Vitalhub (VHI.V) acquired technical health care solution provider Alamac today, according to a press release.

Alamac represents VHI’s 11th acquisition since 2017. They’ve expanded their reach both broadly and deeply, reaching into the growing patient flow and operational visibility market to grow their company substantially in that short timeframe.

“We are delighted to have acquired Alamac, as we continue to progress and execute on our growth strategy, which includes both M&A and organic growth. Alamac has extensive experience building and implementing robust Patient Flow Business Intelligence systems across the NHS, with offerings that are highly synergistic with our Transforming Systems solutions. We believe our existing install base and prospective customers will see immense value through the addition of Alamac’s offering, and through the combination of the two solutions. We look forward to the development of a joint offering in short order, as we continue to enrich our technology platform toward offering best-in-class solutions to address health system needs,” said Dan Matlow, CEO for Vitalhub.

Alamac is a UK-based company that provides technical and advisory solutions to help healthcare organizations across the NHS with their daily diagnosis and performance monitoring needs. They use their technology solutions to provide streamlined data analytics to healthcare providers, so health systems and hospital teams can do their jobs more efficiently.

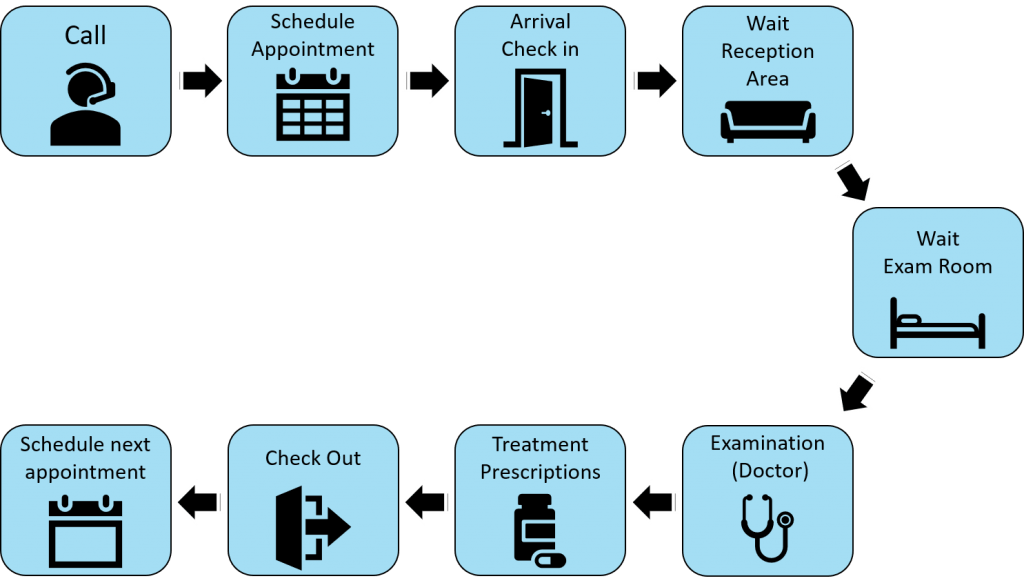

The Alamac solution is intended to help improve operational performance, elevate patient pathway and quality of care while enhancing reporting and performance governance.

The platform is comprised of four key products:

- Patient safety, which uses metrics to ensure that the patient care is both suitable and adequate

- Patient plan, which provides diagnostics to increase service sustainability and performance.

- Patient outcomes, which enable the refinement of care programs through measurement of treatment results.

- Patient flow, which increased transparency across emergency care services to ensure optimal use of resources.

The acquisition comes through their subsidiary The Oak Group, itself an acquisition from 2019, for 1,850,000 pounds sterling.

Alamac financials at a glance:

- Alamac has a recurring contracted revenue base of pounds sterling757,520 (C$1,298,238) which represents almost all of its revenue and adds to Vitalhub’s growing Annualized Recurring Revenue (“ARR”) [footnote 1] base.

- Vitalhub estimates Alamac’s unaudited EBITDA exceeds 20% of gross recurring revenues.

- Vitalhub’s pro forma ARR, including the recently-announced acquisitions of selected assets of Jayex Healthcare Ltd. and S12 Solutions in Q2/2021, was C$20,539,466 in Q1/2021.

Vitalhub is up $0.04 today and presently trading at $3.35.

—Joseph Morton