Gold Mountain (GMTN.V) has generated significant momentum in its push along the mine development curve, picking off one key milestone after another as it transitions into ‘BC’s Next Gold Producer’.

The Company’s aggressive plan to put its flagship Elk Gold Project into production is playing out seamlessly. This Gold Mountain crew can execute.

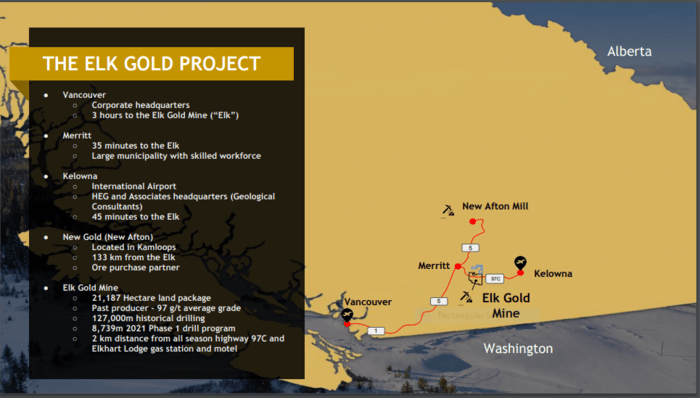

With its Draft Mining Permit in hand, and mining partner Nhwelmen-Lake currently completing site preparation activities (heavy equipment mobilization, drilling, blasting, overburden removal, etc), the Company is on schedule to begin hauling ore in October to New Gold’s New Afton mill just down the highway. With an Ore Purchase Agreement in place, the Company should be cash flowing in November.

Most mine development scenarios take years to get permitted, and years more for planning and construction, before ore can finally be hauled off to the mill. Gold Mountain will begin producing in only one month, after some basic haul-road upgrades.

Since making its debut on the Venture Exchange only six months back, the company has generated considerable newsflow on multiple fronts—partnerships, permitting, exploration, development.

It’s been a flurry of activity—the shareholder value creation kind—without so much a stumble.

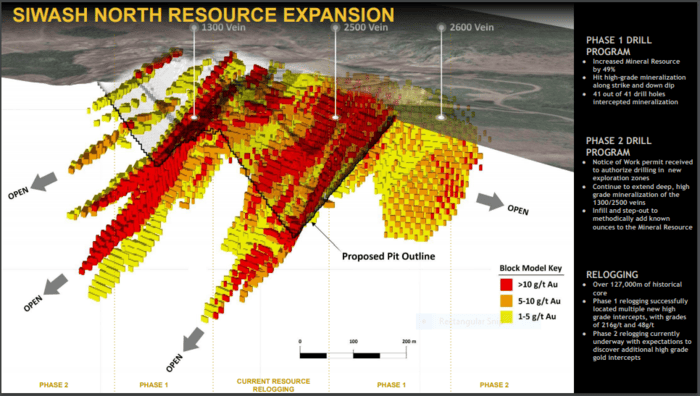

As management and partners continue to study and examine every aspect of the project’s resource base—Elk’s ounce-count currently stands at 651,000 oz at 6.1 g/t Au Measured & Indicated Resources and 159,000 oz at 4.8 g/t Au Inferred—fresh insights emerge and new strategies are put into play. This news release dated June 17th is a prime example of this (brainstorm) dynamic…

Gold Mountain Signs Letter of Intent with New Gold to Increase its Tonnage Limit in its Ore Purchase Agreement

Here, the Company strategically opted out of building a mill on-site for production years 4 thru 11. Alternatively, as per this LOI signed with New Gold, the amount of ore delivered to the New Afton mill will increase markedly beginning in year 4—from 70k tonnes to 350k tonnes per annum.

“This addition reflects a 400% bump to the delivery commitments outlined in the Company’s Ore Purchase Agreement with New Gold and provides a clear path to scale mining operations.”

Highlights:

- The increase in ore delivery allows Gold Mountain to scale mine operations without the need for an on-site mill.

- The Company foregoing an on-site mill was a substantial driver for reducing its all-in sustaining costs (“AISC”) from $735/ounce to $554/ounce (USD).

- Ramp up in mining operations to 350,000 tonnes per year is scheduled to begin 2024.

This move to feed the New Afton mill substantially greater volumes of ore adheres to the year 4 production profile outlined in the Company’s recently updated PEA.

