Sentiment in the uranium arena has turned altogether positive with spot prices tagging multi-year highs at $40 per pound in recent sessions.

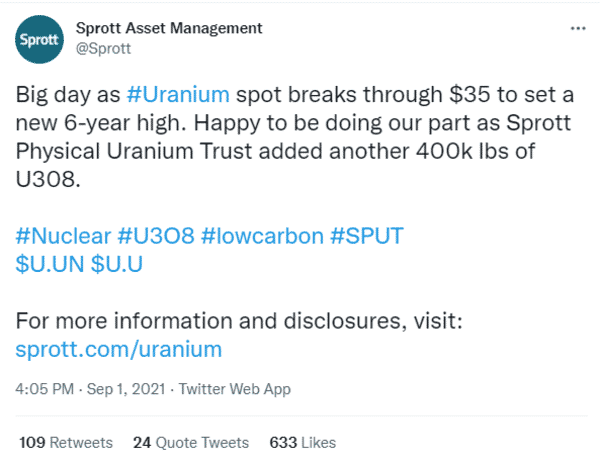

The Sprott Physical Uranium Trust, which made its debut on the TSX in July, invests in physical uranium. According to their updates on Twitter, the fund went on a buying spree adding 900,000 pounds of the energy-dense metal during the week of August 20th. It went on to add a further 400,000 pounds on the 23rd, 500,000 pounds on the 27th, and 400,000 pounds on September 1st, making no apologies for the impact it’s having on the market.

The aggressive buying continued unabated with the fund pulling in another 800,000 pounds on Sep 2nd, (a whopping) 1.1 million pounds on Sep 3rd, and another 850,000 pounds yesterday (September 7th).

The last time I checked, Spot Uranium had taken out $40.00 per pound.

Is it game on?

Are we on the cusp of a new super-cycle in this energy-dense metal?

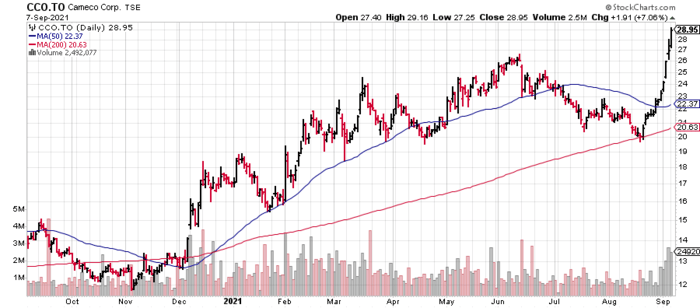

As expected, impressive price chart trajectories were printed across the board among the bigger names in the space.

Example: bellwether Cameco Corp (CCO.T) is currently testing 8-year highs.

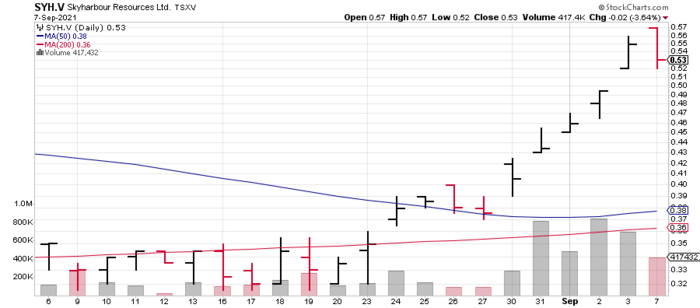

The price action of some of the juniors—NexGen Energy (NXE.T), Fission Uranium (FCU.T), Skyharbour Resources (SYH.V), for example—have performed even better, and on big volume.

Skyharbour Resources (SYH.V)

- 122.51 million shares outstanding

- $64.93M market cap based on its recent $0.53 close

Only two weeks back, Skyharbour common shares were trading sub $0.35. The stock has gone on a tear since then, printing $0.57 during yesterday’s session before settling back slightly at the close (above chart).

