More cred

Earlier this week Cybin (CYBN.NE) announced a conditional uplisting on the NYSE, and Field Trip (FTRP.T) announced conditional approval to the NASDAQ yesterday.

This is a big move for both companies as it opens them up to American investors who don’t want to play around with the OTC. It also makes them much more credible to funds and banks in the US meaning capital raises will likely be bigger and easier, and thus they will be able to scale their company and complete more clinical trials.

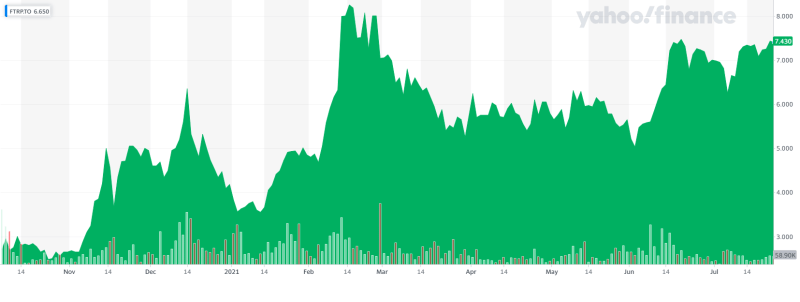

Both companies have a similar-sized market cap and both have seen similar steady runs in 2021.

Field Trip

Field Trip is no stranger to changing exchanges.

Field Trip’s common shares were listed on the NEX board of the TSXV until September 30, 2020, when they were delisted from the TSXV. The shares commenced trading on the CSE on October 6, 2020. ”. On June 7, 2021, the Common Shares and the Warrants were delisted from the CSE and commenced trading on the TSX.

See also: How Field Trip (FTRP.CN) is scaling its ketamine therapy operations following a giant raise

Nasdaq requires a company to have at least $4M USD in assets, with Field Trips $113M CAD cash on hand they are well within the requirements. The exchange also requires a stock to trade above $2.00 USD for 90 consecutive trading days on a lower exchange like the OTC, Field Trip is currently trading at 6.00 USD.

Field Trip will continue to maintain the listing of its shares on the Toronto Stock Exchange under the symbol “FTRP”. There will be no change to the shares, to the warrants, or to Field Trip’s share structure. Field Trip’s shares continue to be quoted in the United States on the OTCQX under the symbol “FTRPF” until such a time that they are listed on the NASDAQ. Once listed they will join Compass Pathways (CMPS.Q), Mindmed (MNMD.Q), and Atai (ATAI.Q) as the fourth psychedelics company on the exchange.

As of Field Trips’ last raise in March they have roughly $113 million CAD cash on hand and a market cap of $344 million CAD.

Cybin

While other psychedelics companies have already listed their stock on the Nasdaq, Cybin will be the first in the sector on the NYSE. Cybin’s over-the-counter shares will uplist into the NYSE American’s Small Cap Equity Market. Cybin shares listed on Canada’s NEO Exchange will remain listed there. The company will use the ticker CYBN for the NYSE.

The NYSE has slightly stricter listing requirements than the NASDAQ. To get an NYSE listing, a company must have a minimum of 400 shareholders who own more than 100 shares of stock, have at least 1.1 million shares of publicly traded stock, and have a market value of public shares of at least $40 million.

See also: Cybin (CYBN.NE) is up 60% this month, what’s going on?

Companies also have to prove they are either profitable or have a ton of cash.

Pre-tax earnings from operations must total $10 million USD for the last three fiscal years, including a minimum of $2 million USD in each of the two most recent fiscal years and positive amounts in all three years, or if there is a loss in the third fiscal year, $12 million for the last three fiscal years, including a minimum of $5 million in the most recent fiscal year and $2 million in the next most recent fiscal year. Or they can skip all of that if they have $200 million USD in market cap. Cybin’s market cap is currently $429 million USD.

The stock price must also be at least $4 USD a share. Cybin’s share price is $3 USD right now, so I would assume Cybin is working on some form of an exemption.

I have written in-depth on both of these companies because I think they are both winners, they have the right management team and business model. Both of these companies are shooting for the stars with giant raises earlier this year, both upwards of $95 million CAD, and both have the cash, expertise, and connections to scale at a fast pace.

Full disclosure: Cybin is an Equity Guru marketing client.