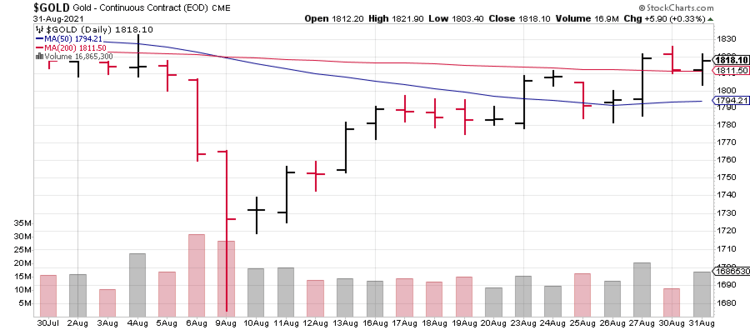

In light of recent trading action—an early August flash crash followed by a nice stair-stepping sequence higher—we may have printed a bottom in the precious metal arena, and a new bull run may be on the horizon.

For those looking for exposure to precious metals—for those conducting due diligence in this wild west of an arena specifically— homing in on a company’s jurisdiction, and the potential risks associated with operating within said jurisdiction, is a critical piece of detective work.

Geological setting, exploration success, and the pedigree of management are key considerations when shortlisting potential investment candidates in this high-risk/high-reward arena, but a companies zip code can trump all of these considerations combined. A Guru piece I published earlier this year—The risks in straying outside the safe zones – the Fraser Institute unveils its Top Ten…— harks back to several experiences early in my career where ‘jurisdictional risk’ played a major role in derailing world-class gold projects as they were being pushed along the permitting and development curve.

Early each spring, the esteemed Fraser Institute, a think-tank that analyses jurisdictional risk, serves up its Annual Survey of Mining Companies. This annual report—ranking provinces, states, and countries according to public policy factors that either encourage or discourage mining investment—is perhaps THE best shortcut to getting a handle on the “Investment Attractiveness” of a region. It also serves as a report card to governments regarding the sense and soundness of their mining policies.

According to the most recent Fraser survey…

“The top jurisdiction in the world for investment based on the Investment Attractiveness Index is Nevada, which moved up from 3rd place in 2019. Arizona, which ranked 9th in 2019, moved into 2nd place this year. Saskatchewan climbed eight spots from 11th in 2019 to 3rd in 2020. Western Australia ranked 4th this year after topping the ranking last year, and Alaska dropped a spot from 4th in 2019 to 5th in 2020. Rounding out the top 10 are Quebec, South Australia, Newfoundland & Labrador, Idaho, and Finland.”

Western Australia stands out on this list. The government here encourages mining development, even co-funding drill campaigns it deems geologically promising.

A Western Australian ExploreCo for your consideration…

Altan Rio Minerals (AMO.V)

- 95,578,494 shares outstanding

- $12.42M market cap based on its recent $0.13 close

When I first looked at Altan Rio, I was immediately struck by the Company’s project location within the prolific Yilgarn Craton of Western Australia.

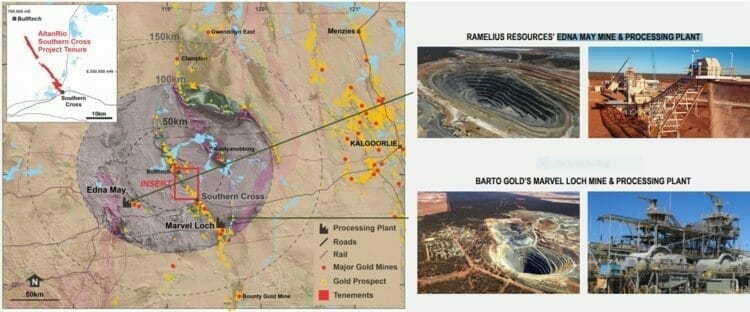

The following slide from the Company’s pitch deck puts this play in perspective as most of the gold belts in the region hold extraordinary mineral endowments—Murchison (>30M ounces), Laverton (41M ounces), Leonora (>44M ounces)… Kalgoorlie (>160M ounces).

Without a doubt, YC is an upscale neighborhood.

Within the Yilgarn Craton domain, Altan Rio’s 23.7 km² Southern Cross Project encompasses a significant, strategic, and vastly under-explored land position along the northern portion of the Southern Cross Greenstone Belt.

“The Southern Cross Greenstone Belt is a north-nor-west-trending highly deformed belt of sediments, mafic and ultramafic rocks wedged between two major granite domes.”

