I am a footy fan. Here in North America we call it Soccer, but for the purpose of this Market Moment, I will refer to the sport as football. One of the worse things we football fans had to stomach during the pandemic was the postponement of Euro 2020. But all is forgot, as the tournament is already providing some excellent matches and drama.

For those of you that do not know, the Euro’s is a tournament to crown the best international team in Europe. The tournament is played out every 4 years just like the World Cup. Every continent has their version of a continental tournament. The Euro’s, and Copa America (South America) are the most popular due to the superstar players. Believe it or not, the Copa is actually being played currently as well, so we football fans of two doses of international football. North America’s version called the Concacaf Gold Cup, will also be played this year starting on July 2nd. Canada will be apart of it, the favorites are always Mexico and the US.

The Euro’s have a special place in my heart, because the first football match I watched was England vs France at Euro 2004. France won the match with two late goals from Zinedine Zidane, in a game where England was leading 1-0 for most of the match. I became hooked to footy ever since.

One thing I learned after becoming a football fan is that there is a lot of money behind it. And I mean big numbers. We always hear about Russian Oligarchs and Middle Eastern Oil Tycoons purchasing teams, but now transfer fee’s for players are surpassing the 100 million Pounds or Euro mark! Norwegian superstar and wonder kid Erling Haaland has a price tag of around 150 million Euro’s, and you will likely see his name pop up on Sportsnet or TSN sports news this summer or next year when they announce him being the most expensive football player.

Even local economies in Europe are all about the football. In the recent year, there have been plenty of stories on Italy restaurants and British pubs feeling the pinch. As someone who follows international markets, this football ‘cyclicality’ is important to note.

Take England for example:

Sainsbury’s already reported a 14% week-on-week jump in beer sales during the first weekend of EURO 2020, while ASDA said it sold 2 million burgers, representing a 50% increase year-on-year. And the impact of the tournament on demand, particularly for electricals and sportwear goods, is already being felt on retailers’ available stock levels.

Analysis of more than 1.85 million SKUs across the UK’s leading sportswear and electrical retailers by OneStock’s Inventory Availability Index, showed that sportswear out-of-stocks jumped 6.8% week-on-week during the first week of international football matches, with unavailable ecommerce inventory accounting for an average of almost a quarter (23.6%) of UK sports retailer’s stock.

With pubs forced to restrict the numbers of punters allowed to watch matches in their venues, electrical retailers were also feeling the strain of demand as footie fans invested in new TVs and audio equipment to tune in and watch games at home. Unavailable online inventory made up over a fifth (20.5%) of electrical retailers’ ranging last week (w/e 21.06.21), meaning many maybe missing out on sales opportunities, just at the time consumers are ready and wanting to buy.

Earnings of some UK and European companies are going to be higher than expected. One could play European indices like I do, or just look for ETFs that deal with retail in Europe.

But for this Market Moment, I will specifically look at North American stocks.

Technical Tactics

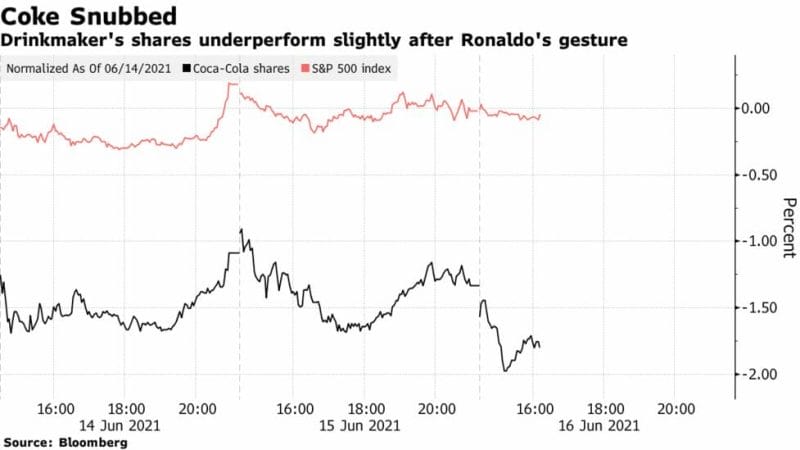

Don’t worry, I will not be recommending Coca Cola. For those that don’t know, Coke is a sponsor for the Euro’s, but their shares took a dive when Superstar Cristiano Ronaldo removed two coke bottles from his press conference table, and then told people to drink water instead. He has the most followers of anybody on Instagram, and many people look up to him. This lead to a drop of KO shares by 6.1%, or a market cap decline of $4 Billion in minutes. Move over Elon Musk.

