Stock Performance

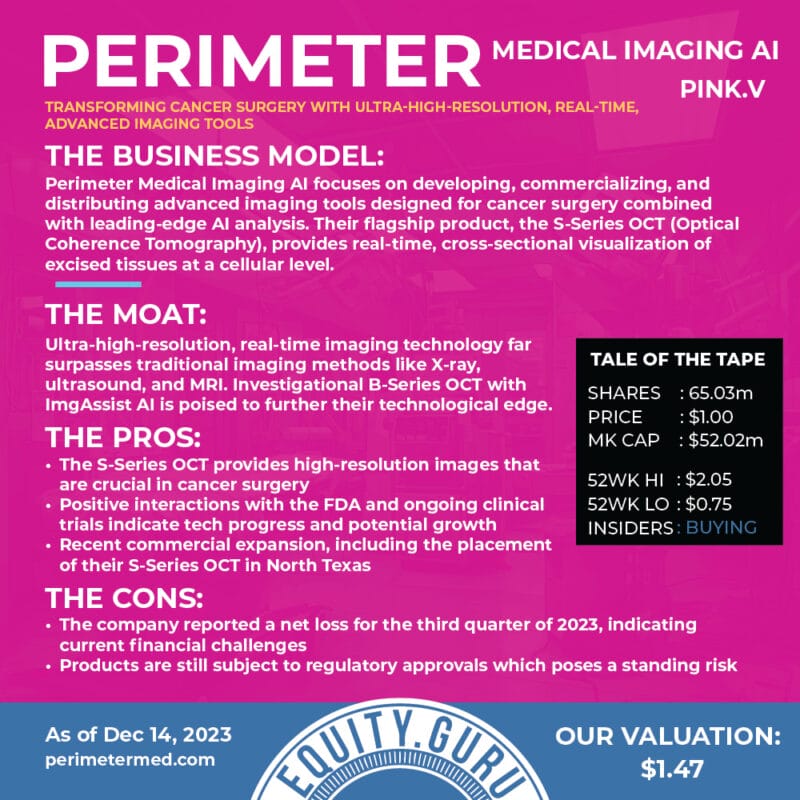

Perimeter’s mission is to transform cancer surgery with ultra-high-resolution, real-time, advanced imaging tools to address unmet medical needs. The operators have a vision that patients will no longer experience the costly emotional and physical trauma of being called back for a second surgery due to cancer left behind.

The company is achieving this mission through its S-Series Optical Coherence Tomography (OCT) imaging system that has received 510(k) clearance from the U.S. Food and Drug Administration.

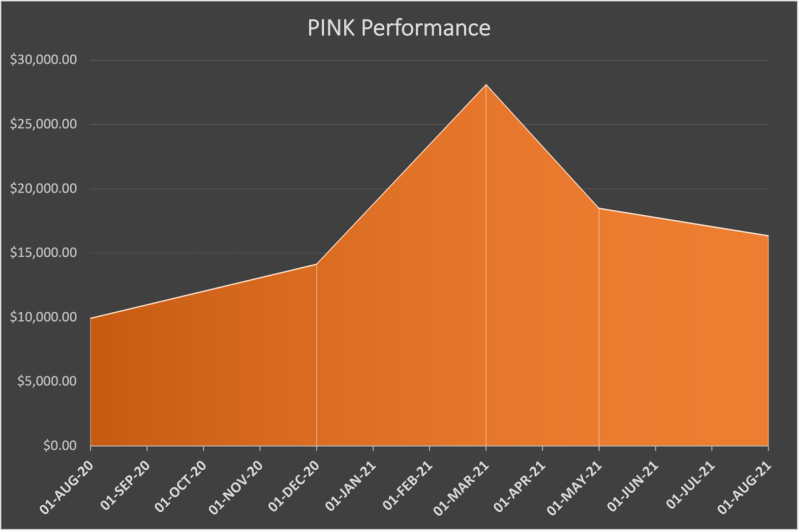

The market also seems to believe in this dream and has rewarded PINK shareholders with a one-year price appreciation return of just above 50%. From August 12, 2020, the stock was trading at $C 1.72 and had a meteoric run, and peaked at $C 4.84 in mid-March 2021.

Since then, the stock has shaved off some of those exceptional gains but has left shareholders with a 63% return as of yesterday’s trading day. If you believed in their state-of-the-art technology and the strength of their patents and had invested $10,000 in August last year the chart below shows exactly what would have happened to your money during that period.

Your $10,000 would have netted you a total of 5800 shares at an initial price of $1.72. At its peak, the value of your portfolio, just in this one position, would have been $28,000 and some change, and as the market consolidated your total value would now be around $16,000.

Of course, this is assuming we are in a perfect world and most people would not have held or would have sold and taken profits at the peak and discounted any future growth by the business without even looking at the business fundamentals, the corporate culture, and the ability of the management team.

Without dragging along the article, I thought it would be nice to just take a quick glance at what has happened since our perfect world investor put their $10,000 into 5800 shares of PINK late in 2020.

Under the hood

I must confess that I usually go on and on when it comes to analyzing the financials for most companies, but I’m going to try my best today to make this as simple as possible also not to bother you with too much of the nitty-gritty information.