The Frasers-Corinthian Shear Zone (FCSZ) is the dominant geological structure along this belt. Significant mineralization—Frasers (1.2 Moz), Golden Pig (640Koz), Hopes Hill (214 Koz), Pilot (54 Koz), Corinthia (190 Koz), and Copperhead (1.5 Moz.)—can be found along its entire 60-kilometer length.

Zooming in closer (still on the map above), Southern Cross’ mineral endowment—roughly 12 million ounces of gold production from 1900 to 2019—appears under-represented, under-explored. Where Altan Rio’s mineral tenure is concerned, there’s a good reason for that.

Back in the day, prospectors chased gold mineralization along surface, exploiting the low-hanging fruit, rarely mining to depths greater than 50 meters. When these early miners ran out of near-surface ore, they pulled up stakes and moved further along trend, chipping away at the shallow easy pickings.

Much of Altan Rio’s land position along the FCSZ is especially compelling in that the surface material—the outcropping (mineralized) rock that would have spurred and guided early mining campaigns—disappeared under the cover of loamy farmland and saltwater lakes. Surface prospecting was simply not possible. The mineral wealth that lurked below this surficial cover… abandoned.

In more recent years, access to these unexplored areas along the FCSZ was restricted by farmers cultivating crops in the region. Altan Rio management has been successful in bridging the gaps between exploration efforts and these hard-working agrarian types. Now, for the first time, all of that prospective geology that lay buried, unprobed, unexploited, is seeing the business end of the drill bit.

“Game on” might be an appropriate response in light of this current development.

The lay

Southern Cross boasts a backyard rich in infrastructure: roads, rail, and close proximity of two operating mills—Edna Bay and Marvel Loch. This framework can work to greatly reduce the significant Capex that normally accompanies a build-out scenario. Producers with hungry mills to feed often welcome the prospect of a toll milling liaison.

There’s an appetite for third-party ore feed at Marvel Loch, where Chinese-backed Barto Gold is installing a new crushing circuit with a capacity north of 2 million tonnes per annum. The same can be said for Edna Bay, also within easy trucking distance from Altan Rio’s tenements.

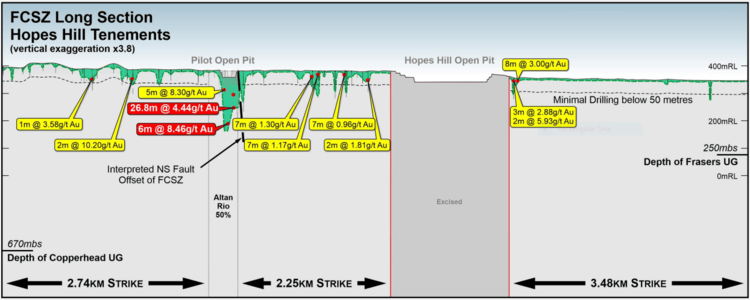

This next map might be the most telltale of the lot as it speaks to the vast unexplored potential in Southern Cross’ subsurface stratum…

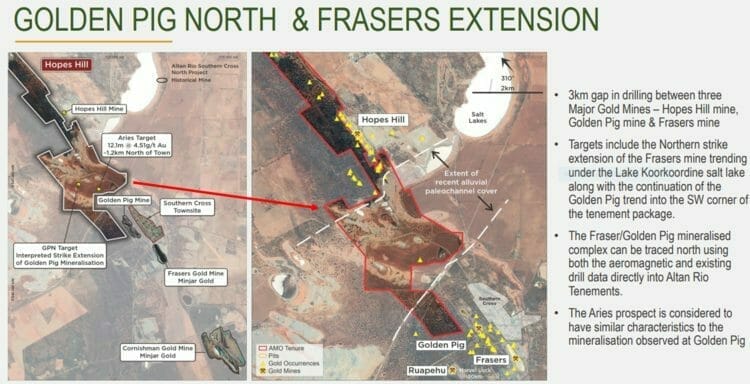

Note the scale on the map above (bottom left). Note the number of mines and gold occurrences along this highly prospective greenstone belt (consult legend – top right). And note the Company’s tenements (shaded in dark red). The gaps you see are those referenced further up the page—the wide-open (exploration) blue-sky courtesy of the thick overburden, lake cover, and the restricted access that derailed early prospecting campaigns.

Geologically, there’s little difference between the southern half of this goldfield—where over a dozen mines have produced in excess of 10M ounces—and Altan Rio’s northern half, where production stands at only 2M ounces.

