17 months ago, silver couldn’t get a date on tinder ($12/ounce)

Suddenly – a year ago – it was an object of mass desire ($29/ounce)

These days, fewer investors are swiping right – but the old girl still has legs.

Silver is currently trading at $23/ounce, up from $12 in March, 2020 on safe-haven and industrial demand, and “green energy” stimulus.

Silver often gets lumped in with gold as a hedge again money-printing.

That’s valid, but unlike gold – it is a vital ingredient in modern machinery.

For instance, silver is used as conductive layer in solar panels.

“More than $50 billion of green stimulus has been approved by governments,” states BMO Capital Markets. “The Biden Clean Energy plan would see new wind and solar capacity built to displace thermal generation.”

“Silver’s potential exposure to green stimulus is now an important tool in its armory.” continued BMO.

The automotive industry will use approximately 61 million ounces of silver in 2021, according to a report published by The Silver Institute.

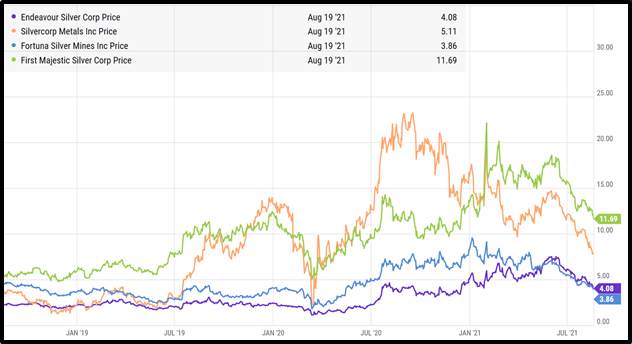

The oscillation of silver sentiment can be seen in the 3-year share price performance of Endeavor Silver (EXK.NYSE), Silvercorp (SVM.T), Fortuna Silver (FSM.NYSE) and First Majestic Silver (AG.NYSE).

Here are 10 silver companies with aggressive leverage to higher silver prices – unhedged production or near-production companies.

As a general rule (not infallible), bigger companies carry lower risks and lower rewards, while smaller companies offer higher risks and higher rewards.

These silver companies are listed from the smallest market cap to biggest.

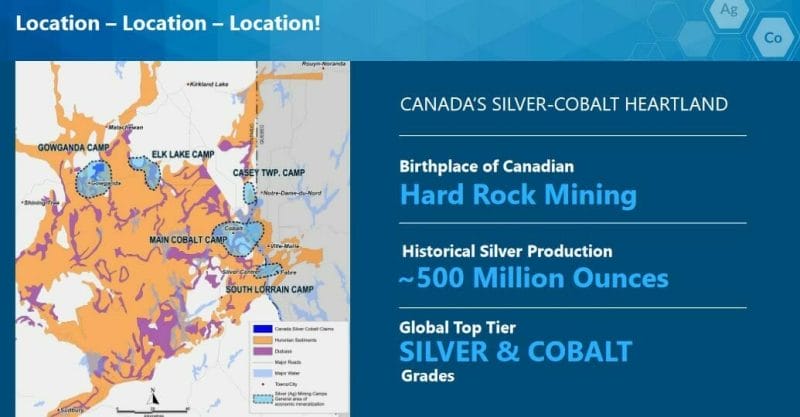

Canada Silver Cobalt Works (CCW.V) is a $12 million development company in northern Ontario’s Silver-Cobalt Camp with a high-grade silver resource (8,582 g/t or 200.2 oz/ton Ag).

August 19, 2021 Drilling Highlights:

- Hole CS-21-61 with an exceptional intercept grading 30,416.91 g/tonne silver (887.31 oz/ton Ag) over 0.42m at a downhole depth of 449.55-449.97m with a gold equivalent grade of 425.94 g/tonne Au (12.42 oz/ton Au). This incredibly mineralized vein is located 35m south from the Robinson Zone discovery hole CA-11-08, and 60m west of Big Silver discovery hole CS-20-39. The Company currently believes this intercept belongs to a brand-new vein structure, independent from both the Robinson Zone and the Big Silver vein.

- The first intercept in hole CS-21-65 contains 7,328.47 g/tonne silver (213.77 oz/ton Ag) over 0.38m at a downhole depth of 254.03-254.41m with a gold equivalent grade of 102.62 g/tonne Au (2.99 oz/ton Au). This intercept is located 230m below the surface, 70m to the south and 220m above the Robinson Zone. To date, this is the closest high-grade intercept to surface and is located within Archean lithologies.