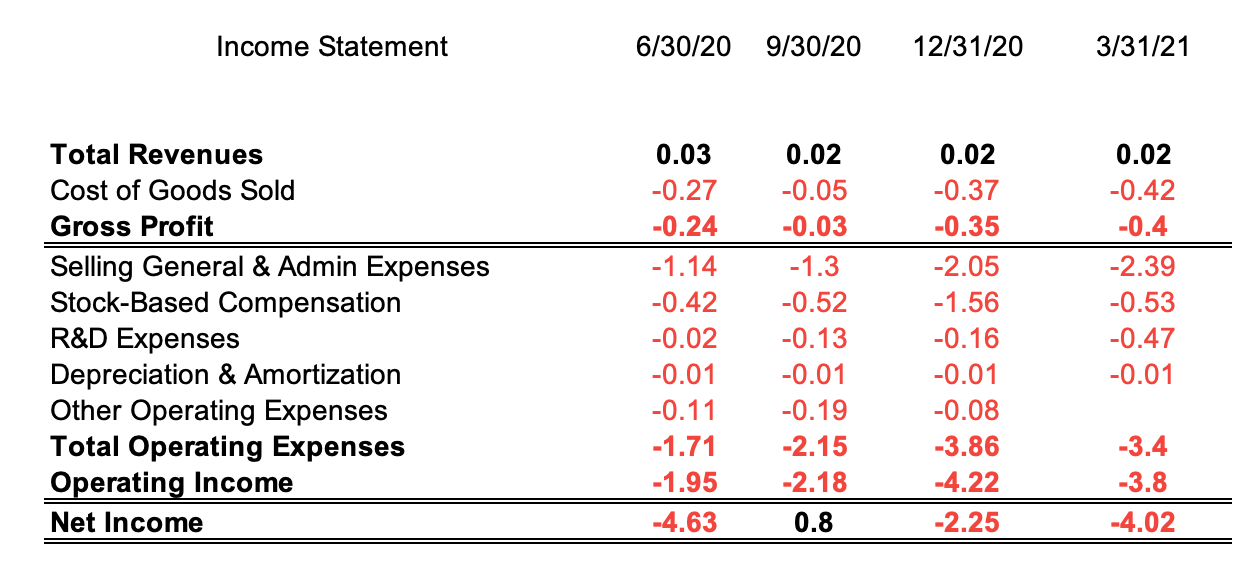

The first thing that I do notice from the table above, which is an extract of the income statement, is a downtrend with the total other revenue from June 2020 till March 2021. In their latest quarterly report, the operators described their performance and sales “B. Going Concern” under the section as follows:

“The Company is currently in its product development stage and therefore has not generated revenue to date, has experienced losses since inception and additional financing will be required before the Company expects to generate positive cash flow.”

Basically, this means the current operations of the business are not generating any sales and to continue to fund their total operating expenses they will need to reach into the pockets of investors and bondholders to continue as a going concern according to accounting norms. For a company in its development stage, this is normal but a better look at the balance sheet and the structure of the expenses can tell us exactly where the money is going and being used.

Operating Earnings Breakdown

The majority of the company’s operating expenses are in selling general https://e4njohordzs.exactdn.com/wp-content/uploads/2021/10/tnw8sVO3j-2.pngistrative expenses which are used to fund the day-to-day operations and salaries and bonuses of most of the employees. They state the reason for the increase below:

“Employment costs were $1,231,084 for the three months ended March 31, 2021, compared to $904,877 for the same period in the previous year mainly attributable to the increased staffing to support establishment of our commercial organization as well as the increase clinical trial activity.”

As the company prepares to support its commercial operations it will increase the number of work hours and available people in the firm to allow them to, hopefully, take advantage of their addressable market. This is a good sign as clinical trials have also increased and there is a greater need for staffing as they move their product from the development stage to finally being able to market. The key would be the ability for the management team to watch the costs like a hawk and hopefully not overextend their financial capabilities.

The second-largest segment is the stock-based compensation which under accounting is noncash expensive usually not subtracted from the operating business when looking at the cash flow.

“The increase was mainly attributable to additional options granted to key management personnel and directors later in 2020 as well as the impact of the reversal of expense related to forfeitures in Q1 2020”

Since the business is in the development stage, they also spend quite a bit on their research and development expenses which have been increasing over time with the hopes of deploying capital into new profitable projects. The increase was due to prototype costs used for research.

The benefit of being a company in your development stage is that you can use the before-tax earnings/cash to reinvest into the business, unlike companies who use after-tax profit and only reinvest in their business after paying the taxman. Sounds sketchy but it’s completely legitimate. A wise man once said, there are only two things that are inevitable in life death and taxes try your best to avoid both for as long as possible.

So, what does this all mean?

It means that our perfect world in investors would have had to sit through almost a full year of no revenue being recorded by the business, an increase in operating expenses, and a reduction in their share ownership through dilution when the Company issues common stock.

The big question is if you had $10,000 today burning a hole in your pocket would you deploy it into PINK stock? Sadly, that question is personal and depends on the risk characteristics of the individual putting down that money. Since they are not profitable and haven’t booked any sales as of now this stock seems to be a gamble and you would only benefit from good news coming up from them as they prepare to go commercial.