There’s no reason Altan Rio’s ground—roughly 30 kilometers of vastly under-explored Southern Cross terra-firma—can’t hold a similar mineral endowment… and then some.

The opportunity not only lies in Southern Cross’ immediate subsurface stratum—the real upside may ultimately lie at depth (some of the deep deposits along the Abitibi Greenstone Belt of Ontario and Quebec may be an analog here). The same can be said for the entire Frasers-Corinthian Shear Zone as mining rarely exceeded depths greater than 50 meters (Marvel Loch to the south at 600 meters and Copperhead to the north at 670 meters are the two exceptions).

I’m not saying that we’re looking at another Hemlo, but the potential for deposits sharing similar geological characteristics—lode and vein-style deposits hosted in amphibolite metamorphic rocks—is certainly there.

Still on the Hemlo analogy, it may seem like a lofty likening, but one only needs to examine the mineral endowments on the map at the top of the page—the weight of multiple world-class Tier-1 deposits—to broaden one’s expectations. This is the allure of holding a position in a company probing virgin ground in a prolific geological setting.

The terms

According to the Company’s project page…

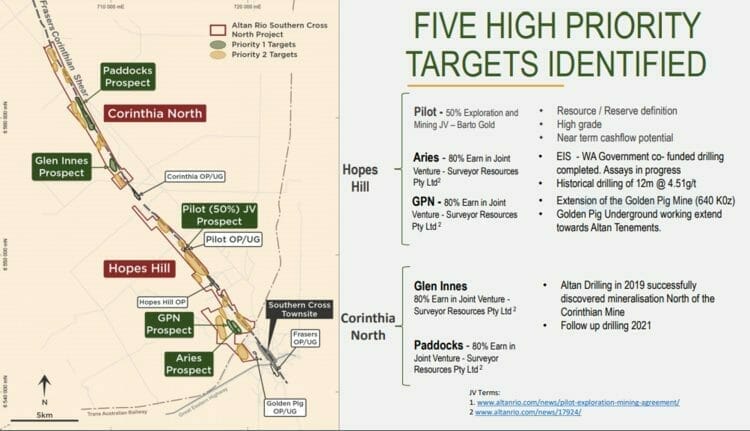

“Altan Rio is earning up to an 80% interest in the Southern Cross North Project from joint venture partner Surveyor Resources. The company also entered into an exploration and mining agreement with Chinese-backed Barto Gold over the Pilot mine. The project is divided into two discrete tenement packages, the Corinthia North and Hopes Hill tenements. Five primary targets have been identified within the project – Pilot, Aries, GPN, Glen Innes and Paddocks. These targets contain historical drill intercepts which are strongly anomalous in gold or contain significant gold intercepts. Another 17 subsidiary targets with prospective geological characteristics and some levels of gold anomalism have been defined and also warrant further investigation.”

The terms for the Southern Cross North JV are spelled out in an April 2020 press release – Altan Rio Announces Joint Venture Agreement for Southern Cross North Project

A transaction that ultimately led to the Pilot Mine exploration and mining agreement with Chinese-backed Barto Gold are spelled out in a June 2020 press release – Altan Rio Announces Exploration and Mining Agreement with Tianye SXO Gold Mining Pty Ltd

The targets

Pilot, Aries, Golden Pig North (GPN), Glen Innes, and Paddocks represent Altan Rio’s Top Five targets at Southern Cross. Flagship status is yet to be determined as they ALL hold similar geological potential. The truth machine will ultimately determine rank.

The Company has completed multiple drill programs at Southern Cross over the past year. Assays are currently pending from the Aries Gold Prospect and phase-3 drilling at the Pilot Mine Prospect.

Rather than ganging up and launching a large-scale drill campaign on one (single) target area, management is drilling off multiple targets via modest programs. Aside from creating a more even distribution of assay-related newsflow, this strategy opens the door to the (virgin) discovery potential along its entire 30 kilometers of Southern Cross tenure.

This next slide showing the southernmost extent of Altan Rio’s tenement—representing roughly 50% of its land position—is a good illustration of the under-explored nature of this ground.

Note the sparsity of drill holes along the first 3.48 kilometers of strike (far right). Note the significant gaps between drill holes over the next 5 kilometers of strike. Also, note the depth of this historical drilling relative to the depths mined at the Frasers UG Mine to the far south (250 meters) and Copperhead to the far north (670 meters). Again: Vastly under-explored terrain.