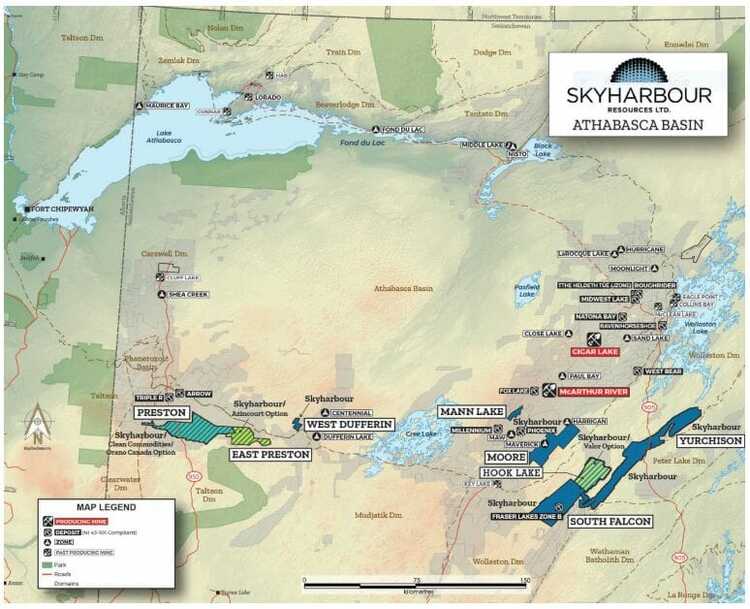

Skyharbour is a cash-rich land baron in a region boasting the highest-grade uranium deposits on the planet. This is Saskatchewan’s prolific Athabasca Basin.

The Athabasca Basin is to uranium what the Carlin Trend is to gold.

According to the Alberta Energy Regulator…

“Athabasca-type, unconformity-related uranium deposits are unique in size and grade compared to similar deposits elsewhere. These deposits have uranium oxide pods, veins, and disseminations at or close to the unconformity at the base of the Athabasca Group.

The flat-lying Athabasca strata are mainly fluvial, pervasively altered, red to pale-tan quartz conglomerate, sandstone, siltstone, and mudstone and are about 1.7 to 1.8 billion years old. The underlying crystalline basement is made of reworked Archean and Early Proterozoic crust. The mines in the eastern part of the basin in Saskatchewan contain the richest uranium deposits in the world. The potential exists for similar unconformity-associated uranium deposits in the western part of the Athabasca Basin.”

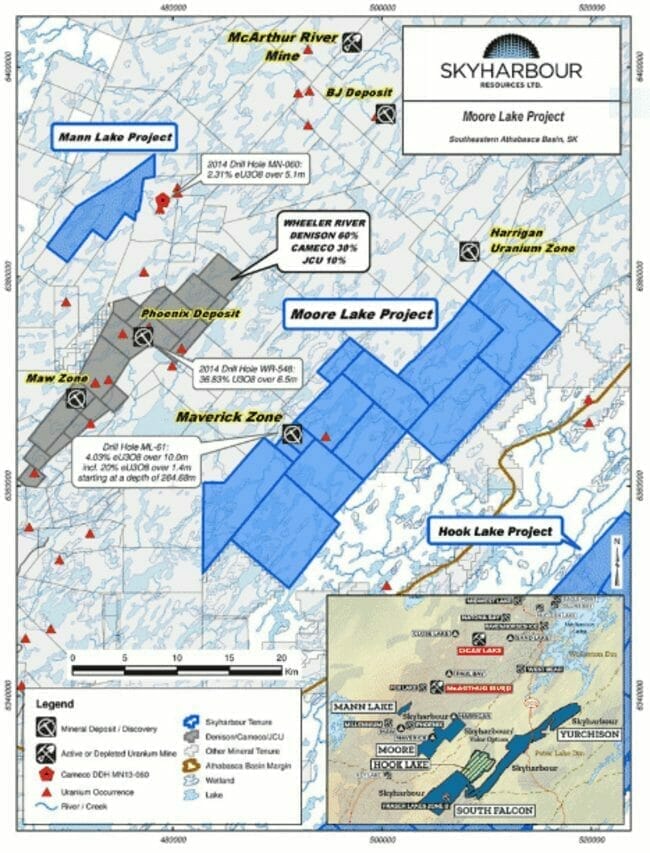

Skyharbour’s 35,705 hectare Moore Lake Uranium Project, a high conviction project located in the southeast corner of the Basin, is the Company’s flagship.

