Bitcoin is the grand-daddy of cryptocurrencies. It’s the OG. The one crypto that your uncle knows about because he’s seen it on television, but he doesn’t understand it and doesn’t think it’ll go anywhere or do anything, because it’s absolutely worthless and has no value and … you get it.

But regardless of your uncle’s confused tirades, it seems that Bitcoin’s here to stay.

Bitcoin has attracted some big names and there seems to be an entire sea of peculiarly named coins and tokens trailing behind it. Big name banks bounce back and forth between acceptance and assault, and now there’s this whole thing with China banning something called mining, and Texas is open for business. How is this possible for a coin with no hope, no value and no future? I get that the entire world has probably turned on its head in the past ten years, and you feel like you’ve been living in the embodiment of a Talking Heads song asking yourself ‘well, how did I get here?’

So with apologies to David Byrne, if you’ve read this far you’re probably here to learn about Bitcoin so let’s get started.

Who is Satoshi Nakamoto?

The principle face behind the creation of Bitcoin belongs to a person (or collective) known as Satoshi Nakamoto.

If Bitcoin achieves half of the promise that its adherents (including yours truly) believe it will, Nakamoto will be remembered as a quasi-mythical figure who brought it all to fruition and then vanished without trace. The reality is that nobody really knows who he is, was, or even if he’s an individual and not the voice of a collective of programmers.

What is known is that someone claiming to be Satoshi Nakamoto made something called Bitcoin in 2007 and Bitcoin.org made an appearance by August of the next year. By October, he’d published the white paper on the cryptography list at metzdowd.com.

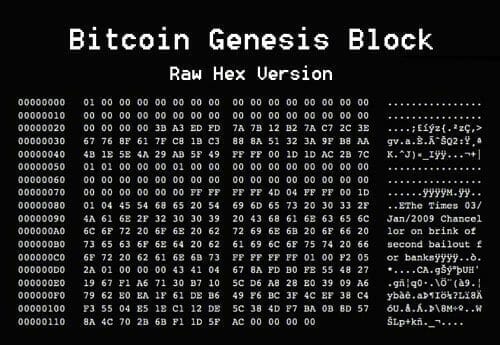

By January, he’d released version 0.1 of the bitcoin software on SourceForge and launched the network by mining the genesis block (block zero), along with a story from The Times that does double duty as timestamp and ideological justification. “The Times 03/Jan/2009 Chancellor on brink of second bailout for banks

The first Satoshi Nakamoto statue is due to make an appearance later on this year in Budapest, Hungary.

Read more:

Deciphering Cryptocurrency: Where in the world is Satoshi Nakamoto?

The Bitcoin ledger started recording data in January 2009. At the time it was the faddish brainchild of computer and economics nerds. The cyberlibertarian proto-unabomber crowd fell in love because they could have their little anti-government coin and a way to buy their fertilizer without the government looking over their shoulder at everything they did. Mostly, though, it was spent on pizza, when it was spent at all.

These were the early years. It went through sufficient price development bumps as the reach of the network spread

The technical nonspecifics: an aside

Bitcoin is what’s known as a single hash algorithm coin (SHA). Without getting too far into the weeds with the technical specifics, you can consider the SHA-256 function (which is its full name) as bitcoin’s means to generate verifiably random numbers in a way that needs a predictable amount of computational effort. Generating the hash with a value less than the current target is what’s required to close the block and get you some bitcoin.

And that’s the stripped-down, simple answer. The really simple answer, and the one most folks need to know, is that it requires a lot of computational power to do some fancy math to solve the problem that closes the block.

Bitcoin’s white paper is called Bitcoin: A Peer-to-Peer Electronic Cash System. If reading it makes you even more confused, don’t worry. This stuff has a fairly steep learning curve.”

The Wild West

In 2011, libertarian and former Eagle Scout Ross Ulbricht christened himself the Dread Pirate Roberts after his favourite The Princess Bride character and opened up, Silk Road, the first marketplace on the Darkweb. It was the place on the net where you could use Bitcoin to buy any variety of horrible black market items from guns to crack to people.