- The second intercept in hole CS-21-65 contains 1,883.21 g/tonne silver (54.93 oz/ton Ag) over 0.42m at a downhole depth of 421-421.42m with a gold equivalent grade of 26.37 g/tonne Au (0.77 oz/ton Au).

Canasil Resource (CLZ.V) is a $15 million company with a portfolio of silver-gold-copper-lead-zinc exploration projects in Mexico and British Columbia, Canada, including several drill ready projects poised for discovery, providing high upside potential with low downside risk.

- 1.70 metres (m), true width (TW) 1.53 m with 20.59 g/t gold and 1,290 g/t silver for 2,783 g/t AgEq* from the Candy vein, including;

- 0.70 m (TW 0.63 m) with 43.70 g/t gold and 1,290 g/t silver for 4,458 g/t Ag Eq*.

- 3.63 m (TW 3.29 m) with 6.44 g/t gold and 884 g/t silver for 1,355 g/t AgEq*, up-hole from the above intercept, referred to as the Candy hanging wall structure, including;

- 2.03 m (1.84 m TW) with 8.45 g/t gold and 1,021 g/t silver for 1,634 g/t AgEq*, and;

- 0.50 m (TW 0.45 m) with 15.6 g/t gold and 561 g/t silver for 1,692 g/t AgEq*.

- 3.00 m (TW 2.71 m) carrying 2.76 g/t gold and 250 g/t silver for 450 g/t AgEq*, in a lower intercept, referred to as the Candy foot wall structure, including;

- 1.00 m (0.90 m TW) with 6.19 g/t gold and 319 g/t silver for 768 g/t AgEq*.

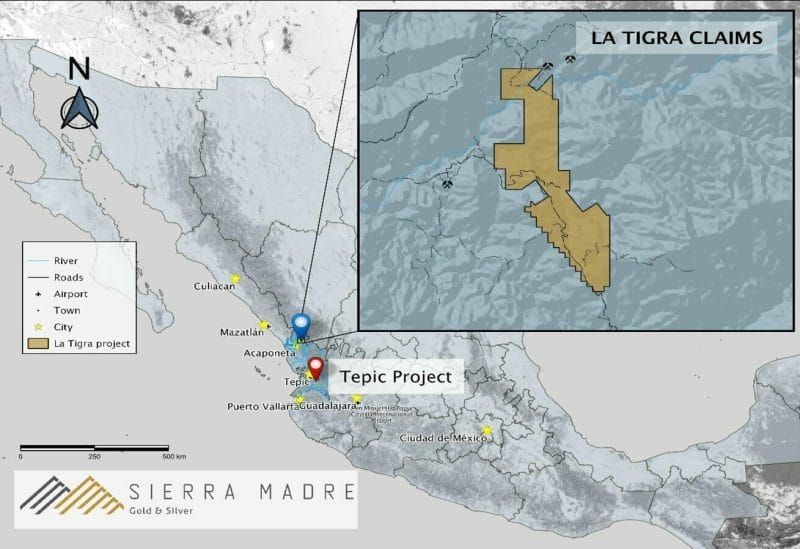

Sierra Madre Gold and Silver (SM.V) is a $37 million company focused on the acquisition, exploration and development of the Tepic Property in Nayarit, Mexico.

Fifteen kilometers from a regional airport, Tepic includes five mining concessions covering a total of 2,612.5 hectares. At Tepic, a 2,000-meter Phase 1 reverse circulation drilling began on April 15th.

Last month SM acquired an option to joint venture for the La Tigra Project, located 148 kilometres north of the Sierra Madre’s flagship Tepic Project in the mining-friendly state of Nayarit, Mexico.

According to reports published by the Mexican department of geology, about 2,500 gold and silver hand-miners worked in La Tigra prior to 1900.

SM has a veteran management team with a reputation for moving quickly. The SM geological team is lead by Gregory Liller (B.SC), who has been operating in Mexico since 1993, playing a key role in the discovery and development of more than 11 million ounces of gold and 600 million ounces of silver.

The CEO Alex Langer considers Liller a key asset to Sierra Madre. “Making one metal discovery could be good luck,” commented Langer. “Making six or seven is not.”

Impact Silver (IPT.V) is a $63 million dollar silver miner, operating two processing plants on adjacent districts within its 100% owned mineral concessions covering 211 km2 in central Mexico. Over the past 15 years, Impact has produced over 11.1 million ounces of silver, generating revenues over $216 million, with no long-term debt.

- Revenue for Q2 2021 was $4.2 million, an increase of 50% from 2020 of $2.8 million.

