Everyone who went near a cannabis stock has probably seen or heard of Bruce Linton. He was a charismatic guy who rarely wore more than a t-shirt and jeans. Linton led the Canopy (CGC.Q) through 16 rounds of financing, 31 acquisitions, and $6 billion of capital raises, including a $5 billion investment by Fortune 500 beverage alcohol company, Constellation Brands (STZ.Q).

Linton has been a key part of psychedelics company Red Light Holland (TRIP.CN) who announced a merger with Creso Pharma (CPH.AX) resulting in an RTO and a new company The HighBrid Lab. Linton has confirmed that he will join The HighBrid Lab as Chairman of the Board, conditional upon shareholder approval and the closing of the merger between Red Light Holland and Creso Pharma.

Linton hasn’t appeared in the cannabis space for the last 2 years likely due to a non-compete he would have signed with Canopy in the summer of 2019. He has skirted that by focusing on psychedelics companies like MindMed (MNMD.Q) and Red Light Holland. So if that’s likely a 2 year deal on the non-compete the timing on this is perfect as Linton looks to be a key figure in the new cannabis/psychedelics hybrid.

Red Light Tokyo

One of Linton’s 31 acquisitions at Canopy was a company called Hiku Brands, the amalgamation of Doja Cannabis and Tokyo Smoke. These lifestyle brands sold to Canopy for a whopping $600M CAD. When I originally saw Red Light Holland it reminded me of Tokyo Smoke momentarily, but once I saw Linton was involved it became even more clear that Linton still puts a huge value on a lifestyle brand going after a rec market that isn’t there yet. Red Light Holland has been one of the only pubcos talking about a future rec market whereas the industry has largely been about to clinical trials and ketamine clinics.

https://equity.guru/2018/09/canopy-growth-weed-t-eats-hiku-brands-hiku-c/

Red Light Holland sells mushroom truffles in areas like The Netherlands where they are legal. They have a supply agreement with a pharmacy chain in Brazil where mushrooms are legal. They also have microdosing programs and sell merch. They are backed by a former radio host Todd Shapiro who has a good reach and social network, but maybe most importantly they have Linton banging their drum on every investor show he goes on.

Creso Pharma is one of Australia’s largest cannabis producers. It’s built itself similar to a big Canadian weed company like Canopy by signing international supply deals, focusing on big grow-ops, and acquiring brands through M&A activities.They were the first company to import medical cannabis into Australia.

Creso’s brand cannaQIX has a diverse product line of human and animal cannabis products that they distribute in Switzerland, UK, Germany, The Netherlands, and South Africa. Creso also operates companies in Colombia and Canada. Mernova Medical, the Canadian arm of Creso is run by two former Canopy execs who I’m sure know Linton.

The HighBrid Lab is expected to be organized into four business units, allowing it to aggressively pursue high growth markets, while also focusing on near-term cash flows. These business units are expected to comprise recreational cannabis (THC), CBD, recreational psychedelics, and psychedelic research. The new company is expected to have a cash balance of approximately $45 million CAD.

Cash flow from recreational cannabis, CBD, and Netherlands-based psychedelic operations will be used to support ongoing market expansion efforts in recreational psychedelics globally as opportunities are presented. The Combined Company also intends to allocate a portion of cash flow from other business units to the ongoing psychedelics applied science program to support potential long-term upside opportunities.

The merger

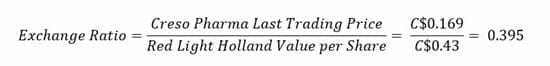

Before announcing the merger, Creso Pharma valued Red Light Holland at $148 million CAD, or roughly C$0.43 per Red Light Holland share.

Based on Creso Pharma’s current capital structure, it is expected that up to 467 million Red Light Holland shares will be issued in connection with the transaction. It’s expected that the former Creso Pharma security holders will own approximately 57.4% of the pro forma issued and outstanding Red Light Holland Shares, resulting in a reverse takeover of Red Light Holland by Creso Pharma. Moving forward the company set out the following strategies for growth:

- Expanding market and brand leadership in recreational psilocybin, supported by education, telecounseling and technology as new markets open

- Applied science and innovation supporting long-term opportunities in psychedelics with both naturally occurring and pharmaceutical grade drug discovery aiming for advanced and approved product offerings through controlled lab environments via the pending acquisitions of Halucenex and Mera Life Sciences

- Scaling recreational cannabis offering in North America by focusing on increasing market share in Canada and taking advantage of the Combined Company’s CSE listing to progress the introduction of products into the US, as well as leveraging industry leading expertise to execute US cannabis acquisitions in the near term (the US is the world’s largest cannabis market, expected to reach US$41Bn/A$53Bn by 2025[i])

- Enhanced European distribution of Creso Pharma’s researched and developed human and animal CBD products through SR Wholesale, Red Light Holland’s wholly owned Netherlands based distribution company

- Introducing unique, innovative and eye-catching recreational product offerings under existing Red Light Holland brands with innovative applied science including combined CBD and mushroom products and ready to drink products with mushrooms, CBD and THC, while focusing on adding adjacent iMicrodose product lines with ingredients including CBD, THC and functional mushrooms, as and where permitted to do so, and promoting responsible use via education and information

- Creation of Red Light Farms, increasing exposure to growing operations; adding to the Combined Company’s already impressive line-up including The Red Light Truffle Farm in the Netherlands, Happy Caps Gourmet Mushroom Farm and Mernova Medical in Nova Scotia

- Increasing vertical integration strategies from growing, harvesting, packaging, branding and distribution to potential brick and mortar stores for increased sales focused on higher margins

- Expanding e-commerce presence and online store initiatives to help boost future sales of CBD, THC, psilocybin, and functional mushroom products, where permissible

https://equity.guru/2021/02/red-light-holland-trip-cn-selling-psychedelics-in-brazil/

Red Light Holland is to be the surviving entity in order to maintain the CSE listing for the combined company, the exchange ratio was calculated on the basis of the number of Red Light Holland shares per share of Creso Pharma. The transaction is expected to close at the beginning of the fourth quarter of 2021. Until the closing date, both companies will continue to operate and trade independently.

It looks like the company has plans to move onto bigger and better things with a recent injection of capital and access to a massive supply of cannabis to try out different products with. I think the merger makes a lot of sense as I think cannabis and mushroom hybrid products will continue to grow as a market. I would bet there is a strong correlation between people who buy mushrooms and people who buy cannabis, and if products are marketed appropriately I think consumers would respond, but it’s still a long way out.