Bioasis is a preclinical biopharmaceutical company focused on research and early-stage development of technologies and products for the treatment of patients with the central nervous system, or CNS, diseases, and disorders.

In layman’s terms, this is a company that researches and develops products for the diagnosis and treatment of neurological diseases and disorders.

The company believes that its single goal is

“Revolutionizing science by transporting therapeutic payloads across the blood-brain barrier and into the brain”

They believe that excessively focusing on this one goal will allow them to create shareowner value in the long term.

As much as a good slogan and goal can lead the culture of the business it’s always good to see this reflected in the fundamentals of the company as well. Fundamentals unlike corporate culture and management’s capabilities are easier yardsticks to use when it comes to valuing a business. This does not mean that they are the most important but they sure as hell how close to being the best measure for the performance of the business over time.

Knowing that I thought it would be pretty informative to look at Bioasis business performance from Q1 2020 till Q2 2021.

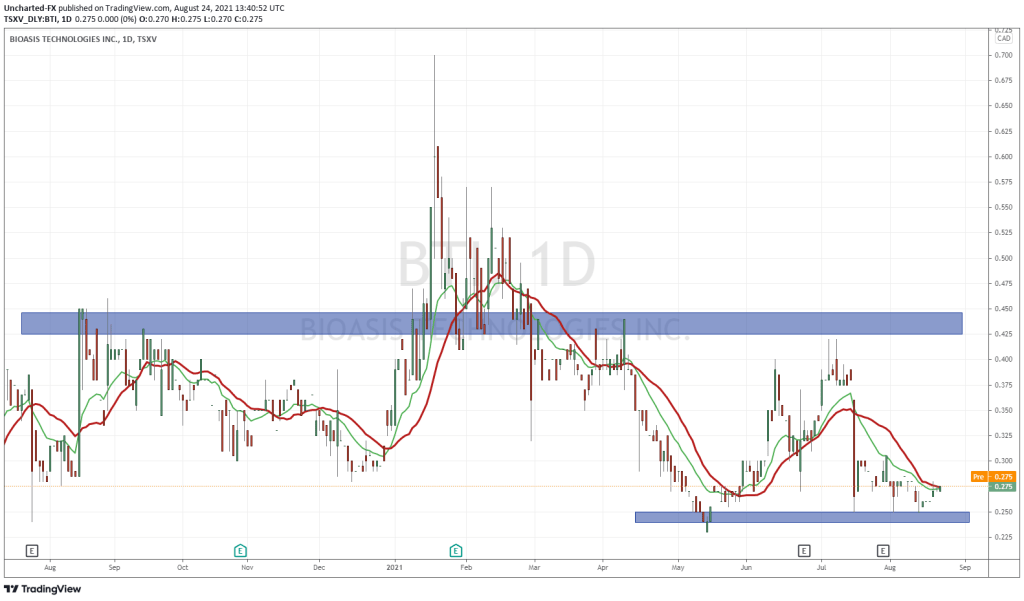

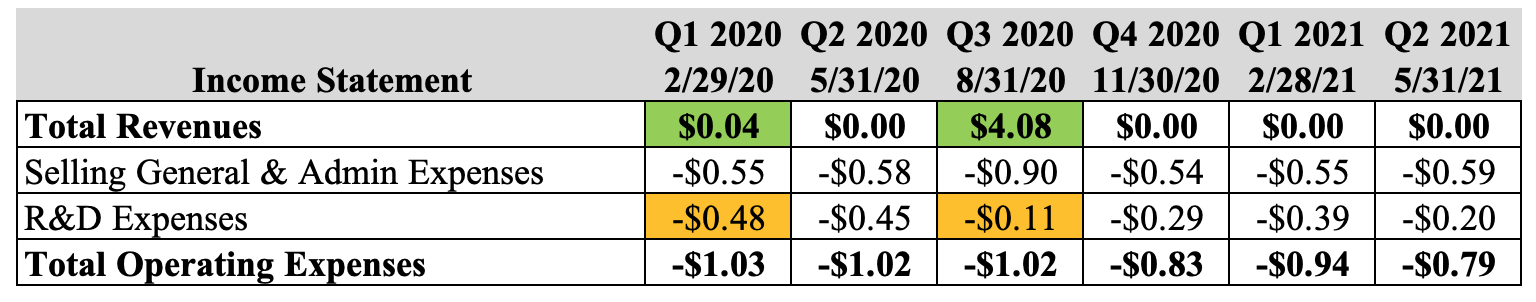

The first place we start off is the top-line figure. Simply put a business that has a viable product for its addressable market usually generates sales unless it’s at the beginning of its development stage where is it still establishing itself. Bioasis is still at the beginning of its journey and focuses mainly on early-stage development technologies meaning that sales would be very cyclical depending on the research that the company has previously done.