Zooming in closer to the southernmost extent of Altan Rio’s tenements, the following slide shows a clear gap between Hopes Hill, Golden Pig, and Frasers. This represents 3 kilometers of virgin ground between three major mines.

The deep overburden (white dashed lines on the righthand map) that limited and deterred historical exploration back in the day is no longer an issue, what with modern exploration techniques. The current farmer that holds much of the land along this gap has also granted Altan Rio access to this unexplored ground.

This 3-kilometer gap holds significant discovery potential.

Pilot and the fast-track-to-production potential

Pilot, a high conviction project, offers both near-term production potential as well as significant exploration upside both laterally and at depth.

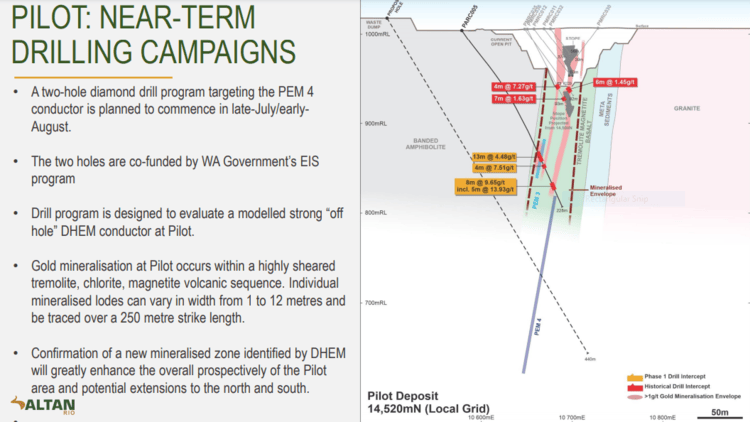

“Gold mineralisation at Pilot occurs within a highly sheared tremolite, chlorite, magnetite volcanic sequence. Individual mineralised lodes can vary in width from 1 to 12 metres and be traced over a 250-metre strike length.”

The Company began exploration at the Pilot Mine Project at the back end of 2020 (no exploration had been carried out on the property since the mid-1990s).

Pilot was mined underground back in the 1960s and reopened as an open-pit scenario between 1991 and 1994. The more recent mining effort was during a low gold price environment when ounces were changing hands at roughly $350 per oz.

Total production at Pilot was roughly 0.56 Mt @ 3.03 g/t for 54,554 oz Au.

The Company is following up on some very decent drill results going back to the 1950s. The Pilot project will likely generate Altan Rio’s first significant resource at Southern Cross. The historical data and drill logs are well intact.

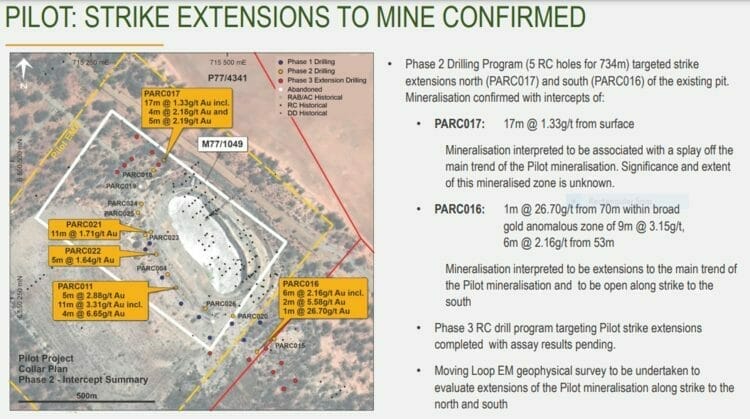

As stated further up the page, there have been three phases of drilling at Pilot by Altan Rio—results from phase-3 are pending.

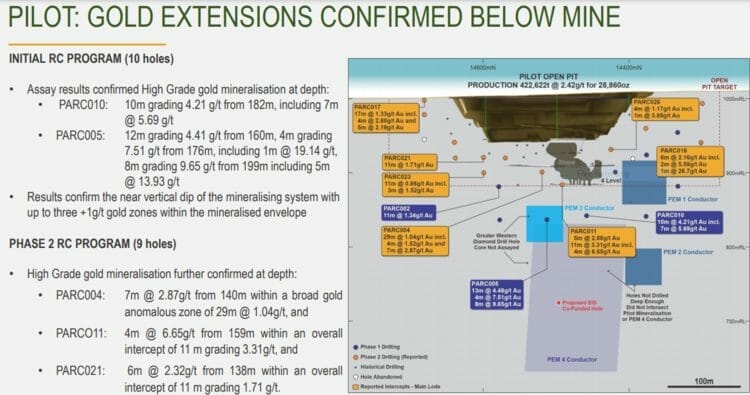

The Company originally thought Pilot would yield only modest potential. Results from recent drilling, where key targets include extensions of the historical mine, have changed that view…

Recent drill hole highlights near-surface:

- PARC017: 17 meters @ 1.33 g/t from surface;

- PARC016: 9 meters @ 3.15g/t (including 1 meter @ 26.70 g/t) from 53 metes.

