Pure Extracts (PULL.C) operates as a cannabis and hemp extraction company in British Columbia. It is involved in the production of cannabis, cannabidiol (CBD) oil, hemp, and functional mushrooms extracts. The company also offers various derivative cannabis products, including edible products, such as delta-9-tetrahydrocannabinol infused gummies. The development of CBD infused mushroom wellness products, as well as the optimum extraction of psilocybin is also in the works. You bullish shrooms and cannabis? Then Pure Extracts provides an enticing risk vs reward entry based on the technicals.

Before we look at the charts, a few fundamental notes to consider.

Recent news is regarding Pure Extracts commencing build out of extraction facility in Michigan. Actually, the company is fast-tracking the build out of the extraction facility it is designing with joint venture partners, Golden Harvests. It didn’t get the stock popping, but when I look over the charts, you’ll see what the play is at these levels.

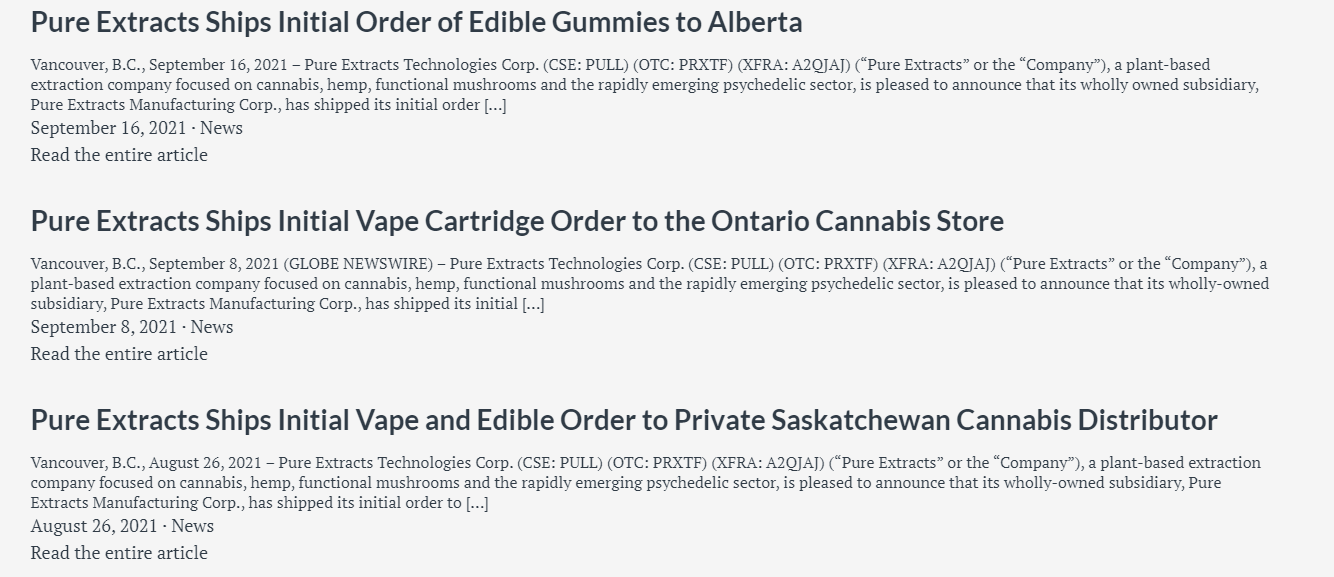

A lot of recent news releases have been about Pure Extracts shipping products to Provinces. Again, this is good news, but the extent of how positive this is will only be confirmed once earnings come out. The last financial statements came out in May 2021. It would be prudent to wait for the next financial statements. The stock needs a catalyst, and earnings would get it going. With all the news on shipping orders, revenues are what investors want to see.

