It’s difficult to pinpoint exactly why confidence in Bitcoin’s future has jumped, but the likely culprit is that the Chinese bitcoin miners recently exiled from their ancestral homelands have made their way to to North America (and Russia and Kazakhstan) and set up shop. The hashrate and mining difficulty both enjoyed a bump, and now Bitcoin’s gradually returning to status quo, albeit stronger because of its reduction in centralization.

Now when the grand poobahs in the CCP in Beijing flap their pieholes about Bitcoin not being ‘legal tender(s) and having no actual value support’ like they did this week, we won’t see a 25% dip in the asset’s core price. Because frankly, now that China doesn’t have to worry about Bitcoin, Bitcoin also doesn’t have to worry about China.

If that’s done anything, it’s definitely facilitated the next great mining rush.

Miners

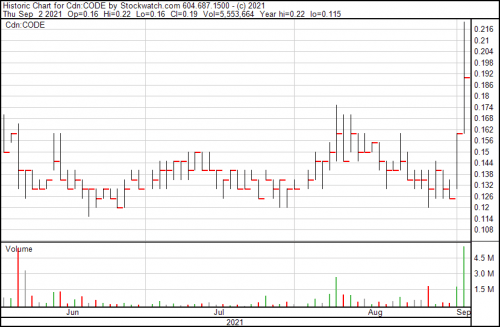

Codebase Ventures navigates ASIC chip shortage

Let’s start the portion of this week’s mining rundown with Codebase Ventures (CODE.C), which received a delivery their 115 Antminer S17+ bit mining units to their facility in New York.

The company’s mining infrastructure is online and apparently generated revenue in spite of a microchip shortage. As a refresher, mining cryptocurrency involves one or two of three different types of chips, depending on what coin you’re tackling. These are Graphic Processing Unit (GPU), Central Processing Unit (CPU), and Application-Specific Integrated Circuit (ASIC) chips. When we’re talking about Bitcoin, it’s always ASICs, but other coins have different energy requirements and may use other chips.

“As previously announced, under mounting pressure resulting from microchip shortages across the industry, Codebase took steps to put new supply in place and on-line, avoiding extreme delays. Codebase remains confident in their long-term thesis surrounding BTC and the continued disruption blockchain technology will have on our world in the coming years,” said Jake Chernoff, Codebase strategic adviser.

Regardless, these are integral to mining, so when COVID-19 disrupted fabrication of these chips throughout 2020, it caused something of a chip-shortage as crypto-miners were expanding.

Canaan’s partnership with Genesis Digital Assets brings the immensity

High performance computing provider, Canaan (CAN.Q), secured a purchase with Genesis Digital Assets, a privately-owned Bitcoin miner operating out of the United States that also builds and operates Bitcoin mining data centers, for 20,000 of its Bitcoin mining rigs. And an option to buy upwards of 180,000 more.

“Since we entered the long-term partnership with Genesis Digital Assets earlier this year, both parties have reached several great deals. This order with an option of future large purchases further solidifies our collaborations and reflects both parties’ confidence in the prospects of the cryptocurrency mining industry. All these mutually beneficial deals demonstrate the quality of our products and our endeavors to deliver for clients, despite the overall challenging supply chain conditions. We remain diligent in helping miner clients expand their computing power while generating value for our shareholders,” said Nangeng Zhang, chairman and CEO of Canaan.

Genesis Digital is already one of the world’s biggest Bitcoin miners and they’re looking to stay that way in the future. They’ve been in business since 2013 and have built over 20 bitcoin mining farms, brought over 300,000 miners online and mined more than $1 billion in Bitcoin. In August of this year their data centre capacity was over 170 megawatts, and 3.1 Exahashes, which is more than 2.4% of the global Bitcoin mining hashrate.

The story here is the numbers, obviously. These guys are a big deal and a heavy competitor in the make money from funny math sweepstakes held every ten minutes.

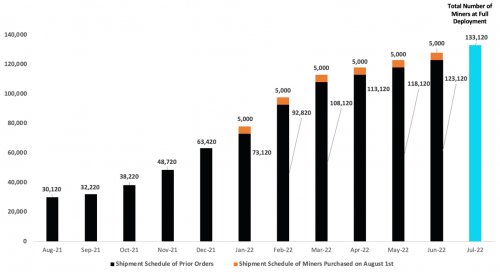

Here’s Marathon Digital Holdings (MARA.Q), one of their chief competitors, as of July:

That chart only goes to 180,000 miners, whereas Genesis already has 300,000 alive and kicking. Sadly, Genesis isn’t public, but Canaan, the company supplying the machines and a competitor of Bitmain’s, certainly is. They’re the real star here. If Bitmain ever goes live, then we’ll have an entirely new competitive pairing to watch out for in the future.

