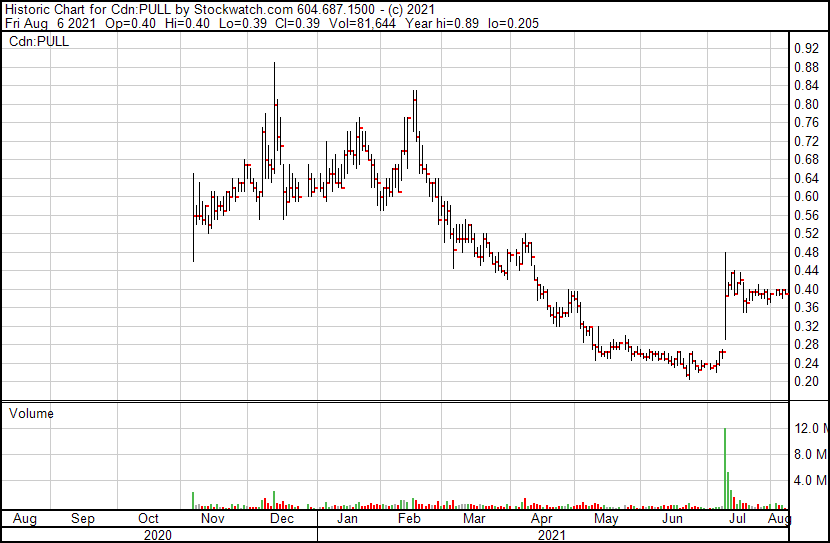

Ouch! This looks like it hurt.

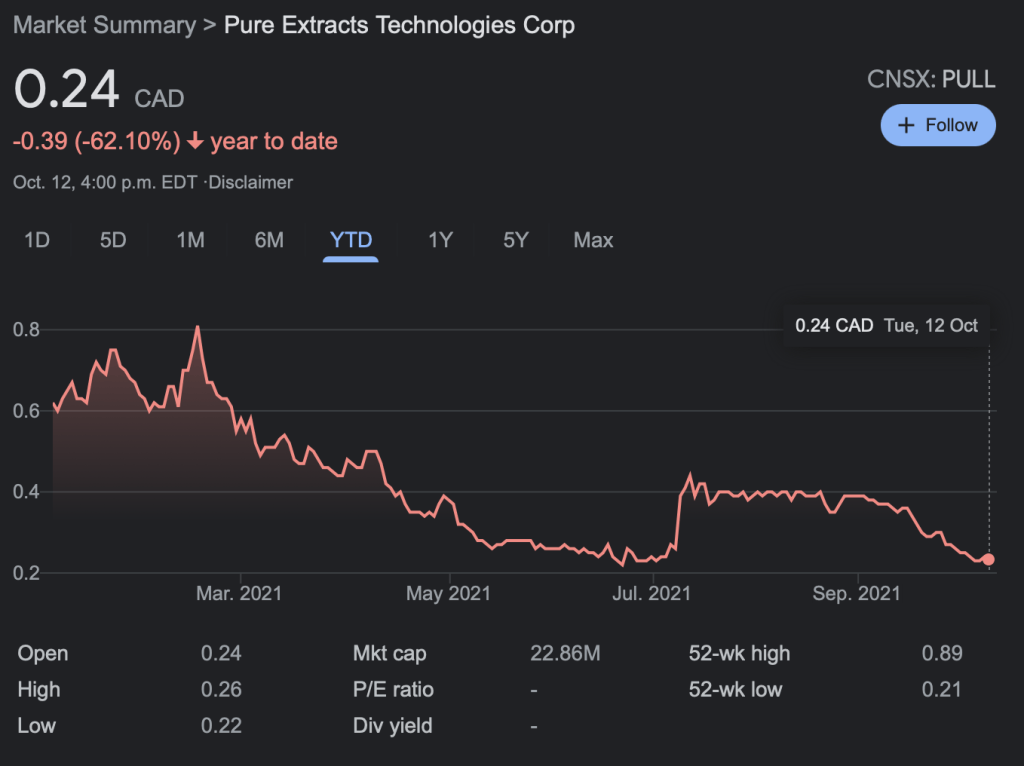

Pure Extracts has a market cap of $37.94 Million, is down -39.84% Year to Date, but up 24.19% in the last three months. Marketwatch has a “Buy” rating for the company.