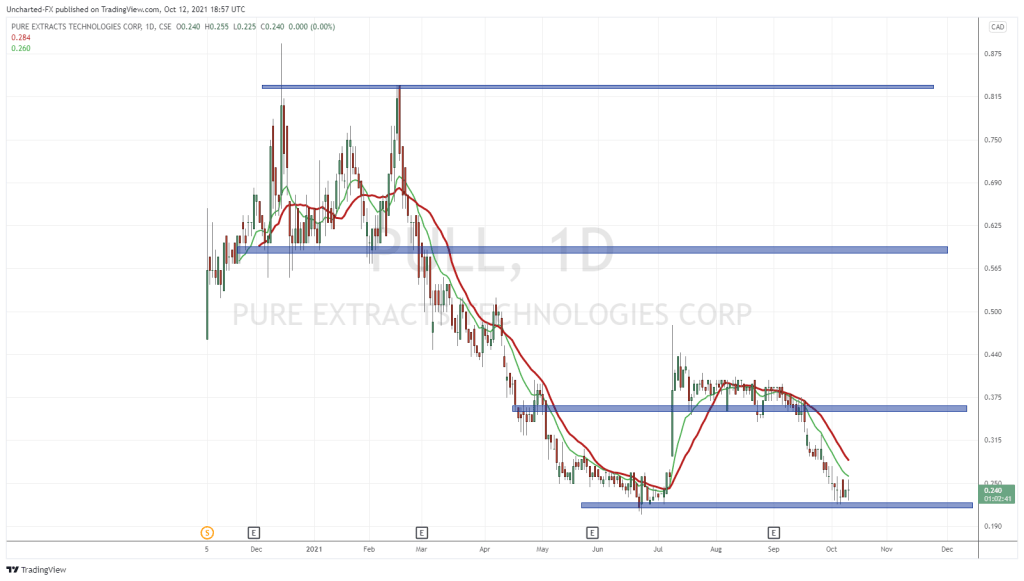

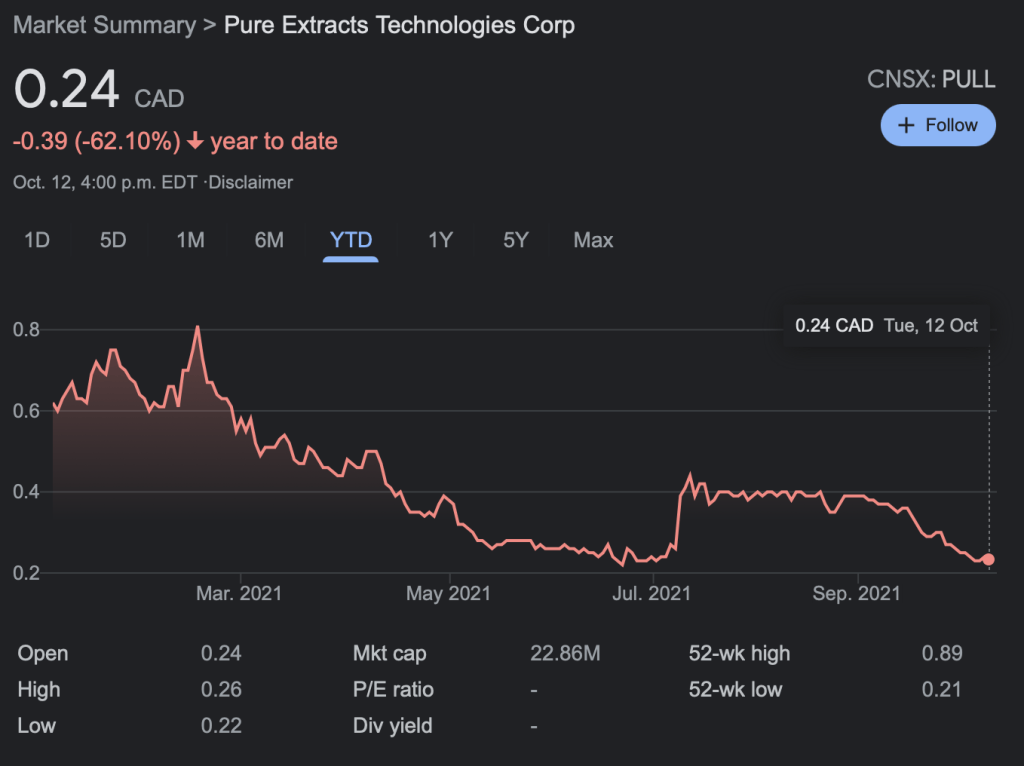

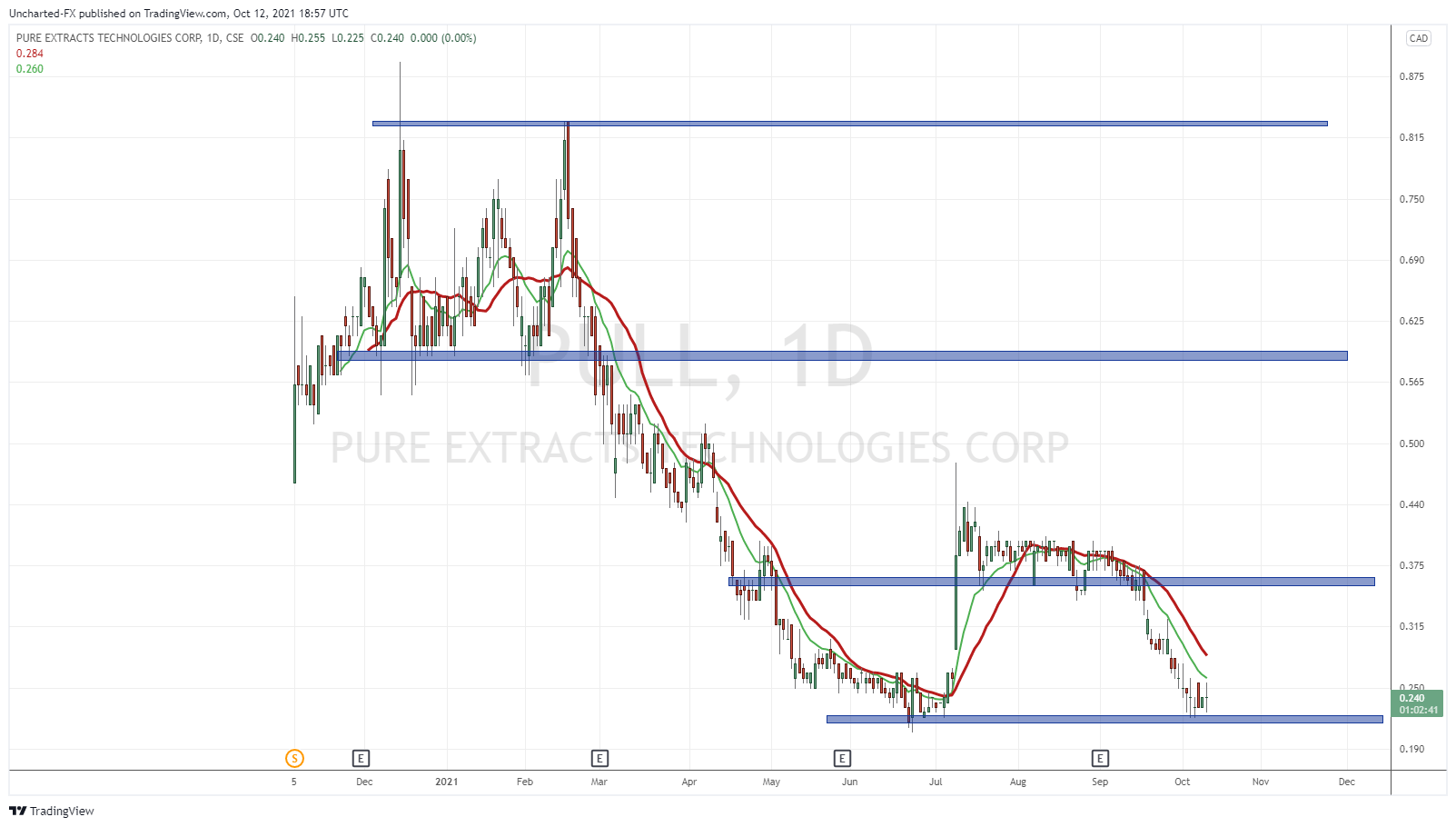

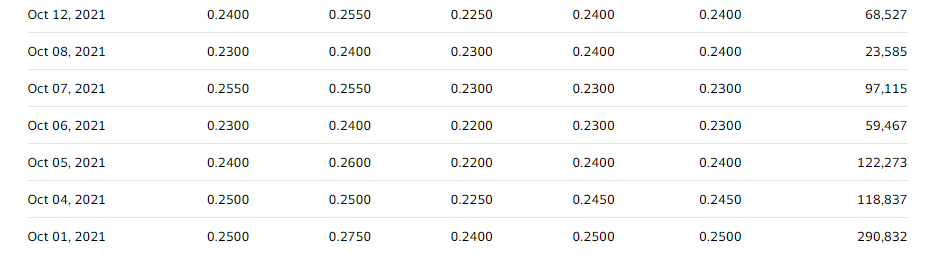

For someone who wants a bottom picker play, Pure Extracts meets the criteria. We are close to previous record lows. This area is acting and holding up as major support. For good reason too. If we close below the $0.215 zone, Pure Extracts is printing new all time record lows. The stock and management has an opportunity to springboard here. Buyers will be enticed purely on the technical play. A nice entry point with a good risk vs reward ratio. The problem is that without the possibility of some good news, or a big catalyst, the stock can move sideways or break down. Hence why I believe the next earnings report could make or break the stock.

From a technical point, we have ranged 5 trading days. $0.25 down to $0.21. A nice break and close above $0.25 could get the stock going. Investors will hope the stock repeats the move from this zone just like it did back in July 2021. A corporate update and news of the license application of a blended functional mushroom product got the stock popping over 70% from these levels. Can price action repeat itself?

To the upside, the $0.35 zone provides some near term resistance. The stock used this level as support, but could not gain any momentum for nearly two months of price action. Eventually breaking below and taking us down to $0.21 where we are sitting currently.

We are seeing some 6 figure orders coming in around this support level, so that is a good sign. Once again, very enticing from a technical perspective. The only debate is whether the stock just ranges, or if the stock can get a pop on good news and a catalyst. Personally, I would wait for the next earnings report. Hopefully this news can get us a strong close over $0.25. Lot of news regarding orders but the numbers are what we want to see. The Cannabis sector isn’t getting much love right now, but that could just mean it is a great time to pick up some quality companies and stocks before the next run up.