The S&P 500 is hovering near record highs with the Federal Reserve Interest Rate Decision looming. A big week for stocks with many key events, with that FOMC Rate Decision being the marquee on Wednesday. The “to taper or not to taper” drama just got more interesting with recent billionaire fund manager comments.

Before we look into those comments, let’s take a look at some of the big macro events for this week:

Monday: British Employment Numbers, German CPI

Tuesday: US Retail Sales, China Retail Sales, British CPI

Wednesday: Canadian CPI, FOMC Rate Decision

Thursday: Swiss National Bank Rate Decision, Bank of Japan Rate Decision.

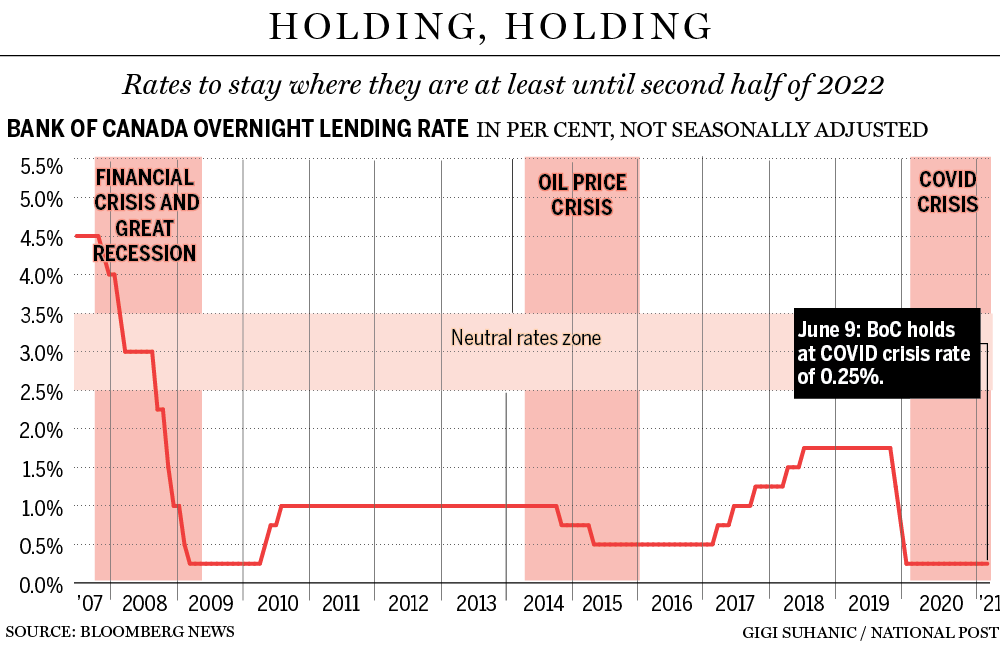

Yes that is right, three central bank interest rate decisions this week. We actually had a few last week. The European Central Bank said that they will keep their $2.2 Trillion bond purchasing program going until March 2022. The Bank of Canada also said last week that they will keep interest rates low until the second half of 2022. Not a surprise. More cheap money for a longer period of time. Central banks keep pushing the threat of rising interest rates further. Some were expecting the Bank of Canada to raise rates by the end of this year. Not happening. Once again, can central banks REALLY raise interest rates when there is so much more debt out there?

This weeks central bank interest rate decisions should not be a surprise. Bank of Japan and the Swiss National Bank will keep things as they are. The big one is the Federal Reserve. Zerohedge already dubbing this weeks meeting as Jerome Powell’s most important meeting in his career.

Back to the Billionaires.

Last week’s Inflation data came out the highest in over a decade. But stock markets actually shot up. This was a surprise because if inflation is higher, many think the Fed will have to raise rates, or even consider tapering sooner than later. But remember, yes the Fed has their 2% target, but is saying this inflation is transitory. Basically it is not meeting their criteria to changing policy. This is because the Fed expected inflation to come out higher on re-opening of the economy. Consumers are buying goods, which is causing inflation, but this inflation should turn when consumers start switching back to services rather than goods.

Lot of the market participants don’t believe it. They are seeing prices of goods increase. But nobody is expecting the Fed to do much about it. The term being thrown out is taper tantrum. A term that means that stock markets would fall when the Fed begins to taper. Which means that the Fed is stuck.

Last week, Billionaire fund manager Stanley Druckenmiller came out saying that the Market is not even factoring in the inflation data. He believes the Fed has to stop cancelling market signals. Essentially, the Fed has to tell the markets they are thinking of tapering. That does not mean they taper, say at this weeks meeting, but they let the market know that they are thinking of tapering sometime in December or later.

