Graph Blockchain (GBLC.C) made their first investment in Global Charity Coin (GCC) today, according to a press release.

GCC is a curious case among cryptoassets. It’s a coin specifically designed to facilitate individuals using crypto to make charitable donations. The notion of a charity-coin is far from novel, but there are definitely none with this type of scope. It’s designed to support the global charity sector, which is roughly $20 billion a year, and provides an option for holders to donate without having to convert their coins to fiat.

“The ability to invest in GCC at this early stage is a fantastic opportunity for GBLC; it positions the company in two ways: It gives GBLC investors exposure to the coins as GCC mints them, and it positions the Graph to collaborate with GCC on the buildout of their blockchain needs to support a global platform,” said Paul Haber, chief executive officer of Graph.

Graph has gone through a number of pivots in its short existence, having come onto the scene in late 2018 as an offshoot of Datametrex AI (DM.V), that it’s complicated the answer as to just what they do. Their latest pivot has them turning entirely into digital asset management, having thrown substantial amounts of money into altcoins which they can stake and draw serious dividends from. Graph is presently aiming to be the first publicly tradable altcoin proof-of-stake miner, which has been their most lucrative bet to date.

GCC is still working on their white paper and will allocate 20% of the initial coin offering to Graph for its $250,000 investment, and until the web properties and company information will be kept private until the ICO is complete.

There’s two points worth mentioning here.

The company hasn’t finished its white paper making this deal the functional equivalent of buying a house before the blueprints are laid out, but in this case there’s no money exchanging hands and a non-disclosure agreement in place, so no harm no foul. So far.

The second point is the initial coin offering, or ICO. This normally should be considered a red flag. It’s an unregulated way for company’s to raise money by circumventing the normal private placement arrangement and going directly to investors, who offer funds in exchange for coins on the promises of appreciation as the company develops. The problem, of course, is that there’s nothing stopping the company raking in the cash from going on wild lambo rides and buying Toronto Real Estate, as in the notorious Vancouver-based ICO Vanbex Labs’ case.

That won’t be happening here as this doesn’t have that same structure, and as it’s early in the proposed deal, they’ll still have time to do their due diligence to ensure the legitimacy of what they’re buying.

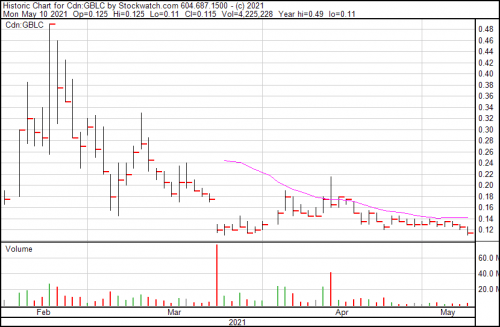

Graph is down a penny today, and trading at $0.115.

—Joseph Morton