Drug science is all about timing. You can either take a preexisting molecule, which has benefits for alternative indications rather than what it’s originally on shelves for, and you after proving that it has these benefits during the regulatory dance, you take it to a new market, rebrand it and resell it. Easy.

Or you can go to the seemingly bottomless treasure trove of ancient medicines to find something that’s supposedly worked for thousands of years, and do the same regulatory dance as for the repurposed drug. After that, market it, brand it, sell it and profit. The woke crowd won’t like you much for doing the whole cultural misappropriation thing, but your shareholders won’t care. Nor will the patients you’ll help.

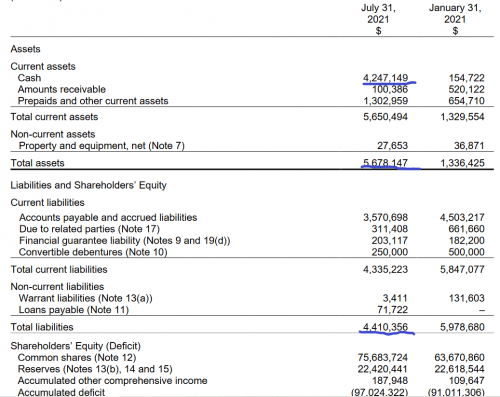

The timing is in what you’re tackling. In the case of BetterLife Pharma (BETR.C), a biotech firm working on the development and commercialization of two separate compounds, there’s a global pandemic, and mental health conditions ranging from depression to PTSD.

The product pipeline

The company has four products in various stages of development.

These include:

- TD-0148-A, an LSD derivative.

- TD-010, an anti-anxiety medication.

- AP-003, an interferon derivative to fight COVID-19

- AP-001, to fight HPV

Let’s get into it.

TD00148-A

The gold standard for psychedelic research is a chemical that effects the brain without any of the nasty, negative side effects. You get the good trip—the healing, magical part of the acid trip—without the eight hours of deeply introspective hell.

TD00148A is the temporary name for BetterLife’s non-hallucinogenic and non-controlled psychedelic candidate, presently dancing through the preclinical hoops and IND-enabling studies. It’s curious because it’s unregulated and therefore can be self-https://e4njohordzs.exactdn.com/wp-content/uploads/2021/10/tnw8sVO3j-2.pngistered. The company’s synthesis patent removed regulatory hoops and its pending patent for method of use covers treatments for issues and disorders like depression, migraines, PTSD and other neuro-psychiatric disorders. At present, the company has applied for patent protection

This is one of the places where the company’s timing comes in: the global depression drugs market reached USD$12.41 billion in 2019, and is expected to bounce up to $25 billion by 2030. Depression is also one of the leading causes of disability, effecting approximately 265 million people worldwide.

TD-010

The company’s other potential drug is presently called TD-010. It’s based on Honokiol, the active anxiety-reducing ingredient in magnolia bark. The company’s formulation doubles the bioavailability, and comes in oral capsules, tablets, and sublingual delivery (or under the tongue). Betterlife’s pending method of use patent covers treatments for benziodiazipine dependency, anxiety, insomnia and more.

Magnolia bark is one of those extracts that’s been around for thousands of years in traditional Chinese medicine, and used for anti-anxiety purposes. Several animal studies have been completed, finding that it’s safe and efficient, nor does it have the same side-effects or addiction properties as benzos. Too date, only two human clinical trials have been published on honokiol. It’s presently sold as a nutraceutical.

Like the TD00148A, there’s no lack of opportunity. This global benzodiapzepines market is expected to grow from US$3.48 billion in 2019 to $4.15 billion in 2017 at a compound annual growth rate of 2.25%.

AP-003

AP-003 is the company’s patent pending proprietary recombinant human interferon alpha-2b (IFNa2b) inhalation formulation. Interferon is a drug that’s supposed to help kick the body’s immunological functions into high gear, and in recent studies, IFNa2b has proven effective at slowing the SARS-CoV-2 replication rate.

The opportunity

-

AP-003 is being developed as a novel interferon alpha-2b (IFN⍺2b) inhalation formulation

-

U of Texas, showed evidence of a direct anti-viral effect of interferon alpha against novelcoronavirus in vitro. The study demonstrated around 10,000 fold reduction in the quantityof virus that was pretreated with interferon alpha 48 hours earlier.

-

-

AP-003 may be used to treat patients early after COVID-19 or its variants’ infection which may prevent the progression to severe disease and need for hospitalization

-

Positive clinical trials may potentially position AP-003 as an initial treatment for COVID – 19 or its variants and other respiratory viruses (MERs, SARs)

-

AP-003 has potential to be used as prophylaxis/prevention – huge market expansion opportunity

A study published in May in the Frontiers of Immunology called “Interferon-a2b Treatment for COVID-19” examined the disease in a cohort of 77 people with COVID-19 in Wuhan, China, and at least as far as the authors were concerned, were the first to determine that the drug works in curtailing COVID-19.