Marathon expands their collaboration with tech and financial services firm

While we’re on the topic of Marathon Digital Holdings, they’ve expanded their collaboration with NYDIG, a tech and financial services firm involved deeply in Bitcoin. They’re going to help provide numbers for Marathon’s Bitcoin mining pool, MaraPool, which will mean access to NYDIG’s services for bitcoin miners.

“NYDIG has been an important collaborator of ours, providing a variety of treasury management and trading services, including facilitation of the purchase of 4,812.66 bitcoins in January. NYDIG’s team shares our passion for professionalizing and institutionalizing the Bitcoin mining industry in the U.S., and by collaborating with NYDIG on our mining pool, we have enabled all members of our pool to have access to the same world class solutions and expertise from which Marathon has benefitted,” said Fred Thiel, Marathon’s CEO.

The Marapool is a US-based bitcoin mining pool focused on carbon neutral mining and reducing the overall environmental impact of mining the coin. It’s part of the green crypto initiative called crypto climate accord that’s been trying to clean up Bitcoin miners acts so we can have a future that doesn’t involve dying slowly from heat exhaustion. The pool also provides its members with transparency and is fully audited with a third-party in the US.

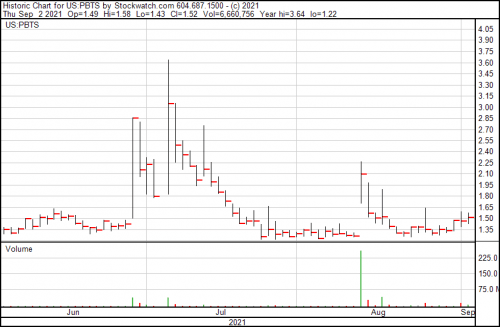

Powerbridge Technologies new tech could increase Ethereum mining efficiency. We’ll see.

Powerbridge Technologies (PBTS.Q) provided a new Linux-based AI integrated operating system called FXOS designed for mining the Ethereum blockchain, but also extended to other GPU based cryptos. It’s an automated and intelligent operating system that apparently increases ETH mining by an estimated 15%. So that’s something fairly neat to look forward to if it works. You don’t normally hear about operating systems optimized for mining cryptocurrency, but it could be something to watch for in the future.

“I am pleased that FXOS is available. As we are deploying our crypto mining machines, having our own mining OS is equally important in our efforts to develop a network of mining operations with higher-than-market ETH mining efficiency,” said Stewart Lor, president of Powerbridge Technologies.

It can be deployed for large-sized mining operations with highly automated and intelligent functionalities, and is available with a convenient App capable of running on iOS, Android, Applet or Web.

Beyond Blockchain Mining

Last week we offered an update about a long time former Equity Guru client called Graph Blockchain (GBLC.C). This week, their NFT platform subsidiary, New World, signed on YouTube famous family, the Rush Fam, to create NFTs.

I have no idea who these people are, but they have over six million subscribers on YouTube, and they apparently create vlogs sharing their life experiences, including pranks, challenges and travel. They are, apparently, Tray and Keshia Rush, and their children Cali, Kirah and Kameiro.

The reason it’s noteworthy is that six million subscriber number, which means that their (probable) ten of diehard fans will likely pay attention to a Rush Fam NFT generator, and maybe a percentage of that will get involved with said digital collectable. That bodes well for everyone involved, except maybe the person buying the NFT, who will soon realize that there’s absolutely nothing they can do with it

except show it off to their friends.

Seriously. Why do people buy these? They’re only going to end up in the back of the digital equivalent of someone’s closet to be unearthed in the distant future as an extremely expensive keepsake. Instant buyers remorse.

Vitalhub prepares to uplist to the TSX, and announces debt facility from schedule I Canadian bank

Vitalhub’s (VHI.V) has had a big week.

First, they’re saying goodbye to the venture exchange and joining the big boy’s club on the TSX, having received conditional approval to offer shares there earlier this week. That bodes well for VHI’s future. Also, this week, they closed a $10 million acquisition debt facility from the tech and innovation division of a Schedule I Canadian bank.

“Establishing this debt facility marks another important milestone, demonstrating our suitability for appropriate term debt to enable our acquisition strategy, with interest and repayment terms that demonstrate the stability of the company, supported by our foundation of a strong recurring revenue base,” said Dan Matlowe, CEO of Vitalhub.

They’ll be using the facility in support of their ongoing M&A campaign. It will carry an interest rate of prime plus 2.75%, with a ten year repayment amortization of the loan amount.

