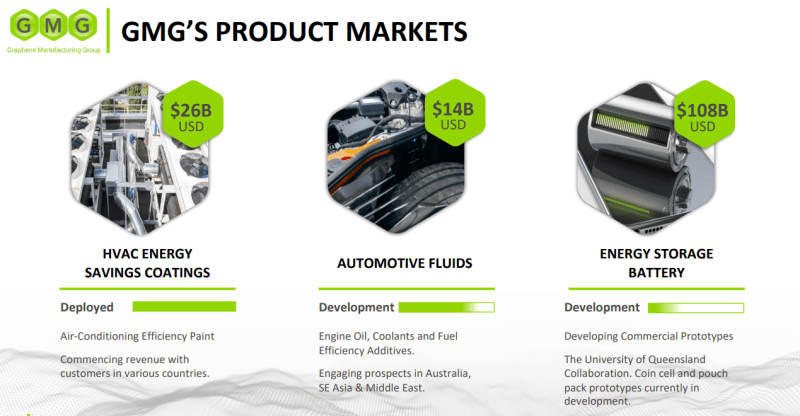

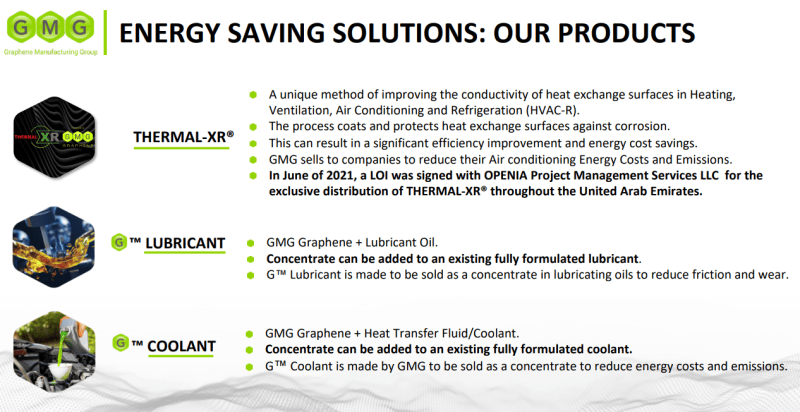

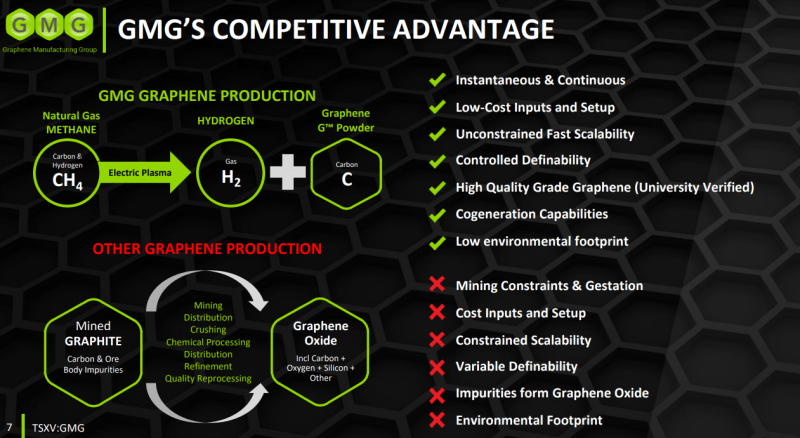

Graphene Manufacturing Group (GMG.V) is an Australian based clean-tech disruptive company that produces graphene and hydrogen by cracking methane (natural gas) instead of mining graphite. By using the company’s proprietary process, GMG can produce high quality, low cost, scalable, ‘tuneable’ and no/low contaminant graphene – enabling demonstrated cost and environmental improvements in a number of world-scale planet-friendly/clean-tech applications. Using this low input cost source of graphene, the Company is developing value-added products that target the massive energy efficiency and energy storage markets.

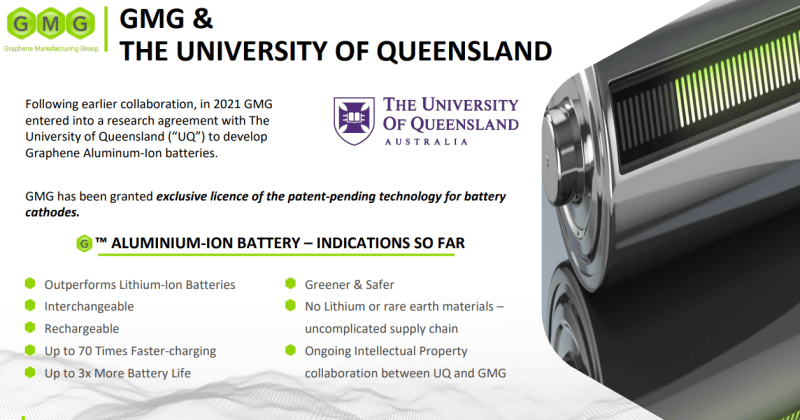

Not only this, but Graphene Manufacturing Group is also exploring the development of next generation batteries, the Aluminum-Ion battery, with the University of Queensland.