Then this morning, Billionaire fund manager Paul Tudor Jones had this to say about the Fed and recent inflation data:

“If they treat these numbers — which were material events, they were very material — if they treat them with nonchalance, I think it’s just a green light to bet heavily on every inflation trade,”

“If they say, ‘we’re on path, things are good,’ then I would just go all in on the inflation trades. I’d probably buy commodities, buy crypto, buy gold,”

“The idea that inflation is transitory, to me … that one just doesn’t work the way I see the world,”

Long time readers of Market Moment, and members of Equity Guru’s Free Trading Discord channel have heard this before. It sort of sounds like yours truly. Albeit, I discussed this months ago. It really looks like the Fed and other central banks, are stuck, and I think interest rates are more likely to decrease lower rather than hike higher. The trade is to be out of fiat. Commodities and crypto’s.

Technical Tactics

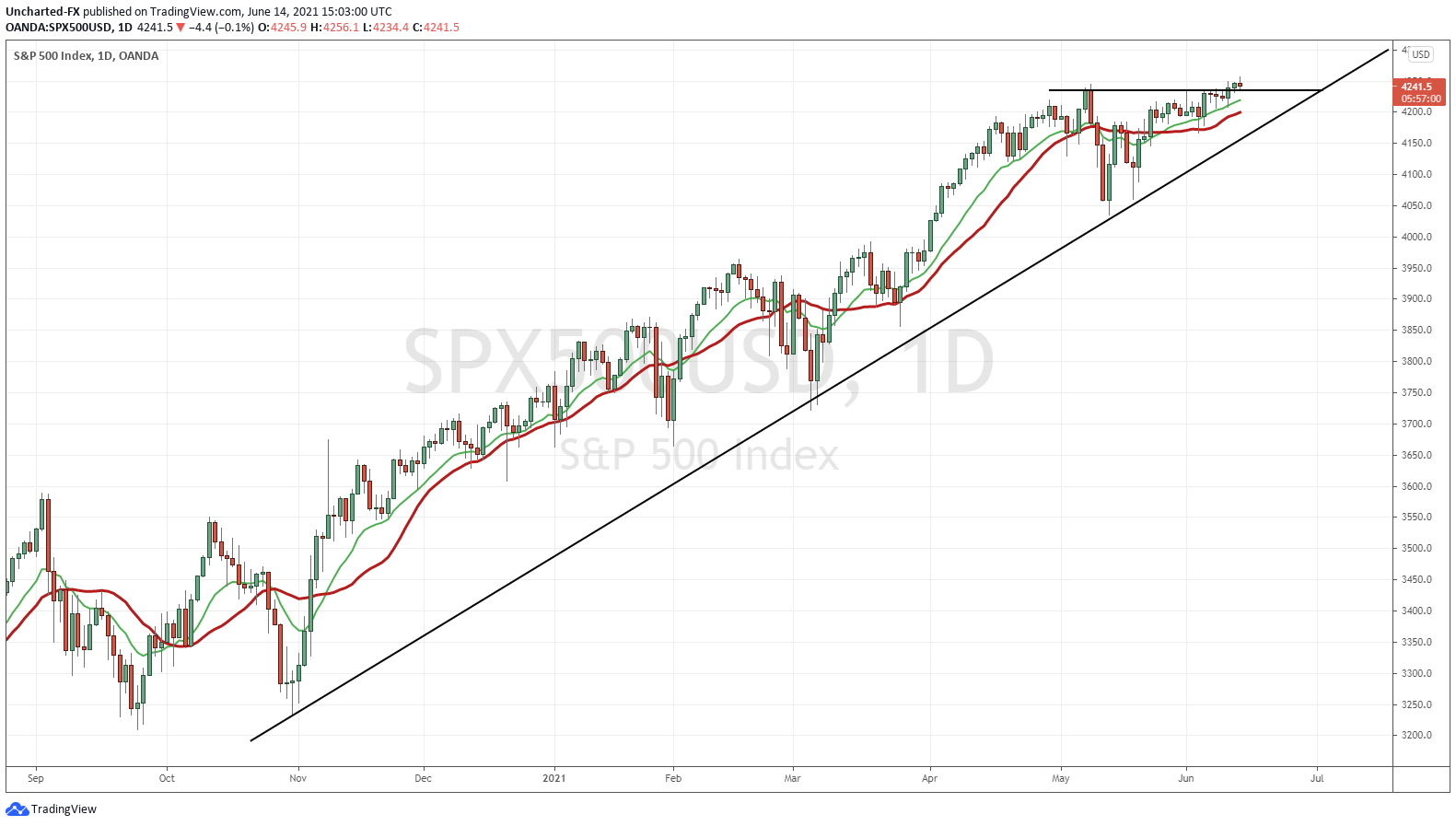

I expect stock markets to be in a holding pattern until the Fed meeting on Wednesday at 11am PST. This just tends to be the case on Fed week. But, if stock markets continue to breakout higher, then we can expect that the Fed will change nothing. And the markets are pricing it in. They won’t even mention thinking about tapering because the inflation data is ‘transitory’ and doesn’t meet their criteria.

The S&P 500 broke out into all time record highs, and is now hovering close to recent highs. For the technical traders, it looks like the S&P 500 is retesting previous highs as support and is seeing some bids. Trajectory is higher, unless the Fed spoils the party.

