Peak Fintech (PKK.C) announced important developments in their planned acquisition of banking artificial intelligence software provider Zhongke Software Intelligence – the transfer of Zhongke IP to a Peak-controlled subsidiary Weilian.

The transfer came after a pilot financing program involving both companies showed success. The pilot program paired Zhongke’s software with Peak’s Lending Hub and was used to provide capital to help restaurant owners in Sihong County manage their short-term cash flow. The pilot was conducted by the newly formed entity Weilian Technology Services. Over a three-month pilot period, from April to June 2021, 123 suppliers provided food, products and related services to 329 restaurants in 675 separate transactions, which totaled roughly 2.5 million RMB (~$480,000).

The success of the pilot led Zhongke to transfer the associated IP to Weilian and Peak will allocate $1 million for R&D related to the integration of the services to its Lending Hub ecosystem. Peak will also contribute $3 million for the expansion and marketing of Weilian’s service offering to other industries, which will focus primarily on short-term microloans, generally under $1,000, and area which they perceive to be an underserved market.

Currently, Peak Fintech owns a 51% stake in Weilian and Zhongke has a 49% stake in the company. Peak announced their intentions to acquire Zhongke in December after they signed an MOU, so if they follow through on that agreement they will own a 100% stake in Weilian. The MOU stipulated that a three-month pilot would be conducted before the two parties agreed upon a final price for the acquisition, however, per the terms of the MOU, the compensation package will be capped at $20 million. Now that the pilot is complete, the two companies will come together and will see if they can come to an agreement about how much Peak will pay to acquire Zhongke.

Back when the MOU was first signed, Peak CEO Johnson Joseph commented that “This proposed acquisition is very strategic for us on several levels. Our study of the banking and commercial lending landscape in China shows that the majority of the small, medium and micro businesses, who stand to benefit the most from our Lending Hub services, are served not by large banks but rather by smaller local banks and lending institutions who also happen to be the financial institutions best suited for Zhongke’s product offering.”

“Our Lending Hub platform makes it easier for banks to lend to small businesses by gathering and analyzing data coming from the businesses and a variety of external data sources, but we found that internally some banks were unable to take full advantage of the platform’s capabilities as they were struggling with some manual procedures, for instance when it came time to sharing loan repayment data with Lending Hub. With this acquisition and the eventual integration of Zhongke’s software to Lending Hub, Peak will be in a position to offer China’s thousands of small banks, whether located in large cities, small towns or rural regions, an end-to-end solution to automate their commercial lending activities, including bringing them new clients.”

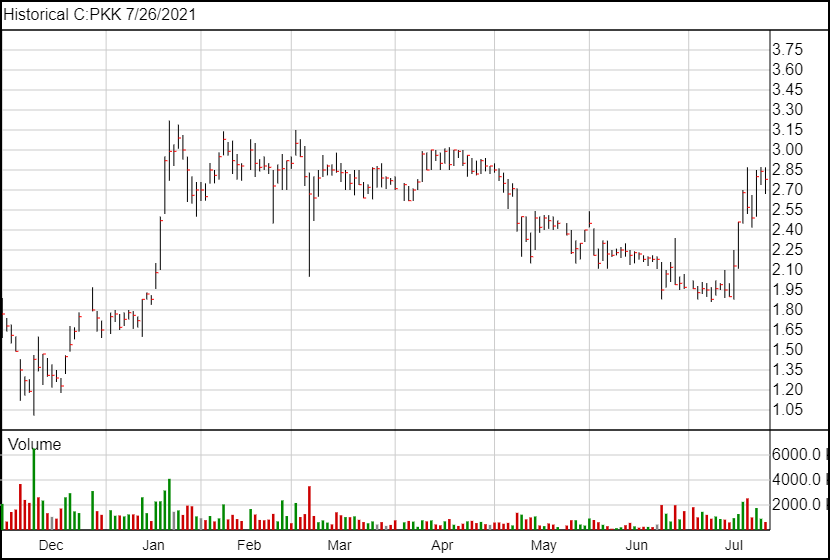

Following the news, Peak Fintech shares are down 4 cents and are currently trading at $2.80.