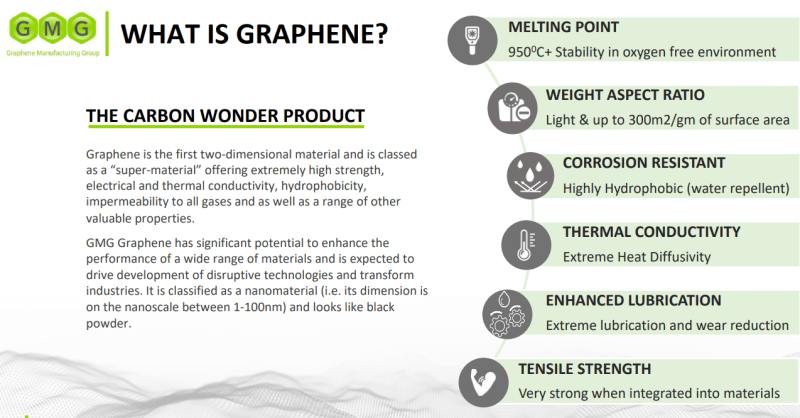

My astute readers have probably heard of graphite, but are probably asking what the heck is graphene? I will let the company explain:

In summary, a nanomaterial that will be used for energy saving and energy storage solutions.

From the introduction, readers will understand the advantages Graphene Manufacturing have: low cost, environmentally friendly than mining graphite, high scalability, and high grade all from the proprietary process Graphene Manufacturing has designed.

There would be one question I would have, and that would be the low cost portion. The process involves and begins with low cost Natural Gas. However, those up to date on current macro trends and global affairs have heard about the energy crisis in Europe, and the rising prices of Natural Gas. We hit prices above $6 on Natural Gas futures, prices not seen since 2014. I just wonder how much that will impact the cost of the process. Nonetheless, it would still be cheaper than the traditional mining way, and still environmentally friendly.

A few other key points worth mentioning. Management is always important. It should be noted that Graphene Manufacturing Group is led by former Royal Dutch Shell executives. They have decades of experience in the energy markets and therefore understand the future opportunity as the world shifts away from fossil fuels.

Clean energy and green infrastructure is coming. We all know about the Biden Green plan, and governments around the world will follow. Not only will it be better for a clean and sustainable world, but also allows governments to create large infrastructure projects in order to boost the economy. This is coming in the future, there is no denying it. Marin Katusa is already talking about Carbon Credits being the next big opportunity going forward.

Copper and Silver are the two metals touted as the green energy play, and investors also look to electric vehicles and renewable energy companies (some of which by the way are already making profits!) as their green/clean exposure. Add Graphene Manufacturing, with their disruptive technology, to your list.