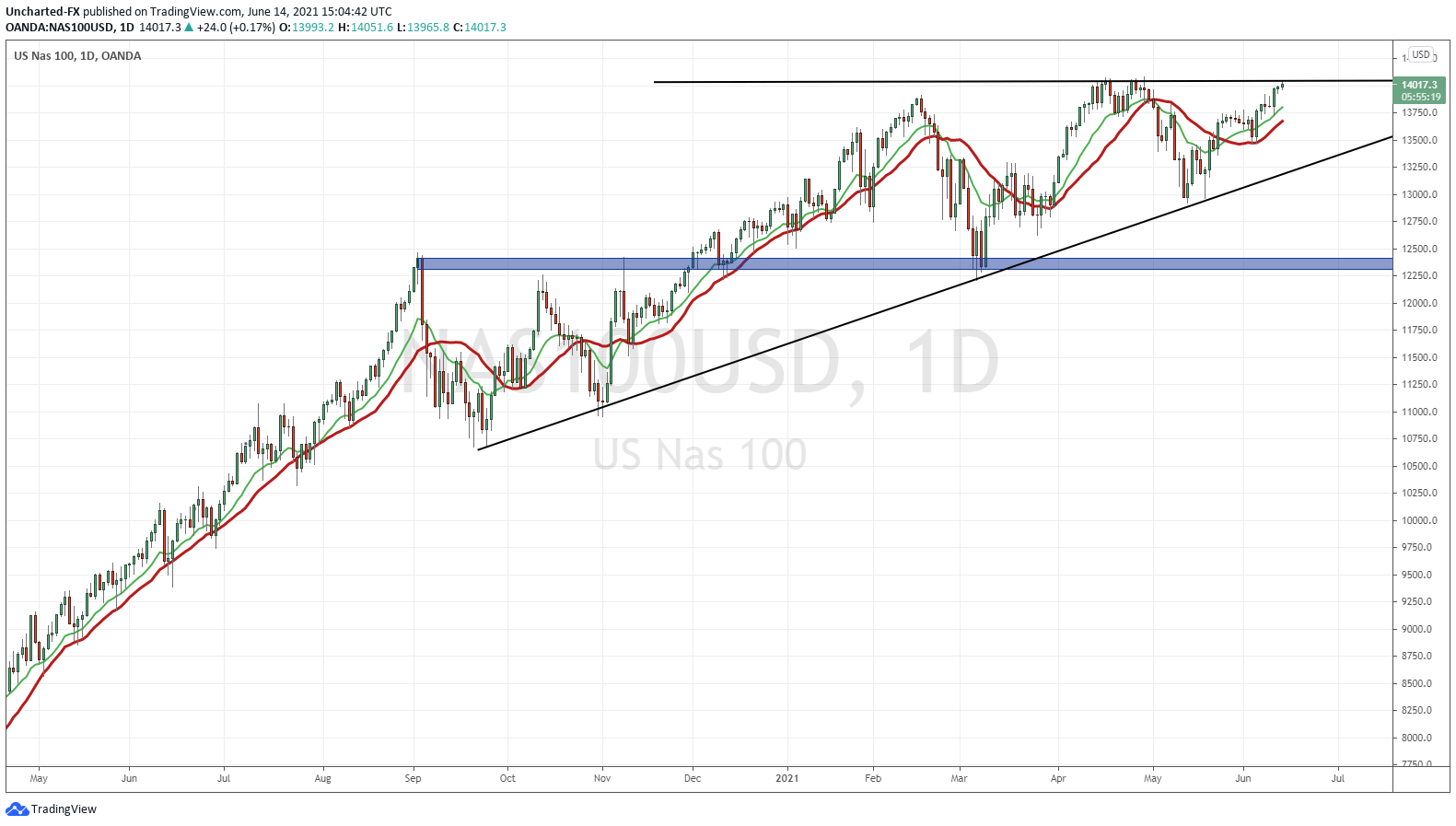

The Nasdaq is on the verge of breaking out into new record high territory. A lot of it depends on what Apple and Tesla will do. Both stocks are actually showing signs of basing, and we are looking for a breakout on both. That would be enough to drive the Nasdaq higher.

