Skyharbour Resources (SYH.V) continues its upward ascent, taking out multi-year highs in recent sessions.

A high-grade U3O8 hit at their Moore Uranium Project in the prolific Athabasca Basin of mining-friendly Saskatchewan is setting the stage for robust newsflow over the balance of 2021. We’ll chip away at that news event directly.

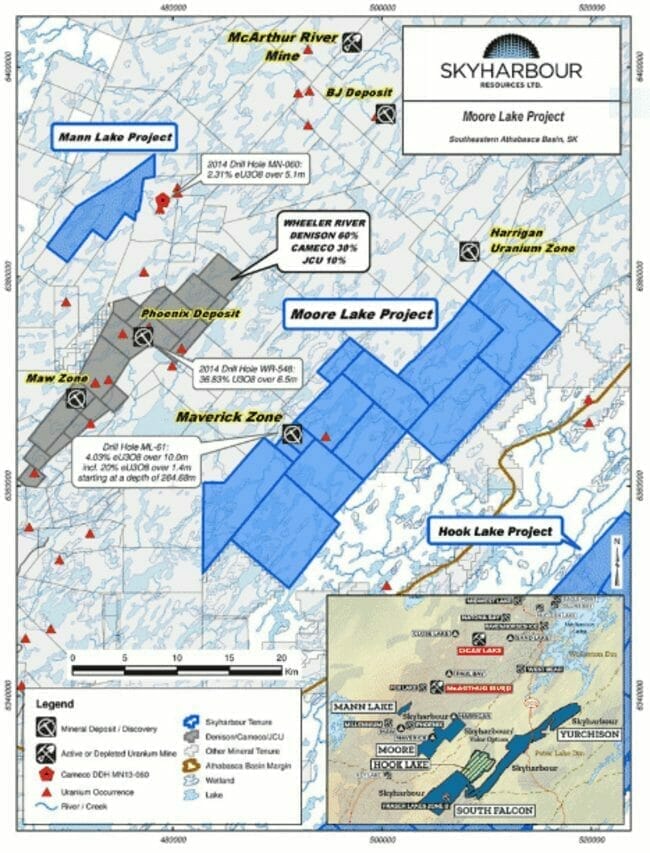

This cash-rich Basin-based land baron controls over 250,000 hectares spread out across a half dozen drill-ready projects. Located 15 kilometers east of Denison’s Wheeler River project and 39 kilometers south of Cameco’s McArthur River uranium mine, the wholly-owned 35,705-hectare Moore project bears flagship status.

Moore was acquired from Denson Mines back in 2016 (Denison is a strategic partner).

A fully-funded recently accelerated drill campaign is probing unconformity and basement-hosted targets along the 4.7-kilometer long Maverick Structural Corridor where significant discovery potential remains along strike and at depth. Several regional targets are also in the Company’s crosshairs.

The Company released the first few holes from this drill program on September 14th.

The September 14 headline

(it can be a positive signal when drill hole values are featured in the text of a headline)

The Company has drilled 4,578 meters in thirteen holes in 2021 thus far. Seven holes were drilled on the high-grade Maverick East Zone, three on the Esker Target, and three on the Grid 19 Target.

A good chunk of this drill campaign was designed to follow up on a significant hit from a previous program at Maverick East—0.72% U3O8 over 17.5 meters (including 1% U3O8 over 10 meters)—where the zone is open down plunge, at depth.

Seven holes (ML21-01 to 05 and ML21-12 and 13) were drilled on this high-grade zone. Assays for the first five (ML21-01 to 05) are reported in this press release.

Maverick East Zone Drilling

Hole ML21-01 was drilled just west of hole ML20-12 which intersected 0.28% U3O8 over 17.9 meters in the winter of 2020. ML21-01 tagged a broad interval of uranium mineralization returning 0.07% U3O8, beginning at 268.8 meters and extending 18.2 meters to encompass both sandstone and basement lithologies.

“This hole migrated well into the footwall and intersected structurally disrupted and clay altered to replaced sandstone and granite, along with uranium mineralization. The hole did return a typical footwall geochemical signature, with intense boron enrichment (up to 8,060 ppm) in the sandstone as well as elevated uranium, nickel and other pathfinders in the sandstone and basement.”

Hole ML20-02 was drilled to test for continuity within the central portion of the Maverick East Zone. The mineralized intercept in ML21-02 occurs in a broad zone that returned 0.19% U3O8 over an 11.7-meter interval, from 271.8 to 283.5 meters downhole.

“This mineralization straddles the unconformity with approximately two-thirds of the interval within basement rocks comprised of sheared, clay-altered to -replaced felsic intrusives. This hole once again intersected the main Maverick Fault towards the footwall side and the geochemistry is indicative of that with highly anomalous boron within the basement and the sandstone. The intercept confirms continuity within the central portion of the Maverick East Zone.”

Drill hole ML21-03 is the highlight interval from this first batch of assays as the company continues to probe the depth extent of the high-grade Maverick East Zone down plunge in the basement rocks. It was drilled to test for continuity within the eastern half of the zone, ten meters northeast of hole ML20-09 which returned 0.72% U3O8 over 17.5 meters.

ML21-03 tagged an impressive 2.54% U3O8 over 6.0 meters from 276.0 to 282.0 meters including 6.80% U3O8 over 2.0 meters from 278.5 to 280.5 meters.

ML21-03 represents one of the highest grade intercepts to date on the Maverick East Zone and stands as THE highest grades discovered to date in the basement rock.

“This mineralization is predominantly basement-hosted and accompanied by intense clay alteration of pelitic assemblages below the unconformity as well as up to 0.83% Cu and 0.73% Ni in half-meter sample intervals.”

