If you’ve got your ear even remotely close to the ground in terms of all-things crypto, then you’ve probably not only heard about decentralized finance, but you’re tired of hearing about it. If you’re not sure what it is—think blockchain enabled financial instruments. A decentralized savings or chequing account. Options trading. Think decentralized exchanges where you can swap crypto without having to relinquish your private key, then boom: wallet to exchange transfer, no key action required.

But this is still the realm of bespectacled computer geeks and wild haired libertarian John Galt wannabes. It’s opening to a wider audience, but it’s happening slowly and the learning curve is really steep. Even moreso than with standard blockchain.

DeFi Technologies (DEFI.NE) wants to challenge that notion.

Think of them as DeFi -lite.

Let’s ignore the obvious for a second. DeFi is a company with series of offices, located in terrestrial earth and is therefore by definition centralized, and this is really only the first hurdle to grasping this company. If you’re new to cryptocurrency, blockchain and the like, then you are probably scratching your head as to why such things matter. But if you’re not then you get it. Decentralization is everything.

Or at least it was.

DeFi Technologies’ wants to give both institutional and retail investors access to baskets of cryptocurrencies—not unlike an ETF, or Grayscale Investments. They’re one of the first publicly traded companies to take advantage of the craze around decentralized finance

Where’s the money?

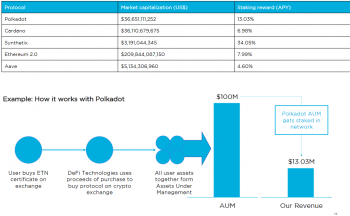

This company makes money primarily through offering exchange traded notes (ETN), which track the value of a single DeFi protocol or a basket of protocols. Their recent acquisition of Valour Structured Products gave them the ability to deal in baskets of crypto called respectively, Bitcoin Zero and Ethereum Zero.

- Bitcoin Zero started trading on Dec. 3, 2020, on the Nordic Growth Market in Stockholm, Sweden.

- In the months since December, 2020, Bitcoin Zero has been in the top three most traded exchange-traded products on the exchange.

- Valour ended the 2020 fiscal year with $6.9-million (U.S.) in assets under management. It currently has $54.5-million (U.S.) assets under management as of March 31, 2021.

- Valour intends to list additional products on Boerse Stuttgart and Frankfurt in Q2 2021 (and possibly other additional global exchanges).

- Ethereum Zero launched on March 30, 2021, and subsequent digital asset product launches are planned for Q2 2021.

- Significantly, Valour was co-founded by Johan Wattenstrom, founder and director of Nortide Capital AG. Mr. Wattenstrom was also the founder of XBT Provider, the first synthetic exchange-traded product ever launched for BTC in 2015, which currently has $4-billion in assets under management.

These are exchange-traded products that give investors access to both the BTC and ETH markets without the 2.5% management fees. These ETP’s track the performance of both of these assets, giving investors exposure, standardization and operational efficiency, but with reduced risk. Naturally, the company buys the equivalent amount of the asset to ensure that the investment is backed at all times.

They make their money through the fees they charge on these basket products. But t hey hold off on the DeFi protocols that offer high staking rewards. It’s not exactly a new business model nor does it really take advantage of everything DeFi offers, but it’s something to build on. For a centralized publicly traded company to get completely involved in decentralized finance would be a regulatory headache par excellence, but this will do for now.

hey hold off on the DeFi protocols that offer high staking rewards. It’s not exactly a new business model nor does it really take advantage of everything DeFi offers, but it’s something to build on. For a centralized publicly traded company to get completely involved in decentralized finance would be a regulatory headache par excellence, but this will do for now.

Alternatively, they have a secondary source of income through running nodes (and verifying the blockchain) of their Shyft network, their private, semi-permissioned blockchain, in which they pull in Shyft coins whenever they close the block. Shyft is worth approximately $2.21.

The Hive Mind

Their relationship with Hive Blockchain (HIVE.V) is perhaps the most noteworthy piece of information about DeFi. The two companies completed a share-swap with Defi sending ten million shares to Hive in exchange for four million for a partnership regarding the decentralized finance ecosystem and certain applications around Ethereum and miner extractable value (MEV).

Here’s what we wrote about MEV when this deal originally broke:

“MEV is the amount of profit miners can take from reordering transactions on the blockchain. It’s grown in importance as the DeFi ecosystem itself has grown from US$3 billion to US$71 billion. Extracted MEV stands at roughly $347.3 million, and 88% of that number comes from DeFi activities. Over half of all ethereum miner revenue comes from transaction fees—which is what we’re talking about when we talk about the price of gas being too high—and by partnering, individuals can get access to a more capital efficient market while greater returns are distributed to miners.”

The problem then as now is a matter of scale. It’s the thorn in the side of all blockchain technologies and the largest hurdle that any cryptoasset (or cryptoasset-adjacent) company needs to get over. Regardless of what cryptocurrency we’re talking about—be it Hoskinson’s Cardano with its promised hydra-sharding protocol or Buterin’s Ethereum with its shard-chains—if customers have to wait five minutes for the Ethereum block to close and the transaction to happen, then they’re going to go elsewhere and DeFi won’t be of any interest to the impatient mainstream.

Here’s a helpful video covering some of the key concepts.

—Joseph Morton