Cybin (CYBN.NE) announced that they have received conditional approval to join the New York Stock Exchange (NYSE), specifically, the NYSE American LLC stock exchange.

Cybin has reserved the ticker CYBN on the NYSE, the same ticker they trade on the NEO exchange under. Cybin plans to continue trading on the NEO exchange, as well as on the OTCQB exchange where they trade under the ticker CLXPF. They must still meet certain regulatory requirements and receive final approval from the NYSE America before their listing is officia, but Cybin seems fairly confident they will be able to check those last couple boxes.

“Conditional listing approval on the NYSE American is an important milestone in Cybin’s growth journey. We expect expanded access to investors to further fuel our mission to develop revolutionary psychedelic therapeutics for patients suffering from mental health conditions,” added Cybin CEO Doug Drysdale.

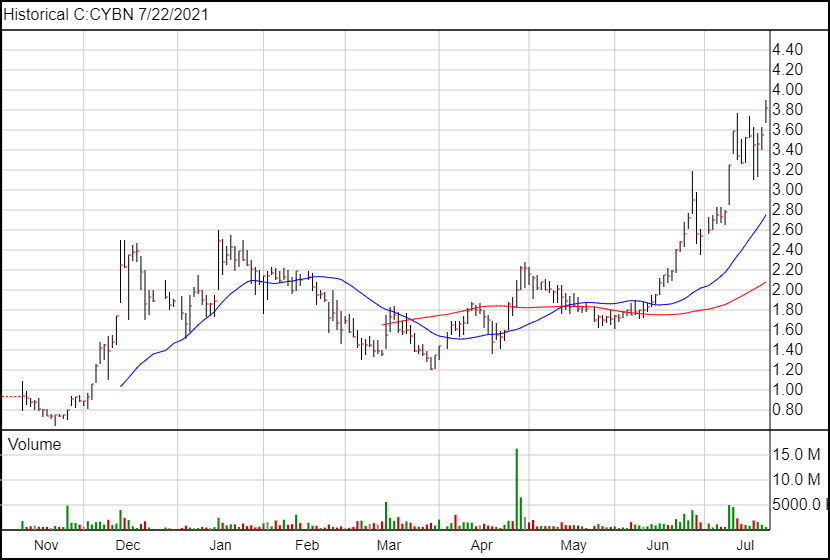

Cybin’s share price has been climbing steadily for months. Last November, CYBN was trading at less than a dollar, before nearly tripling in December.

After that, it moved up and down between the $1.20 and $2.60 range. Since the beginning of June, however, the share price has more than doubled, and when they announced the NYSE listing, the price was $3.55 a share. What will happen if/when Cybin is listed on the NYSE American is still an open question, as Cybin is the first psychedelic company to be listed on the NYSE.

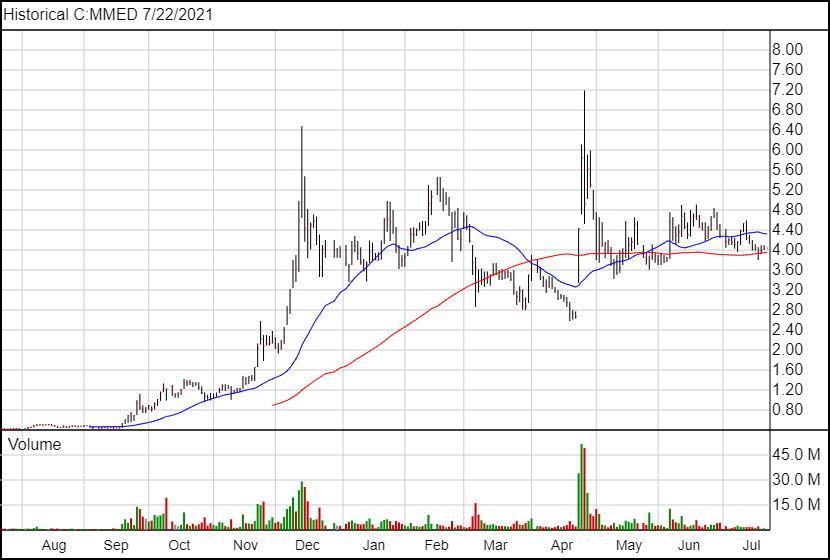

It’s worth taking a look at what happened with MindMed when they announced their Nasdaq listing though.

Those few days after the MMED announcement about the Nasdaq near the end of April were pretty crazy, with the stock peaking over $7 a share, reversing the downward slide that MindMed had been on. Obviously things calmed down, but more than anything the Nasdaq listing brought MindMed into the conversation as a major player alongside COMPASS Pathways.

Unlike MindMed, Cybin is announcing their uplisting at a time when their stock price is as high as its ever been. At the end of June, they announced that in March they had had over $64 million in cash. They have also established partnerships with Greenbrook TMS, Catalent and Kernel. On top of their partnerships, they have completed over 50 pre-clinical studies and have filed 13 provisional patents, on topics ranging from their psychedelic molecules to their telehealth system.

So they have the cash, the connections, the patents, and now they are close to having the listing on the big exchange. Cybin is cementing its place as a top-notch psychedelic company.

Following the news, Cybin shares are up 27 cents and are currently trading at $3.82.

Full Disclosure: Cybin is an Equity Guru marketing client.