Back in 2017 during the original bitcoin bull run, blockchain companies popped up like digital whack-a-mole and disappeared just the same. Some were legit, others were questionable, a few ambled around and didn’t know their ass from a hole in the ground, and a few were outright frauds. Basically like every other bubble built on a tech only really understood by the pocket-protector types who built it, and their legion of followers.

Among the few, the proud, was a plucky little startup called Neptune Dash Technologies, a cryptocurrency miner focusing on one of the little known altcoins – Dash. In a field where money could really only be made mining the top two or three coins by market cap—usually Bitcoin and Ethereum, and sometimes buttressed by XRP in those days before Tether and it’s fraudulent clown car of misfits and inflation-happy assholes—Dash somehow managed to not only pay its bills and stay alive, but grow. Then the bubble burst and crypto huddled underground for the better part of a year, and Neptune went with it, the coin itself tied irrevocably to Bitcoin’s future.

Let’s fast forward. The crypto-winter ends and Bitcoin goes on a tear. Breaks new records every week. Hits an all-time high. But where’s Dash? Wasn’t the coin correlated positively with Bitcoin, and therefore should’ve enjoyed the same benefits?

Technically, yes. Dash did go on a run—getting up around the $450 mark at the peak of the bull run— but that’s nowhere near it’s all time high during the last run, which was $1,493.59 in December of 2017.

Why?

Dash is what’s called a privacy coin. It uses fancy code to hide or obscure transactions and movements on its blockchain. On its face, that seems like a wonderful little addition and why wouldn’t everyone want to get on board with that? Because the big name institutions and government bodies want to be able to track transactions on the blockchain to make sure they’re not going to Al-Queda, or being used by bad men to clean their money, or to buy illegal goods or services on the deep web. You get the idea.

Technically, this kind of illegal activity is associated with Monero, another type of privacy coin, but Dash has been used in the past to fund questionable organizations like Wikileaks. Remember them?

Right now, Dash is worth $153.22 and the coin itself has gone through some changes. It’s mineable using proof-of-work, but also stakeable for folks running masternodes. The block reward is approximately 3.34 dash, which means that every 2.5 minutes, the successful miner gets about a hundred bucks. That’s really not a lot of money when compared to Bitcoin, Ethereum, and other, bigger named coins.

So since Dash isn’t exactly a cash cow, the folks at Neptune Dash rebranded themselves Neptune Digital Assets (NDA.V) in December last year and spread the wealth around. They’re still mining and staking Dash and involved in the DAO, but they now include Bitcoin, Ethereum, ATOM (Cosmos), and FTM (Fantom) and more. They’ve raised money and made deals with Bitmain to bring in antminers, and companies like Link Global Technologies (LNK.C) to build and share a renewable energy space where Dash can mine. (The latter has signed onto the crypto climate accord. Neptune? Soon.)

“Patience has paid off with the expansion of our bitcoin mining operations as machines have dropped in price substantially over the last two months. We waited until we hit what we felt was the near-term bottom to make the purchase. We are excited to expand our existing fleet of mining machines with these new S19 Pros and will get them up and running as soon as possible,” said Cale Moodie, chief executive officer of Neptune, in a press release.

Presently, NDA is sitting on $47.06 million in cash, investments and digital assets. They have 105 BTC, 285 ethereum, 142,300 cosmos, 2,070 dash, 1,440,400 FTM, and smaller positions in litecoin, polkadot, bitcoin cash, stellar, NEO, OmiseGo, and Qtum. They have 298 ASIC S17 mining rigs up courtesy of Link that are pulling in 0.09 BTC per day, or $114,000 per month at the present price. Add the $323,000 per month for their staking operations at present prices and—okay, that’s still small potatoes compared to some of the larger Bitcoin mining companies, but it’s vastly better than simply mining Dash alone.

It’s also a great start given prevailing market conditions.

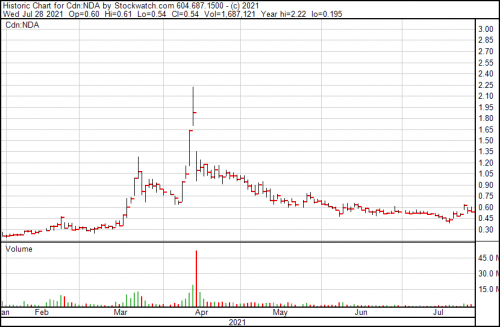

Bitcoin is presently trading at $40,005.31—up 33% on the week, but down 38% from its all-time high four months ago of $64,804.72—suggesting a potential recovery after the Chinese diaspora scattered miners across the globe. Neptune Digital Assets comparatively enjoyed a similar bounce and have also begun their recovery, closing today at $0.54.

—Joseph Morton