As you notice the business has only been able to generate sales, In the period we’re analyzing, in Q1 2020 and Q3 2020. Since then, they haven’t been able to generate any sales, but the Q3 2020 figures give us an indication of what the business can do when it does generate some sales.

In Q3 2020 the company generated $4.08 million in sales and spent close to $900,000 in selling and general https://e4njohordzs.exactdn.com/wp-content/uploads/2021/10/tnw8sVO3j-2.pngistrative expenses. Since it is a research-based company, you would expect R&D is an ever-present and fluctuating expense.

Continuing with Q3 2020 we notice that the total operating expenses were $1.02 million in that quarter generating a net operating income of $3.06 million. A quick note here about total operating expenses. There is a persistent trend when it comes to their total expenses, and this is either a function of the management’s ability to control costs or can be an early indication that once sales ramps up there will be a need to increase selling and general https://e4njohordzs.exactdn.com/wp-content/uploads/2021/10/tnw8sVO3j-2.pngistrative expenses as well. There is no sure-fire way of telling which direction this would go but it would serve us well to keep that in mind as we continue to look at their numbers in the future.

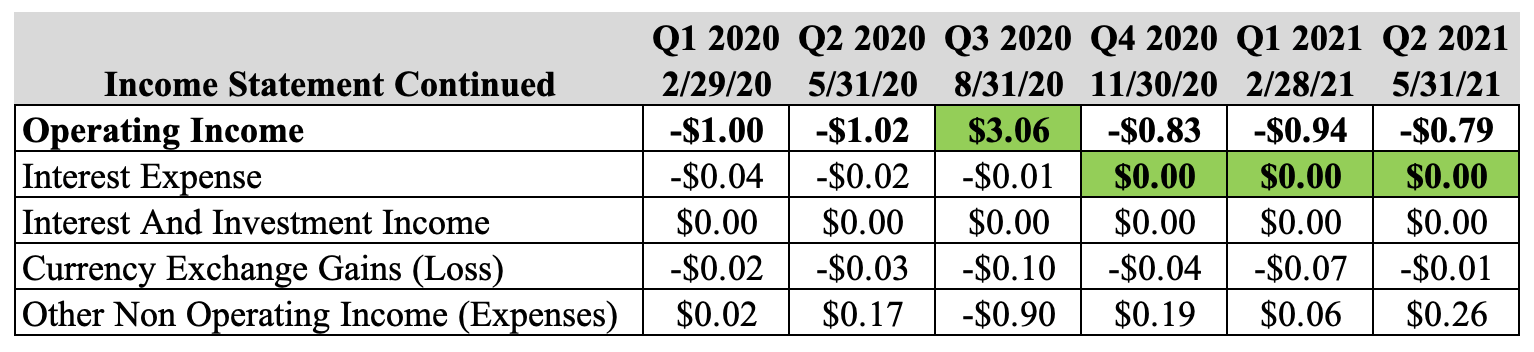

Continuing down the income statement we can see the $3.06 million in operating income generated in that quarter. This is a great indication of the firms’ ability to generate positive income when they have a large amount of sales volume showing that their business model is profitable. I do feel that this profitability is at a certain sales volume and if they were to generate more sales, we might see selling and general https://e4njohordzs.exactdn.com/wp-content/uploads/2021/10/tnw8sVO3j-2.pngistrative expenses increasing as they try to cope with this new capacity.