Moore Lake is located 15 kilometers east of Denison Mine’s Wheeler River project and proximal to regional infrastructure for Cameco’s Key Lake/McArthur River operations (Denison is a strategic partner).

Skyharbour has a distinct advantage over many of its peers in that it’s probing ground that has already demonstrated significant (high-grade) resource and discovery potential.

Some history and (high-grade) highlights from previous drill campaigns:

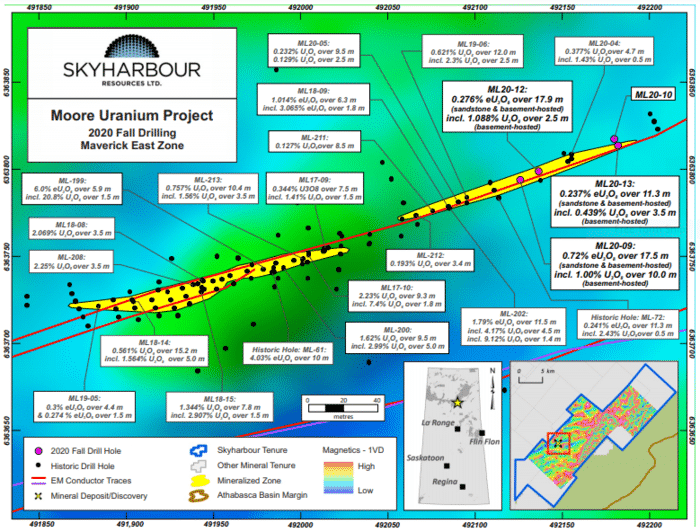

- Moore hosts high grade uranium mineralization at the Main Maverick Zone, which was discovered by JNR Resources in the early 2000’s; historical drill results include 4.03% U3O8 over 10 meters, including 20% U3O8 over 1.4 meter at a depth of 265 meters in hole ML-61;

- Skyharbour has carried out diamond drill programs over the last few years with several drill holes intersecting high grade uranium mineralization along the 4.7 kilometer long Maverick structural corridor;

- Drill intercepts of high grade, shallow uranium include 20.8% U3O8 over 1.5 meters at 264 meters, 9.12% U3O8 over 1.4 meters at 278 meters and 5.29% over 2.5 meters U3O8 at 279 meters;

- Skyharbour’s drill hole ML-199 tested the Main Maverick Zone lens and intersected high grade uranium mineralization containing 6.0% U3O8 over 5.9 meters at 265 meters depth including 20.8% U3O8 over 1.5 meters;

- Hole ML-202 from the Maverick East Zone intersected high grade uranium of 1.79% U3O8 over 11.5 meters at 270 meters including 4.17% U3O8 over 4.5 meters and 9.12% U3O8 over 1.4 meters;

- This is a newly discovered high grade mineralized lens at Maverick East on the Maverick corridor 100 meters from the Main Maverick Zone, and illustrates the strong discovery potential of additional high grade lenses along strike;

- More recently, Skyharbour has identified and refined new targets in the underlying basement rocks using modern exploration and methodologies;

- Drill hole ML19-06 intersected a broad zone of uranium mineralization from 273.0 meters to 285.0 meters downhole within the growing Maverick East Zone. The interval returned 0.62% U3O8 over 12.0 meters with a basal high grade basement-hosted intercept returning 2.5 meters of 2.31% U3O8.

In the Fall of 2020, drill hole ML20-09 confirmed continuity in the Maverick East Zone tagging an impressive 0.72% U3O8 over 17.5 meters (including a basal high-grade basement interval of 1.00% U3O8 over 10.0 meters) in a discrete zone of predominantly basement-hosted uranium mineralization at a depth of 271.5 meters.

ML20-09 represents THE longest continuous drill intersection of uranium mineralization discovered on the project to date.