DeFi Technologies doubles down on virtually unknown alt

DeFi Technologies (DEFI.E) printed 300,000 Shyft tokens over the past two months and anticipates being able to pick up another 6,800 tokens every day, or 2.4 million shift coins per year. Before we get into what the Shyft coin is, we should probably point out what it’s worth right now. That’s roughly USD$1.05.

So, ostensibly a little more than a quarter of a million dollars in three months, with a solid one year yield of almost two and a half million dollars, which is a decent rate of return for mining a virtually unknown altcoin. The problem of course lies in whether or not they can move it. Most of the altcoins are like that, and given that this is a private, semi-permissioned blockchain, the prospect of popping onto say, Poloniex, and exchanging said coin for fiat, or shapeshifting it to a coin with more liquidity in the future isn’t great.

There does seem to be some liquidity for it, though, but not a great amount and definitely nothing without its own host of regulatory and security problems. A quicky google search pops up KuCoin, Gate.io, Jubi, Bilaxy, and Uniswap (V2) as unloading options for exchanges. Given how precarious the crypto-sphere is in terms of security and the stealthy future approach of international regulation, getting involved in a low-liquidity coin at this level seems like a peculiar choice.

Still, here’s Russell Starr, executive chairman of Defi Technologies:

“As our entire business platform at Valour continues to grow in terms of AUM [assets under management] and revenues, to see our governance product now kick in and add to our already-substantial revenue profile is incredible news for shareholders. What is even more exciting are our new products coming to market, along with our intent to also build out a node portfolio. Defi Technologies remains one of the only ways for investors to get exposure to Defi TVL [total value locked] (which has grown to $157-billion (U.S.)) in a listed and regulated equity market.”

Despite the liquidity issues for this particular token, the price action over the past month has made it worthy of a second look, and maybe even approach the status of hidden gem.

Could be one to watch.

The9 Limited wades into NFT pool with new non-fungible token platform NFTSTAR

The9 Limited (NCTY.Q) announced today their intent to dive into the NFT pool. Their subsidiary, NFTSTAR Singapore Pte., will launch NFTSTAR, a trading and community platform in Q4 of this year. They have also launched a pre-registration incentive program to assist with onboarding.

“NFT market is growing rapidly all over the world. Our NFTSTAR platform has great potential to grow. Driven by the dual core businesses of NFT and cryptocurrency mining, our globalization strategy is getting more solid, and a broader market will bring stronger growth to The9,” said Zhu Jun, chairman and CEO of The9.

NFTSTAR is a trading and community platform that gives users the ability to purchase and trade, but also access to interactive activities. It will feature NFT collections. Users will be able to buy different tiers of blind boxes and own stars’ limited NFT collections. Each collectible, of course, will feature on a blockchain, and the users will get ownership of the NFT collectible through purchase on the platform, or through trading on NFTSTAR’s marketplace.

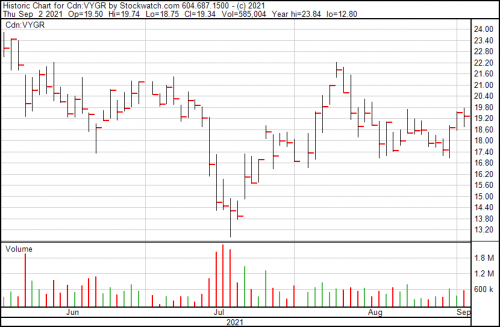

Voyager Digital completes token merger, and finds a new home

By the time you read this, Voyager Digital (VYGR.T) will have delisted from the Canadian Securities Exchange and found a new home among the big boys in the TSX. That’s only part of the story, though.

Voyager completed one of the largest token swaps and mergers ever, combining the original Voyager token, VGX, with the LGO token from the European exchange LGO SAS, originally acquired by Voyager in December 2020. Completing the token swap meant that VGX and LGO were converted into a new token under the ticker VGX. At the time of the swap, the VGX token had a market cap of over $900 million.

“This merger gives Voyager the ability to service the 750 million European population with the most consumer-friendly agency brokerage platform for investing in crypto assets. We look forward to our international expansion as Voyager’s growth continues on all fronts, with AUM (Assets Under Management) growing rapidly and our product offering continually enhanced with debit and credit card, margin, and more traditional banking products on the horizon. We look forward to making Voyager a truly global company and having Gaspard de Dreuzy lead the integration efforts in Europe,” said Steve Ehrlich, co-founder and chief executive officer of Voyager.

The new token includes decentralized finance features like community governance, as well as staking at 7% interest, cash back rewards if you trade on their platform, a debit card, interest boosters, and reduction of withdrawal fees. If DeFi is the future like a lot of crypto-pundits and personalities seem to think, then this is an excellent decision.