The whole coke thing is now out of control. The Russian head coach even casually opened up a bottle and gulped it down while saying he prefers Coke! French player Paul Pogba then snubbed Heineken, another Euro sponsor, by removing their bottles of the table. Player power and social media is a theme in this Euro which we have not seen before.

Leaving Coke aside (although I think it is a great value stock with those dividends!), here are three stocks to play on the Euro 2020 hype.

Sports Betting comes first to mind. With the group stages matches now over at the Euro’s, we begin the knockout rounds this weekend. It is supposed to be really hot this weekend here in Vancouver. I know what I, and many others, will be doing in air conditioned living rooms.

If I were a betting man, I would put my money on France. They have the complete team, and bookies list them as the favorites. But anything can happen. I mean back in 2004 we saw Greece win the entire tournament. The next few weeks are going to be exciting for the neutral viewers, but also for those who want to bet on the matches. Nothing beats knockout football matches.

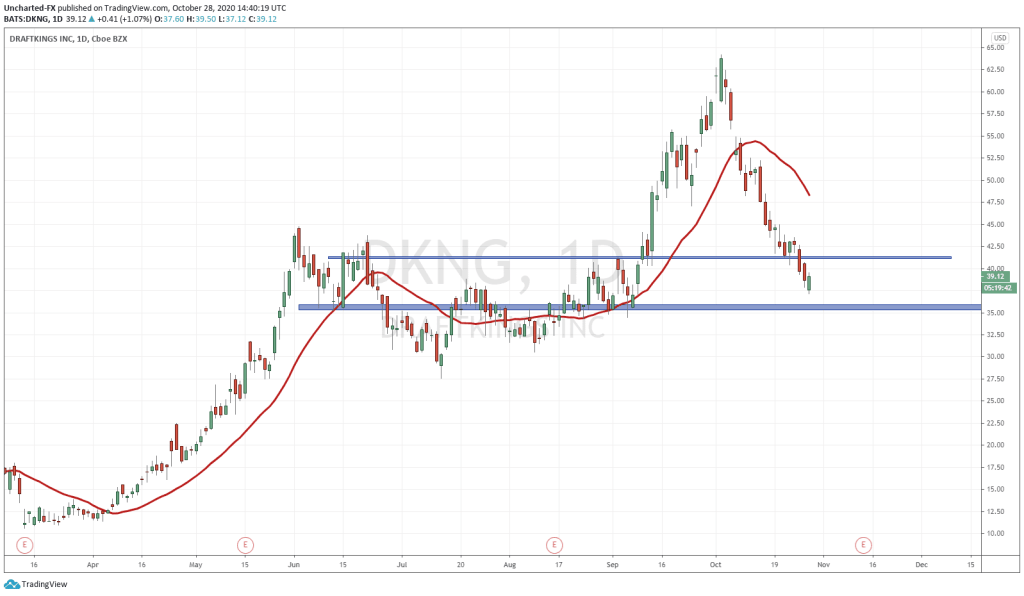

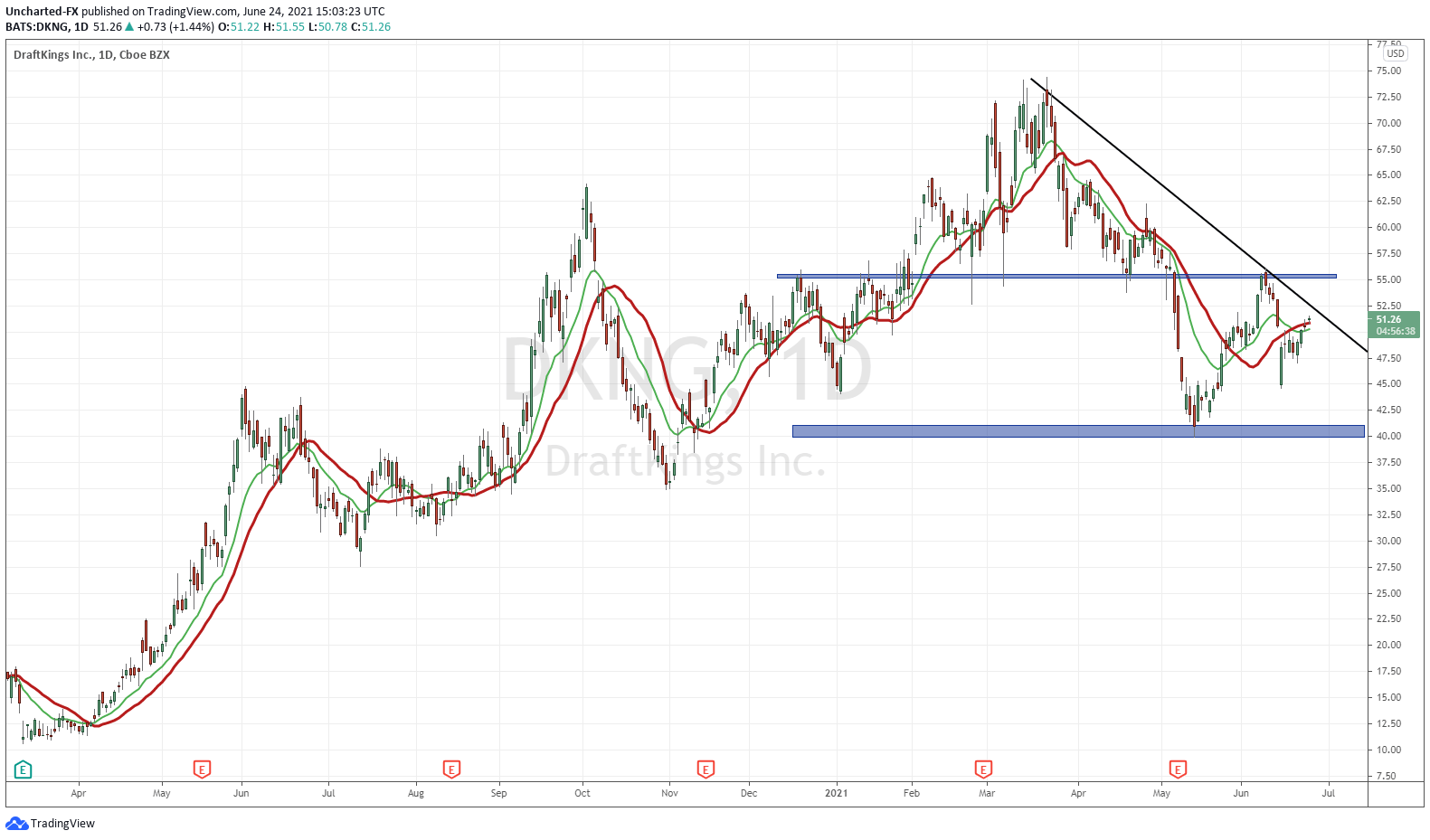

No surprise that Draftkings is on the list. I will be following the price action on this one for the next few weeks, as this is the first major football tournament since Draftkings has been publicly traded. For those interested, here are the odds and lines for the knockout games on Draftkings. Euro 2020 shows up number 1 on their list of most popular sports betting. Earnings report Mid August will tell us how popular Euro betting was.

Technically, $55 is the major resistance on DKNG that I want to see break. Why? It is actually the neckline of a head and shoulders pattern. Meaning DKNG can drift lower if it does not climb back above $55. I have also drawn a trendline. If this breaks, we can get further momentum to take us above $55.