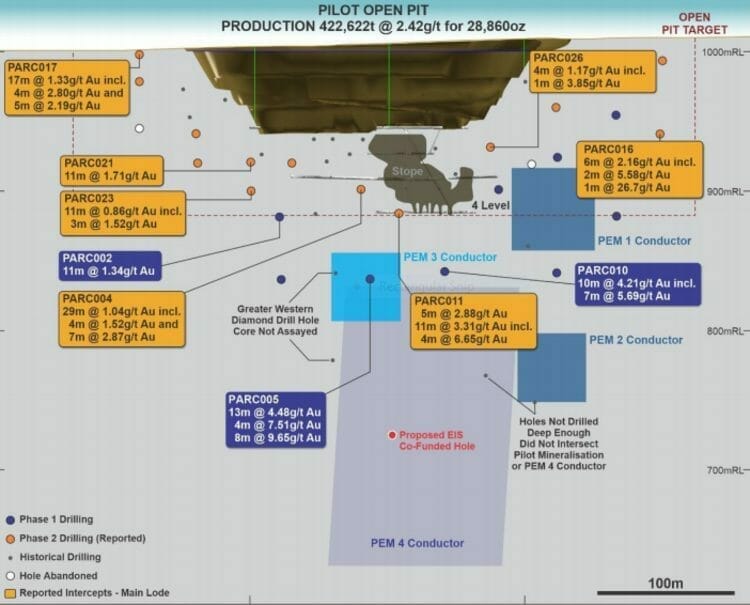

Recent drill hole highlights below the historic pit (at depth):

- PARC010: 10 meters grading 4.21 g/t from 182 meters (including 7 meters @ 5.69 g/t);

- PARC005: 12 meters grading 4.41 g/t from 160 meters, 4 meters grading 7.51 g/t from 176 meters (including 1 meter @ 19.14 g/t), 8 meters grading 9.65 g/t from 199 meters (including 5 meters @ 13.93 g/t).

PARC005 is a fat hit.

Rather than extensions off the main orebody, these recent (and historic) hits at depth may represent a parallel vein set.

Not to diminish the significant high-grade underground potential at Pilot, the Company’s current focus is on the (near-surface) open-pittable ounces as they can be rapidly fast-tracked to production. Barto’s Marvel Loch milling facility is within easy trucking distance of the project, eliminating the need to build a standalone mill.

As noted above, Pilot is a partnership agreement with Chinese-backed Barto Gold—an agreement that factors in a 50:50 profit share on future production (after taking out Altan Rio’s exploration expenses and Marto’s processing costs). This is a rare deal—a win-win.

This next map illustrates Pilot’s near-surface, open-pit potential…

The gold dots represent phase-2 drilling that successfully expanded mineralization laterally in multiple directions (hole PARC017 – 11 meters at 1.33 g/t Au started at surface). The red dots represent phase-3 pokes with the drill bit—we should see these assays within the next two weeks.

Still on the map above, everything inside the dashed gold boundary is on the 50:50 ground (Altan Rio and Barto). Everything outside that boundary is 80% Altan Rio / 20% Surveyor.

A stockpile of ore lying adjacent to the historic pit (roughly 30k tonnes grading ~1.5 g/t Au) will likely be the first load hauled off to the Marvel Loch mill.

The depth potential unlocked via modern age targeting tools

Modern age exploration techniques have opened up a window of opportunity, to more accurately probe the subsurface depths for gold-rich mineralization. Example: The presence of pyrrhotite along this greenstone belt brings modern geophysics into play.

Downhole EM surveys are giving these geological sleuths an important targeting tool to help vector in on potential high-grade orebodies at depth.

Downhole EM is not generally used in gold exploration, but it’s being applied with great success by the likes of Bellevue Gold along the prolific Wiluna-Norseman gold belt of Western Australia. The key here is the presence of pyrrhotite.

Downhole EM picked up a geophysical anomaly in what is now known as the PEM 4 Conductor—an anomaly interpreted to be associated with the sulphide-rich zone intersected in PARC005 (8 meters grading 9.65 g/t from 199 meters).