Aside from enhancing the project’s overall economics—the reduction in the AISC from $735 per oz to $554 per oz is HUGE—this move to aggressively scale production via accelerating the toll milling option greatly reduces risk.

Kevin Smith, Gold Mountain’s CEO:

“We recently updated our PEA with an increase to our production profile in years 4-11, an increase in total ounces produced over the life of mine, and the continuation of selling our ore directly to New Gold. In order to substantiate those economics we felt it was important to show a willingness on both sides to expand the long term working relationship, by executing this LOI. Based on trade off studies that we have completed as part of our ongoing PFS work with JDS Energy and Mines, it became apparent constructing a mill in Year 4 was not the correct decision.”

CEO Smith continues:

“This new plan eliminates a large amount of CapEx and reduces the environmental impacts by not building an on-site mill and tailings storage facilities. This will allow us to reallocate that capital into continuing to aggressively explore the property, as well as accelerate the remediation and expansion of the existing underground decline. Continuing to demonstrate this project’s economics and scalability has always been a high priority. This new mine plan has us producing more gold sooner, at a drastically lower AISC. With the drill turning and the Elk being approximately six months away from commercial production, we intend to continue pushing the pace over the second half of 2021.”

The above-highlighted comment re the reallocation of capital—”to aggressively explore the property, as well as accelerate the remediation and expansion of the existing underground decline“—is a consideration most shareholders will find highly desirable.

Accelerating the remediation and expansion of the existing underground decline will result in greater efficiencies and increased production.

Regarding an acceleration in exploration activity—the resource expansion and exploration upside at this 21,187-hectare property… Dr. Quinton Hennigh, technical advisor:

“A few years ago, I undertook a detailed review of the Elk high grade gold project. The vein system not only displays remarkable gold grades but strong persistence along strike and at depth. Geophysical data, particularly magnetic, indicates excellent potential to extend known veins along strike as well as target new veins. It is unusual to find an advanced project already on a fast track toward production that also displays strong exploration upside.”

The Elk project is a mesothermal, intrusive related gold vein system where multiple, largely untested, mineralized zones have been confirmed by previous drilling.

An acceleration in exploration will undoubtedly add to the current 810k ounce count.

The Ore Purchase Agreement

On January 26th 2021, the Company entered into an Ore Purchase Agreement with New Gold to purchase the ore from the Elk Gold Mine. The Company will deliver ore to New Gold’s New Afton Mine located 133km from the Elk Gold Mine in Kamloops BC. Under the terms of the Ore Purchase Agreement, Gold Mountain will deliver 70,000 tonnes of ore per annum or approximately 200 tonnes per day. The Ore Purchase Agreement has a term of three years.

The ore will be sampled and weighed at the Elk Gold Mine to determine the contained ounces of gold and silver. Following delivery, New Gold will pay Gold Mountain at the end of each calendar month based on the value of the gold and silver in the ore, net of the agreed metallurgical recovery and concentrate selling costs. The terms of the Ore Purchase Agreement mitigate the variance and volatility of operational throughput and allows the Company to avoid any risk of recovery.

The LOI

The LOI contemplates an increase to the annual tonnage delivered to New Gold by 400%. Under the terms of the LOI, New Gold confirmed its ability to purchase up to 350,000 tonnes of ore per year beginning in year 4. The new terms allow Gold Mountain to scale production without the requirement to build an on-site mill, drastically reducing its capital requirements over the life of mine. The Company foregoing an on-site mill was a substantial driver for reducing its AISC from $735/ounce to $554/ounce (USD) in its latest Preliminary Economic Assessment (“PEA”). For more information, see the Company’s press release dated May 27, 2021.

With the LOI in hand, Gold Mountain will now look to streamline the permitting process required to scale production by avoiding the environmental impact of an on-site mile. The Company anticipates increasing production to 350,000 tonnes per year beginning in 2024 subject to both the Company and New Gold obtaining the necessary regulatory approvals.

New Gold Permitting Update

Additionally, New Gold has submitted its Notice of Departure (“NOD”) to the Ministry of Energy, Mines and Low Carbon Innovation to receive ore from the Elk Gold Mine. The NOD contemplates New Gold processing 70,000 tonnes per annum in years 1-3. Both parties do not foresee any delays to the production schedule which anticipates ore delivery in October 2021.

END

—Greg Nolan

Full disclosure: Gold Mountain is an Equity Guru marketing client.