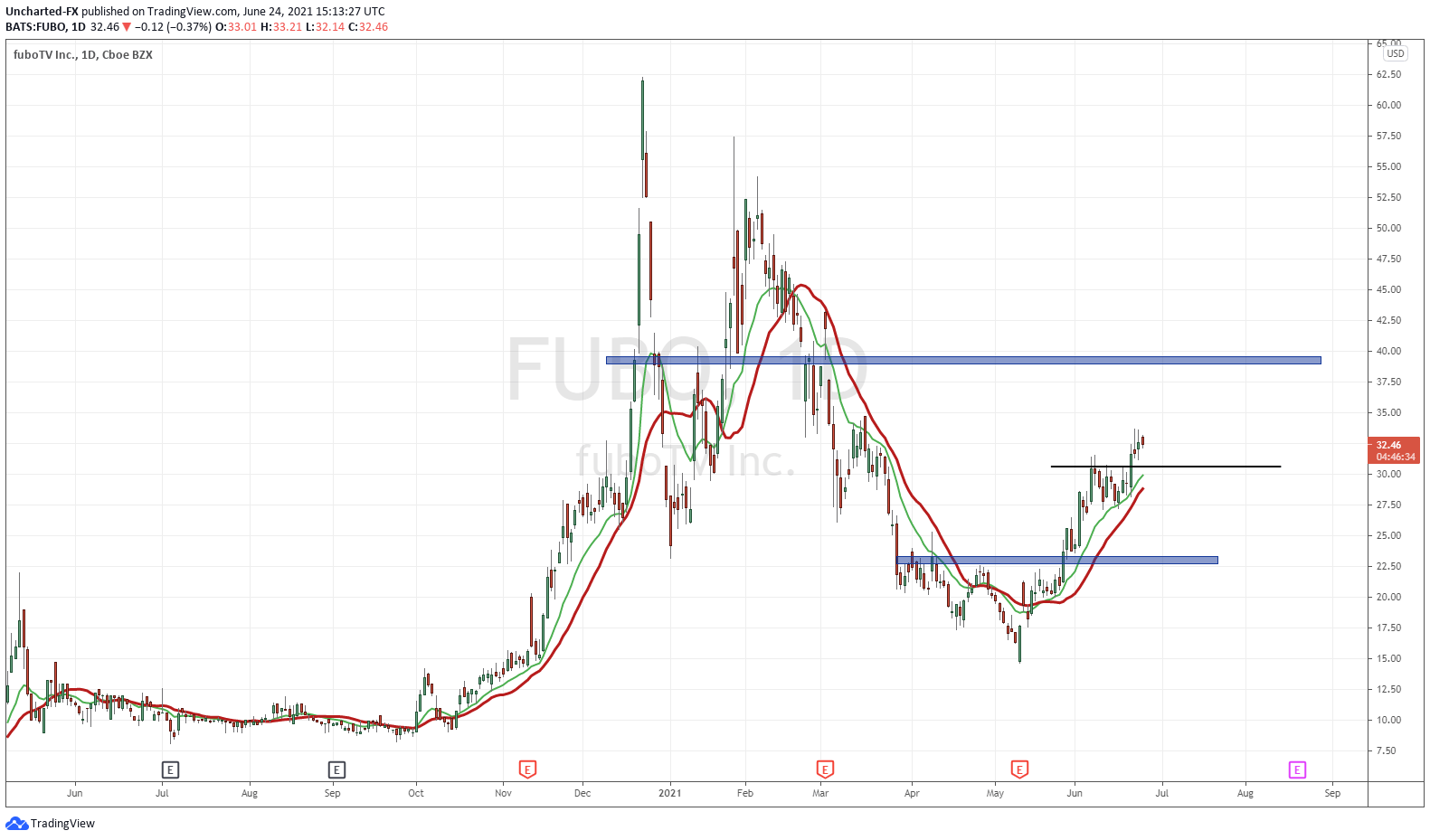

FUBO was mentioned on the Equity Guru Free Discord channel. The break above $22.50 triggered a reversal pattern. The good ol inverse head and shoulders. The recent break above $30 is significant, as it confirms another higher low in this uptrend. The $40 zone is the next resistance to the upside.

Fubo TV is live sports and TV without cable. Channels include Bein sports, Fubo sports, Game +, Paramount, BTV, and Fight Network. They even say that FuboTV is the ‘Home of Live Soccer”. Latest news is Fubo is set to join the Russell 3000 Index. Keep this one on your radar. A nice chart breakout, and will gain on popularity of the Euro’s and football in general.

