In the junior exploration arena, where grassroots plays are concerned, most of us want to see our due diligence pay off within a compressed period of time. Some measure of joy might reasonably be expected within, say, a year—eight to ten months for the company to conduct fieldwork (two months for shit happens). But some want to see their speculations bear fruit within a few months. Others want immediate gratification, which is hardly realistic.

The pace of exploration can be slow, sometimes painfully so. A disciplined approach to exploration—mapping, prospecting, surface sampling, geophysics—is necessary to prioritize targets for drilling. This boots on the ground fieldwork requires time.

Getting the necessary permits to drill and push access roads into the target areas can also take time.

This disciplined approach to early-stage exploration is critical as the next step—drilling—can be an expensive, highly dilutive proposition. Depending on the location of the target, a company can spend hundreds of dollars for each meter drilled. If the target requires the support of a helicopter, Jet A1 (fuel) and heli-time can push costs well north of $500 per meter. If we’re talking about a multiple-target drill campaign, exploration budgets can wreak all kinds of havoc on a company’s balance sheet (and share structure).

This controlled and orderly approach to early-stage exploration isn’t just necessary… it takes time.

If your company is run by a competent management team—a gifted group of rock kickers and capital market types—they’ll be pulling out all the stops employing multiple (cost-efficient) modes of good science to home in on the fattest and juiciest targets before a costly drill rig is mobilized. This all takes… time.

Delta Resources (DLTA.V)

- 36.8 million shares outstanding

- $12.88M market cap based on its recent $0.35 close

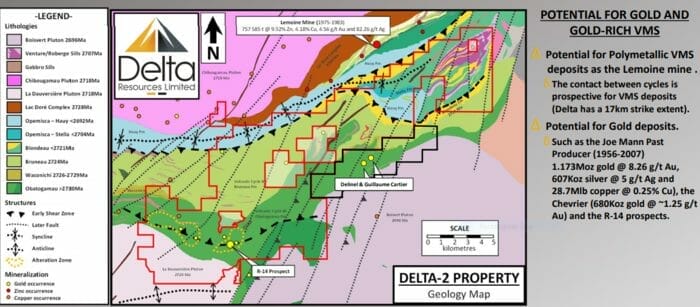

Delta is actively exploring two highly prospective projects in two mining-friendly jurisdictions with deep roots in the culture—Ontario and Quebec. Both projects have been subjected to multiple rounds of early-stage exploration—geochem, geophysics, good science all around. Both demonstrate excellent discovery potential (Delta-2 is already lit up). Both are in the early stages of drilling.

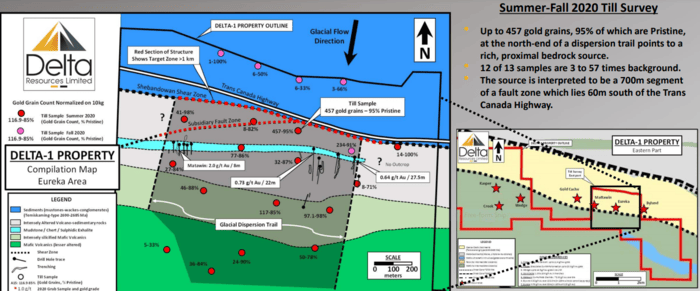

DELTA-1 is a wholly-owned 45 km2 project located in the Thunder Bay region of Ontario. Weighty (pristine) gold grain counts and an expansive gold-bearing alteration halo characterize a highly prospective regional structure.

DELTA-2 is divided into two distinct zones—Delta-2 Gold and Delta-2 VMS. This wholly-owned 170 km2 project is located in the prolific Chibougamau District of mining-friendly Quebec.

On July 9th, Delta provided shareholders with an update concerning both of these projects (at this stage it’s a toss-up as to which project deserves flagship status).

Delta-1 Gold project in Thunder Bay, Ontario:

The Company is waiting on the lab to return drill core results from an April 2021 campaign that consisted of eight holes for a total of 1,376 meters. We can expect results any day now.

Having delivered impressive (pristine) gold grain counts—up to 457 gold grains (95% deemed pristine)—the Company has identified a dispersion trail, the north end of which points to a rich, proximal bedrock source. This is geological sleuthing at its finest.

The following slide is #19 on Delta’s pitch deck. Note the project’s proximity to the Trans Canada Highway. Access into a project is rarely this agreeable.

Five of the eight holes from this campaign intersected an intense zone of alteration consisting of “silica flooding, ankerite, calcite, chlorite and fuschite, all associated with disseminated pyrite and chalcopyrite, along with several generations of quartz-calcite-ankerite-pyrite veinlets, stockworks, and breccias.”

This alteration zone was intersected over a strike length of 400 meters, and down to a depth of up to 130 meters—widths vary from seven to forty-six meters.

The Company states that “it is unclear at this point if this alteration and veinlet zone is the source of the high gold-in-till anomaly, however it seems like reasonable geological assumption at this stage.”

“A reasonable geological assumption” regarding the origin of some remarkable (pristine) gold grain counts in the project’s immediate subsurface layers—you gotta love the exploration game.

An exploration program consisting of mechanical trenching, detailed geological mapping and sampling is planned for late August and September.

Additional drilling is planned for the fall and winter of 2021-22.

