I’m not the biggest fan of stablecoins.

That’s not to say they don’t have their uses. When Bitcoin is way waaaay down like it is right now, it’s nice to have a cozy spot to put your stake while you’re waiting for bottom. What I dislike is that they’re in direct contravention to what cryptocurrency is supposed to be: decentralized and untouchable. While not exactly the democratizing force Satoshi Nakamoto expected decentralized coins to be given the high barriers to entry—they’re at least something the government can’t steal, or private companies can’t bungle away.

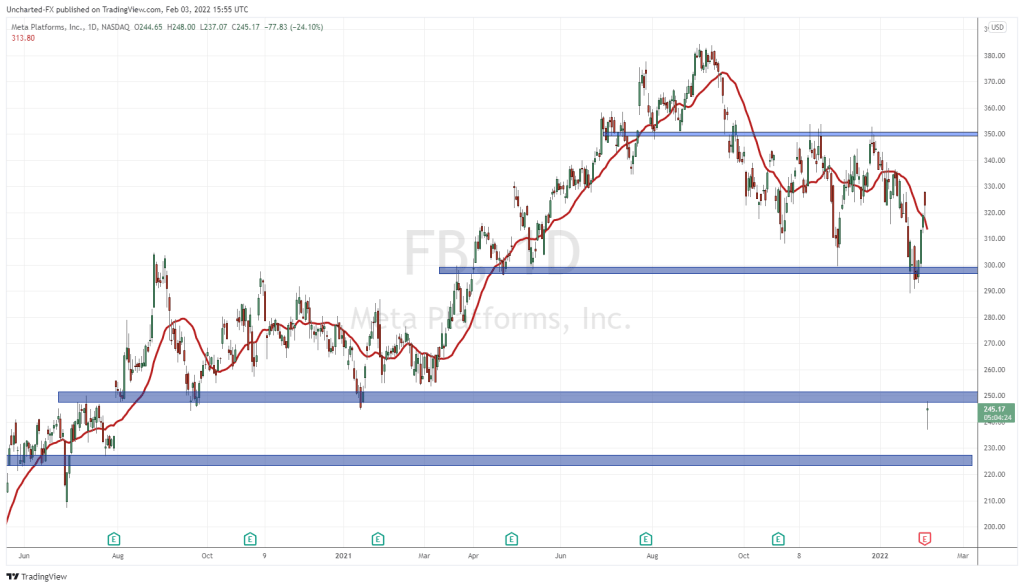

Stablecoins are the opposite. Usually tied to companies run by corrupt nincompoops whose endgame involves a prison cell, they’re centralized and therefore subject to government regulation. See Facebook’s (FB.Q) troubles with their so-far vapourware stablecoin Diem for details.

But you’ll have that. The future of cryptocurrency is veering increasingly towards centralization. China’s got a new central bank issued digital currency and Venezuela’s had one for years, and there have been some rumblings about other countries getting involved. If the Digital Yuan takes off, then you can guarantee we’re going to see a United States Fed-backed digital currency within the year.

But on the private side we have companies. There’s Tether Limited, owners of Bitfinex and distributor of USDT (or Tether), the much embattled stablecoin. It’s third by market cap right now, never sufficiently audited to ensure it maintains reserves to back its claims, and loves to print new coins. There are other stablecoins, like Binance’s US-backed stablecoin which is worth mentioning because of Binance’s recent woes, but mostly the other stables are too small or not widely distributed enough to be interesting.

Today, though, we’re talking about USDC, the stablecoin backed by global fintech firm, Circle and its recent deal with Mastercard.

USDC runs on the Ethereum, Stellar, Algorand, Hedera Hashgraph and Solana blockchains, and is managed by a consortium that calls themselves Centre. Said consortium comprised of members of Circle, Coinbase (COIN.Q), and Bitcoin mining giant Bitmain.

What I like about USDC is that unlike USDT, every coin is actually backed by one U.S. dollar. It’s what USDT wants to be when it grows up, and yes, it doesn’t have Tether’s market cap right now but if you were to auger down into Tether’s reserves, you’d find it can’t justify the market cap it has. Eventually, that’s going to come back to haunt them. Right now, it’s worth nothing that while USDT is third in size in terms of market cap, USDC is actually the sixth largest coin this week.

The deal with Mastercard makes it easier for customers and businesses to use USDC for high trust, low friction transactions. It’s easier to make the USDC to fiat transaction and back, which is something most cards (nor stablecoins) actually have.

“The engagement between Circle and Mastercard reinforces how USDC is growing its role in payments and commerce on the internet, while building a vital bridge between digital currency payment systems and large, established payment networks. We are thrilled to work with Mastercard to simplify card offerings for cryptocurrency companies,” said Jeremy Allaire, co-founder and CEO of Circle.

The demand for USDC has expanded in the last year as users, businesses, fintech companies and global payment firms got on board to handle their payments and commerce activity on the internet. It will help folks using Mastercard simplify their crypto-to-fiat transactions.

“The engagement between Mastercard and Circle fuels new payment opportunities and commerce in digital currencies. The cryptocurrency market continues to mature and we are driving it forward together to reduce friction and create choice for people,” said Raj Dhamodharan, executive vice president of digital asset and blockchain products and partnerships at Mastercard.

Right now, card issuers that want to enable payments using digital assets have to first convert the crypto into fiat before settling the transaction. That step’s rather costly and complex, given the relative price volatility of most digital assets compared to USDC. Not having to make the exchange would flatten the difficulty curve of dealing in crypto.

Also, considering that Mastercard is one of the biggest, most well connected financial institutions in the world, the test of this new capability will give more crypto companies a chance to offer a card option to do business anywhere Mastercard is accepted. That’s a huge step towards widespread adoption if there ever was one.

—Joseph Morton