The promising nature of PEM 4 was sufficient to qualify for EIS funding—two deep holes will test the potential of this geophysical anomaly with the WA Government footing half of the bill.

The drill bit should begin turning on these two EIS co-funded drill holes within the next 4 to 6 weeks, depending on rig availability. Both drill holes will be targeting the central area within the conductor. Depth = 250 meters.

Expectations are high here.

If Pilot’s mineralization extends to the same depth as Copperhead—some 670 meters—champagne corks will be a poppin.

Once again, drilling success at depth here could repeat itself across the entire tenement creating a district-scale play. Very exciting times for the Company.

Aries

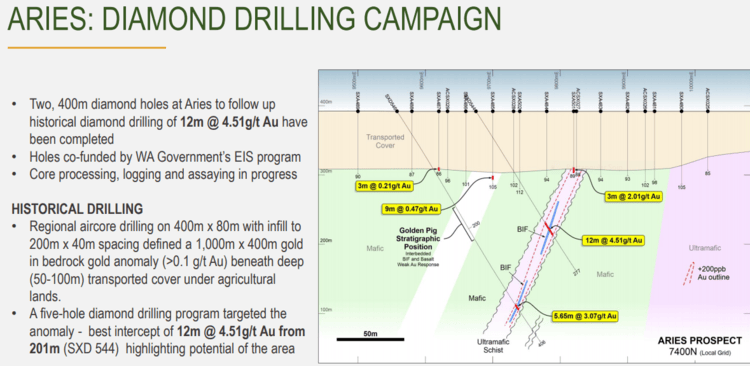

Historic drilling at the Aries Prospect tagged an interval of 12 meters grading at 4.51 g/t from 201 meters (including 1 meter at 21.4 g/t Au) from 203 meters.

Two 400 meter diamond drill holes, also co-funded by the WA gov’t, have been completed—results are expected within the next two months.

“Initial geological observations reveal both Aires holes successfully intersected targeted Banded Iron Formations (BIFs) which have been associated with gold mineralisation in nearby/neighbouring goldproducing deposits (Golden Pig). Further observations reveal the presence of quartz diopside veining with proximal amphibole and pyrrhotite sulphide alteration assemblages developed in places.”

The projects highlighted above represent only two of the five target areas Altan Rio has elevated to priority status.

Alton Rio Management

At the risk of sounding like a broken record, management is everything in the junior exploration arena (okay, nearly everything). You can have a great, company-maker of a project in the friendliest jurisdiction, but without the right team in place—a combination of gifted rock kickers and competent capital market types—things can fly apart at the seams.

Operational inefficiencies often create a processional effect that can lead to an erosion in shareholder value via reckless spending and an endless cycle of heavily dilutive raises.

One of Altan Rio’s goals is to keep the share count reasonably low by generating sufficient cash flow to fund ongoing (regional) exploration.

The Altan Rio crew is stacked with talent. If you peruse slide 6 on the Company’s pitch deck, you’ll see what I mean. Note the depth of geological and capital markets expertise.

Just two examples…

Kalgoorlie raised John Jones has an impressive resume—a prominent player in the international mining sector for over thirty years, his guiding involvement in four companies led to the discovery of four deposits and the development of eight mines.

Greg Wilson, a top-shelf geologist with a proven track record in discovery and development is credited with the discovery of >4M ounces along various Archean settings. Example: the +500Koz Strezlecki deposit which now forms part of the 5Moz Kundana gold camp owned by Northern Star. Greg has examined opportunities up and down the Southern Cross Greenstone Belt. He knows his Southern Cross rocks.

Final thought

Alton Rio’s efforts to unlock the vast, unexplored potential of its northern half of the Southern Cross Greenstone Belt are at a very early stage. This might be considered a ground-floor opportunity.

Though Altan Rio’s CEO, Paul Stephen, would prefer NOT to arm wave and would rather surprise shareholders if things play out in their favor, the potential for near-term cash flow is very real.

More importantly, the Company is set to enter a period of significant assay-related newsflow.

END

—Greg Nolan

Full disclosure: Altan Rio is an Equity Guru marketing client.

Postscript…

Australia surpasses China in gold production

“Australian gold production for the first half of 2021 was four tonnes more than China’s figures for the same period, according to Melbourne consulting group Surbiton Associates.

From January to June, Australia produced 157 tonnes of gold, with 74 tonnes in the March quarter and 83 tonnes in the June quarter.”