GCAC and their scheme to raise awareness

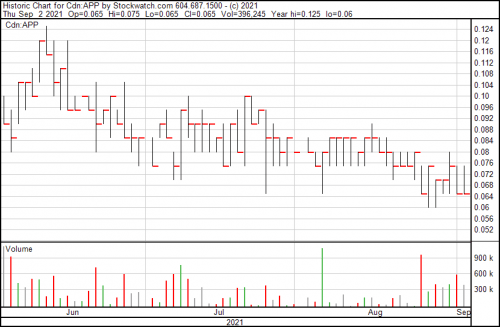

Global Cannabis Applications (APP.C) used a percentage of its quarterly revenue to purchase its token on the Uniswap decentralized exchange as part of a marketing program directed to the decentralized finance community.

I’m delighted to continue to promote our company amongst the DeFi community. We now have 342 holders of the GCAC token who are a critical part of our strategy to fund Canadian cannabis grows- who will license Efixii. Every day we see this excitement grow on a vibrant Telegram @GCACToken channel. Working collaboratively with these folks was made clear in our recent NFT press release and as such we will continue to buyback tokens which increases our balance sheet exposure to the Ether cryptocurrency” said Brad Moore, CEO.

First, GCAC designs, develops and licenses software-as-a-service innovative data tech for the medical cannabis industry. Ostensibly, what they do is provide their Citizen Green and Efixii platforms, which are the first end-to-end from patient to regulator medical cannabis solutions using six core technologies. These are mobile apps, AI, RegTech, smart databases, the Ethereum blockchain and GCAC smart rewards.

Admittedly, their approach is a touch strange, but there’s some validity to it. Most of DeFi right now are folks under 34 years old, and with a heavy amount who are probably cannabis enthusiasts. The multi-year campaign intends to raise awareness of the company by getting involved in a DeFi token buyback program on both the Ethereum and Binance Smart Chain blockchains, and raising awareness among this group ensures a bright future.

Former Chinese English-as-a-second language school makes world’s strangest pivot

The company is called Meten EdtechX (METX.Q), and they’re intending to strike out from their former business model of providing being one of the omnichannel English language training service providers in China to develop a blockchain and cryptocurrency angle.

Admittedly, this is vaguely reminiscent of the blockchain craze of 2017 when everyone was throwing blockchain in their name with the hope of getting a little bump on the back of the hype machine. You know, whether they were a blockchain company or not.

They’ve been looking into a cryptocurrency and blockchain style business change since 2020, and devised a plan, including a Dogecoin reward mechanism, and applied non-fungible token for digital copyright in online education. Now they’re thinking about buying miners and NFT assets, and setting them up in either the United States or Canada.

“Our New Business Initiative will be built upon the traction we are already seeing in our past research and preparation of blockchain and cryptocurrency business. After an in-depth research and exploration in the crypto world, with the resources and talents of the Company, we are committed to building a professional team to explore the blockchain and cryptocurrency business while maintaining our core adult ELT business. We believe this move will help us create a new ecosystem in the fast-evolving Internet industry and give us the opportunity to increase our growth potentials and broaden our vision,” according to Alan Peng, CEO of Meten EdtechX.

This is maybe the most peculiar part of the Bitcoin diaspora. How companies that weren’t even remotely related to Bitcoin mining when Beijing handed down its edict are now thinking seriously about getting involved. The implications for the future of Bitcoin, and cryptocurrency in general, are considerable.

The future is bright. Maybe.

Inherent in the final entry in this roundup is a question about what to expect from Bitcoin in the near future. Bitcoin miners have only started to land and set up shop, and while we’ve seen some considerable bumps thanks to it, but I don’t think we’ve quite seen the end of it. Like Meten above, what has me curious is the Chinese expatriot companies that followed in the wake of Xi Jinping’s anti-bitcoin proclamations that have been curious about cryptocurrency and blockchain but wary of the government response. If there are more companies like Meten, then we could see the beginning of a new sector push.

Regardless, what we have to look forward too, and serving as a nice counterpoint to China’s vehement distaste for all things crypto (that they don’t own) is that El Salvador will be adopting Bitcoin as legal tender on Tuesday, September 7th, despite warnings from the International Monetary Fund and World Bank.

The thing is the warnings they issued aren’t wrong:

Privately issued cryptoassets like Bitcoin come with substantial risks. Making them equivalent to a national currency is an inadvisable shortcut. Read more in our #IMFBlog by the IMF’s Tobias Adrian and @RhodaWeeksBrown: https://t.co/r1NwBuyAq8 pic.twitter.com/Sk9tOjvhD6

— IMF (@IMFNews) August 29, 2021

But you can’t accomplish anything truly great without taking risks and there is definitely potential for something great here.

—Joseph Morton