- EBITDA was $0.8 million for quarter, a substantial increase over $0.2 million for comparable period in 2020.

- Mine operating earnings before amortization and depletion for Q2 2021 were $1.3 million, improving from $1.0 million in 2020.

- Net income for the quarter was $0.2 million compared to a loss of $0.2 million in 2020.

- Net working capital for the Company at June 30, 2021 was $22.8 million compared to $5.7 million in Q2 2020.

- The Company continues to have no long-term debt.

Q2 2021 Production Overview

- Throughput at the mill was 37,833 tonnes milled in Q2 2021 compared to 25,602 tonnes in 2020. In Q2 2020 operations were temporarily suspended due to COVID-19 by government decree.

- Average mill feed grade for silver was 147 grams per tonne (g/t) in Q2 2021, a decrease of 21% from 187 g/t in Q2 2020 as a result of increased processing of development muck and declining grades in an older level of the Guadalupe mine.

- Q2 2021 silver production was 150,331 ounces (2020 — 129,570 ounces).

- Revenue per tonne sold was $119.69 in Q2 2021, an increase of 2% from same period 2020 at $117.81, dropping back from $124.17 in Q1 2021 on lower silver prices.

- Direct costs per production tonne were $81.51 in Q2 2021, a 6% change from 2020’s comparative period of $76.66.

Here’s the CFO Jerry Huang talking about the IPT investment opportunity [Full Disclosure: I directed this video].

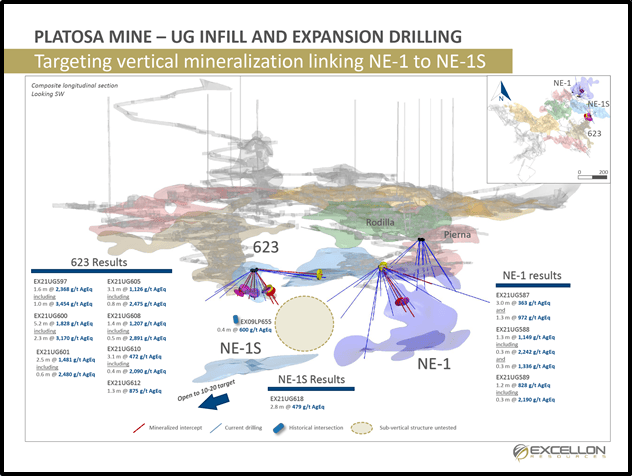

Excellon Resources (EXN.V) is a $72 million company with a precious metals pipeline that includes Platosa, a Mexico’s high-grade silver mine, and an option on Silver City, a high-grade epithermal silver district in Saxony, Germany.

August 18, 2021 underground drilling results from the Platosa Mine.

- Further definition and expansion of the 623, NE-1 and NE-1S Mantos, with diamond drilling results from underground including:

- 1,828 g/t silver equivalent (“AgEq”) over 5.2 metres (1,051 g/t Ag, 12.1% Pb, 13.1% Zn and 0.2 g/t Au) in EX21UG600;

- 2,368 g/t AgEq over 1.6 metres (1,647 g/t Ag, 12.3% Pb, 11.6% Zn and 0.1 g/t Au) in EX21UG597; and

- 1,481 g/t AgEq over 2.5 metres (784 g/t Ag, 7.7% Pb, 13.9% Zn and 0.3 g/t Au) in EX21UG601

- Drilling from underground continues to define and delineate mineralization in areas ahead of production and outside of the current mine plan

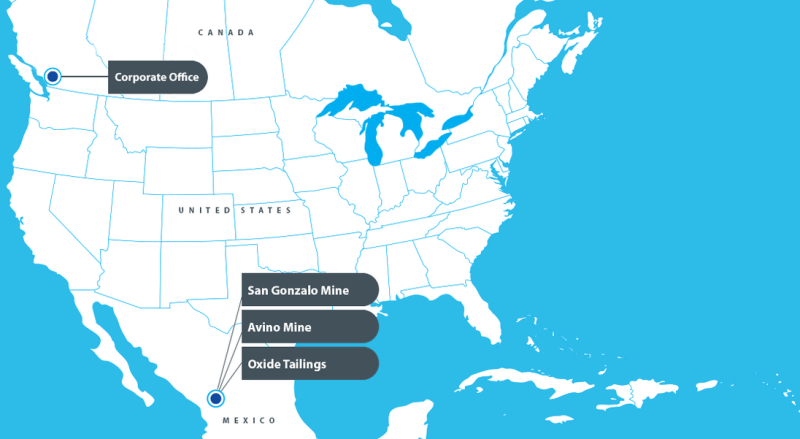

Avino Silver & Gold Mines (ASM.V) – is a $115 million company, operating its 99.28% owned Mine near Durango, Mexico. Year-to date, ASM produced about 3,500 ounces of silver.

