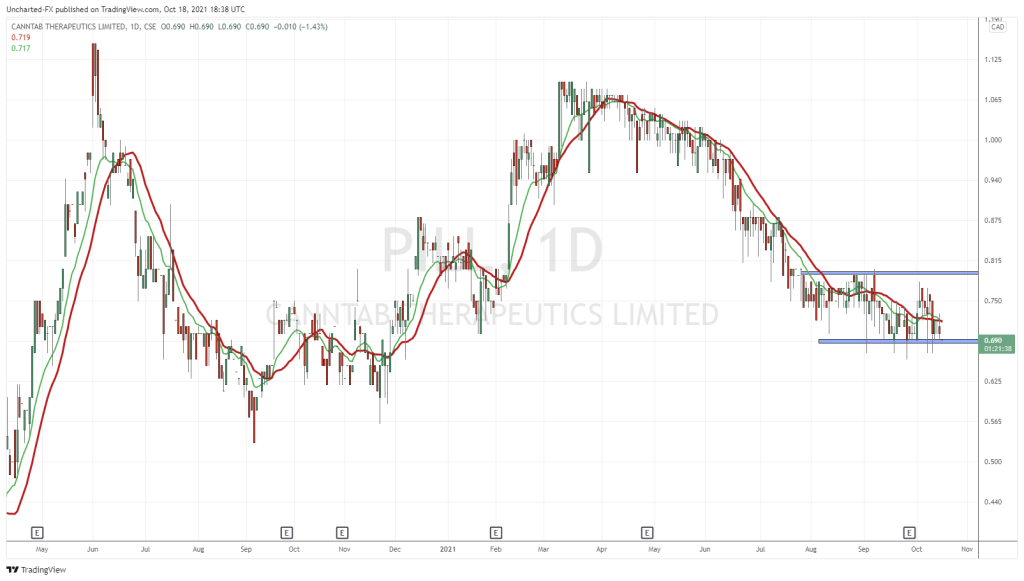

The stock is down 13% year to date, and has slowly given up the gains from early 2021. Not much news which is seeing volume decline on daily trading, but to be fair, it hasn’t been much fun for cannabis overall. The stock is currently holding support here at $0.69. This support has been held since August, and notice the past five times we dipped below, buyers bought the dip to ensure we did not close below support. This is a very strong support level, and we can entertain the idea of an entry here.

Those who follow my regular Market Moment posts are familiar with my Market Structure method of trading. It isn’t groundbreaking or overly complicated. Instead, it emphasizes patience and entering when the trend has reversed and our probabilities of success have increased. In the case of Canntab, the trigger for a breakout is a close over $0.80. The range is then broken, and a new uptrend can begin. Entering at support gives us a good risk versus reward ratio, but the probability of a reversal isn’t as high as it would be with the breakout over $0.80. We may miss out on some of the run, but the probability of success is in our favor. Also, if that breakout isn’t triggered, the stock could continue making lower lows by breaking below the range. If this happens, we will look for support to build at around the $0.60 zone.

I like to use the MSOS ETF to gauge overall cannabis sector strength. As you can see, we were finding some support and were potentially setting up for a double bottom. But the breakout did not happen and we broke below support. It still looks weak. Press releases are great, but Canntab, as well as other Cannabis stocks, will need MSOS to turn before gaining some momentum. We can wait for that basing to form, and in the meantime buy good cannabis companies frontrunning a turn in the cycle sometime in the future.