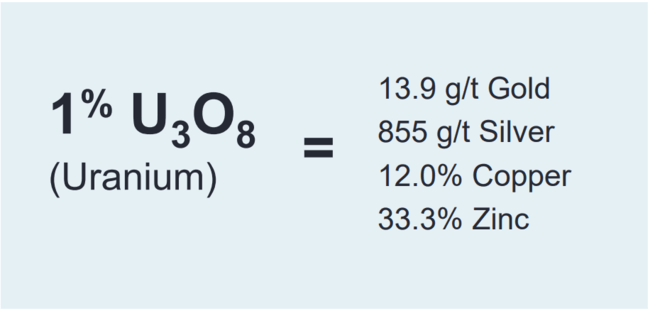

The following chart helps put the above values in perspective. Of course, with the recent spike in uranium prices, 1% U3O8 takes on greater (economic) meaning.

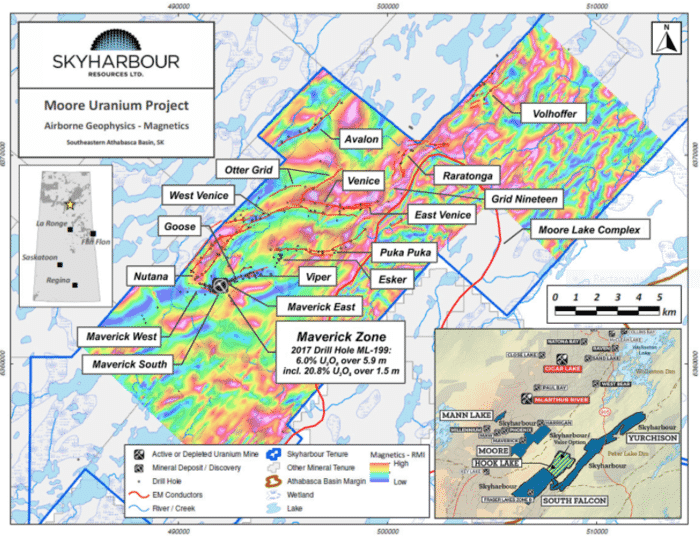

The Company is currently drilling Moore Lake, having accelerated the program back in mid-June from 3,500 meters to 5,000 meters.

This fully-funded program is following up on existing unconformity and basement-hosted targets along the 4.7 kilometer long Maverick structural corridor where significant discovery potential remains along strike and at depth.

Recent drilling has been largely focused on testing the Maverick East Zone down plunge—the thinking is that they may have only just scratched the surface at this high-grade zone.

Other regional targets, including those recently defined at the Grid Nineteen Zone, will also receive a proper probe with the drill bit during this campaign.

During an August 31st call with Skyharbour’s CEO, Jordan Trimble, I learned that this campaign is close to reaching the targeted 5,000 meters (in 12 to 14 holes).

CEO Trimble anticipates tabling the first batch of assays within the next two weeks.

After a short break, the Company plans to return to Moore Lake in late September for another 2,000 meters, just before freeze-up.

This additional phase of drilling will succeed in (roughly) doubling the size of the original 3,500-meter program, and should generate assay-related newsflow right on through December, perhaps into the New Year.

Once all of the assays are in hand, the Company will begin work on a maiden Moore Lake resource estimate. Beyond that, we’ll receive an update on a planned Winter-of-2022 drill campaign that should see a rig mobilized back to Moore Lake early in the New Year.

The partner companies

At the top of the page I characterized Skyharbour as a cash-rich Athabasca Basin land baron. For the remaining properties in the project pipeline, the Company (wisely) employs the prospect generator business model to push them further along the exploration and development curve.

A few examples:

The Preston Uranium Project is a JV with industry-leader and strategic partner Orano Resources Canada where Skyharbour maintains a 24.5% stake.

The East Preston Uranium Project, located on the west side of the Basin, is a JV with Azincourt Uranium (AAZ.V).

The following headline relating to East Preston dropped yesterday, September 7th…

Azincourt Energy Completes Radiometric Survey – Updates Plans for the East Preston Uranium Project

Updated Exploration Plans:

“The planned early fall diamond drilling program to complete approximately 1,000 meters of drilling remaining from the shortened winter 2021 program has been rescheduled after consultation with local communities and contractors. As a result, this meterage will be used to further expand the upcoming extensive winter drill program. This program will now consist of approximately 7,000 meters in 30-35 drill holes. Preparations are set to begin in early December. Target selection is ongoing and will be refined based on the ground-based follow-up of anomalies identified from the recently completed airborne survey.”