All in all, the $3.6 million is a good indication of potential profitability for the business although they are still growing at scale. After that there aren’t many significant costs outside of their interest payments and other non-operating expenses, so we can go straight to the unusual items.

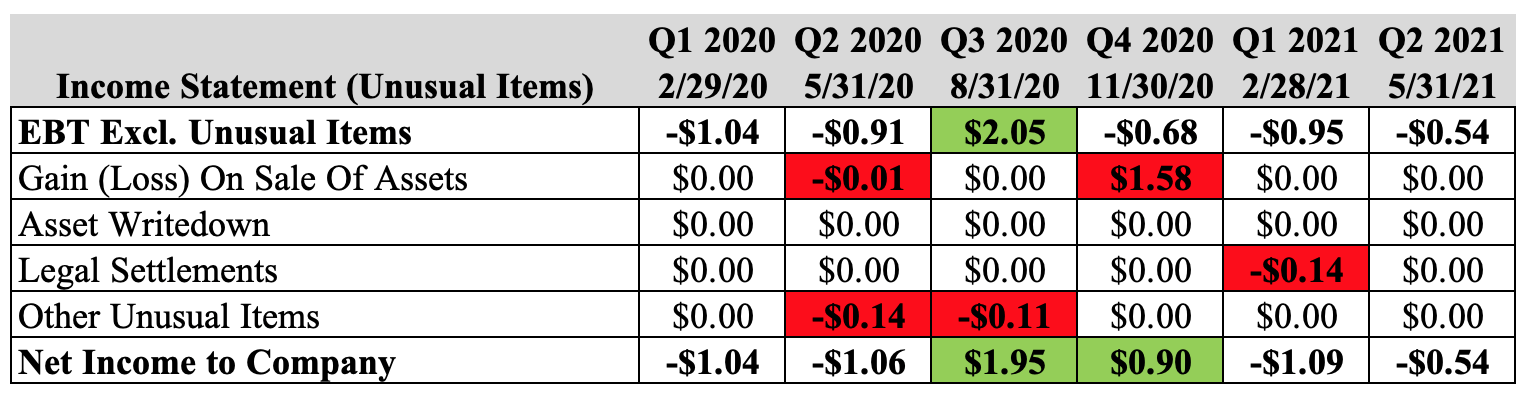

When accountants described unusual items, they usually mean nonrecurring and nonoperational changes in the income statement. These are not fundamental to the operations of the business and are usually one-time income or expense changes. For example, in Q4 2020 the company had a gain on a sale of assets of $1.58 million. In their quarterly reports, they call this a gain on sale of royalty rights.

Although the business might generate net cash from this transaction it would be misleading to use this as an indication of the profitability of the business. You notice that the earnings before taxes excluding unusual items was negative $0.68 million and once you added the gain on the sale of the asset of 1.58 million, they generated net income in that quarter of $0.9 million. If we were to adjust for these nonoperating activities that quarter the company would have generated a negative $0.68 million in net income.

We do not have to make any adjustments for Q3 2020, although they do have an expense of $0.11 million, and can assume $1.95 is a clean net income figure for the quarter. What we learn from this simple breakdown is that

- they are able to generate a profit from their business model by keeping costs low

- the firm is asset-light and does not need large amounts of money to be deployed into capital expenditures (they generated $2.24 million in simple free cash in Q3 2020)

- they need to continuously deploy money into research projects and personal to keep the sales pipe-line healthy

- they do not have many unusual items outside of one-time sales of royalty propety assets, legal settlements, and other items.

Although the sales outlook is unpredictable the management team seems to have the experience and know-how to keep costs low and deploy cash on hand productively for the shareowners.