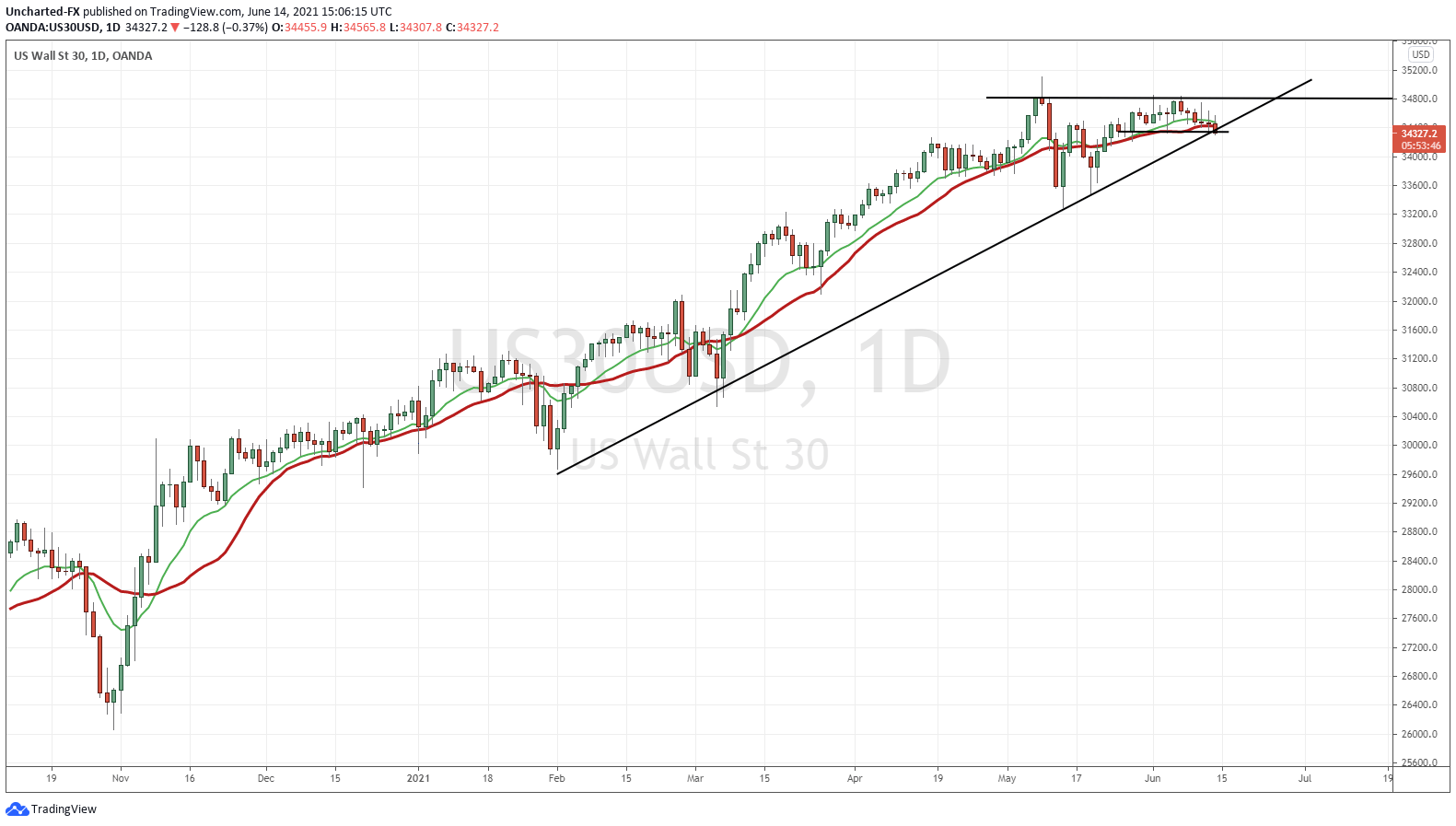

The Dow is one I am a bit worried about. It looks like it wants to break and close below our uptrend line today. Not looking good, but of course we must wait for the candle close. This could easily reverse near the end of the day. Financial media has been saying that the move lower on the Dow is because money is leaving value for growth. If this is the case, we should see the Dow dump while the Nasdaq pops.