“Drill holes ML21-04 and ML21-05 were collared to test for continuity between holes ML20-04 and -13. Hole ML21-04 was lost just above the target and the unconformity in the Maverick Fault at 238 meters. ML21-05 successfully tested the unconformity, but did not intersect significant uranium mineralization. The basement lithologies in this hole are typically intrusive in character within clay-altered to -replaced granites throughout. The sandstone is enriched in pathfinder elements, primarily boron, as is typical of footwall holes along the Maverick Fault.”

“Holes ML21-12 and 13 were drilled as follow-up holes within the eastern end of the Maverick East Zone. Both holes were completed to depth and intersected the expected prospective faulting and geology that has been identified in the Maverick East to date. Final geochemical assay results are pending and will be reported on once received and correlated with the noted geological features.”

Assays are also pending from two regional targets at Moore Lake—the Esker Zone and the Grid 19 Zone.

Grid 19 Zone Drilling

Three holes (ML21-07 to 09) were drilled on the Grid 19 target located roughly ten kilometers northeast of the Main Maverick Zone where two sub-parallel north-trending conductors were identified in a recent geophysical campaign (SML-EM). This target has seen limited historical exploration. Holes ML21-07 and 09 were drilled along strike, 400 meters apart along the westernmost extent of these conductors.

“These holes intersected significant graphitic conductors and sulphides, basement faults, and in the case of hole ML21-07, anomalous radioactivity. Hole ML21-08 also intersected prospective basement geology. The unconformity in the Grid 19 Target area occurs at a shallow depth of approximately 190 meters.”

Assays are pending for Grid 19 and will be reported once received and fully evaluated.

Esker Zone Drilling

Three holes (ML21-06, 10, and 11) were drilled on the Esker target located roughly five kilometers northeast of the Main Maverick Zone where anomalous uranium values were intersected in historical holes MT-04 and MT-10 (holes drilled during the 1980s). Hole ML21-06 was lost prior to intersecting the target, and the unconformity. Hole ML21-10 and 11 intersected significant graphitic conductors associated with faulting and pelitic rocks.

Assays are pending for these holes and will be reported once received and fully evaluated.

Meanwhile, drilling continues at the Moore Project with an additional 2,000 meters (four or five holes) added to the program.

Jordan Trimble, Skyharbour’s President and CEO:

“We are thrilled with the first batch of drill results announced herein highlighted by drill hole ML21-03 which returned the best intercept to date in the basement rocks at the Maverick East Zone. Our geological team is continuing to explore for higher grade uranium mineralization along strike and down plunge at this zone with an expanded drill program. We are successfully increasing the size of the high grade zones at the Maverick corridor and these results illustrate the notable discovery upside potential at the Project especially in the basement rock feeder-zones which have had limited drill-testing historically. Furthermore, there is good progress being made at regional targets at Moore and we intend to follow up on other high-priority targets throughout the Project. The remaining assay results from the drill program are pending which will provide additional news flow in the months to come amidst a significant resurgence in the uranium market.”

This 4.7-kilometer Maverick Structural Corridor, where significant discovery potential exists along strike and at depth, remains the Company’s primary focus.

The Uranium Market

In a recent Guru offering—Skyharbour Resources (SYH.V) well positioned as Uranium takes out multi-year highs—I chronicled Sprott’s recent appetite for physical uranium having mobilized the lion’s share of its $300M cash horde, its most recent purchase a whopping 1.25 million pounds.

If my arithmetic is correct, the fund acquired roughly 7,000,000 pounds of physical uranium over the past few weeks. Incidentally, Sprott recently bumped up their long-term price estimates for uranium to $60 per lb (from $50). Clearly, there’s a certain degree of bias where these price targets are concerned.

So… is Sprott out of dry powder? Has the buying spree come to an end?

Not quite…

Sprott Physical Uranium Trust Announces US$1.0 Billion ATM To Fund Further Uranium Purchases

I got a good kick out of this recent Zero Hedge headline (well crafted Mr. Durden):

There are a stack of additional (potential) catalysts supporting higher uranium prices going forward.

In a recent Ellis Martin interview, CEO Trimble details how the long, brutal bear market in the uranium sector has driven down our current primary mine supply to roughly 125M pounds, not nearly enough to meet the growing demand at over 180 million pounds (2020 figures).

Further, according to this September 14th press release:

“There are 443 operable nuclear reactors and 51 new reactors under construction globally with hundreds more planned in the pipeline. China and India continue to be at the forefront of demand growth and have the largest reactor pipelines making up a significant portion of the global growth. More recently, an important emerging market for nuclear and uranium demand in small modular reactors has gained notable positive press and momentum. As the global push for decreasing carbon emissions continues, nuclear energy will play a vital role in providing base-load, carbon emissions-free, low-cost electricity generation.

On the supply-side, mine closures and production curtailment continue to dominate headlines which was exacerbated by the pandemic clearly illustrating the risks to global primary mine supply. Major production cuts and depleting mine reserves appear to be working their way into the uranium market and driving prices higher. The two largest producers, Cameco and Kazatomprom, have announced large supply cuts over the last several years and have been actively buying uranium directly in the spot market to fulfill their contract deliveries as their production profiles have decreased.”

A few striking digits plucked from the above-noted interview: The combined market cap of ALL publicly traded uranium companies is equal to roughly $35B. This pales when compared to the previous bull cycle when the collective market cap topped $150B.

Final Thoughts

In this current environment, new discoveries and the successful expansion of existing high-grade zones will be lapped up by a market demonstrating an insatiable appetite for the energy-dense metal.

This bull run could be in the very early innings and Skyharbour is well-positioned to see a continued re-rating of its shares.

This just in…

Skyharbour Resources Receives $585,000 from Warrant and Option Exercises

END

—Greg Nolan

Full disclosure: Skyharbour Resources is an Equity Guru marketing client.