Second Quarter 2021 Financial Highlights

- Ending cash balance of $26.8 million

- Ending working capital of $30.4 million

- Reduction in debt liabilities by $1.7 million since the beginning of the year

- Mine operating losses of $1.7 million

- Net losses from continuing operations of $2.7 million, or $0.03 per share

- Losses before interest, taxes, depreciation, and amortization (“EBITDA”)1 of $2.9 million

- Adjusted losses1 of $0.8 million

Bear Creek Mining (BCM.V) is a $170 million Peru-focused silver exploration and development company. The 100% owned Corani silver-lead-zinc deposit is one of the largest, fully permitted silver deposits in the world, and comes with substantial base metal credits.

Corani contains 225 million ounces of silver, 2.7 billion pounds of lead and 1.8 billion pounds of zinc, and is expected to produce over 9.6 million ounces of silver and 165 million pounds of combined lead and zinc annually over a projected 15-year mine life. Corani projects a $113 million increase in NPV for every $1 increase in silver price with proportional changes in lead and zinc prices.

BCM recently raised $34 million, pumping some of that money back into the local community.

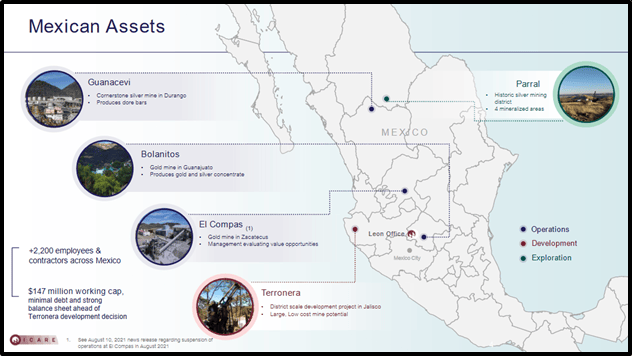

Endeavour Silver (EDR.T) is a $900 million company operating three, underground, silver-gold mines in Mexico. In Q2 2021, net revenue increased 136% to $47.7 million as a result of higher metal prices and increased production.

2021 Second Quarter Highlights

- Metal Production: Produced 1,073,724 ounces (oz) silver, up 80% and 11,166 oz gold, up 92%, in-line with guidance for 2.0 million oz silver equivalent (AgEq), up 85%, at an 80:1 silver:gold ratio, compared to Q2, 2020 when operations were suspended due to COVID-19 for a portion of the period.

- Net Revenue: Totaled $47.7 million, up 136%, from the sale of 1,120,266 oz silver and 9,810 oz gold at average realized prices of $26.82 per oz silver and $1,866 per oz gold. Management withheld metal sales in Q1, 2021 and continues to carry higher metal inventory totaling 459,659 oz silver and 1,891 oz gold of bullion inventory and 12,159 oz silver and 944 oz gold in concentrate inventory.

- Operating Costs: Cash cost(1) $13.03 per oz payable silver, up 369% year-on-year and all-in sustaining cost (AISC)(1) $25.39 per oz payable silver, up 70% year-on-year, net of gold credits. Operating costs were higher than budgeted due to global supply chain constraints creating inflationary pressures, increased labor costs, a strengthening Mexican Peso and increased operating development at Guanacevi.

- Strong Balance Sheet: Cash position $125.2 million and working capital $146.8 million. Raised $28.4 million in equity financing through an ATM facility, net of issuance costs. Only remaining term liabilities are equipment loans of $7.8 million.

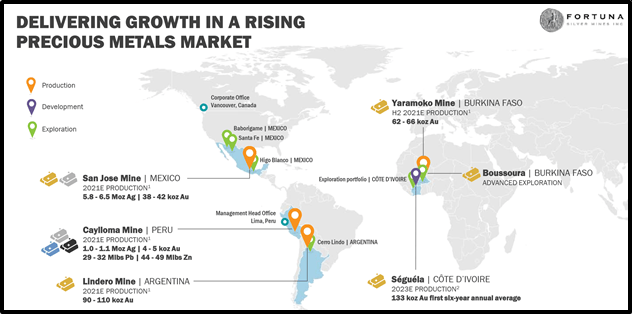

Fortuna Silver Mines (FVI.V) is a $1.4 billion company with precious metals mining company with four operating mines in Argentina, Burkina Faso, Mexico and Peru, and an advanced development project in Côte d’Ivoire.