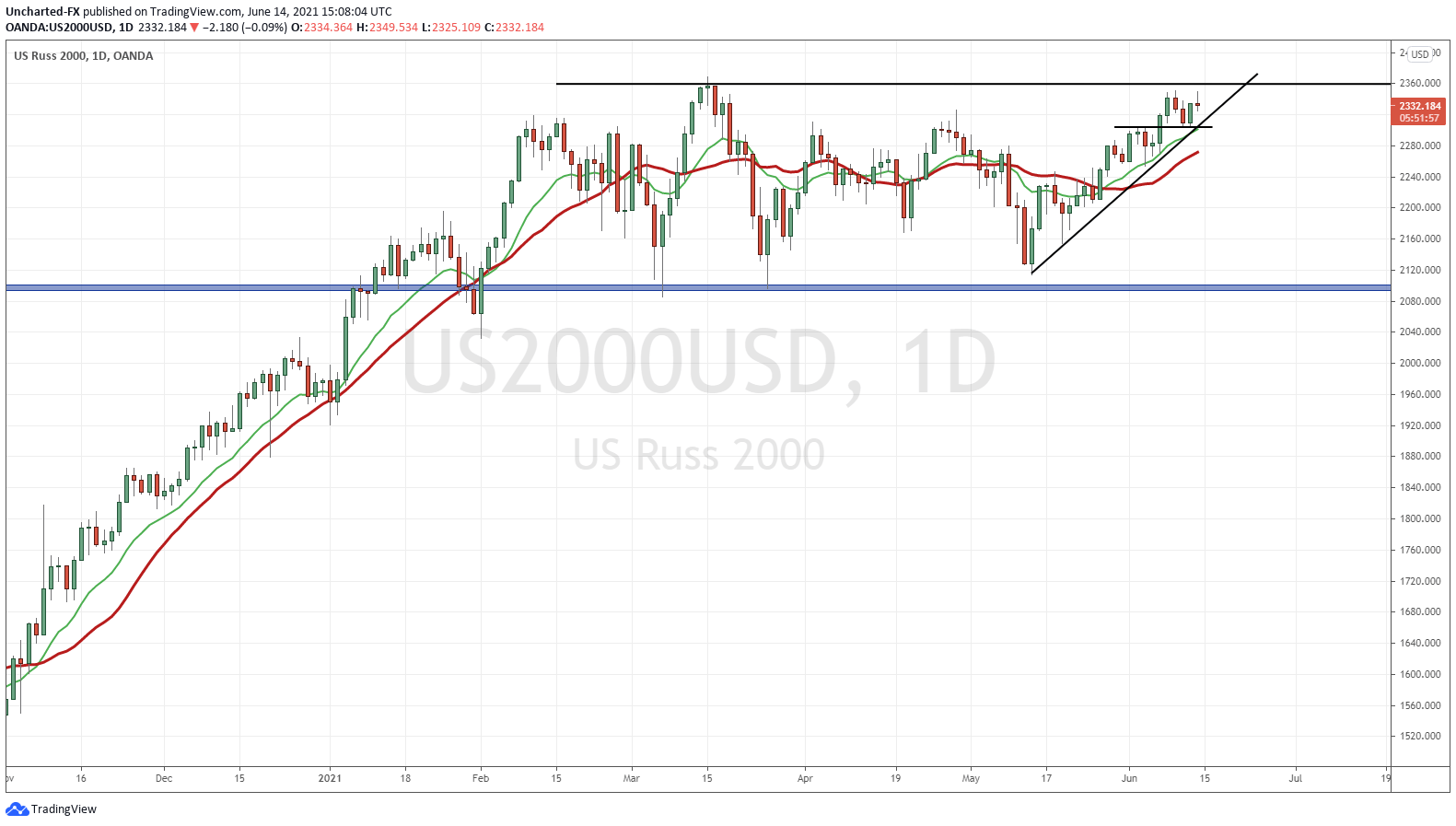

The Russell 2000 is the index I have written about a lot recently on Market Moment. This is how we are gauging whether retail/meme crowd money is leaving crypto’s for small cap stocks. It definitely has been the case lately. Now the Russell is testing previous highs, looking to print new record highs. Let’s see if momentum carries us into a breakout. But here is some concern: Bitcoin and other crypto’s are popping. We may see the retail/meme crowd go back to crypto’s meaning the Russell fails to breakout.