7,000-meters is an aggressive campaign. Azincourt’s technical team is top-shelf, as is the discovery potential at the East Preston project.

The Hook Lake Uranium Project, located 60 kilometers east of the Key Lake Uranium Mine, is a JV with Valor Resources.

Back in December of 2020, Skyharbour inked a deal with Valor where this ASX-listed explorer can earn up to 80% in the 25,846-hectare project by contributing cash and exploration expenditures totaling $3,975,000 over three years ($475,000 in cash and $3,500,000 in exploration commitments).

To seal this deal, Valor was also required to issue 233,333,333 shares to Skyharbour, upfront.

There’s considerable exploration upside at Hook Lake, a view heightened by the discovery of uber high-grade grabs plucked from the north end of the property six years back.

“In October 2015, on the northern side of the property at the Hook Lake target, Skyharbour reported that it had confirmed the presence of high-grade uranium mineralization with up to 68.0% U3O8 in a grab sample from a trench. The trench is referred to as the Hook Lake U-Mo showing and was the focus of the Company’s Summer 2015 field program which consisted of detailed prospecting and vegetation sampling. Skyharbour randomly selected three grab samples from the Hook Lake showing to verify historic results and these grab samples returned 68.0% U3O8, 35.7% U3O8 and 29.8% U3O8.”

Previous operators of the project were unable to locate the source of this high-grade surface material.

Having mobilized a field crew to the project earlier this summer, Valor is beginning to generate news. The following headline dropped on August 31st…

These additional high-grade surface samples further support the geological potential in Hook Lake’s subsurface stratum.

Highlights:

- Sampling results from the Hook Lake (Zone S) prospect returns:

- 59.2% U3O8, 499g/t Ag, 5.05% TREO (11,797ppm Nd2O3 + Pr6O11 and 1,825ppm Dy2O3), 14.4% Pb (Float sample)

- 57.4% U308, 507g/t Ag, 3.68% TREO (8,562ppm Nd2O3 + Pr6O11 and 1,676ppm Dy2O3), 14.5% Pb (Rock chip sample)

- 46.1% U3O8, 435g/t Ag, 2.88% TREO (7,054ppm Nd2O3 + Pr6O11 and 1,139ppm Dy2O3), 8.8% Pb (Rock chip sample)

- 6.92% U3O8, 0.81% TREO, 2% Pb (Rock chip sample)

- 6.42% U3O8, 1.17% TREO, 1.8% Pb (Rock chip sample)

“A total of 57 samples were taken from across the Hook Lake Project with assay results now having been received. The results are highlighted by the assays from the Hook Lake (or Zone S) prospect which confirmed the reported historical high-grade uranium mineralization. A total of seven rock chip samples were taken from a historical trench located at the Hook Lake prospect, with four of these samples returning high-grade uranium assays (>6% U3O8) as well as highly elevated rare earth (>0.5% TREO*), silver (>50ppm) and lead (> 1.8%) assays.”

In Australia, Valor’s stock has responded positively to this news (Valor has 2.95B shares outstanding giving it a market cap of roughly AUD $43M).

If my math rings true, Skyharbour’s equity position in Valor is currently worth somewhere in the neighborhood of $3.5M Cdn.

Valor is using good science—a combination of geochem and geophysics—to push Hook Lake further along the exploration curve. The Company is currently defining drill targets for a campaign that should see a late Q4 start.

This setting is reminiscent of Fission Uranium (FCU.T) in 2012, where high-grade boulders were traced up ice leading to the Triple R discovery—a discovery that opened up the whole western side of the Athabasca Basin.

Continued success at any one of these partner-funded programs—East Preston, Hook Lake, Preston—will be icing on the cake. There’s also South Falcon Point which could generate a headline before year’s end.

These are exciting times to be a speculator in the uranium arena.

END

—Greg Nolan

Full disclosure: Skyharbour is an Equity Guru marketing client.