Here’s how:

AP-001

AP-001 is an interferon-based cream for your junk. It uses the company’s interferon alpha-2b in Altum’s patented BiPhasix tech to deliver biomolecules into the body via the mucus membranes. It’s a broad acting anti-viral agent that’s been proven to work against HPV, or the virus that causes genital warts (condylomata acuminate).

The treatment involves intra-lesional injections three times a week, which makes it hard to perform on some types of HPV—such as cervical neoplasia, wherein lesions aren’t exactly visible and the injections can actually hurt the patient’s quality of life, and then there’s the cost and inconvenience of showing up at the doctor’s office to get said injections. Intron A—the standard medicine—doesn’t include this indication for this reason. Using it intravenous (via a shot or maybe a hanging bag) has proven to cause toxicities, so it’s generally out. As an alternative, there’s interferon alpha-2b, (or AP-001 as the company calls it) which aims to be a suitable alternative.

The delivery should be easy to use and even self-https://e4njohordzs.exactdn.com/wp-content/uploads/2021/10/tnw8sVO3j-2.pngistered, so no going to the doctor’s office in the middle of a pandemic to get a painful shot. AP-001 has completed Phase 1 and Phase 2 clinical trials, where it was shown to be active (in cervical neoplasia regression) and safe (no systemic or local side effects). A randomized Phase 2b clinical trial in HPV-cervical CIN2/3 patients is projected to be initiated by Q1 2021.

The Numbers

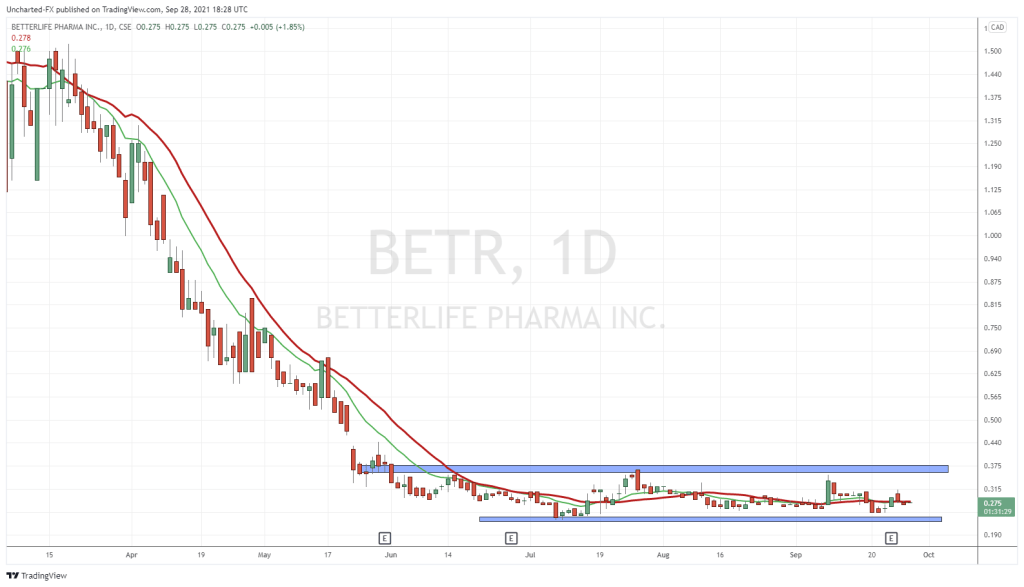

The biggest problem with this company’s timing isn’t their products or their viability, but their financial timing. Their numbers from their most recent financial statements tell a story about improvement and development, but it might be too little too late. Their January 2021 cash position was a little under $200K, and their liabilities far outstripped their assets.

You’ll note that in I make note of this in our roundup for this company, but this was actually filmed prior to their most recent release of financials. The reality is that they’re considerably improved on all fronts. Now they have a cash position of over $4 million,fresh off a raise of $6.2 million in a bought deal back in May, and their assets outstrip their liabilities, but not by much.

One key problem here remains with their financial timing, though, and that’s the continuing price of doing science. They have three products in the earliest stage of preclinical development, and getting each of them through to clinicals, through three stages, FDA approval and out to market, is going to cost them vastly more than $4 million.

The total number is actually quite scary.

“The costs of phase 1, 2, and 3 clinical trials conducted in the United States are in the range of US$1.4-6.6, 7.0-19.6, and 11.5-52.9 million respectively,” according to a study.

It’s not a good look. They may be a science-based company, but they should be hoping that their CFO can work some money magic sometime in the future, or they risk having three stalled products and no profit to show for it. Granted, if the company does manage to produce a marketable LSD derivative sans hallucination to the medical community, they’ll make bank. No timing required.

—Joseph Morton