It took the United States government four years to bring his ass down.

Over the next four years, we saw the rise and collapse of unregulated exchanges largely on the backs of Bitcoin, which gave Bitcoin (and cryptocurrency in general) a black eye and a bad odour, which has only recently started to lift.

Bitcoin’s Bastards

Some terminology explained: Hard Fork.

‘A hard fork alters the validity of previous transactions on the chain, making them either valid or invalid depending on the change. A chain split creates two or more competing versions of the original chain that share the same history up to a certain point. One path follows the new upgraded blockchain and the original coin continues along the old path. All of the infrastructure running previous versions will need to upgrade to the newest version. Usually, folks using the old blockchain realize that theirs is now obsolete and upgrade to the latest version. Sometimes, though, miners can’t reach a consensus on which coin should be followed and this facilitates the creation of a second, competing coin with all of its own infrastructure.’ A heavy percentage of the cryptocurrencies out there presently in the market are either hard forks of the original Bitcoin core code, or directly augmented variations of its source code. This includes some of the more popular coins: This non-exhaustive list includes Bitcoin Cash, Litecoin, Bitcoin Gold, Bitcoin SV, and a few others that have faded into history.

Now firmly on the radars of countries around the world, the US Financial Crimes Enforcement Network (FinCEN) determined regulatory guidelines for what they called decentralized virtual currencies, classifying miners who sell their bitcoins as Money Service Businesses (MSBs), which made them subject to registration and other legal obligations. China’s contentious love-hate relationship with Bitcoin started in 2013, when they banned financial institutions from using Bitcoin, even as buying items using digital currencies has been banned since 2009.

As always prices rose and fell with the news, as people onboarded and offloaded their Bitcoin, but nothing really started to make headway until 2016 with the proposed SegWit (Segregated Witness), soft fork which was supposed to boost the transaction power of the network. Naturally, not everyone liked the SegWit idea and shortly after it was locked-in, Bitcoin hard forked as part of the development team took their ball and went home. Their ball later became Bitcoin Cash, which we’ll discuss indepth in future installments.

By this time, though, Bitcoin was already on its first trip to the moon, setting an all-time high of USD$19,458 on December 17, 2017. The causes of the collapse and decline, and the lengthy bear market that followed, have been attributed to hacks, negative press, illegal activity, but the largest contributing factor seems to be the response of the Chinese government—effectively implementing a complete ban on trading on February 1, 2018. Bitcoin’s price cratered from $9,052 to $6,914 by February 5th, and the percentage of bitcoin trading in the Chinese renminbi fell from over 90% in September 2017 to less than 1% by June of 2018.

It’s also a perfect example of one country that has far too much control over the functions and fate of a coin, and definitely a noteworthy bit of foreshadowing of what was to come.

Add to that the number of notable failed exchanges, the rise of scams using Bitcoin (and other coins), and the emergence of Bitcoin as the coin of choice for money launderers globally, and all of that spelled a lengthy crypto-winter.

Artificial Scarcity

Nakamoto set a monetary policy based on artificial scarcity at bitcoin’s inception to ensure that the total number of bitcoins could never exceed 21 million. The block closes every ten minutes, releasing new bitcoins into the network, but at a rate which diminishes by half roughly every four years or 210,000 blocks. At the outset, Bitcoin released 100 new coins into the network, which has subsequently divided in half every four years since to where we are today (as of last year’s halving in May 18, 2020) wherein the block reward was reduced to 6.25 bitcoins. The next halving is scheduled for February 4th, 2024 wherein the block reward will be further reduced to 3.125 bitcoins.

The attendant response on price fluctuations has been generally positive. As bitcoin halves, and thereby becoming more scarce, the price tends to rise. Whether or not this trend continues is hard to predict. The first set of halvings saw the price rise by an order of magnitude, while a year into this latest halving only has it reaching all new highs, but nothing close to the changes from previous halvings. Not yet at least.

