Originally posted July 12:

Another day, another milestone for Gold Mountain and its flagship Elk Gold Project in the mining-friendly region of Merritt B.C.

On July 9th, the Province—the Ministry of Energy, Mines & Low Carbon Innovation Communications Office (EMLI for short)—notified Gold Mountain that final comments from all parties concerned (local communities, the Mine Review Committee, the Company itself) are in hand.

Gold Mountain Receives Update from the Ministry of Mines

The province is now positioned to issue a final mine permit for the Company’s 21,187-hectare flagship asset.

By receiving all comments from stakeholders, EMLI is in a position to finalize the mine permit and submit it to the statutory decision maker. Gold Mountain’s permit amendment application was submitted to provincial regulators in May ‘20. In total there have been three rounds of review and responses regarding components of the application, which the Company promptly answered to ensure it maintained its permitting timeline.

With this milestone, the Company’s portion of the mine permitting process has concluded and will be notified once the permit has been submitted to the statutory decision maker. Gold Mountain is anticipating this process to take approximately two weeks and the Company remains on schedule for ore delivery to New Afton in October.

Kevin Smith, CEO:

“This is an important milestone for Gold Mountain and marks the conclusion of the review and information request portion of the permit amendment process. All information is now in the hands of provincial regulators and based on our communications we anticipate delivery of the permit in the coming weeks. We’d like to thank the surrounding Indigenous communities for their input and guidance on how best to develop the project. We also recognize that this is just the first step of many and look forward to continued engagement and consultation as the mine transitions into production.”

It’s important to note that this final permit review process has been delayed by several weeks due to the recent residential school discovery in Kamloops, a tragedy, the scale of which has shaken the province, and the rest of the country, to its very core.

“The Company was in full support of affording additional time and felt it was the only appropriate choice to allow for local Indigenous communities and governments to have a chance to properly review and make final comments on the proposed conditions of the permit.”

Gold Mountain anticipates the granting of this final permit by the end of July. This timing plays well with the Company’s plan to deliver its first load of ore to New Gold’s New Afton mill in October of this year.

The Company expects to be cash flowing in November.

Today’s press release goes on to state that this mine permit represents the last major hurdle in putting the Elk project into production—its receipt bolsters management’s confidence that all remaining permissions will follow directly: Explosives Storage and Use, Bulk Explosives Use, Road Use, Effluent Discharge, Industrial Access, and Free Use (forest use).

“The Company is actively pursuing the receipt of all necessary authorizations and does not anticipate any delays in its production schedule resulting from the failure to hold any required authorization.”

Meanwhile, construction at the Elk project is at full tilt. Mining partner Nhwelmen-Lake is currently stripping waste rock, exposing the shallow high-grade mineralization that will feed the New Afton mill for the first few years of Gold Mountain’s mine plan.

CEO Smith:

“Our timelines and company goals have always been considered aggressive, but we have shown our ability to execute and continue to deliver shareholder value as we build BC’s next Gold and Silver producer.”

Fully cashed up – a whole new gear

After closing a $12M bought deal PP on June 24th, the Company is finding a whole new gear as it pushes the Elk project aggressively along the development and exploration curve.

On the subject of exploration, the Company’s exploration contractor, HEG Explorations Services Inc, is continuing to drill off the property in an aggressive 10,000-meter Phase-2 campaign.

Initial results from Phase-2 continue to extend the deposit’s mineralization down-dip, demonstrating good (vein) continuity at depth.

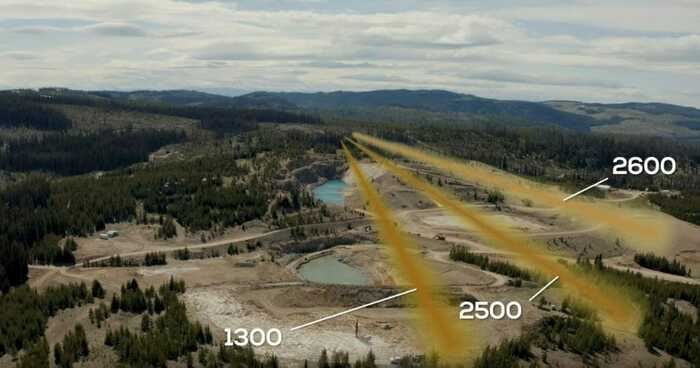

In targeting the 1300, 2500, and 2600 veins along the Siwash North zone, the following intercepts were highlighted in a June 30th press release:

- 1.0 meter grading 17.3g/t Au including 0.73 meters of 24.4g/t Au;

- 1.3 meters grading 13.9g/t Au including 0.30 meters of 60.4g/t Au;

- 1.12 meters grading 6.4g/t Au including 0.30 meters of 24.0g/t Au.

Grant Carlson, COO (from a Youtube video attached to this June 30th exploration update):

“Right now, the drill is located south of pit one and it’s drilling through the 1300 2500 2600 veins. This is very efficient and cost-effective because we’re able to intercept three mineralized zones with each hole.

We learned in phase one that as we chase the veins further west, they’re starting to converge and the results from this drilling in phase two is confirming that model”.

In addition to this 10,000 meter Phase-2 program, the Company has deployed a crew of eight geologists to scour the immediate subsurface layers at the Elusive zone located approximately 4.5 kilometers to the south of the soon-to-be producing pits. A soil sampling campaign is targeting a gold-in-soil anomaly—the second-highest on the property in terms of grade—along with numerous copper showings.

By methodically exploring the property and stacking data—establishing positively correlated layers of (alteration) mapping, geochemical, geophysical intel—the company increases the odds of tagging a significant new discovery along these highly prospective 21,187-hectares.

COO Carlson:

“By pairing our geochemical data with our magnetic survey and alteration mapping it will allow us to paint a bullseye of where we need to drill.”

The Elusive zone could represent a bulk tonnage style deposit that could move the needle for this near-term producer/developer/explorer in a big way.

Final thought

Initially, GMTN management was intent on establishing itself as BC’s next Gold and Silver producer. Now, with a goal of bumping up its current high-grade ounce count—651,000 ozs Measured & Indicated plus 159,000 ozs Inferred—to a million AuEq ounces by this fall, the Company is intent on becoming BC’s next million ounce Gold and Silver producer.

We stand to watch.

END

—Greg Nolan

Full disclosure: Gold Mountain is an Equity Guru marketing client