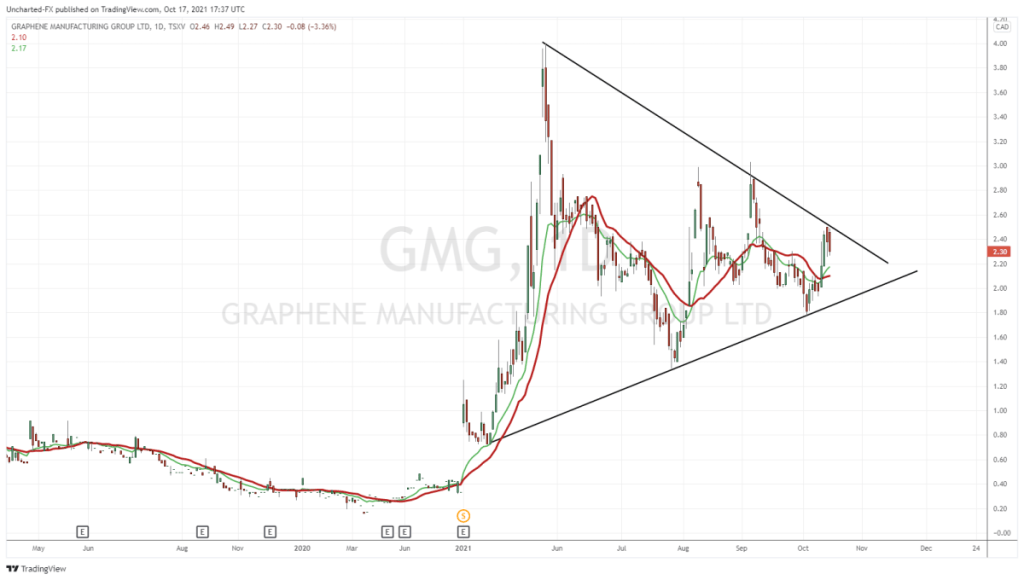

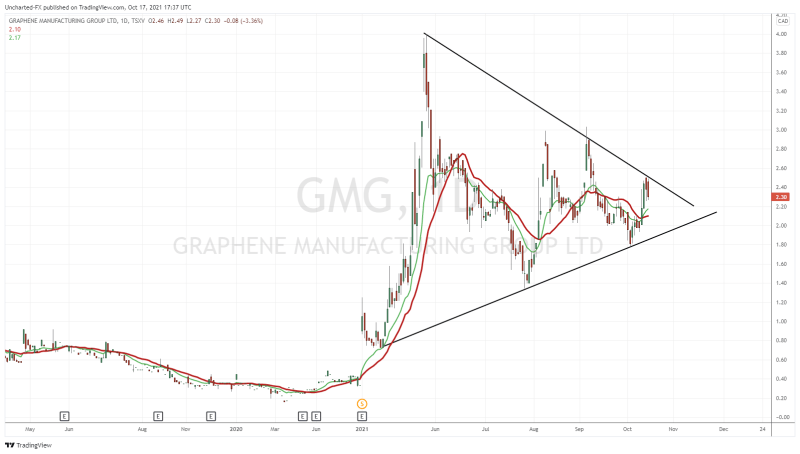

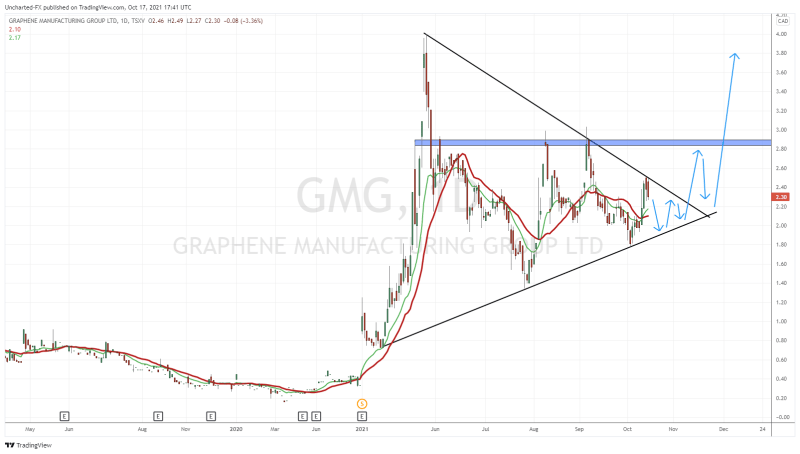

For investors, the technicals are hinting at an upcoming big move higher. Year to date, the stock is up 586.59%. A big mover, hitting highs of $4.00 in May 2021. In terms of volume and liquidity, the stock often sees six figures in the amount of shares traded daily.

In technical terms, we have a large triangle forming. one important criteria for trendlines is the number of touches to validate them. Technical analysts tend to draw trendlines willy nilly. The key for validation is THREE or more touches. Then we have a valid trendline that traders and investors are watching. The bottom trendline marking the rising trendline has three touches. The top trendline marking the lower highs just saw its third touch last week. For those who have watched our Investor’s Roundtable video on Graphene Manufacturing, I mentioned how I hoped to see a rejection at the trendline only because it would validate the pattern.

Now above is a hypothetical situation outlining price action. Let’s go through this step by step.

First off, prices could remain in the triangle. Bouncing from the bottom trendline, and rejecting the top trendline. The trigger for all patterns is the breakout. Meaning a breakout above the top trendline. If the bottom trendline is broken instead…then the stock heads lower. But in this scenario, I have drawn out the bullish case.

We eventually get that breakout and we rip higher. There is a resistance zone at $2.90. We have had three rejections there in the past. Again, our magic number. Once we hit that resistance, two things can happen. We either breakthrough right away, or we pullback to retest the trendline before moving higher and breaking out. For those who follow my Market Moment here on Equity Guru, you are familiar with this retest. It is just market structure. Retests happen and provide an opportunity for bulls, who missed the initial breakout, to enter with a favorable risk vs reward. I must also say that this retest of the breakout can actually happen even before we test resistance at $2.80. If this is too much info for you, then the one takeaway that is key is this: await the breakout of the top trendline for entry. That’s it. That triggers the breakout, and if the breakout is a fakeout, you will know because price would fall back below the top trendline.

In summary, Graphene Manufacturing is a clean/green play that the Market loves. The stock has made a big move year to date, and is consolidating in a triangle. A breakout looks imminent, and could be triggered as early as this week. Once triggered, the stock will have the volume and interest for momentum to continue. Longer term, this upside breakout will lead us to all time record highs if the technicals are supported by good news and decisions by management.