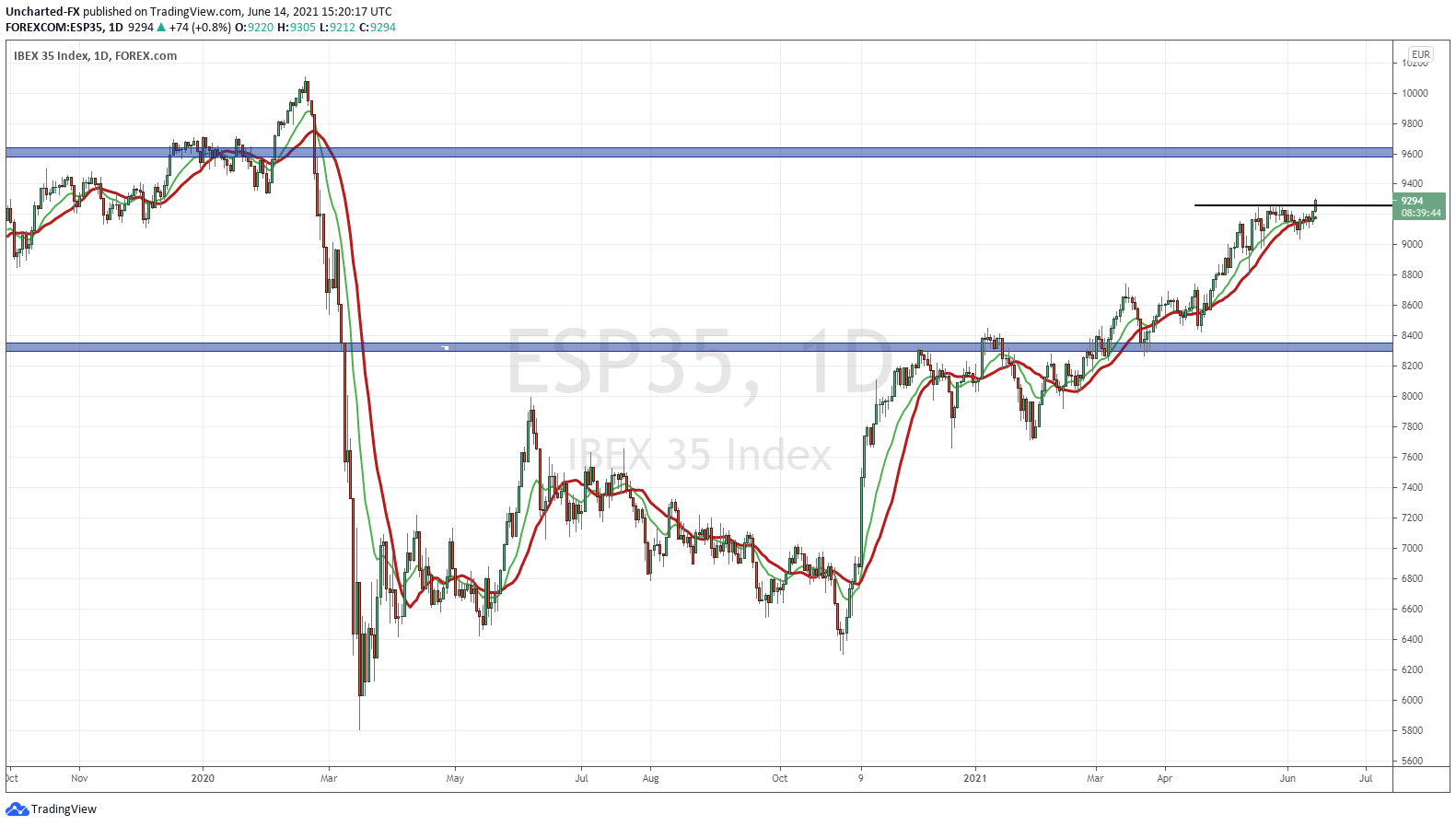

Lastly, I want to leave you all with some European equity indices. Remember, the ECB is doing the exact same thing too. More cheaper money for a longer time. As US markets continue breaking out higher, money might find ‘value’ in European equity markets. A few like the French CAC, the German Dax, and the Euro Stoxx 50 already in record high territory.