It ended and prices began to rise. By June 2019, the price rebounded to $13,000. With the promise of a global pandemic on the horizon, price fluctuations reduced Bitcoin’s price to four figures, and then rebounded it as big names like Circle, Jack Dorsey or Twitter (TWTR.Q) and Square (SQ.NYSE), Microstrategy, and later on Tesla’s (TSLA.Q) Elon Musk and the CEO of Ark Investments, Cathy Wood, got involved, lending their names and social media followings to affect the price, which promptly Bitcoin’s bounded over its previous all-time high and went on its second trip to the moon.

Naturally, there’s more to the story of Bitcoin’s second moonshot than these three. Big name banks like Morgan Stanley and J.P. Morgan stopped dithering about getting involved in Bitcoin. Big name exchanges either went public like Coinbase (COIN.Q) or took other avenues towards legitimacy, agreeing to work with government towards foundering new regulations.

It reached the moon in April, setting a new all-time high of $64,804.72, and then catapulted itself back to earth. The most recent spate of price decreases, which saw Bitcoin lose almost 60% of its value, came at the behest of a mix of the pandemic, and China’s banning of cryptocurrency mining and value trading. Formerly, Chinese miners were responsible for 70% of Bitcoin’s hashrate, further demonstrating the issues associated with giving any one country too much control over a global enterprise.

Growing Pains – an issue that plagues all of crypto.

The largest problem with the Bitcoin network is its inability to scale.

The block closes every 10 minutes, which means that any transaction made using Bitcoin will take ten minutes to clear. Other coins have similar problems, often compounded by large amounts of users trying to squeeze their transactions through all at the same time, which can cause backups, lag and other such issues. The most common of these is with the cryptocurrency, Ethereum, which we’ll get into in a future article. Bitcoin was originally touted as being the replacement for fiat currency and a completely decentralized alternative to credit cards and other payment methods, and so far it hasn’t lived up to its promise. The numbers are decently astounding:

Visa performs more than 1,700 transactions per second. Bitcoin performs 4.6, and not much more with the Lightning Network. The numbers speak for themselves.

This facilitated a lengthy diaspora, wherein Bitcoin miners formerly drawing on the electrical grid and largess of the Chinese government, were scattered across the globe in search of low-cost electricity and a favourable regulatory environment. For example, Texas has flung open its borders to crypto-miners, offering abundant, cheap electricity, but highlighting one of the principle environmental problems with large scale proof-of-work mining and one which will need to be addressed in the coming years.

Where are we now?

The legislative assembly of El Salvador enacted legislation to make Bitcoin legal tender in June. The law will take effect in September. On the technical side, there’s another bitcoin network software update called Taproot on the horizon, which will add support and improvements for smart contract functionality as well as the Lighting Network—a potential solution to the Bitcoin scaling issue—and the change is expected in November.

Smart contracts could open up entirely new vista for Bitcoin users, including entry into the decentralized finance sector.

Nowadays, companies and governments are getting wise to the criminal enterprises using Bitcoin as their de facto currency. They’ve since developed various technologies that allow for tracing the lifecycle of a given Bitcoin from inception to wherever it ultimately lands on the blockchain, and then engaging in a little sleuth work to determine the owner of said address.

Regulations are on the horizon, which likely push Bitcoin towards its goal of widespread adoption. Meanwhile, powerful voices yammer about it on twitter, affecting its price. People get in and out based on market sentiment provoked by such disparate voices like wallstreet bets. At the very least, it’ll signal the death knell of the retail age of crypto, and usher in an all new institutional age.

When you factor in that Bitcoin is presently trading at $45,479.51, and is basically out of reach for the average investor, then you could almost say it’s already started.

This might be the end of the first crypto guide to the perplexed, with its focus on Bitcoin, but that doesn’t mean the story’s over. Whenever something big happens to Bitcoin, or any of the coins we cover, we’ll be sure to provide updates so check back periodically.

—Joseph Morton