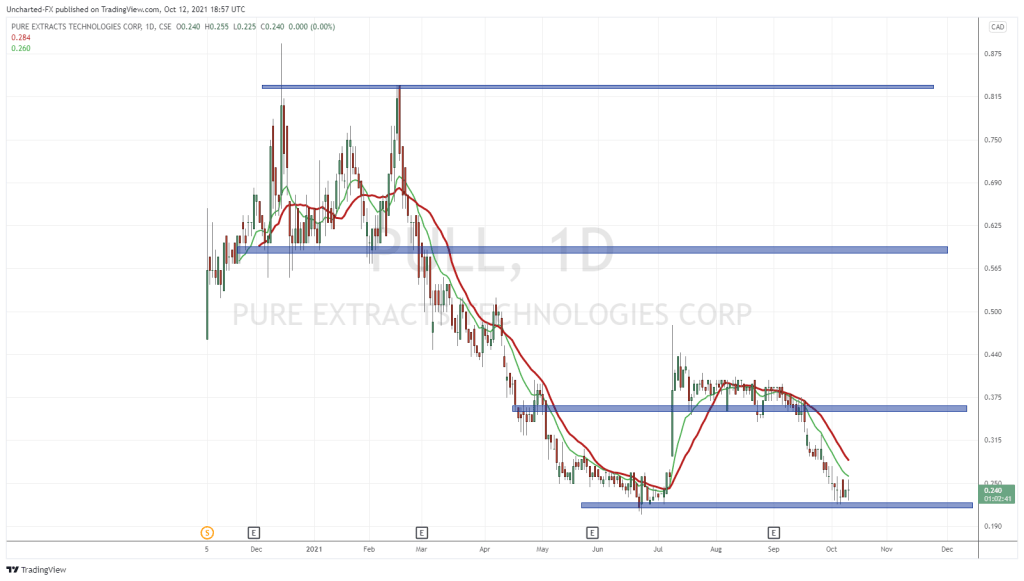

In terms of technicals, I favor the upside. Why? (Link to the full write up)

– Vishal Toora , Equity Guru Market & Trend Analyst

I am no pro when it comes to the technical side of stock charts, but I found Vishal’s article interesting and would recommend reading it to go even deeper into the price action. My natural curiosity forced me to “flip some rocks” to try to figure out what was pushing such a massive decrease in the value for shareholders, for a stock that has just reported its first full quarter of revenue.

Who are they?

Pure is the extraction and processing of cannabis and hemp as a third-party service to licensed producers for toll processing or white-label processing and for its own private label of products incorporating its full spectrum THC- and CBD-based extracted oils.

The Company’s subsidiary, Pure Mushrooms Corp. (“Pure Mushrooms”), has established a capital-efficient e-Commerce portal on the Amazon platform for direct-to-consumer sales of functional mushroom wellness products. Currently, the portal is only available to US customers with the opening to Canadian customers expected to occur in June 2021.

Pure Extracts CEO, Ben Nikolaevsky, remarked, “We are excited to be on Amazon, the largest online marketplace and the most powerful platform in the world for brand development, and to have made our first US and Canadian sales of our Pure Mushrooms products. The functional mushroom wellness market is experiencing robust sales as many consumers are trying to boost their immune systems in light of the COVID-19 pandemic. As we build-out the mushroom extraction section of our facility, we plan to bring more products to market [emphasis added].”

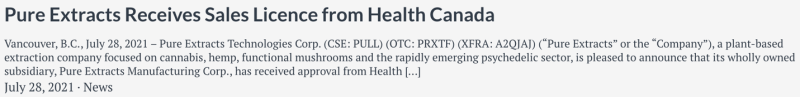

On top of this, they planned a Natural Health Product (NHP) Site Licence application for Q4 2021 to allow for onsite production at the Company’s Pemberton facility. And on March 3, 2021, a Dealer’s Licence application was submitted to Health Canada with regard to controlled substances. Once granted, Pure Mushrooms would be permitted to cultivate and/or purchase psychedelic mushrooms and extract and sell compounds such as psilocybin.

As you can see from the company’s press releases above, the team seems to be meeting and exceeding some of these corporate objectives. And if you take a deeper dive into a lot of the other press releases everything seems to be running smoothly as well. So what’s going on?

What’s been happening under the hood?