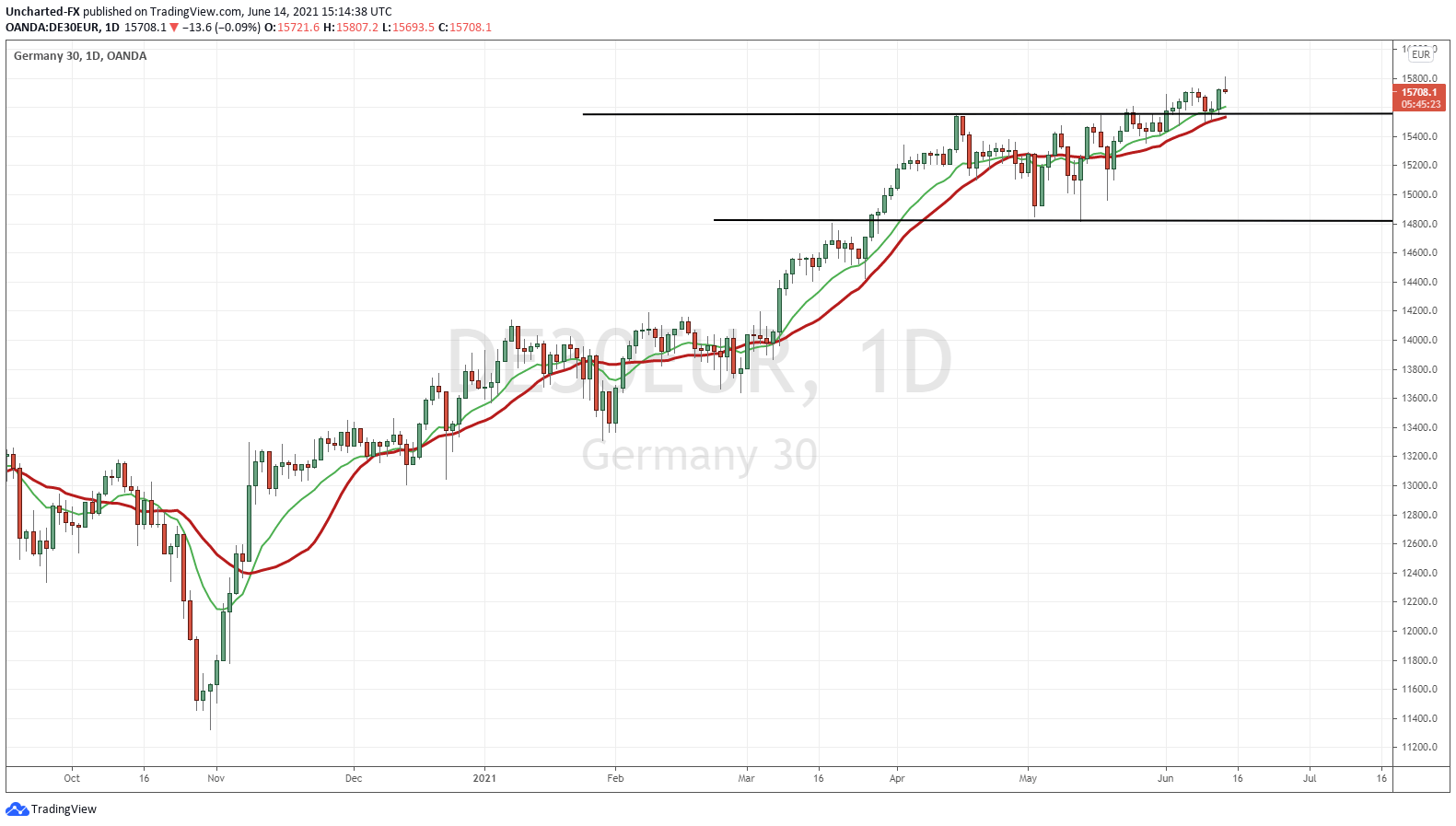

The German Dax is similar to the S&P 500. New highs and now hovering close to recent highs. Trajectory still is higher unless US markets take a hit on Fed tapering.

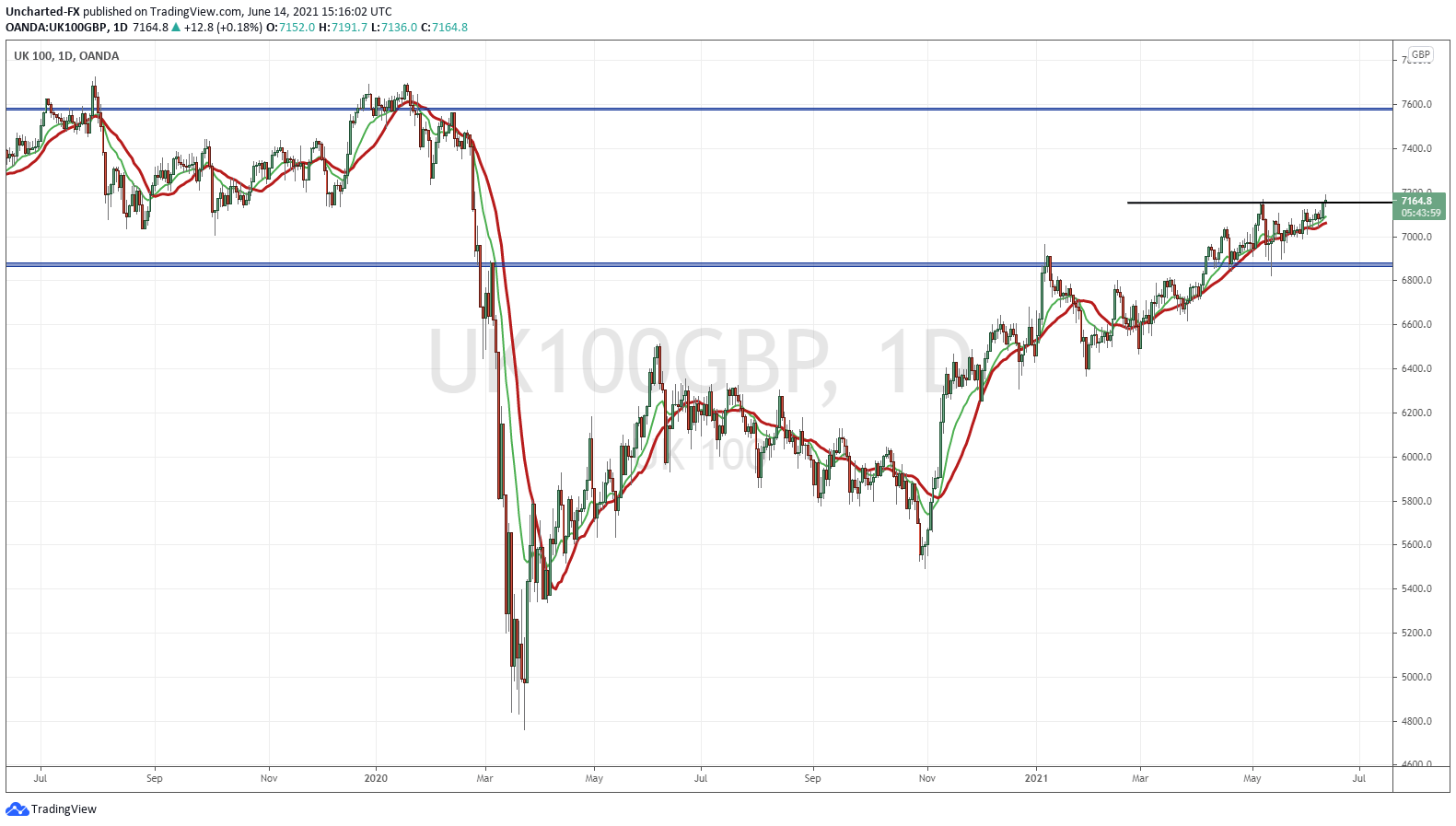

The UK FTSE is breaking out, but nowhere near record high territory. This can be a catch up play. One thing to note: hearing that PM Boris Johnson will extend lockdowns further. If this is the case, and if he keeps extending the extensions, then markets may initially take a hit. But then they will recover based on the cheap money and nowhere to go for yield.