August 11, 2021 announced Q2, 2021 Highlights

- Record sales of $120.5 million, an increase of 171% from the $44.5 million reported in the same period in 2020 (“Q2 2020”), due to higher gold and silver sales volumes and higher realized prices for all metals, and sales from the Lindero mine of $ 34.2 million

- Net income of $16.2 million or $0.09 per share, an increase of $21.9 million and $0.12 per share, from the $5.7 million net loss or $0.03 net loss per share reported in Q2 2020

- Adjusted net income1 of $21.5 million compared to $5.1 million net loss in Q2 2020

- Adjusted EBITDA1 of $54.9 million compared to $9.4 million reported in Q2 2020

- Free cash flow from ongoing operations1 of $18.5 million compared to $0.2 million reported in Q2 2020

- As of June 30, 2021, the Company had cash and cash equivalents of $121.8 million, a decrease of $10.1 million from December 31, 2020, primarily due to a $35.3 million promissory note that was provided to Roxgold Inc. (“Roxgold”) to cover a portion of the expected acquisition closing costs

- Silver and gold production of 1,892,822 ounces and 31,048 ounces, respectively

- AISC1, per silver equivalent ounce of payable silver sold of $13.61 and $18.45 for the San Jose Mine and Caylloma Mine, respectively, and AISC1 per ounce of gold sold of $1,214 for the Lindero Mine

- Completed the business combination with Roxgold on July 2, 2021 creating a low-cost intermediate global precious metals producer with extensive brownfields and greenfields organic growth potential in the Americas and West Africa; and led by a highly experienced management team

First Majestic Silver (TSX: FR.T) is $3.8 billion company that owns 100% of four producing mines: the San Dimas Silver/Gold Mine, the Jerritt Canyon Gold Mine, the Santa Elena Silver/Gold Mine and the La Encantada Silver Mine.

From August 16, 2021 Q2, 2021 Financials:

- Revenues reached a new Company record of $154.1 million following the inclusion of approximately two months of production from the Jerritt Canyon mine in Nevada and robust production from the Mexican operations

- Average realized silver price per ounce of $27.32, a 1% increase compared to Q1 2021

- Cash costs increased to $13.89 per AgEq ounce, compared to $12.61 in Q1 2021, primarily due to higher ore development and the addition of the Jerritt Canyon operation

- AISC were relatively unchanged at $19.42 per AgEq ounce, compared to $19.35 in Q1 2021

- Mine operating earnings of $29.4 million, compared to $28.1 million in Q1 2021

- Net earnings of $15.6 million (EPS of $0.06), compared to $1.9 million (EPS of $0.01) in Q1 2021

- Adjusted EPS of $0.05 after excluding non-cash and non-recurring items, compared to $0.03 in Q1 2021 (non-GAAP)

- Cash flow per share was $0.21 per share (non-GAAP), compared to $0.14 per share in Q1 2021

- Cash and cash equivalents as of June 30, 2021 was $227.1 million. In addition, the Company has a strong working capital position of $276.3 million and total available liquidity of $316.3 million, including $40.0 million of available undrawn revolving credit facility

- Declared a cash dividend payment of $0.006 per common share for the second quarter of 2021 for shareholders of record as of the close of business on August 26, 2021, and will be distributed on or about September 16, 2021

The gold-silver ratio is used by chartists to assess the value of gold & silver relative to each other. Gold usually leads the way – the ratio widens – then silver catches up.

In 1792, the gold/silver price ratio was fixed in the U.S. at 15:1, which meant that one ounce of gold was worth 15 ounces of silver. For most of the 20th Century, it averaged about 45.

Last year, the gold/silver ratio charged fearlessly from 80 to 124 – saw its own reflection – then scurried back to 65.

The ratio is now at 75 – suggesting silver has room to move higher.

“The recent selling in silver has come from tactical players, as evidenced by a sharp reduction in managed money longs on COMEX,” states Metal Focus, “Silver ETPs also witnessed outflows, albeit modestly, leaving holdings just 5% below February’s all-time high.”

“With trend following selling largely done and the hawkish tilt factored in, this should leave scope for fresh investment inflows later this year, leading to a healthy rebound in silver prices in the coming months,” added Metal Focus.

Last summer’s silver buzz has died down.

It’s counter-intuitive – but this is a buy-signal.

– Lukas Kane

Full Disclosure: None of these silver companies are Equity Guru clients.