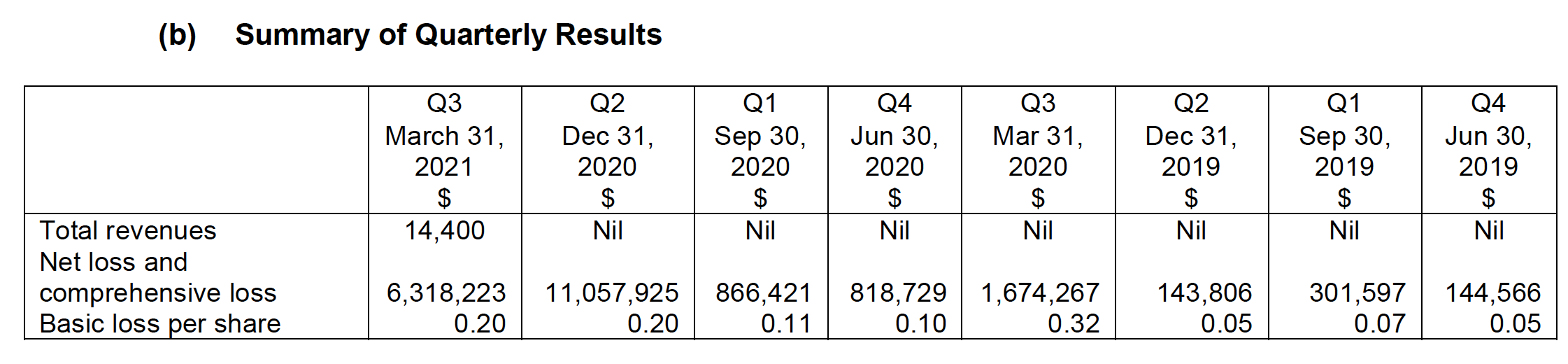

During the three months ended March 31, 2021, the Company had a net loss of approximately $6 million (2020 – $1 million) an increase of $4 million. They also recorded their first accounting sales numbers($14,000) since they went public.

There is the first sign of trouble. It seems that they are progressing on the process side of their business model, but the total addressable market seems to not be responding as rapidly as the market would have thought initially.

With only $14,000 of sales in their books and close to a $4 million increase in the net loss from the previous quarter, it’s obvious that a deeper look into what the actual operating costs are would help any individual investor understand what most of the money they raised is being used for.

During the three months ended March 31, 2021, the Company spent $6.2 million in operating expenses an increase of $5.7 million. This increase was mainly due to the following:

- The Company recorded a staggering $2.6 million(almost 142 times their revenue base!) in stock-based compensation during the period. They state that this was mainly due to recognizing expenses related to the vesting of options and performance securities granted during the period. NOTE: There were no equity incentives granted in the prior period.

- The Company incurred $1.8 million in advertising and promotion expenses during the three months ended March 31, 2021, as compared to $0 in the prior comparable period. Most of the expenses were related to website development, branding, and public relations.

- The Company hired personnel in order to begin the early stage of operations[emphasis added] which includes salaries and benefits of $565,211 as compared to $188,694 in the prior comparable quarter.

- The Company recognized $246,675 in amortization expense during the three months ended March 31, 2021, on its right of use assets which consist of a building lease entered into during the fourth quarter of 2020 and equipment leases entered into during the quarter ended September 30, 2020, and the quarter ended March 31, 2021. Additionally, the Company began amortizing its equipment during the quarter as they were put into use.

In summary, most of their cash was used for stock-based compensation, marketing, and the payments for their building in machinery leases.

On March 31, 2021, the Company had working capital of $3.7 million (June 20, 2020 – deficiency of $3.8 million). From that working capital, cash totaled $3.3 million.

Management estimates that the current cash position may not be sufficient for the Company to carry out its operating plans through the fiscal year ended June 30, 2021. The Company will therefore rely on debt or equity financing to continue with its operating plans. During the period ended March 31, 2021, the Company closed a private placement of 16,895,491 Special Warrants for net proceeds of $8,532,223.

Now I know most of you are saying wow now it’s obvious what’s going on here. but just in case there is a slim chance we’re not seeing the same thing here basically what we have is a business that :

- still in the start-up stage of its product development although it raises a lot of cash from investors because of the total addressable market that it probably advertises in its investor decks

- The business is capital intensive and needs the proper equipment for the day-to-day operations which can be reduced by leasing out equipment at favorable rates

- there is a need for more marketing and advertising in the future as the firm needs to establish its brand compared to the other financially stable companies in its industry

- there seems to be a disproportionate relationship between the stock-based compensation and performance bonuses compared to the business performance and market performance of the stock

The conclusion I draw from this is that the initial spike of the stock during the IPO was that it was mostly speculatory as people expected great things from the company. Once investors digested the quarterly reports from the initial public offering, they noticed how much money would need to generate a certain amount of business. This might have scared off some of the initial speculators.

Now the business performance stock performance hopefully trend in the same direction, meaning if the firm can increase revenues reduce its costs and gain the market share that’s needed for it to be profitable at an appropriate cost basis the stock should perform well. But if the opposite happens this pain shall continue.

If I had $1000 burning a hole in my pocket right now, I would not touch this stock. But I would watch cautiously as any key developments in the business model change for the better.