Delta-2 Gold project in Chibougamau, Quebec:

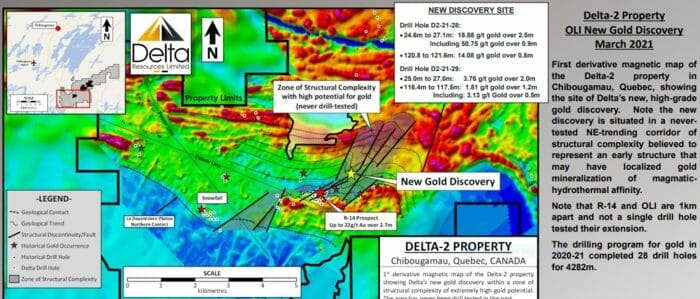

Delta began pushing access trails into the OLI vein target area in late June. An extensive mechanical trenching program commenced on July 5th. Gaining a better understanding of the structural controls and geometry of the mineralization is the objective of this round of surface exploration (more geological sleuthing).

Earlier this year, the Company announced a discovery at the OLI zone, highlighted by the following high-grade hits:

- 27.93 g/t Au over 3.3 meters (including 106 g/t over 0.8 meters);

- 5.74 g/t Au over 1.8 meters (including 12.2 g/t over 0.6 meters);

- 12.13 g/t Au over 3.5 meters (including 56.70 g/t over 0.7 meters);

- 18.88 g/t Au over 2.5 meters (including 50.75 g/t over 0.9 meters);

- 14.08 g/t Au over 0.8 meters.

This new discovery, summarized on Delta’s pitch deck (slide #10 )…

How to zero in on the guts of this high-grade mineralization?

- The one square kilometre area located between the R-14 gold prospect and the OLI gold discovery will undergo detailed structural mapping and sampling.

- Geological mapping and sampling will also be expanded to the NE of the OLI gold discovery in a zone of structural complexity believed to be responsible for channeling mineralized fluids from the La Dauversiere intrusion.

- A drill campaign is planned for the fall of 2021 to test new gold targets between R-14 and OLI, and to test for extensions of the high-grade mineralization at OLI.

Delta-2 VMS project in Chibougamau, Quebec:

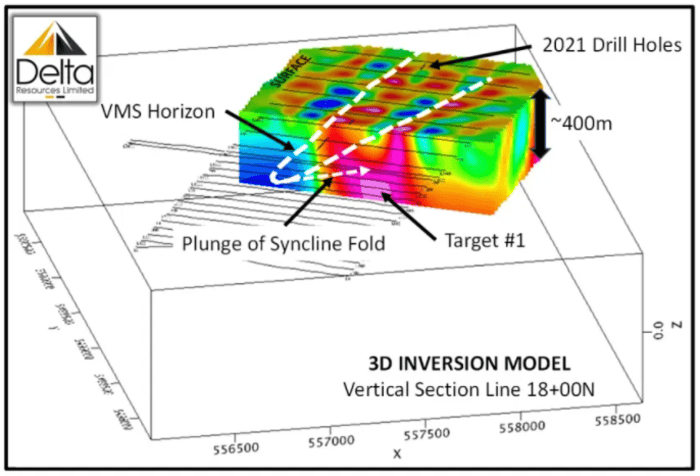

On June 22nd, the Company announced that a gravimetric geophysical survey along the VMS section of its Delta-2 project located a number of highly prospective anomalies down-dip from a VMS horizon at depths greater than 300 meters.

“The gravimetric survey consisted of 29.9 line kilometres, covering an area of 4.25 square kilometres, in the south-east portion of the Delta-2 VMS property. The survey area covered approximately four kilometres of strike length of a sulphidic horizon believed to be the stratigraphic horizon that hosts the Lemoine past-producing mine located north of the property.”

Regarding the significance of these geophysical anomalies, Delta’s CEO, André Tessier:

“These gravimetric anomalies couldn’t possibly be better located; down-dip from our target horizon, potentially in the fold hinge of a syncline, and within a package of highly altered rocks. These are very exciting gravimetric signatures, typical of buried VMS deposits. Preparations underway to drill test these targets.”

Drilling is planned to test three high-priority gravity anomalies in the south-eastern portion of the property. Additional high-priority VTEM conductors will also receive a proper probe with the drill bit—targets that couldn’t be drilled in the spring due to an early thaw.

Further, gravity and VTEM geophysical surveys are planned to cover the newly acquired Dollier-Cartier property which is contiguous to the Delta-2 VMS claims.

These high-priority drill targets are believed to be located on the same stratigraphic horizon as the past-producing Lemoine Mine. Lemoine goes down as one of the richest mines in Canadian history (757 585 tonnes @ 9.52% Zn, 4.18% Cu, 4.56 g/t Au and 82.26 g/t Ag).

We’re big fans of VMS settings here at Equity Guru. Spawned by volcanic hydrothermal events in submarine environments, they almost always occur in clusters—where there is one deposit (or lens), there are often others. And though they vary in scale—ranging from one million all the way to 100 million tons—these polymetallic orebodies can hold huge concentrations of metals due to their rich nature.

Being a VMS deposit, Lemoine is likely NOT a one-off. It’s possible that an entire VMS camp remains to be discovered in Delta-2’s subsurface stratum.

I can appreciate the geological potential in all three prospects in the Company’s project pipeline, but it’s this VMS potential that really turns my crank. A significant hit here could move the needle for this $13M market cap ExploreCo in a big way.

For a deeper delve into Delta, the following (recent) EG offerings hold additional insights…

END

—Greg Nolan

Full disclosure: Delta is not currently an Equity Guru marketing client.

Very helpful analysis of the entire picture.

I always look forward to Nowlan’s articles.

Thanks. I appreciate the feedback Shyamal.

Greg.