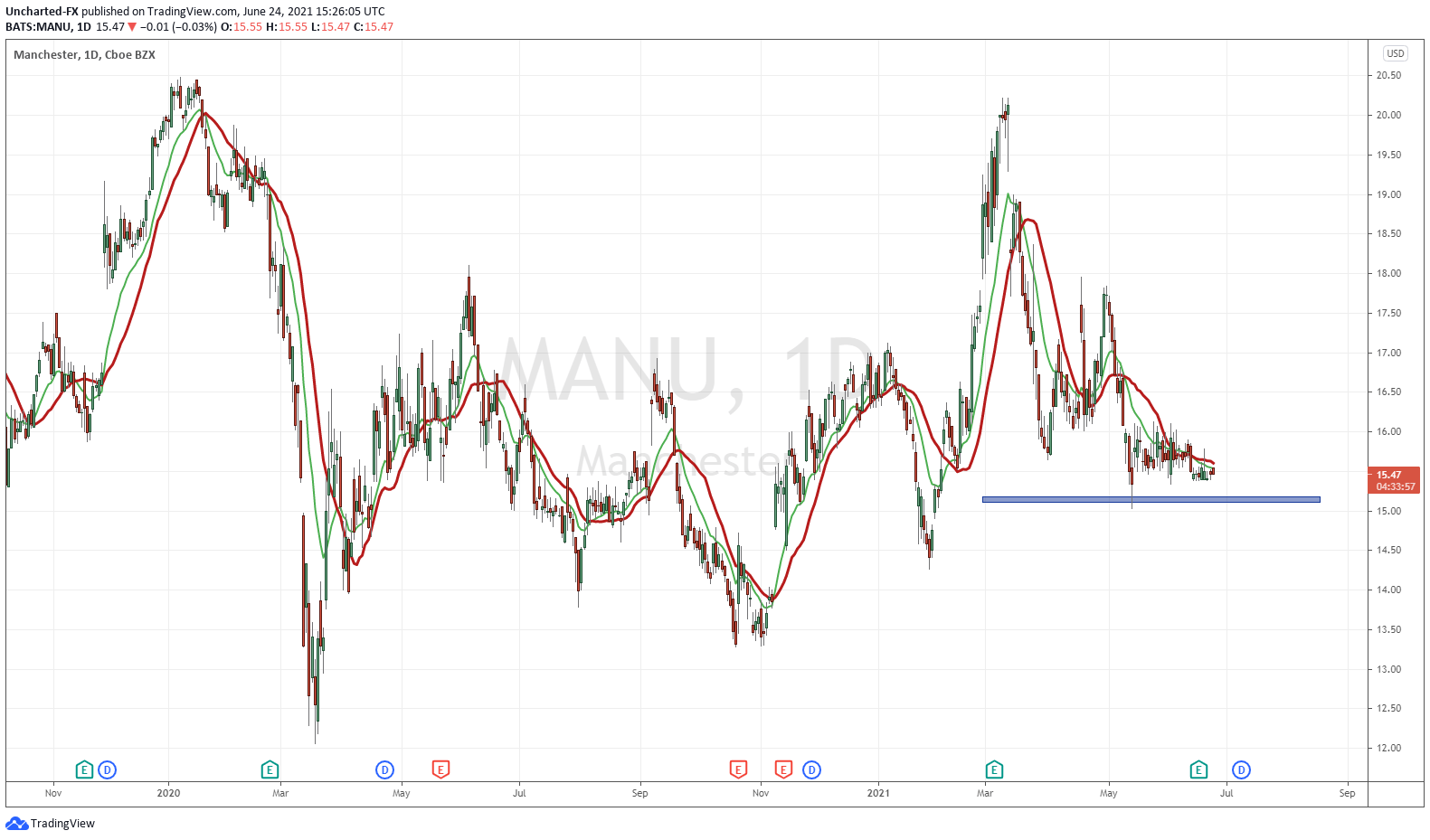

Last but not least, Manchester United. It still surprises people to hear that Man U is traded on US markets. But yes, the American owners, the Glazer family, took the football team public. Mind you, many football teams are traded publicly over on European markets (Juventus, Celtic and a few German clubs to name a few on the top of my head). Sports teams going public isn’t so common in North American markets.

Manchester United still remains one of the largest football clubs in the world. Everyone has heard of them. Past players include David Beckham, Cristiano Ronaldo and Wayne Rooney. Big household names. They also play in the most popular (and $$$) leagues, the Premiership in England. But it really is about the debt and the money being spent to sign players. Fans attending games was a big revenue loss for clubs of all sizes. With fans being able to attend season games regularly next season (hopefully), a revenue stream will be revived. Let’s not forget that the club does pay a quarterly dividend.

Technically, MANU has just been ranging since May 11th. We are in a range between $15-$16. We just need a breakout to trigger the next direction. Hopefully, it is to the upside.