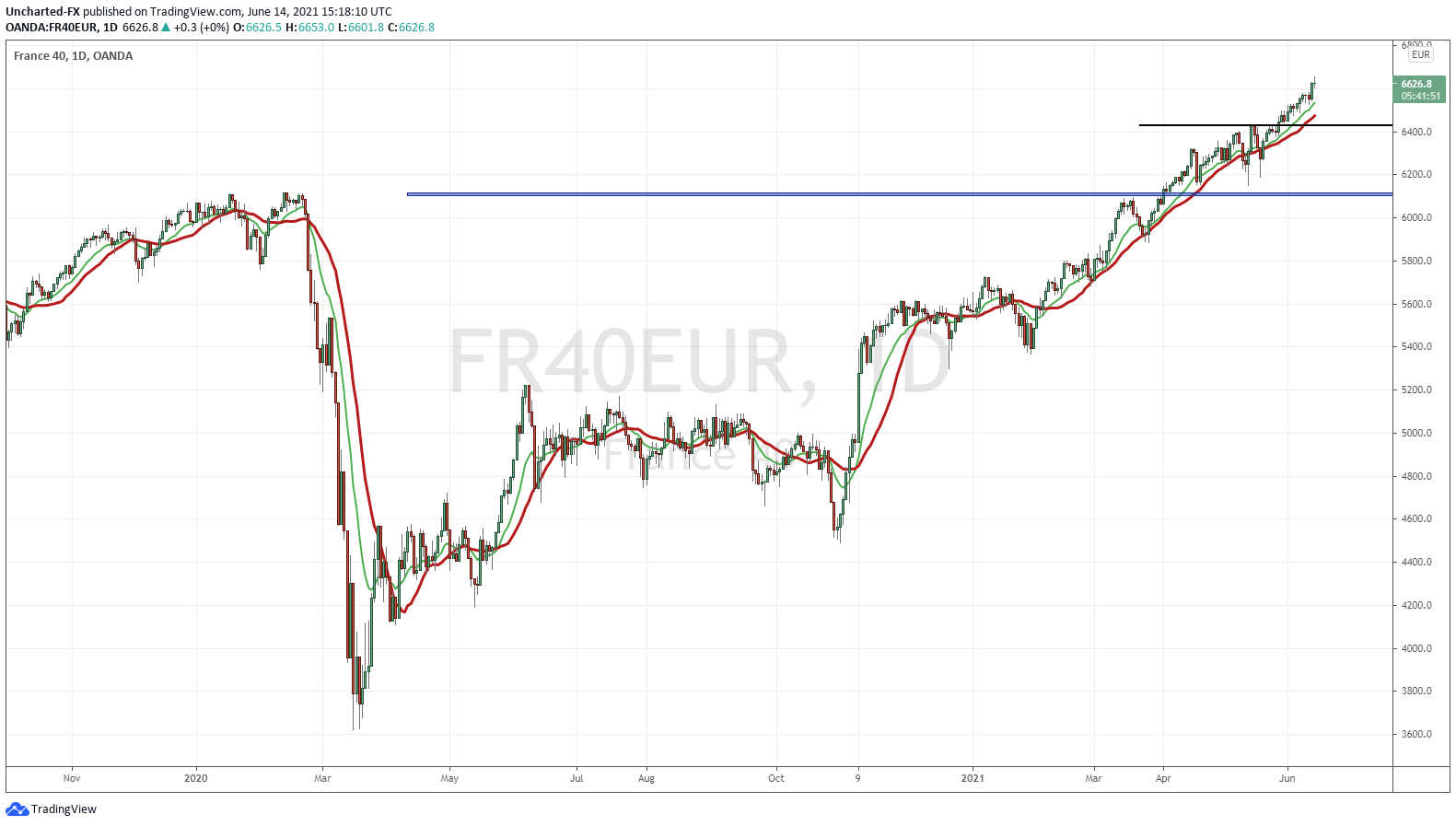

The French markets have not turned back ever since the breakout into new highs since the beginning of May. Had some pullbacks which were bought up, and the French markets keep making record high after record high.

Oh and by the way, I have France winning the Euro tournament this year.

I like the Spanish markets more for a ‘catch up’ value play. It is just freshly breaking out, and still has some room before making new record highs like the UK FTSE. Yes, it is one of the PIGS nations (Portugal, Italy, Greece, Spain), which has some issues, but don’t worry, the European Central Bank goes brrrrr.